West Coast Life Insurance Review: Customer Ratings

Last Updated on: August 22nd, 2024

Reviewed by Joyce Espinoza

- Licensed Agent

- - @InsureGuardian

West Coast Life Insurance is an insurance company that specializes in offering insurance services in the western region of America. It has been in operation for over half a century and is now a one-stop shop for families looking for life insurance, retirement, and other financial products. But is West Coast Life Insurance company truly catering to the needs of today’s customers in a fast-changing world?

West Coast Insurance will be discussed in this essay in terms of its formation, development and its position in today’s society. Specific areas of interest include the company’s financial performance, portfolio of insurance services, customer satisfaction, and technology. In this blog will discover how well West Coast Insurance meets policyholder expectations today and how ready it is to satisfy future needs.

What to know about West Coast Life Insurance?

In 1997, West Coast Life Insurance Company became a member of the Protective Life Insurance Family. West Coast Life added its excellent reputation in the insurance industry amongst the brokerage community and, of course, policyholders, to the growing list of the Protective Life family of policyholders.

Table of Contents

ToggleWest Coast Life was founded in 1906 and Protective Life in 1907. The two companies have forged the experience of over 200 years in the life insurance business in America. West Coast Life’s history includes more company “firsts” than most other companies can even imagine.

Their excellent reputation is based in part on these pre-eminent values: quickness to respond, quality, serving our people, and growth.

In their quickness to respond, serving policyholders and the brokerage community, they have adopted Protective Life’s Five Cardinal Principles which have given us the communication tools and framework to make quality an integral part of our company.

– History:

In March of 1906, a small group of prominent businessmen met in San Francisco to organize a company dedicated to serving the insurance needs of the West. Born or bred into prosperity, they represented a cross-section of Americans that composed the social and economic backbone of the new West.

Recognizing an opportunity for a West Coast-based insurance company, these men turned a hunch into history. In just a few weeks they elected a board of directors and voted insurance veteran Dr. George A. Moore as president. Fueled by the determination and vision that would become its lifeblood, West Coast Life Insurance Company was established in San Francisco’s Merchants Exchange Building and opened for business on April 2, 1906.

What Type of Insurance Does the West Coast Offer?

West Coast is a specialized insurance company, with a focus on coverage for life insurance and annuities. Their insurance products offered are as follows.

How Much Does Life Isurance Cost?

- Life insurance products

- Annuities

Your independent insurance agent can help you find more information about the coverage offered by West Coast and Protective Life, and help you decide if this insurance company is right for you.

What Discounts Does the West Coast Offer?

West Coast makes information about their specific discounts readily available. These discounts include the following.

- Get rewarded for your spending discount: Offered to those who use a rewards credit card to manage monthly expenses. May be able to ring up the benefits.

- Bundling discount: Offered to life insurance customers who bundle their policies.

An independent insurance agent can provide better discount information and premium quotes for coverage through the West Coast. When it comes to coverage, independent insurance agents work hard to help you get the most out of your money.

What is West Coast’s claims process?

To submit a claim with West Coast, you will need to complete the application and submit it online or by mail. The following are the correct steps to file a claim.

- Notify them of the death of the insured/annuitant via their website or by phone.

- They will then verify the beneficiaries.

- They will reach out to beneficiaries and ask them to complete a claim packet and provide any necessary documents.

- Once all documents and forms are returned, they will review the claim.

- After review, they will either process the claim or contact the beneficiary for any additional information needed.

If customers have any questions about filing or the claims process itself, they can contact the carrier via phone, online form, or get in touch with their independent insurance agent.

Does West Coast’s insurance create a user-friendly experience for customers?

West Coast’s official website is pretty user-friendly. The carrier provides a lot of information about their claims process and they detail a claims response time frame. They also list a lot of information about their coverage. Online bill pay is available, as is 24/7 claims reporting via online form or by phone during business hours, which are nice, modern customer service features. West Coast is pretty good in terms of user-friendliness.

Should I Replace My West Coast Life Insurance Policy?

There is no reason to change insurance companies simply because of the consolidation of the companies.

If your current policy with West Coast Life meets your needs, there’s no reason to trade it in for a new policy.

Remember that any new policy will be based on your current age, health, paramedical exam results, and medical records.

If you’ve had a change in health since the original policy was taken out, buying new insurance may not be a good strategy.

Financial Strength and Ratings of West Coast Life Insurance

There is no doubt that insurance companies that are financially sound or have stable financial positions are ideal insurance providers. Now, it is high time to discuss the soundness of the financial position of West Coast Life Insurance and the Credit Ratings that it has acquired.

– Analysis of Financial Stability

Based on West Coast Life Insurance’s performance, we can see that they are financially fit to meet their obligations to the policyholders. It means that they can offer reliable insurance and make timely payments for the claims.

This is a clear sign of the company’s financial strength, so it is always important to look at the growth in assets when evaluating West Coast Life Insurance. In the last ten years, the company has consistently posted higher levels of their assets which prove that they are capable of raising as well as utilizing funds. This improvement is not only beneficial for satisfying the needs of policyholders but also for improving their long-term financial sustainability.

Furthermore, West Coast Life Insurance’s investment portfolio is strong and continues to expand its assets. In this way, favorable investments in various fields allow them to earn significant profits and enhance their financial situation. This conservative investing policy also means that the firm will always have a strong balance sheet to address any economic shocks and as such it will continue to deliver dependable insurance services.

Lastly, West Coast Life Insurance is simply financially secure enough and has been given good standings by various organizations in defending their insurance company. The increase in their total assets, sound investment plan, and policies that focus on policyholders reveal their fitness to embrace sound financial parameters. Therefore, when people decide to insure themselves with the West Coast Life Insurance Company they can be assured that they are dealing with a strong and reliable company.

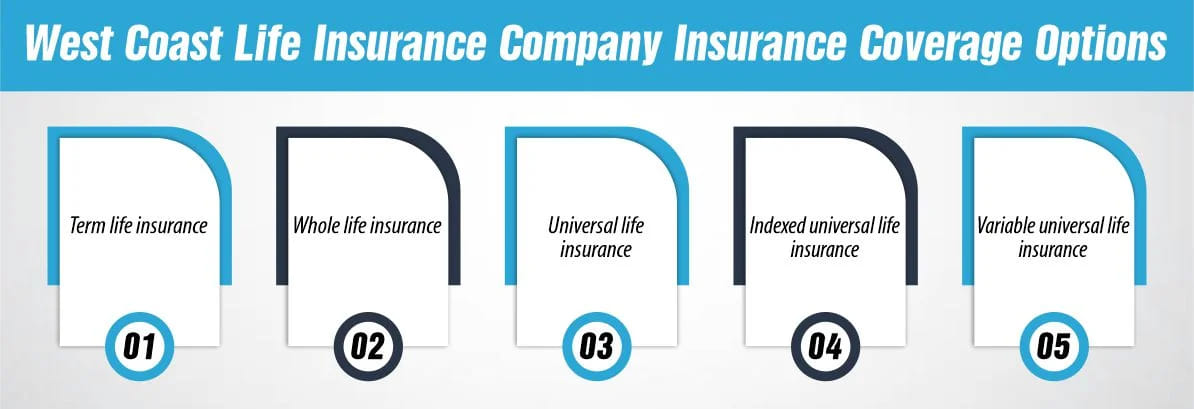

West Coast Life Insurance Company Insurance Coverage Options

As mentioned above, West Coast Life Insurance Company provides various life insurance solutions for its consumers. The coverage options offered by the company include:

- Term life insurance: Offers insurance for a given period or during a particular term.

- Whole life insurance: Offers lifelong coverage for the policyholder for the agreed period for regular premium payments.

- Universal life insurance: Allows certain changes regarding premium amount and death benefit which makes it easier to offer flexible solutions.

- Indexed universal life insurance: Like universal life insurance but with premium flexibility and the potential for interest back from a stock market index.

- Variable universal life insurance: Similar to Universal Life Insurance coverage but with flexibility where the premiums can be invested in different investment products.

Please remember that each coverage option and the details may differ depending on the state. Customers should visit the West Coast Life Insurance Company’s website for more information about available products.

West Coast Life Insurance buying guide

To start making comparisons between the companies, decide on the type of life policy you want, say for instance a term policy or whole policy. Finally, choose if you want the policy to have any additional riders relative to what you have for your life insurance policy. Determine how much life insurance you require and for how many years you want the policy to provide coverage. Make sure that the available insurers provide the necessary form of insurance.

When comparing rates, make sure that the quote you compare is based on the same amount of insurance for the same period. It is also important to ensure that the medical requirements of the policy are in line with your expected needs. For instance, if you wish to avoid the medical exam for life insurance but are comfortable with answering health questions, ensure that the application procedure of the policies you are comparing matches these criteria.

Price may not ultimately be the deciding factor when it comes to purchasing a product or service. Check the frequency of consumer complaints that have been made against each of the companies as frequent complaints are an indication of poor performance.

Conclusion

Summing up, it is possible to conclude that West Coast Life Insurance is one of the largest companies that focus on offering life insurance policies in the West Coast region. These firms provide different forms of life insurance plans to people and companies at reasonable premiums. It is important to note that their customer service interacts with clients when they have questions or claims.

Offering a variety of insurance for personal and commercial clients, the company will likely continue to focus on catering to the diverse needs of the group as it grows in the market.

FAQs

1. What is West Coast’s average claim response time frame?

West Coast offers claims reporting through a couple of channels. The claims process normally takes two to three weeks; however, the insurance company cannot promise an exact timeline.

2. What is West Coast’s customer service availability?

West Coast allows customers to file claims online 24/7 or by phone during business hours. Their customer service department specifies business hours on the carrier’s official website. The carrier’s social media presence extends across Facebook, Twitter, and LinkedIn, which makes them more accessible to customers.

References:

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.