Table Rating Life Insurance: Detailed Rating Table

Are you getting the best value for your life insurance? Understanding the complexities of life insurance can be daunting, especially when it comes to table rating—a factor that can significantly impact your premiums. How does your health status affect your policy costs, and are you aware of how table ratings work? Dive into the details with us and learn how to navigate the nuances of life insurance, ensuring you get the coverage you need at the best possible rate. Let’s explore how to make informed decisions about your life insurance and secure peace of mind for your future.

What Are Life Insurance Tables?

When you submit a life insurance application, the carrier’s underwriting department reviews your application. This review is called underwriting.

The life insurance underwriters then take your information and place it in a “table”. The table is based on actuarial science, life expectancy, mortality rates, health issues, etc.

Specifically, the underwriters look at:

- information from the MIB: shows your medical claim history as well as your medical conditions and application history

- prescription drug history,

- driving records,

- bankruptcy and credit history,

- doctor’s records: to confirm the severity of a medical condition (for example) and medical history,

- felony/criminal records,

And anything else material to your application.

As we stated earlier, the underwriter takes all of this information and places your information in a “table”.

What Exactly is table rating life insurance?

Table ratings are a way for life insurance companies to assess and weigh the risk associated with insuring you if you are a Substandard risk.

If you have, say, a dangerous job and/or a chronic medical condition, you are seen as a higher risk to insure, and, therefore, will have to pay a higher insurance price.

The table ratings chart has a rate associated with each increased risk you are seen to have. Each different increase in risk bumps you further down the table, and into a higher rate class.

Only term, universal and whole life get these types of ratings.

How Much Does Life Isurance Cost?

While most insurance companies rely on basic classifications, table ratings help make the process more specific. It also helps your insurance agent to immediately compare one carrier to the next, even though prices may vary.

For example, the basic Preferred rating typically includes people with above-average health. These people present a minimal risk to insure.

The Standard rating usually includes people with more average health – like maybe those who have some minor health concerns and are slightly overweight. This is what most people end up with.

While these categories help determine the rates many life insurance consumers will receive, they aren’t able to account for more complicated situations. Enter table rating life insurance, which help provide more detail and assess risks that don’t necessarily fall into one of these categories.

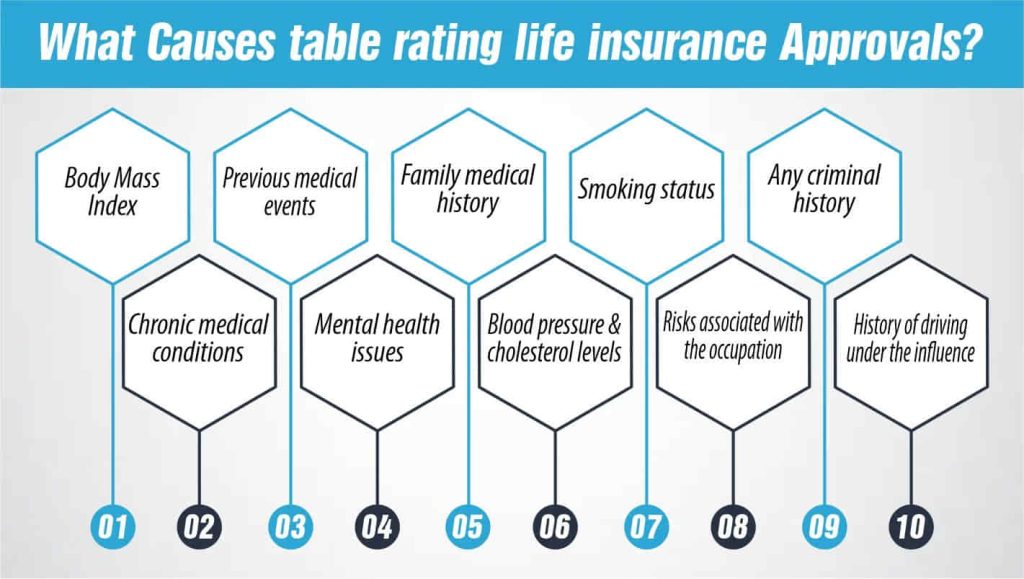

What Causes table rating life insurance Approvals?

When applying for life insurance, you provide a detailed medical history, and answer questions about your health and lifestyle in the process. You will also undergo a medical exam which will involve laboratory tests like urine samples and blood tests.

Life insurance companies will then analyze the information gathered to get a detailed picture of your health and risks to your well-being.

Most insurance companies determine your risk by using a system called risk points. These points are assigned proportionally with each perceived increase in risk, depending on how severe the risk is thought to be in the long run.

For example, while having high blood pressure might result in just a few risk points, having a recent stroke on your record will mean a much more significant addition of risk points.

After your risk points are all added up, they will be used to determine your table rating life insurance, and thus, your cost for life insurance.

There are many issues which could factor in, but here are a few common ones:

- Body Mass Index

- Chronic medical conditions

- Previous medical events

- Mental health issues

- Family medical history

- Blood pressure and cholesterol levels

- Smoking status

- Risks associated with the occupation

- Any criminal history

- History of driving under the influence

Health Conditions Which May Affect a table rating life insurance

The following conditions and situations, not exhaustive, will likely affect a table rating life insurance as well as an APS order from the life insurance company (i.e. ordering medical records to confirm the severity of health conditions).

- Alcohol abuse and/or treatment

- Atrial fibrillation

- Bipolar disorder

- Cancer history (other than basal and squamous cell skin cancers)

- Carotid artery disease

- Elevated cholesterol without treatment

- Chronic obstructive pulmonary disease (COPD/emphysema)

- Crohn’s disease/ulcerative colitis

- Diabetes/gestational diabetes

- Drug abuse and/or treatment

- Emphysema

- Epilepsy/seizure

- Gastric bypass/lap band

- Heart disease/surgery (all types)

- Hepatitis B or C

- Hypertension (severe, uncontrolled)

- Kidney disease

- Melanoma

- MIB and prescription database results that indicate adverse medical history

- Multiple sclerosis (MS)

- Peripheral artery disease (PAD)/ peripheral vascular disease (PVD)

- Chronic prescription narcotic use

Why Do Life Insurance Companies Use Tables And Table Ratings?

Why do life insurance carriers use tables and table ratings? The reason is to create a standardized and equitable way of analyzing risk.

Stated another way, a healthy person shouldn’t pay the same premium as an unhealthy person right?

Right, That makes sense.

Right. The healthy person pays a lower rate. Conversely, the unhealthy person pays a higher rate.

Let’s get into the specifics and the parts of a life insurance table and table ratings.

Shopping with Table Ratings in Mind

Although it may be disappointing to receive a table rating higher than you’d hope, the rates are a good thing. Without them, people considered higher risk would not be able to obtain coverage at all, or placed in a larger risk pool where everyone is forced to pay higher rates than they may need to otherwise.

With table ratings, insurers can assess your risk in a more detailed way. And yes, while you will pay a higher rate than someone with no history of medical issues, you’ll still be able to receive coverage and protect your family.

The detailed approach of table ratings means many different factors are taken into account, which can work to your advantage.

For example, table ratings reduce the likelihood you’ll be automatically denied coverage because of your history of heart attack.

Thanks to table ratings and the inclusion of your background information, you will end up with a lower monthly premium than you would otherwise.

Final Thoughts

It is also important to remember table rating life insurance are not necessarily permanent. With many companies, you can have your risk reassessed after just a few years, or when you have new information to present them.

This potential for a future review is great if you would like to get life insurance coverage soon, but are currently recovering from a medical event or are in less-than-ideal health.

Just make sure to do your research, provide all the information about your health as possible when applying, and consider what exactly your personal life insurance needs and goals are.

References:

https://www.marketwatch.com/guides/life-insurance/preferred-standard-life-insurance-rating/

https://www.riskquoter.com/high-risk/life-insurance-table-ratings/

https://www.lifeinsure.com/insurance-rating-classifications/’

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.