Variable Life Insurance vs Whole Life: What You Need to Know

Last Updated on: December 27th, 2024

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Two primary varieties of life insurance, which people compare frequently, are Variable Life Insurance and Whole Life Insurance. Even though these two kinds of insurance sound quite similar, there are differences. Now let’s examine both to further help you understand them.

Table of Contents

ToggleWhat is Whole Life Insurance?

– Definition and Nature:

- Whole life has had its roots as a type of permanent life insurance; this means you have coverage for your whole life.

- While a term life insurance policy provides you coverage for a given period only, a whole life insurance policy provides coverage for life if you pay your premium.

Lifetime Coverage:

- The biggest strength of whole life insurance is its duration of coverage. More than that, it stays valid as long as you make your payments for the premiums, which then only expire after your death.

- The death benefit can always be paid to your heirs at any age of your death which makes it very useful.

Premiums:

- Costs of whole life insurance policies are payable throughout the life of the insurance agreement. This means your premium payments will not be hiked as you grow old or if your health deteriorates.

- The premiums for these plans are normally higher than those of the term life insurance because they do not have an expiry period and contain an investment element.

Cash Value Account:

- Some of the premiums paid are reserved in a cash value account. This account increases with time thereby creating value within the policy.

- The cash value grows at a guaranteed interest rate, that is, in case the market performs poorly, one will still find that his/her cash value has grown.

- While the cash value is growing, the earnings are tax-deferred which means that the holder will not be expected to pay tax on it until he takes cash out of it.

Cash Value Growth:

- The actual money increases in a quite constant manner and is more often secure than other forms of investment like shares.

- The cash value builds up over time to some reasonably good amount depending on the existence of the policy.

- What the cash value increases each year is to be determined by the insurer and there should always be an increase.

– Borrowing Against the Cash Value:

- Unlike most other insurance products, one of the additional features of owning a whole life insurance is the possibility to take a credit based on the cash value accumulated.

- This is normally true concerning the loan terms and the fact that you don’t have to undergo a credit check to access these funds. The loan can be taken for any purpose such as tuition or other school fees, to carry out home improvements, or for any need and emergency.

- But you should remember that any outstanding loans together with the interest on them will result in a reduction in the amounts your heirs are going to receive once you die.

Dividends:

- Most whole life insurance policies are usually participating policies that may pay out dividends to policyholders if the insurance company has a good year on the stock market.

Dividends can be used in several ways:

- Reduce premium payments

- Buy more (in terms of the amount of money paid out in the event of death)

- Stored in cash value account Also

- Be paid out to you in cash

- While dividends are not fixed many insurance companies have a good history of paying them- dividends.

Death Benefit:

- The death benefit of a whole life insurance policy is the sum of money that is payable by the insurance company any time you die, while the face amount is the amount that is payable to your beneficiaries upon your death. This amount is assured and generally, the benefits will be free of tax for the recipients.

- The death benefit may be used by your loved ones to pay for burial and funeral expenses, clear outstanding bills, or even live comfortably.

- Again, this depends on the need and policy type but it could be anything between several thousand dollars to millions of dollars.

Guaranteed Cash Value and Death Benefit:

- This type of insurance is different from other kinds of life insurance policies in a way that the cash value and the face amount are sure to increase.

- The insurer explains that after a formula is set up, the cash value will grow along with the cash value, and the disagreeable death benefit will be received accordingly regardless of the policyholder’s conditions.

– Long-Term Financial Planning Tool:

- The whole life insurance commonly applies in estate planning and wealth transfer. It can also be used to pass property to heirs in cases of death, to see to it that the testator’s dependents are well provided for.

- We also have the fact that the policy could form part of a financial portfolio, giving constant and probably standard returns apart from other avenues such as stocks or bonds.

- This is commonly applied by persons who would like to make provisions for their next of kin in their prerogative to leave something behind for their benefit, and at the same time accumulate wealth as they live.

Cost Considerations:

- Whole life insurance is usually more costly than term life insurance because of its lifetime coverage, guaranteed benefit at the policy owner’s death, as well as cash value.

- While the premiums may be slightly higher than those of other policy types, for some the price of whole-life insurance can be significantly high at the start; however, it is very beneficial in the long run in two ways: protection and savings.

- It has been seen that the price of the premium varies with the age, health, and coverage amount of an individual. Premiums or costs are predetermined and are cheaper when they are paid at a young age.

Policy Loans and Withdrawals:

- You can withdraw a policy loan or make a partial withdrawal from your cash value.

- Loans themselves are tax-free unless the policy is surrendered and the loan is not repaid. However, when drawing money from the cash value, this is taxed as it deems fit depending on the amount that is being withdrawn.

However, it was also found useful to emphasize the fact that the loan interest is compounded over the period and the unpaid amount will be subtracted from the death benefit.

What is Variable Life Insurance?

– Definition and Nature:

- Variable life insurance is one of the forms of permanent life insurance that guarantees an individual permanent insurance coverage like Whole life insurance.

- However, while with whole life insurance the cash value part is guaranteed, with variable life insurance, the cash value is associated with the investment, such as stocks, bonds, or mutual funds.

- This let alone the possibility of growing the cash value at a much faster pace, also comes with more risk.

Lifetime Coverage:

- Like any other type of permanent insurance policy both variable and fixed, a variable life insurance policy offers life-long insurance coverage provided you keep up with your premium payments.

- The death benefit is ensured to be paid out to your beneficiaries, but it is versatile based upon the performance of the investment in the policy.

Premium Payments:

- You pay fixed amounts of money whether monthly, quarterly, or yearly during the existence of the policy.

- They may also be variable meaning you can change the amount you pay per certain time limit.

- This part of the premium is invested in cash value accounts, which are part of the policy accumulations.

Cash Value and Investment Options:

- The cash value of the variable life insurance is invested in any number of investment options selected by the holder. They may include shares in the stock market; fixed deposits, interest rates in the bond market; mutual investment funds, and units.

- Your cash value may be matched with either increasing or decreasing depending on how your chosen investments will perform. This creates some measure of uncertainty however, there is always the possibility of more growth than with whole-life policies.

The Investment choices are all under your discretion thus the ability to diversify according to our risk appetite and financial requirements.

– Investment Risk and Potential Growth:

- While it incorporates the cash value, this is a variant with market performance and, therefore, variable. When investments do well your cash value really increases. Nevertheless, if the investments grow poorly the cash value could be lower and result in the surrender of the policy.

- In general, the possible growth in variable life insurance is higher than that in whole life insurance because of the part that pertains to investments.

- Such a policy can be quite attractive for those buyers who do not mind certain risks related to the stock market or other similar investments.

Flexible Death Benefit:

- The amount of coverage within variable insurance is not fixed while determining the policy, as it is open for changes later. There are generally two options:

- Option 1: The face or assured amount is unchanged, while the cash value grows independently of it.

- Option 2: The death benefit is further defined as the face value of the policy plus the amount of cash value that has commenced to accumulate. This option encompasses a wider variability but also allows for a higher variety.

- The death benefit is flexible in the sense that it can be adjusted up or down subject to certain parameters within the financial plan and the 〈performance or profit shareholders gain.

- The amount of coverage within variable insurance is not fixed while determining the policy, as it is open for changes later. There are generally two options:

Loans and Withdrawals:

- Like in the case of whole life insurance, the policy’s cash value is accessible and can be used to get a loan. Compared to other modes of credit facilities, loans are known to attract relatively lower rates of interest.

- This can be quite helpful when planning for death mainly because any loan balance and the interest accrued on it will be recovered from the death benefit, thus needing to pay off the loan for the amount to be given to beneficiaries.

Other options include a partial surrender, where you will receive some money, but it comes at the cost of reducing both the cash value and the face amount of the policy.

Does Variable Whole Life Insurance Contain Cash Value?

| Type of Insurance | Cash Value | Price Range (Annual Premium) |

| Variable Whole Life | Cash value is tied to investment options (stocks, bonds, mutual funds), so it can fluctuate over time depending on market performance. | $2,500 – $5,000 |

| Whole Life Insurance | Over time, cash value increases at a predetermined, guaranteed rate, offering greater growth certainty. | $3,000 – $7,000 |

Note: The price range for annual premiums varies based on factors like age, health, coverage amount, and the insurer.

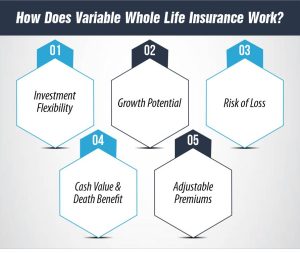

How Does Variable Whole Life Insurance Work?

- Investment Flexibility: You decide where your money goes that can be invested in stocks, bonds, mutual funds, and many more.

- Growth Potential: If the investments of the policy do well then the cash value as well as the face amount of the policy may go up.

- Risk of Loss: If it does poorly on the invested funds their cash value can reduce and so does the face amount.

- Cash Value & Death Benefit: The cash value is associated with the performance of your selected stocks and the death benefit is influenced in this regard as well.

- Adjustable Premiums: There are flexible policies in which you can make premium payments in any way based on necessity and investment yields.

Is Variable Life Insurance the Same as Whole Life?

– Lifespan of Coverage

- Variable Life Insurance: It is lifelong insurance, and the amount of premium to be paid can be changed later on as well. It remains active as long as the premiums are being paid but the face amount and cash surrender value could vary because of the credits or debits earned by the participating investments.

- Whole Life Insurance: Also offers lifelong insurance. The Premiums are fixed; all cash Values have guaranteed effectiveness, and assured death benefit makes it calmer compared to variable life insurance.

– Investment Flexibility

- Variable Life Insurance: Enables policyholders to choose the provision of their payments into standard investment opportunities including stocks bonds or mutual investment funds.

- The policyholders’ benefits – the cash value of such policies – are tied to these investments. It can increase if the investments do well but may well decrease if the investments happen to do poorly.

- Has better potential to yield than the whole life insurance but is relatively risky.

– Whole Life Insurance:

- The first part namely the premium portion is used to cater for the death benefit and the cash value part.

- None of the investors has something like an investment component in which they can choose freely stocks or bonds.

- Cash value grows at a fixed rate declared by the insurance company and tends to be safer yet produce fewer amounts of money in comparison to participating products.

– Death Benefit

- Variable Life Insurance: The structure of the death benefit can be also flexible. There are generally two options: a fixed amount basically known as a level death benefit or a death benefit that rises based on the performance of the cash value.

- The other component of the death benefit may increase if investments are good; on the other hand, it may be less if the investments are poor.

- Whole Life Insurance: In other cases, the benefit paid at the death of the insured is fixed and determined in advance.

- It covers the death benefit to the policy holders’ beneficiary and the quantity does not reduce based on the performances of market stocks provided the policyholder has not borrowed or withdrawn on the cash value.

– Premium Payments

- Variable Life Insurance: Premiums can be stated, which means that the magnitude of payments and their frequency may be changed at any time.

- However, for a policyholder, if they pay low premiums or if the investment yields low returns then they have to pay more amount to continue the policy.

- The flexibility is relatively a disadvantage in terms of policy dealing especially when compared with whole life insurance.

– Whole Life Insurance:

- Premiums are agreed and constant, making it possible to plan the finances in the future well.

- These premiums stay fixed for the entire life of the policyholder thus can easily plan whether to pay or not.

- The stated benefits aid in the assuring of cash values and death benefits for a guaranteed fixed premium.

- Premiums are agreed and constant, making it possible to plan the finances in the future well.

- Example of Variable Life Insurance vs Whole Life

- For example, monthly premiums are $1,000. Part of your premium payment will go to a cash value account that is guaranteed and the amount will increase over the years at a fixed interest rate.

The fact with variable life insurance, a portion of the premium is placed in various funds, and the cash value increases according to the returns of the fund. If the market does well then you have the potential to be growing your cash value much faster. But if the market performs poorly then your cash value may reduce.

Whole Life Insurance: Pros and Cons

Pros of Whole Life Insurance:

- Fixed Premiums:

- The premium is fixed for the entire life of the policyholder, so policyholders can more easily plan their expenses.

- Guaranteed Cash Value:

- Whole life insurance builds up a guaranteed cash value which is a steady build-up of cash value. The policyholder can take credit or withdraw from this value.

- Stability and Predictability:

- The cash value and death benefit increase at a constant rate thus policy “holders are assured of a definite amount of coverage.

- Lifelong Coverage:

- It means it doesn’t have any set time but affords coverage of the life of the policyholder as long as premiums are being remitted.

Cons of Whole Life Insurance:

- Higher Premiums:

- Whole life insurance costs much more than term life insurance, thereby, making it expensive to some people.

- Slow Cash Value Growth:

- The cash value grows steadily and surely, but some may not find its growth rates as attractive compared to other vehicles such as variable life insurance or even other vehicles.

- Limited Flexibility:

- Unlike variable life insurance, choice of investment or flexibility in premium paying is not available and this may restrain the expansion of the company in terms of returns.

Variable Premium Whole Life Insurance

Variable premium whole life insurance is a type of variable life insurance, where premiums that you are willing to pay can alter. Flexibility is good when the need arises to alter some payments and the only downside is the fact that your coverage can be altered at any one time.

Conclusion

The key to variable life insurance and whole life insurance involves comparing one against the other through the lens of one’s financial plans and risk-taking ability. It can be considered if the insurance department needs more steady returns or higher risks and possibly greater returns provided by variable life insurance. Periods of coverage are for life, so you must pick what would suit you best.

How Much Does Life Isurance Cost?

FAQ’s

1- What is the main difference between Variable Life Insurance and Whole Life Insurance?

The premiums of Variable Life Insurance are also flexible, as is the face amount of the policy, but the cash value is invested in stocks or bonds and is variable. Whole Life Insurance comes with a fixed price of risk and a fixed amount that is paid to the benefactor or the nominee upon the policyholder’s death. The cash value grows at a fixed rate annually.

2- Which one is better for long-term financial growth, Variable Life or Whole Life Insurance?

Longer-term improvements are more possible in Variable Life Insurance because the cash value is linked to investments, but it also has more risk. Whole Life Insurance, on the other hand, is much safer; it has steady performances and steady growth, yet lower returns than those of its Participating Whole Life Policies.

3- Can I change my premiums or death benefit with Whole Life Insurance?

No, with Whole Life Insurance the agreed amount of premiums to be paid and the amount of the benefit payable to the beneficiaries are more or less constant. There is usually little flexibility in that regard in a standard Whole Life Insurance policy; on the other hand, the Variable Life Insurance policy allows both the premium as well as the death benefit to be altered to some extent.

4- Is Variable Life Insurance a good option for someone who wants to take more control of their investments?

Yes, Variable Life Insurance is a good choice for someone who would like to have a great deal of say in which type of funds his/her cash value will participate in because, unlike the fixed ones, it includes several options, though that also involves more risk.

5- Whole Life, Universal, or Variable Life Insurance: Which is More Beneficial?

That is individual circumstances and fancies that will determine your choice of the two platforms. Whole life insurance is perfect for anyone who desires a fixed and consistent form of insurance protection. This one is also slightly more flexible than whole life insurance when it comes to both the premiums and the death benefits. Variable life insurance is perfect for those individuals who want to be in charge of both their investment and risk-taking abilities to enjoy better yields than fixed ones.

Resources

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.