Modified premium whole life insurance is permanent life insurance offering flexible premiums. You can increase or decrease your premium payments as your needs and budget change.

If you want everlasting coverage from a life insurance policy, you might consider whether a modified premium whole life policy is the best option. This type of policy is similar to traditional whole life insurance but typically costs less and offers more flexible coverage options. To help you determine if modified premium whole life coverage is the best option, here is everything you need to know about it.

What is Modified Premium Whole Life Insurance?

Whole life insurance is a type of permanent life insurance. Universal life, indexed universal life, and variable universal life are all types of whole life insurance. Whole life insurance is the original life insurance policy, but whole life does not equal permanent life insurance.

Permanent life insurance policies do not expire as long as the premiums are paid. Whole life insurance policies are one type of permanent life insurance. Universal life, indexed universal life, and variable universal life are all types of permanent life insurance.

Whole life insurance is permanent life insurance, but whole life does not equal permanent life insurance. Universal life, indexed universal life, and variable universal life are all types of whole life insurance. Whole life insurance is the original life insurance policy, but whole life does not equal permanent life insurance.

Permanent life insurance policies do not expire as long as the premiums are paid. Whole life insurance policies are one type of permanent life insurance. Universal life, indexed universal life, and variable universal life are all types of permanent life insurance.

What are the Benefits of Modified Premium Whole Life Insurance?

Modified premium whole life coverage comes with several advantages, including:

Flexible premium payments: Modified premium whole life coverage gives flexibility in premium payments, which is one of its main advantages. As your demands change, you may adjust your payments, which can significantly aid in managing your budget.

Death Benefit: Like all types of permanent life insurance, a modified premium whole life policy provides a death benefit to your beneficiaries. This can help your loved ones financially if you pass away.

Cash Value: Another benefit of modified premium whole life coverage is that it builds cash value over time. The insured can access this cash value through loans or withdrawals, giving you a source of funds in an emergency.

Policy Loans: Policy loans are another feature of modified premium whole life coverage that can be helpful in an emergency. You can borrow against your insurance’s cash value if you need money but don’t want to sell it.

Tax-Advantaged: Modified premium whole life policy also offers some tax advantages. Your policy’s cash value increases tax-deferred, and you may borrow money against it without paying taxes on the borrowing.

As you can see, modified premium whole life coverage has many benefits. If you’re looking for a permanent life insurance policy that offers flexibility and other great features, a modified premium whole life policy may be the right option for you.

What are the Drawbacks of Modified Premium Whole Life Insurance?

One of the most well-liked forms of life insurance is whole life, but it also has certain disadvantages. The following are some possible cons of modified premium whole life insurance:

- Compared to other forms of life insurance, whole life insurance might be more expensive.

- Whole life insurance policies typically have higher premiums than term life insurance policies.

- Whole life insurance policies may have surrender charges if you cancel the policy before maturity.

- If you have specific medical issues, you might not be eligible for whole life insurance plans.

- Understanding all of the features and advantages of whole life insurance may be challenging due to its complexity.

Is Modified Premium Whole Life Insurance Right For Me?

Modified premium whole life insurance can be a good choice for those looking for lifelong coverage and want the flexibility to change their range as their needs change. It may also be a wise solution for individuals who wish to increase their cash worth gradually. If you want modified premium whole life coverage, talk to your life insurance agent to see if it is right for you.

What is the difference between modified whole life and graded whole life insurance?

Modified whole life and graded whole life insurance are both types of permanent life insurance, but they differ in how the premiums and benefits are structured.

Modified Whole Life Insurance:

This type of policy starts with lower premiums that increase over time until they reach a level premium after a specified period, usually one or two years. During the initial period, the policy is “modified” with lower premiums, making it more affordable for policyholders, especially in the early years when financial obligations may be higher. After the modification period, the premium remains level for the rest of the policy’s life. The death benefit is typically level from the start of the policy.

Graded Whole Life Insurance:

Graded whole life insurance also starts with lower premiums, but the difference is that the death benefit is limited during the first few years of the policy. Suppose the insured passes away during this initial period. In that case, the beneficiary may receive only a portion of the death benefit or a return of premiums paid, rather than the full face amount of the policy. The death benefit gradually increases over time until it reaches the full face amount, usually after a period of three to five years. Graded whole life insurance is often used for individuals who may not qualify for traditional whole life insurance due to health issues or other factors.

In summary, the main difference between modified whole life and graded whole life insurance is how the premiums and death benefits are structured during the initial years of the policy. Modified whole life insurance starts with lower premiums that increase over time, while graded whole life insurance starts with lower benefits that increase over time.

Difference Between Modified Premium Whole Life Insurance and Traditional Whole Life Insurance

Modified premium whole life coverage is a form of life insurance that is becoming increasingly popular due to its flexibility and cost savings. It combines features of traditional whole life insurance with the ability to adjust premium payments over a set period, allowing you more control over your monthly payments and cash flow.

Unlike traditional whole life insurance, modified premium whole life policy allows policyholders to pay premiums on an extended basis, often up to age 95. This option may be helpful for people who want to keep their rates low while still retaining life insurance coverage. Additionally, this type of policy typically offers a lower insurance cost than traditional whole life insurance.

Another difference between modified premium whole life coverage and traditional whole life insurance is how death benefits are paid. The death benefit is paid out in one lump sum with standard whole life insurance. Modified premium whole life coverage allows the policyholder to plan for long-term financial needs because the death benefit is paid out as a series of installments over time.

Finally, modified premium whole life coverage differs from traditional whole life insurance regarding its investment features. Policyholders with this coverage can access various investment choices, such as stocks, bonds, mutual funds, and annuities. This allows policyholders to increase their cash worth over time, which may benefit individuals wishing to establish a supplemental retirement income source.

Overall, modified premium whole-life coverage allows policyholders to control their premiums and cash flow while giving them access to various investment options. It is a desirable choice for people who want to reduce life insurance premium costs without sacrificing coverage.

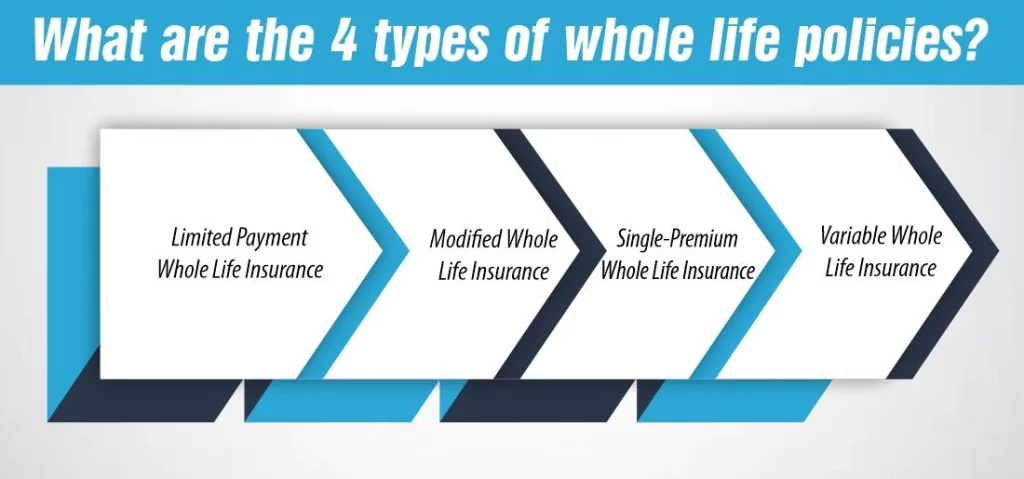

What are the 4 types of whole life policies?

Whole life insurance has several types, including limited payment, modified, single-premium, and variable whole life. Here’s a brief overview of each:

Limited Payment Whole Life Insurance

With limited payment whole life insurance, policyholders pay premiums for a specified period, such as 10 or 20 years, or until a certain age, such as 65. After completing the premium payments, the policy remains in force for the rest of the insured’s life, with no further premiums due. This type of policy allows for a shorter premium payment period while providing lifetime coverage.

Modified Whole Life Insurance

Modified whole life insurance starts with lower premiums that increase over time until they reach a level premium after a specified period, usually one or two years. This type of policy is designed to be more affordable initially, making it easier for policyholders to manage their insurance costs, especially during the early years when financial obligations might be higher.

Single-Premium Whole Life Insurance

Single-premium whole life insurance is paid for with a single, lump-sum premium payment. This type of policy provides immediate coverage with a guaranteed death benefit and cash value accumulation. Single-premium whole life insurance is often used as an investment or estate planning tool because of its ability to provide a significant death benefit and cash value growth.

Variable Whole Life Insurance

Variable whole life insurance allows policyholders to allocate a portion of their premiums to a separate investment account, known as a cash value account. This account is invested in a variety of sub-accounts, similar to mutual funds, and has the potential to grow over time. The cash value and death benefit of a variable whole-life policy can fluctuate based on the performance of the investment sub-accounts, providing the potential for higher returns but also greater risk compared to traditional whole life insurance.

These are just a few examples of the types of whole life insurance policies available. Each type has its features, benefits, and considerations, so it’s important to carefully review and understand the terms of any policy before purchasing.

Conclusion

For individuals seeking a lifelong financial safety net regardless of changes in their health or income, modified premium whole-life coverage is a great option. It combines the whole life policy’s cash value with the term policy’s flexibility. People may have peace of mind from knowing they will get protection without worrying about ever-rising costs with this type of insurance. The benefit of a modified premium whole-life policy is that dividends may be adjusted to meet individual requirements. This sort of coverage may benefit a wide range of people and is an excellent choice for those looking for long-term financial security.