Target Premium Life Insurance: A Comprehensive Guide

Calculate your Life Coverage

Discover financial peace of mind with our Life Insurance Calculator.

Calculate your Life Coverage

Discover financial peace of mind with our Life Insurance Calculator.

In a world full of insurance options, finding the right coverage that suits your unique needs can be a daunting task. One such policy gaining popularity for its tailored approach is Target Premium Life Insurance.

Target Premium Life Insurance, often simply referred to as TPLI, is a type of life insurance designed to provide policyholders with a flexible and customizable premium structure. In this blog post, we’ll explore different aspects of this insurance policy including some of its basic workings, pros and cons, and much more.

Let’s get started!

What is Target Premium on Life Insurance?

Target Premium on Life Insurance (TPLI) is a modern and flexible life insurance option that differs from the rigid structures of traditional policies. It is designed to empower policyholders by granting them unprecedented control over their premium payments. Unlike fixed premium policies, TPLI allows individuals to set their target premium within specified limits.

The uniqueness of TPLI lies in its dynamic nature. Traditional insurance policies often come with fixed premiums and predetermined benefits, offering little room for customization. TPLI, on the other hand, introduces a level of adaptability that caters to the ever-changing financial landscape of policyholders.

This insurance variant typically consists of two key components: a traditional insurance element and an investment component. The premiums paid by the policyholder contribute not only to the life insurance coverage but also to an investment account, often linked to various financial instruments such as stocks or bonds.

How Much Does Life Isurance Cost?

The investment component of TPLI introduces an element of market sensitivity. The performance of the underlying investments can influence the cash value of the policy. This feature allows policyholders to potentially benefit from market growth, but it also exposes them to associated risks.

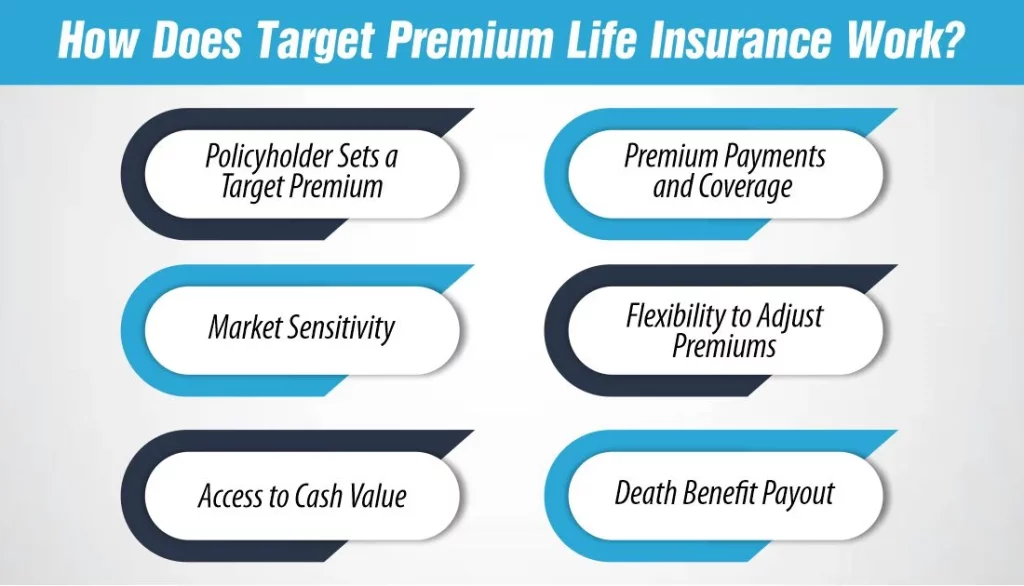

How Does Target Premium Life Insurance Work?

Understanding the inner workings of Target Premium Life Insurance (TPLI) is crucial for anyone considering this innovative approach to life coverage. TPLI operates on a dynamic model, blending traditional life insurance elements with an investment component.

Here’s a step-by-step breakdown of how TPLI works:

1- Policyholder Sets a Target Premium

Unlike traditional life insurance, TPLI puts the policyholder in control. Individuals have the flexibility to set their target premium within certain limits. This target premium serves as a guideline for premium payments.

2- Premium Payments and Coverage

Premium payments made by the policyholder contribute to two primary aspects of TPLI. A portion goes toward the traditional life insurance coverage, ensuring a death benefit for beneficiaries. Simultaneously, another portion is allocated to the policy’s investment component.

3- Market Sensitivity

TPLI is influenced by market conditions. If the investments perform well, the cash value of the policy may increase over time. However, if the market experiences downturns, there is a risk of decreased cash value.

4- Flexibility to Adjust Premiums

TPLI stands out for its adaptability. Policyholders can adjust their premium payments within certain limits. This flexibility allows individuals to respond to changes in their financial situation or investment goals.

5- Access to Cash Value

Over time, the policy accumulates a cash value based on the performance of the investment component. Policyholders may have the option to access this cash value through withdrawals or loans, providing a potential source of funds when needed.

6- Death Benefit Payout

In the unfortunate event of the policyholder’s death, beneficiaries receive a death benefit. This benefit is typically a combination of the traditional life insurance coverage and the accumulated cash value.

Moreover, Target Premium Life Insurance operates as a dynamic and market-linked policy that adapts to the evolving needs and goals of the policyholder. The combination of traditional coverage and an investment component makes TPLI a versatile option for those seeking a more personalized and flexible approach to life insurance.

Benefits and Drawbacks of Target Premium Life Insurance

Target Premium Life Insurance (TPLI) presents a unique blend of flexibility and market exposure, making it an attractive option for those seeking a tailored approach to life insurance. However, like any financial product, TPLI comes with its own set of benefits and drawbacks.

Let’s have a look at both aspects to help you make an informed decision.

Benefits

Flexibility in Premiums

TPLI offers unparalleled flexibility, allowing policyholders to adjust their premium payments based on changes in their financial situation. This adaptability is particularly beneficial for those facing fluctuating income or unexpected expenses.

Potential for Cash Value Growth

The investment component of TPLI provides an opportunity for cash value accumulation over time. As the underlying investments perform well, the cash value of the policy may increase, offering a potential source of funds for the policyholder.

Customization of Coverage

TPLI allows individuals to tailor their coverage to align with specific financial goals. Whether it’s planning for education expenses, a mortgage, or retirement, policyholders can customize their TPLI policy to suit their unique needs.

Access to Cash Value

In addition to the death benefit, policyholders may have the option to access the accumulated cash value through withdrawals or loans. This feature can be advantageous in times of financial need.

Market-Linked Returns

TPLI provides the opportunity to benefit from market-linked returns. If the investments in the policy perform well, policyholders may experience higher cash values, potentially outpacing the returns of traditional life insurance policies.

Drawbacks

Market Risks

TPLI’s connection to the market exposes policyholders to investment risks. Economic downturns or market volatility can impact the cash value and overall performance of the policy, leading to potential losses.

Complexity

The dynamic nature of TPLI, with its investment component and flexibility, can be complex for some individuals. Understanding the complexities of market-linked policies may require a higher level of financial literacy compared to traditional life insurance.

Possibility of Increased Premiums

While TPLI offers flexibility, there are limits to how much premiums can be adjusted. If the underlying investments perform poorly, policyholders may face the risk of increased premiums to maintain the desired coverage.

Not Ideal for Short-Term Needs

TPLI is designed for individuals with a long-term perspective. Those seeking a life insurance solution for short-term needs may find other options more suitable, as the investment component requires time to potentially grow and yield returns.

Potential Complexity in Management

Managing the investment component of TPLI may require ongoing attention and decision-making. Individuals who prefer a hands-off approach to their life insurance may find the dynamic nature of TPLI more involved than they desire.

What is the difference between annual premium and target premium?

The annual premium and target premium are both related to the cost of life insurance, but they serve different purposes:

Annual Premium

The annual premium is the amount of money you pay each year to keep your life insurance policy in force. It is based on factors such as your age, health, coverage amount, and the type of policy you have. The annual premium can vary from year to year based on changes in these factors.

Target Premium

The target premium, on the other hand, is the premium amount that is expected to be paid to keep a policy in force for the entire duration of the coverage. It is calculated based on the policy’s death benefit, the insured’s age, health, and other factors, as well as the insurance company’s assumptions about future interest rates and expenses. The target premium is typically set at a level expected to cover the cost of providing insurance coverage over the long term.

In summary, the annual premium is the actual amount you pay each year for your life insurance coverage, while the target premium is the expected amount that is calculated to keep the policy in force for its entire duration.

Who Can Benefit from Target Premium Life Insurance?

Target Premium Life Insurance (TPLI) is not a one-size-fits-all solution, but it can be particularly advantageous for individuals with specific financial profiles and preferences. Here are scenarios where TPLI might be a beneficial choice:

Financially Flexible Individuals

TPLI caters to those who appreciate financial flexibility. If you anticipate changes in your income or expenses and desire the ability to adjust your life insurance premiums accordingly, TPLI offers the adaptability you seek.

Long-Term Investors

Individuals with a long-term investment horizon stand to benefit from TPLI. The policy’s investment component requires time to potentially grow and yield returns, making it suitable for those with a patient and strategic approach to financial planning.

Risk-Tolerant Investors

TPLI’s market-linked nature introduces investment risks. Those comfortable with market fluctuations and willing to tolerate some degree of risk may find TPLI appealing, especially if they believe in the potential for higher returns over time.

Customized Financial Planning

TPLI is ideal for those who seek a tailored life insurance solution. If you have specific financial goals, such as funding education, paying off a mortgage, or creating a retirement nest egg, TPLI allows you to customize your coverage to align with these objectives.

Individuals with Evolving Needs

Life is dynamic, and so are financial needs. TPLI suits individuals who expect their financial goals and responsibilities to change over time. Whether it’s starting a family, launching a business, or planning for retirement, TPLI adapts to your evolving circumstances.

Those Seeking Cash Value Growth

If the idea of building cash value within your life insurance policy appeals to you, TPLI offers the potential for cash value accumulation. The ability to access this cash value can be advantageous for various financial needs throughout your life.

Sophisticated Financial Planners

Individuals who are comfortable navigating the complexities of market-linked insurance products may find TPLI appealing. Those with a higher level of financial literacy and a strategic approach to wealth management can leverage the benefits of TPLI

Tips for Choosing the Right Policy

Here are some of the tips you can follow to get the right insurance plan:

- Understand Your Financial Goals: Clearly define your financial objectives before considering TPLI. This will help you tailor the policy to align with your long-term aspirations.

- Consult a Financial Advisor: Seek guidance from a financial advisor who specializes in life insurance. They can provide insights into the market and help you make informed decisions.

- Review Policy Terms Carefully: Thoroughly examine the terms and conditions of TPLI policies. Be aware of any limitations, restrictions, or fees associated with the policy.

- Regularly Assess Your Policy: Periodically review your TPLI policy to ensure it continues to meet your evolving needs. Adjustments may be necessary based on changes in your financial situation or goals.

What is the purpose of establishing the target premium?

Establishing the target premium serves several purposes in the context of life insurance:

Policy Sustainability: The target premium is calculated to ensure that the policy remains in force for its entire duration. By setting a target premium, insurance companies aim to collect enough premiums to cover the cost of providing insurance coverage over the long term.

Risk Management: Setting a target premium helps insurance companies manage their risk. By accurately estimating the cost of providing coverage and setting premiums accordingly, insurance companies can ensure that they have enough funds to pay out claims when they arise.

Customer Expectations: Establishing a target premium helps set customer expectations about the cost of insurance coverage. It allows policyholders to understand how much they need to pay to keep their policy in force and helps prevent unexpected premium increases.

Regulatory Compliance: Insurance regulators may require insurance companies to establish target premiums as part of their regulatory oversight. Target premiums help ensure that insurance companies are financially stable and able to meet their obligations to policyholders.

Establishing the target premium is an important step in the underwriting and pricing process for life insurance policies, ensuring that both the insurer and the policyholder understand the cost of coverage and the expected benefits of the policy.

What is a target in insurance?

In insurance, the term “target” can refer to different concepts depending on the context. Here are a few common uses of the term:

Target Premium: As discussed earlier, the target premium is the premium amount that is expected to be paid to keep a policy in force for the entire duration of the coverage.

Target Market: The target market in insurance refers to the specific group of individuals or businesses that an insurance company aims to sell its products to. Insurance companies often develop products and marketing strategies tailored to meet the needs of their target market.

Target Loss Ratio: The target loss ratio is a measure used by insurance companies to assess the profitability of their underwriting operations. It is calculated by dividing the expected losses by the earned premiums and is used to determine the appropriate premium rates for insurance policies.

Target Benefit Amount: In some cases, the term “target” may also refer to the desired benefit amount that a policyholder aims to achieve with their insurance policy, such as a specific death benefit or cash value accumulation.

Overall, the term “target” in insurance is used to describe various aspects of the insurance business, including premium pricing, marketing strategies, profitability goals, and benefit amounts.

Final Thoughts

Target Premium Life Insurance offers a unique and flexible approach to life insurance that can provide financial security and peace of mind. However, it’s crucial to carefully evaluate your own financial situation, risk tolerance, and long-term goals before committing to a TPLI policy. By understanding how TPLI works and following the tips provided, you can make informed decisions that align with your unique needs, ensuring a secure and customized financial future.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.