In today’s uncertain world, ensuring your family’s financial stability is more important than ever. Several life insurance plans can provide you safety as well as stability for your financial needs. But with a lot of options available which one is the best? Let’s explore.

If you are a person along with 5 to 6 individuals in your family, you can consider getting Family Income Benefits Insurance. This policy is a key solution to creating a strong safety net for your loved ones.

In this blog post, we will discover the layers of this insurance, offering insights into its importance, key features, and how it can be a game-changer for your family’s financial security.

What is Family Income Benefits Insurance?

Family Income Benefits Insurance (FIBI) is a specialized form of life insurance designed to provide ongoing financial support to your family in the event of your untimely death. Unlike traditional life insurance policies that typically offer a lump sum payout, FIBI ensures a steady stream of income to replace the lost earnings of the insured individual.

The key feature of this insurance plan is its focus on income replacement. Instead of a one-time payout, beneficiaries receive regular payments over a specified period. This approach aims to maintain the family’s financial stability by covering living expenses, mortgage payments, education costs, and other financial obligations.

FIBI is often considered a more affordable option compared to traditional life insurance, making it an attractive choice for individuals and families seeking cost-effective ways to secure their financial future. The duration of benefits can be customized, allowing policyholders to tailor the coverage to their family’s specific needs, such as until the youngest child reaches a certain age or until the surviving spouse retires.

Moreover, FIBI acts as a financial safety net, ensuring that your loved ones continue to receive support even after you’re no longer there to provide for them.

What is the income benefit plan?

An income benefit plan is a type of insurance or financial product that provides a regular stream of income to the policyholder or their beneficiaries. This type of plan is often used to supplement retirement income, provide financial support in the event of disability, or ensure a steady income for beneficiaries in the event of the policyholder’s death.

Income benefit plans can take many forms, including annuities, pension plans, and life insurance policies with income riders. The specifics of the plan will vary depending on the provider and the type of coverage selected. The goal of an income benefit plan is to provide a reliable source of income over a specified period or for the rest of the beneficiary’s life, helping to ensure financial stability and security.

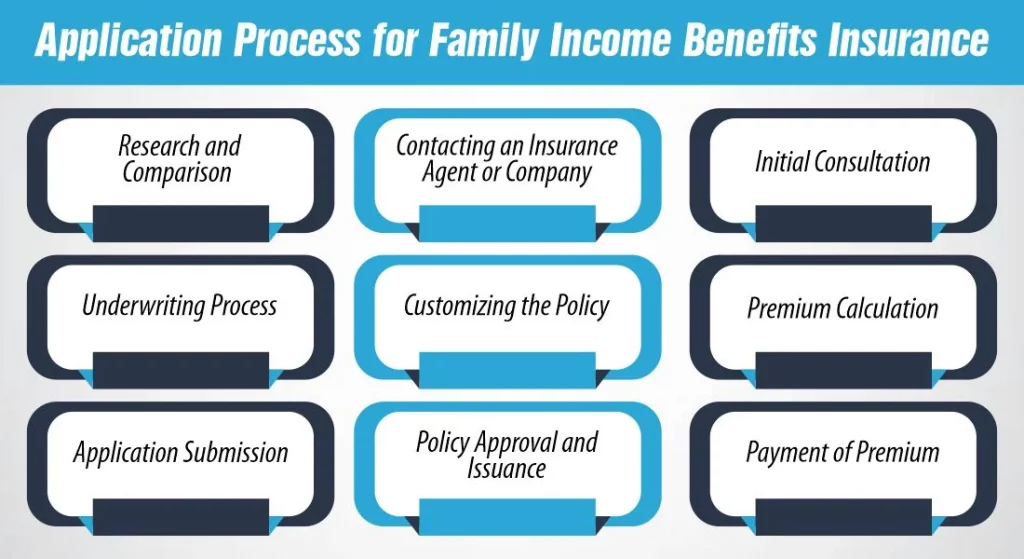

What is the Application Process for Family Income Benefits Insurance?

The application process for Family Income Benefits Insurance (FIBI) is generally straightforward, but it involves several key steps to ensure that the policy meets the specific needs of the insured and their family. Here’s an overview of the typical application process for FIBI:

1- Research and Comparison

Begin by researching different insurance providers offering Family Income Benefits Insurance. Compare policies, coverage options, premium rates, and additional features to find the one that best aligns with your family’s needs.

2- Contacting an Insurance Agent or Company

Reach out to an insurance agent or the chosen insurance company to initiate the application process. This can be done through online portals, phone calls, or in-person meetings.

3- Initial Consultation

During the initial consultation, the insurance agent will gather information about the applicant’s financial situation, family structure, income, and other relevant details. This information helps determine the appropriate coverage amount and duration.

4- Underwriting Process

The underwriting process involves a comprehensive assessment of the applicant’s health, lifestyle, and occupation. The insurer may request medical records, conduct a health examination, or ask lifestyle-related questions to evaluate the risk.

5- Customizing the Policy

Based on the collected information, the insurance agent will work with the applicant to customize the policy. This includes determining the coverage amount, duration of benefits, and any additional riders or features that may be included.

6- Premium Calculation

The insurer calculates the premium based on various factors, such as the applicant’s age, health, occupation, and the chosen coverage. The premium is the cost paid by the insured to maintain the insurance policy.

7- Application Submission

Once the policy details are finalized and the premium is agreed upon, the applicant submits the completed application to the insurance company. This may include signing relevant documents and authorizing the necessary checks.

8- Policy Approval and Issuance

The insurance company reviews the application, underwriting results, and other submitted documents. If everything is in order, they approve the policy, and the insured receives the official insurance contract.

9- Payment of Premium

The insured is required to pay the agreed-upon premium regularly (monthly, quarterly, or annually) to keep the policy active.

10- Policy Activation

Once the premium payment is received, the Family Income Benefits Insurance policy becomes active, and the insured and their beneficiaries are covered according to the terms of the policy.

It’s essential to provide accurate and honest information during the application process to ensure that the policy reflects the family’s actual financial needs and to avoid complications in the future.

Advantages and Disadvantages of Family Income Benefits Insurance

Now let’s explore the benefits and drawbacks of this insurance plan:

Advantages

- Steady Income Stream: FIBI provides a regular stream of income to beneficiaries, ensuring a consistent financial lifeline in the absence of the insured.

- Income Replacement: The primary purpose of FIBI is to replace a portion of the insured’s income, helping the family meet living expenses, mortgage payments, and other financial obligations.

- Affordability: FIBI is often more affordable than traditional life insurance, making it accessible to a broader range of individuals and families.

- Customizable Coverage: Policies can be tailored to meet the specific needs of each family, allowing for flexibility in terms of coverage amount, duration, and additional features.

- Tax Advantages: In many cases, the benefits from FIBI are tax-free, providing a financial advantage to the beneficiaries.

- Financial Security for Non-Breadwinners: FIBI is not limited to primary breadwinners; even those with smaller incomes contribute significantly to the family’s well-being, and FIBI can offer crucial support.

Disadvantages

- No Lump Sum Payout: Unlike traditional life insurance, FIBI does not provide a lump sum payout. Some individuals may prefer a lump sum for flexibility in managing financial needs.

- Limited Duration of Benefits: The benefits from FIBI are typically provided for a specified duration. If the insured lives beyond that period, there may be no additional benefits, potentially leaving the family without coverage.

- Premium Payments Required: Regular premium payments are necessary to keep the FIBI policy active. Failure to pay premiums could result in the lapse of the policy and loss of coverage.

- Not an Investment Vehicle: FIBI is designed for income protection rather than as an investment. It may not accumulate cash value over time, unlike certain types of life insurance policies.

- May Not Cover All Expenses: The income provided by FIBI may not cover all the financial needs of the family, especially if the insured had substantial additional expenses or debts.

- Dependence on Insurer Stability: The effectiveness of FIBI relies on the financial stability and reliability of the insurance company. If the insurer faces financial difficulties, it could impact the payout and stability of the policy.

Who should get a Family Income Benefits Insurance?

Family Income Benefits Insurance (FIBI) can be a valuable financial tool for a variety of individuals and families. While it may not be suitable for everyone, certain situations make FIBI particularly relevant.

Here are some scenarios where individuals should consider getting FIBI:

1- Primary Breadwinners

Individuals who are the primary earners for their families should strongly consider FIBI. It ensures that in the event of their untimely death, a steady income stream is provided to replace lost earnings and support the family financially.

2- Dual-Income Families

Even in families where both spouses contribute to the income, FIBI can be beneficial. If the loss of one income would significantly impact the family’s financial stability, FIBI can provide an extra layer of protection.

3- Single Parents

Single parents often shoulder the entire financial responsibility for their families. FIBI can offer crucial support to ensure that their children’s needs are met if they are no longer there to provide.

4- Young Families

Families with young children may find FIBI especially valuable. The policy can be structured to provide income until the children reach a certain age, ensuring financial support during their formative years.

5- Those with Specific Financial Responsibilities

Individuals with specific financial responsibilities, such as a mortgage or educational expenses, can benefit from FIBI. The policy can be customized to cover these specific needs, offering targeted financial protection.

6- Individuals with Limited Resources

FIBI is often more affordable than traditional life insurance, making it an attractive option for individuals with limited financial resources. It provides a cost-effective way to secure financial protection for their families.

7- People with Non-Traditional Income Sources

Those with income sources that may not be easily replaceable, such as freelance or contract workers, can benefit from FIBI. It ensures that their unique income contributions are accounted for in the policy.

8- Individuals with Health Concerns

People with health concerns may find it challenging to secure traditional life insurance at affordable rates. FIBI, with its focus on income replacement, may offer a more accessible alternative.

What is a family income policy with a 20 year rider?

A family income policy with a 20-year rider is a type of life insurance policy that provides a regular income to your family or beneficiaries if you pass away during the term of the policy, with an additional feature that extends the payout period to 20 years.

Here’s how it typically works:

- Regular Income Benefit: The policy pays out a regular, tax-free income to your family or beneficiaries if you die during the policy term. This income is designed to help your family meet their day-to-day living expenses and maintain their standard of living.

- 20-Year Rider: The 20-year rider is an additional feature that extends the income payout period beyond the standard policy term. For example, if you have a 20-year term policy with a 20-year rider and you die in the 15th year of the policy, your beneficiaries will continue to receive the income benefit for the remaining 5 years of the rider period.

This type of policy can provide added peace of mind by ensuring that your family has a steady income for an extended period if you were to die unexpectedly. It can help them cover ongoing expenses such as mortgage or rent payments, utility bills, and childcare costs.

What is the monthly income benefit?

The monthly income benefit refers to the amount of money that a beneficiary receives each month from a life insurance policy or annuity. This benefit is typically paid out if the insured person dies or, in the case of an annuity, if the annuitant reaches a certain age or milestone.

The amount of the monthly income benefit is determined by the terms of the policy or annuity contract. It may be a fixed amount, or it may be based on a percentage of the policy’s face value or the annuity’s accumulated value.

The monthly income benefit can provide a steady source of income to help the beneficiary cover living expenses, pay off debts, or meet other financial needs. It can be particularly useful for beneficiaries who may not be able to manage a large lump sum payment, such as young children or individuals with limited financial experience.

Final Thoughts

Family Income Benefits Insurance stands as a pillar of financial security, offering a reliable income stream to support your family during challenging times. As you explore insurance options, consider the unique advantages that FIBI brings to the table. Remember, investing in the right insurance is not just a financial decision; it’s a commitment to safeguarding the well-being of those you hold dear.

Take the first step now towards a more secure future with FIBI.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.