Have you Ever thought about what the Colonial Penn is? Who is Jonathan Lawson colonial penn? Is colonial penn an insurance company? Interesting questions? Let’s have detailed answers for each question.Meet Jonathan Lawson. He’s the guy you see in their commercials, promoting insurance plans with a warm, trustworthy smile. But who is he beyond the screen? What’s his story? Let’s explore his fascinating career journey, achievements, his life, career and uncover the man behind the ads.

Who is Jonathan Lawson colonial Penn?

Jonathan Lawson was born on 3rd June 1980 in Dunedin, Florida. He completed high school in 1998 and the following 14 years of his life were spent in the Marine Corps as an infantryman. His service was not only as a participant in ground combat but also as a Master Instructor with teaching responsibilities at Marine Corps University in the education and training of other Marines.

After self-discharge from the military, Jonathan took a corporate job for three years as an artist manager for musicians. During this period he worked in the marketing and branding division of the entertainment industry as well as recovering from his wounds received in battle.

Jonathan later stepped into films having voluntarily left the military through medical discharge. The first project in the career of Jonathan was the producer and director starting with the movie Hellbilly Spitfire While the production process of this movie started in 2014, thus it was the start of the career in the motion picture industry.

Jonathan Lawson’s experience of work highlighted that he managed to succeed in different fields – from the military to the art, which proves that he is a hard-working, persistent, and flexible man.

Is jonathan lawson colonial penn married

Yes, the guy named Jonathan Lawson working for Colonial Penn is married. Nevertheless, he rarely discloses information about himself and his family. Information concerning his wife can not be obtained from any source. It also enables him to distinguish between the professional and the personal clearly. He also has two children, but like his wife, he also does not give out much information regarding them. Suddenly, colonial penn commercial jonathan lawson was concerned with his job and with Colonial Penn, the company for which he recently started appearing in commercials.

How much does colonial penn pay jonathan lawson

One more interesting question is Jonathan Lawson Colonial Penn salary. Jonathan Lawson serves at CNO Financial Group Company which is the parent company to Colonial Pen Co. Online Records show that Jonathan Lawson Colonial Penn salary is around $400,000 yearly.

Truth about Jonathan lawson colonial penn Life Insurance:

As Jonathan claimed on TV about how good Colonial Penn life insurance is, only $9.95 It was observed that 9.95 plans are more expensive than other insurance providers in this country.

The life insurance data also demonstrate that other choices result in an order of magnitude greater protection per dollar invested. Here are some of the tactics used by Colonial Penn Life Insurance to promote people, especially the elderly into buying life insurance policies; Their advertisements include the one about the $9. 95 monthly subscription that seems cheap but is not without a couple of nasty tricks.

The policies include high-priced premiums that rise with age, strict provisions, and small benefits, which challenge policyholders to achieve adequate coverage. Misleading marketing, vague policy details, and complex terms trap customers in expensive and inadequate insurance plans.

Moreover, getting life insurance with no waiting period is possible for most Americans with this company, unlike in the case with Jonathan Lawson of Colonial Penn. Even if you are looking for final expense insurance with all the pre-existing conditions, that statement is true.

Is Colonial Penn’s Terrible Life Insurance a Scam?

Jonathan Lawson is a worker at Colonial Penn who stars in the firm’s TV advertisements for the ‘guaranteed acceptance $9.’ 95 plan for seniors. In this case, he is not merely a paid icon like the famous television game show quiz master Alex Trebek.

Is Colonial Penn’s Terrible Life Insurance a Scam. Many Public channels describe it in different ways . Let’s explore How Scott Shafer explain it:

In this video “Uncovering Colonial Penn’s Terrible Life Insurance Scam” explores the unethical practices of Colonial Penn Life Insurance, focusing on how the company exploits elderly customers. It starts by dissecting the alluring advertisements that promise affordable life insurance with no medical exams required.

The video exposes the true costs, such as hidden fees, increasing premiums, and minimal benefits, making it difficult for policyholders to receive a substantial payout. Interviews with victims and experts illustrate the financial burden and emotional distress caused by these policies. The video also provides practical advice for viewers on how to identify and avoid similar scams, emphasizing the importance of thorough research and understanding the fine print of any insurance policy. It encourages viewers to seek advice from independent financial advisors before committing.

This detailed video not only highlights the flaws in Colonial Penn’s business model but also serves as a warning to potential customers about the dangers of misleading marketing in the insurance industry. It’s All about Scott Shafer opinions.

Jonathan lawson colonial penn net worth

Jonathan Lawson is a paid salesman for Colonial Penn Insurance Company. However, he holds a title with CNO Financial Group of Director of Quality Assurance & Escalations.

Though there is not a lot of information about his financial status, Jonathan Lawson has a total jonathan lawson colonial penn net worth of between $15 million and $19 million. The main source of his earnings stems from his position within Colonial Penn, in which he mainly focuses on the company’s advertisements as well as the firm itself. Also, his experience in the acting and production field perhaps has played a part in enhancing his financial status.

This net worth is not fact-based; it’s an estimated amount after analysis of data given online. No one knows his real net worth amount.

Jonathan Lawson Colonial Penn wife

Jonathan Lawson colonial Penn is known to be a private person when it comes to his personal life. As for Jonathan Lawson, he is a married man with two children; however, there is not much information about his wife available. He has not revealed her name to the public or her occupation, which is an indication that the man wants to keep his private life most especially his marital life secret. Such discretion is reflected in different aspects of his life as he often deflects public attention towards his accomplishments as a professional.

Sadly, there is little information to the public regarding Jonathan Lawson’s wife and it seems that he cherishes and respects the family’s privacy. It enables him to have a normal family life which is an issue that many personalities in the public domain struggle to deal with. This shows dedication to the family and their welfare as he avoids exposing them to instances that are associated with the media.

How old is Jonathan Lawson from Colonial Penn?

Jonathan Lawson, known for his work with Colonial Penn, is currently 43 years old. He was born on June 3, 1980. Jonathan’s career path is quite diverse and interesting.

Early Life and Career

Jonathan Lawson was born and raised in Dunedin, Florida. After high school, he joined the Marine Corps. He served for 14 years, including deployments to Iraq and Afghanistan. His time in the military shaped his leadership skills and work ethic.

Transition to Civilian Life

After leaving the military, Jonathan didn’t slow down. He went into the entertainment industry. He worked as an actor and producer on various projects. His experience in front of and behind the camera prepared him for his next big role at Colonial Penn.

Colonial Penn

Colonial Penn spokesperson Jonathan lawson is now a familiar face in Colonial Penn’s commercials. He helps promote their $9.95 Guaranteed Acceptance life insurance plan. His straightforward and friendly demeanor makes him relatable to viewers, especially seniors. Jonathan Lawson’s life is a mix of military service, entertainment, and insurance. At 43, he has accomplished a lot and is a respected figure at Colonial Penn. His story is one of dedication and versatility.

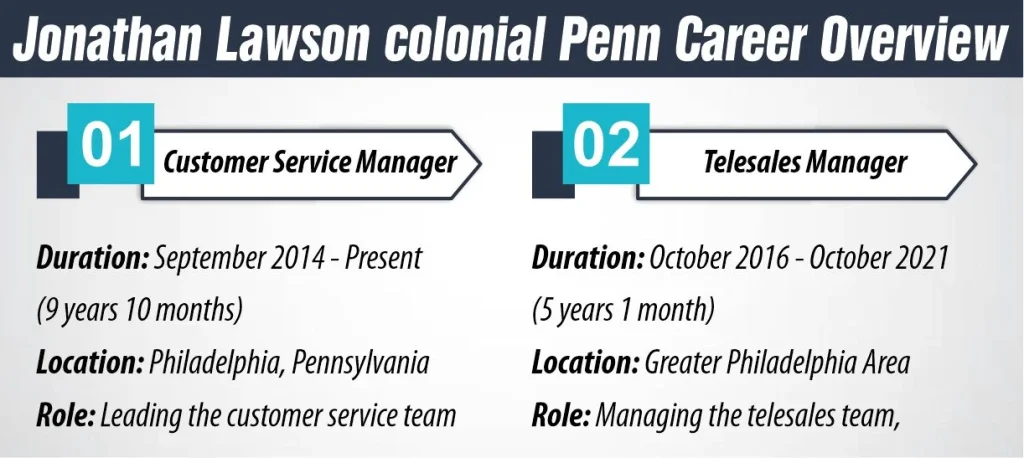

Jonathan Lawson colonial Penn Career Overview

Jonathan Lawson has a robust career primarily focused on the insurance sector, with notable roles in customer service and management. Here’s a breakdown of his career based on the provided information:

Customer Service Manager

Customer Service Manager

- Duration: September 2014 – Present (9 years 10 months)

- Location: Philadelphia, Pennsylvania

- Role: Leading the customer service team, managing client interactions, and enhancing customer service processes.

Telesales Manager

- Duration: October 2016 – October 2021 (5 years 1 month)

- Location: Greater Philadelphia Area

- Role: Managing the telesales team, developing sales strategies, and driving sales performance through effective leadership and training.

Current Role

Director of Quality Assurance & Escalations at CNO Financial Group

- Duration: September 2021 – Present (2 years 10 months)

- Location: United States

- Role: Overseeing quality assurance and managing escalations, ensuring high standards in service delivery and customer satisfaction.

Career Highlights

- It shows that Jonathan is a loyal and dedicated employee of Colonial Penn Life Insurance with good knowledge about the company and its objectives as he has been working with the company for about 9 years.

- His positions as Customer Service Manager and Telesales Manager portray him as a team player skilled in handling people.

- His current job in CNO Financial Group shows his commitment and experience in raising up the standards as well as dealing with problematic situations to meet the client’s and the company’s expectations.

Moving through the company Jonathan Lawson has demonstrated his commitment to insurance and progressed through the ranks to become a leader. His working experience in customer service and sales makes him eligible for an important role in the provision of the quality and effectiveness of services.

Feel free to ask more if you’re curious about any specific aspect of his life or career!

Conclusion

Jonathan Lawson’s journey with Colonial Penn is nothing short of inspiring. From managing customer service to leading telesales, he’s made a mark. Now, as the Director of Quality Assurance & Escalations at CNO Financial Group, he continues to excel. Ever wondered how he balances it all? Jonathan Lawson colonial Penn story shows that dedication and passion can lead to great heights. What’s next for Jonathan? Only time will tell, but it’s bound to be impressive.

FAQs

What is the Colonial Penn 995 Plan?

Colonial Penn 995 Plan is actually a Life Insurance Policy that is so designed that the applicant is automatically accepted. It is marketed at a rate that is fixed at $9. 95 per unit is quite cheap and therefore the cost of service provision is reasonable. It is important to maintain focus on coverage for the specific population, which in this plan is 50- to 85-year-olds without overwhelming costs.

Do I need a medical exam to apply for the Colonial Penn 995 Plan?

Well, the colonial Penn 995 plan does not require you to undergo a medical examination during application. Applicants with chronic diseases will not be discriminated against or denied enrollment into the program. This makes it a convenient way of acquiring these commodities, especially for many especially seniors who may have some underlying health complications.

References:

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.

Customer Service Manager

Customer Service Manager