Tax-Deferred Pension and Retirement Savings Plans 1040

Are you maximizing your retirement savings while minimizing your taxes? Going through the world of tax-deferred pension and retirement savings plans can seem daunting, but understanding these financial tools is crucial for securing your future.

In this guide, we’ll break down everything you need to know about tax-deferred plans, their benefits, and how they impact your 1040 tax form. With the right strategies, you can make the most of your contributions, reduce your taxable income, and ensure a comfortable retirement.

What Are Tax-Deferred Pension and Retirement Savings Plans 1040?

Tax-deferred pension and retirement savings plans are financial tools designed to help you save for retirement while offering significant tax benefits. These plans allow you to contribute pre-tax income, which means you don’t pay taxes on the money you contribute until you withdraw it during retirement. This deferral can lead to substantial tax savings and allow your investments to grow more efficiently over time.

Here are some of the most common types of these plans.

401(k) Plans

A 401(k) plan is a widely used employer-sponsored retirement savings option. Employees can contribute a portion of their salary to their 401(k) account, and often, employers will match these contributions up to a certain percentage. The contributions and any investment gains are not taxed until the funds are withdrawn, usually during retirement.

403(b) Plans

Similar to 401(k) plans, 403(b) plans are available to employees of public schools and certain tax-exempt organizations. These plans offer the same tax advantages, allowing participants to contribute pre-tax income and defer taxes on investment gains until retirement.

Traditional IRA

A Traditional Individual Retirement Account (IRA) is a personal savings plan that offers tax-deferred growth. Contributions to a Traditional IRA are made with pre-tax income, which can lower your taxable income for the year. Like other tax-deferred plans, you don’t pay taxes on the contributions or earnings until you withdraw the funds during retirement.

SEP IRA

Simplified Employee Pension (SEP) IRAs are designed for self-employed individuals and small business owners. SEP IRAs allow higher contribution limits than traditional IRAs, providing a significant tax-deferred savings opportunity for business owners and their employees.

SIMPLE IRA

Savings Incentive Match Plan for Employees (SIMPLE) IRAs are another option for small businesses. These plans are easier to set up and administer than other retirement plans, offering tax-deferred growth and employer-matching contributions.

Benefits of Tax-Deferred Pension and Retirement Savings Plans 1040

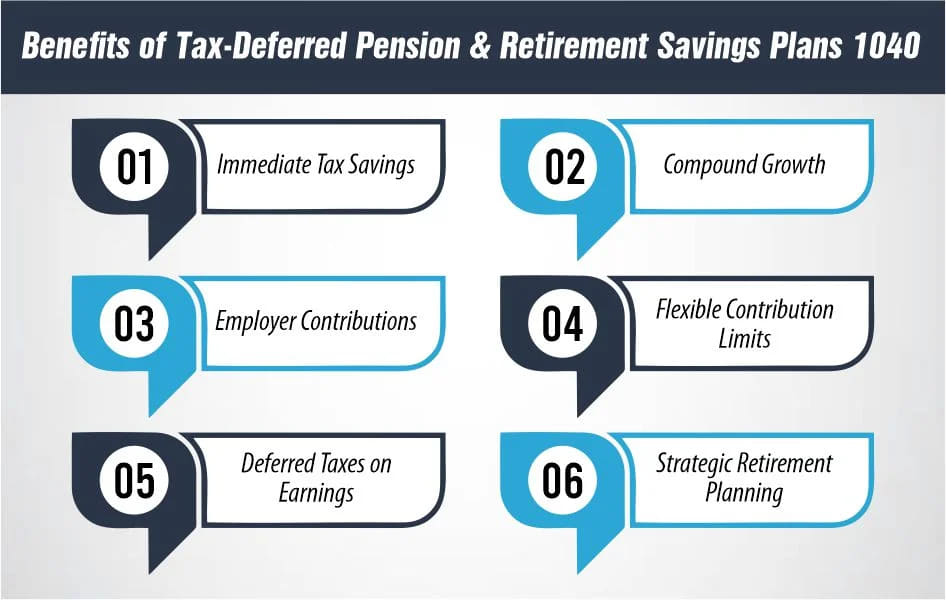

Tax-deferred pension and retirement savings plans 1040 offer a range of advantages that can significantly impact your financial well-being in retirement. Here are some of the key benefits:

1- Immediate Tax Savings

One of the most compelling benefits of tax-deferred plans is the immediate tax savings. Contributions are made with pre-tax income, which reduces your taxable income for the year. This can lower your overall tax bill, allowing you to keep more of your earnings.

How Much Does Life Isurance Cost?

2- Compound Growth

The power of compound growth is amplified in tax-deferred plans. Since your contributions and earnings grow without being reduced by taxes, your investment can compound more effectively over time. This means your money works harder for you, potentially leading to substantial growth by the time you retire.

3- Employer Contributions

Many tax-deferred plans, such as 401(k) and 403(b) plans, include employer matching contributions. This is essentially free money added to your retirement fund. Ensuring you contribute enough to receive the full employer match can significantly boost your retirement savings.

4- Flexible Contribution Limits

Tax-deferred plans often come with generous contribution limits. For instance, 401(k) plans have higher contribution limits compared to other retirement savings accounts. This allows you to save more money on a tax-deferred basis, accelerating your retirement savings.

5- Deferred Taxes on Earnings

Earnings on your investments within tax-deferred plans are not taxed until you withdraw the funds. This includes dividends, interest, and capital gains. Deferring these taxes allows your investments to grow more rapidly than they would in a taxable account.

6- Strategic Retirement Planning

Tax-deferred plans allow for strategic retirement planning. You can plan your withdrawals to minimize tax impact, particularly during years when your taxable income might be lower. This flexibility can lead to significant tax savings throughout your retirement.

Impact of Tax-Deferred Plans on Form 1040

Tax-deferred pension and retirement savings plans play a significant role in shaping your tax return, particularly your Form 1040. Understanding how these contributions and their associated benefits affect your tax filing is essential for optimizing your tax situation.

1- Reducing Taxable Income

Contributions to tax-deferred plans reduce your taxable income for the year. When you contribute to a 401(k), 403(b), or Traditional IRA, the amount you contribute is deducted from your gross income. This reduction lowers your taxable income, which can potentially place you in a lower tax bracket, thereby reducing your overall tax liability.

2- Reporting Contributions

Properly reporting your contributions to tax-deferred plans on Form 1040 is crucial. Here’s how it works for different plans:

401(k) and 403(b) Plans

For employer-sponsored plans like 401(k) and 403(b), your contributions are reported on your W-2 form, specifically in Box 12. When you fill out your Form 1040, these contributions will be reflected in the adjustments to income section, reducing your adjusted gross income (AGI).

3- Deductions

Traditional IRA Contributions

Contributions to a Traditional IRA might be tax-deductible. The amount you can deduct depends on your income, filing status, and whether you or your spouse are covered by a retirement plan at work. The deduction lowers your taxable income, further reducing your tax bill.

Income Phase-Out Limits

There are income phase-out limits that determine the deductibility of Traditional IRA contributions. If your income exceeds certain thresholds, the amount you can deduct may be reduced or eliminated. It’s essential to check the current IRS guidelines for these limits.

4- Impact on Adjusted Gross Income (AGI)

Reducing your AGI through tax-deferred contributions can have several benefits beyond just lowering your taxable income. A lower AGI can make you eligible for various tax credits and deductions that phase out at higher income levels, such as:

Child Tax Credit

A lower AGI can increase your eligibility for the Child Tax Credit, providing substantial tax savings for families.

Education Credits

Tax credits for education expenses, such as the American Opportunity Credit and Lifetime Learning Credit, have income phase-outs. Reducing your AGI can help you qualify for these credits.

How to File Your 1040 with Tax-Deferred Plans

Filing your 1040 tax form correctly when you have tax-deferred pension and retirement savings plans is crucial for maximizing your tax benefits and avoiding potential penalties. Here’s a step-by-step guide to help you navigate the process.

1- Gather Documents

Before you start filing, gather all the necessary documents. Key documents include:

- W-2 Forms: Provided by your employer, showing your total earnings and tax-deferred contributions to employer-sponsored plans like 401(k) or 403(b).

- Form 5498: Provided by your financial institution, showing your contributions to IRAs.

- Form 1099-R: Shows distributions from pensions, annuities, retirement, profit-sharing plans, IRAs, insurance contracts, etc.

2- Report Your Income

Start by reporting all your income on your Form 1040. This includes wages, salaries, tips, interest, dividends, and any other income sources.

3- Adjusted Gross Income (AGI)

Calculate your AGI by subtracting adjustments from your total income. Adjustments include contributions to traditional IRAs, student loan interest, and other eligible expenses.

4- Report Contributions to Tax-Deferred Plans

401(k) and 403(b) Contributions: These are typically reported in Box 12 of your W-2 form. The code “D” indicates 401(k) contributions, while “E” indicates 403(b) contributions. Enter the total amount contributed on your 1040.

Traditional IRA Contributions: Enter your IRA contributions on Schedule 1, Line 20, of Form 1040. This amount will then transfer to Line 32 on Form 1040 as an adjustment to income.

5- Itemized Deductions or Standard Deduction

Decide whether to take the standard deduction or itemize your deductions. Use Schedule A to itemize deductions such as mortgage interest, charitable contributions, and medical expenses. The choice between standard and itemized deductions depends on which method provides a greater tax benefit.

6- Calculate Taxable Income

Subtract the standard deduction or itemized deductions from your AGI to determine your taxable income. Enter this amount on Line 15 of Form 1040.

7- Calculate Your Tax

Use the IRS tax tables to determine your tax liability based on your taxable income. Enter the calculated tax on Line 16 of Form 1040.

8- Report Retirement Plan Distributions

If you took distributions from your tax-deferred retirement plans, report these on Line 4a (IRA distributions) and Line 4c (pensions and annuities) of Form 1040. The taxable portion of these distributions goes on Line 4b and Line 4d, respectively.

9- Claim Credits and Other Payments

Claim any tax credits for which you are eligible, such as the Child Tax Credit or Education Credits, on the applicable lines of Form 1040. Enter any other payments, including withholding and estimated tax payments, on Lines 25 to 33.

10- Calculate Total Tax and Payments

Add up your total tax and payments to determine if you owe additional tax or are due a refund. Enter this information on Lines 37 to 40 of Form 1040.

Final Thoughts

Tax-deferred pension and retirement savings plans 1040 are powerful tools for building a secure retirement. By understanding how they work and how they impact your 1040 tax form, you can maximize your savings and reduce your tax burden. Take advantage of these plans’ benefits, and avoid common pitfalls to ensure a comfortable and financially stable retirement.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.