When planning for life’s final chapter, State Farm Burial Insurance is a compassionate and practical solution. State Farm, synonymous with trust and reliability, offers a burial insurance plan to provide financial security during difficult times. From its straightforward application process and flexible coverage options to its stable premiums and reliable payouts, State Farm’s approach to burial insurance reflects a deep understanding of what families go through during such pivotal moments.

This State Farm Burial Insurance Review aims to provide a clear, comprehensive perspective on What makes it stand out. Does it offer families flexibility and affordability during such a sensitive time? Let’s explore how State Farm Insurance can be integral to your end-of-life planning, ensuring your final wishes are honored without imposing a financial strain on your loved ones.

State Farm Burial Insurance: A Closer Look

State Farm, a trusted name in the insurance industry, offers a comprehensive burial insurance plan designed to ease the financial stress associated with end-of-life arrangements.

State Farm burial insurance, or final expense insurance, is a type of whole-life insurance specifically tailored to cover funeral and burial costs. Policyholders pay regular premiums, and in return, their beneficiaries receive a tax-free payout upon the insured’s passing. So, how does State Farm insurance work? Let’s check it out:

How State Farm Burial Insurance Works:

Approach to planning for the inevitable costs associated with the end of life. State Farm burial insurance, often called final expense insurance, is designed to cover funeral and burial costs. Let’s look into how it works:

Simple Application Process: State Farm makes the application process for burial insurance relatively straightforward. Typically, it involves answering a few health-related questions, but a medical exam is often unnecessary. This simplicity is particularly comforting for older individuals or those with health issues who might worry about qualifying for insurance.

Fixed Premiums: One of the defining characteristics of State Farm’s Burial Insurance is that the premiums remain constant throughout the policy’s life. This means no unexpected hikes in costs as you age, allowing for easier financial planning and budgeting.

Guaranteed Death Benefit: The policy ensures that your designated beneficiaries will pay a death benefit upon passing. This benefit covers funeral expenses, burial costs, and any final debts or obligations you may leave behind. The consistency of this benefit ensures that these expenses won’t burden your loved ones during a difficult time.

Cash Value Accumulation: Like many whole-life policies, State Farm’s Burial Insurance may accumulate cash value over time. This aspect can be beneficial if you find yourself in need of funds before the policy pays out. You might be able to borrow against the policy, though this could reduce the death benefit if not repaid.

Coverage for All Ages: State Farm insurance policies are not limited by age. Whether you’re a young adult looking to plan for the future or a senior seeking immediate coverage, State Farm has options suitable for your unique situation.

State Farm Burial Insurance provides a compassionate and practical solution for managing the financial aspects of end-of-life expenses. Its straightforward application process, fixed premiums, guaranteed benefits, and the potential for cash value accumulation offer a sense of security and preparedness. This policy ensures that your final wishes are honored without placing a financial burden on your loved ones, allowing them to focus on celebrating your life and legacy.

Why You Should Buy State Farm Burial Insurance?

Purchasing State Farm Burial Insurance is a compassionate and practical choice for anyone looking to ease the financial burden on their loved ones during a challenging time. The absence of a medical exam requirement makes it accessible to individuals with various health conditions, ensuring everyone can secure the protection they need. Whether planning for the future or seeking immediate coverage, State Farm Insurance offers financial security, allowing your loved ones to focus on commemorating your life and finding closure without the added worry of financial concerns.

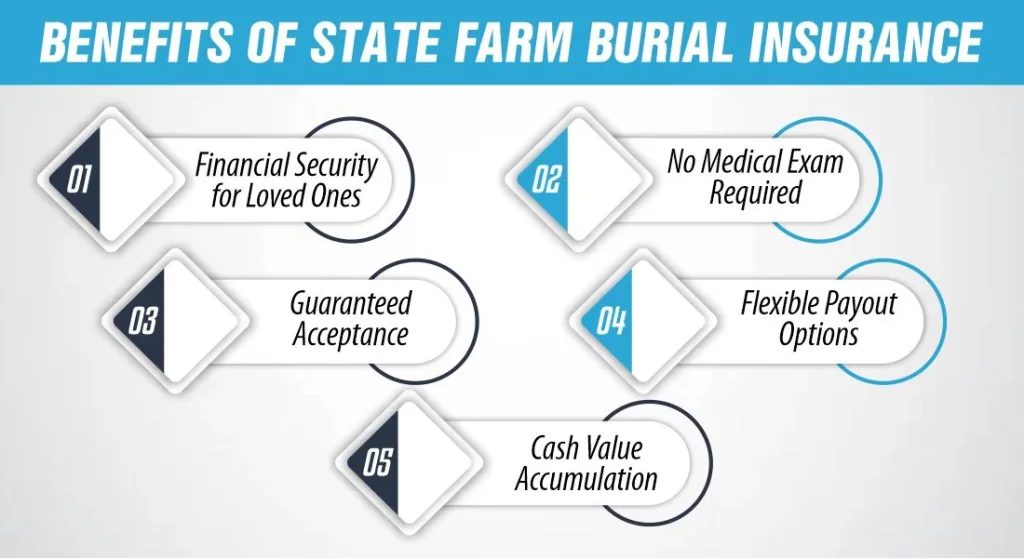

Benefits of State Farm Burial Insurance:

Now, let’s explore the multitude of benefits that State Farm Burial Insurance Review brings to the table:

Financial Security for Loved Ones:

The most significant benefit of State Farm burial insurance is the assurance it provides to your family and loved ones. They can grieve without the added stress of worrying about the financial aspects of arranging a funeral and burial. Instead, they can focus on celebrating your life and saying their goodbyes.

No Medical Exam Required:

State Farm burial insurance typically does not mandate a medical exam for policy approval. This is a crucial advantage for individuals with pre-existing medical conditions or who are concerned about age or health issues, making them ineligible for traditional life insurance. The simplified underwriting process makes it accessible to a broader range of individuals.

Guaranteed Acceptance:

Many State Farm burial insurance policies offer guaranteed acceptance, meaning you cannot be denied coverage based on your health status or age.

Flexible Payout Options:

State Farm burial insurance policies typically provide beneficiaries with a lump sum payout upon the policyholder’s passing. The flexibility of these funds ensures that your loved ones can allocate them according to their priorities during a challenging time.

Cash Value Accumulation:

Some State Farm burial insurance policies offer a cash value component. As you continue to pay your premiums, some premium payments may accumulate as cash value within the policy. This cash value can be accessed or borrowed against in case of emergencies or other financial obligations, providing an additional layer of financial security.

The Cost of State Farm Burial Insurance:

State Farm offers burial insurance, or final expense insurance, to help individuals and their families plan for the financial aspects of end-of-life expenses. Various cost factors can affect the monthly cost of your burial insurance policy, although it’s generally less expensive than traditional life insurance policies.

Several key factors influence the cost in State Farm Burial Insurance Review:

Age at the Time of Application: Generally, the older you are when you apply, the higher the premium. This is because the risk of insuring someone increases with age.

Health and Medical History: Your current health status and medical history can significantly impact the cost of State Farm Insurance Review. A history of severe health conditions may result in higher premiums.

Gender: In many cases, insurance companies use gender to determine premiums. Women tend to live longer than men, affecting insurance costs. Consequently, women may receive slightly lower premium quotes than men of the same age and health status.

Coverage Amount: The amount of coverage you choose will directly impact your premium costs. Higher coverage amounts will result in higher monthly premiums. When selecting a coverage amount, it’s important to balance ensuring that your final expenses are adequately covered and your premiums are affordable.

Lifestyle Factors: Certain lifestyle choices, such as smoking or high-risk hobbies, can increase the cost of insurance due to the higher risks they represent.

To give you an idea of how much State Farm Burial Insurance costs, here’s a sample table of quotes:

| Age (Years) | Coverage Amount ($) | Monthly Premium ($) |

| 50 | 5,000 to 6,000 | $30 |

| 60 | 10,000 | $60 |

| 70 | 15,000 | $90 |

| 80 | 20,000 | $150 |

| 90 | 25,000 | $250 |

To obtain accurate and personalized quotes for State Farm Insurance Review, it’s recommended to consult with a State Farm insurance agent or representative. They can assess your unique circumstances and provide tailored information about the cost of burial insurance that meets your needs and budget.

It’s essential to consult with a State Farm insurance agent or representative to obtain accurate and personalized quotes based on your specific circumstances. They can help you assess your insurance needs and provide a more detailed understanding of the costs associated with State Farm Guaranteed Issue Life Insurance. Remember that while this type of policy offers guaranteed acceptance, it may come with limitations in coverage amounts and higher premiums than traditional life insurance policies due to the increased risk to the insurer.

What company has the best burial insurance?

The best burial insurance company can vary depending on individual needs and preferences. However, some companies are often highly rated for their burial insurance offerings. Some top companies to consider for burial insurance include Mutual of Omaha, AARP/New York Life, Gerber Life, Colonial Penn, and AIG. It’s essential to compare quotes and policy details from multiple companies to find the best burial insurance coverage for your specific situation.

Which is the best funeral insurance?

The best funeral insurance in terms of price can vary depending on factors such as age, health, coverage amount, and the insurance company’s rates. However, some companies are known for offering competitive rates for funeral insurance.

Companies like Mutual of Omaha, AARP/New York Life, Gerber Life, Colonial Penn, and AIG are often considered among the best for affordable funeral insurance coverage. It’s important to compare quotes from multiple companies to find the most cost-effective option for your needs.

Is funeral insurance good?

Funeral insurance, also known as burial insurance or final expense insurance, can be a good option for some people. It is designed to cover the costs associated with a funeral and other final expenses, such as medical bills or outstanding debts.

One of the main benefits of funeral insurance is that it provides peace of mind knowing that your loved ones will not be burdened with these expenses. It can also help ensure that your final wishes are carried out as you intended.

However, funeral insurance may not be the best option for everyone. It typically has higher premiums compared to other types of life insurance, and the coverage amount is often limited. Additionally, some policies may have waiting periods before full coverage takes effect.

Before purchasing funeral insurance, it’s essential to carefully consider your needs and compare quotes from different insurance companies to find the best option for you.

Can you get a $15,000 life insurance policy?

Yes, you can typically get a $15,000 life insurance policy. This amount is often available as a type of final expense or burial insurance, which is designed to cover end-of-life expenses such as funeral costs, medical bills, and other debts.

Final expense policies are usually whole-life insurance policies, which means they provide coverage for your entire life as long as premiums are paid. These policies often have simplified underwriting, meaning they may be easier to qualify for than traditional life insurance policies.

It’s important to note that the availability of $15,000 life insurance policies and their specific features can vary depending on the insurance company and your circumstances. It’s a good idea to compare quotes from multiple insurers to find the best policy for your needs.

Conclusion

In conclusion, State Farm Burial Insurance Review is a reliable and accessible solution for individuals looking to ease the financial burden on their loved ones during a difficult time. With its straightforward application process, guaranteed acceptance, fixed premiums, flexible payout options, and potential cash value accumulation, State Farm burial insurance offers essential peace of mind. It’s worth exploring the burial insurance options available through State Farm and consulting with a State Farm agent to determine the best fit for your needs and circumstances. By taking this step, you can ensure that your family can focus on commemorating your life and finding closure without the added stress of financial concerns.

FAQs

How much coverage can you buy?

The coverage you can buy with State Farm Insurance varies based on individual needs and financial circumstances. Burial insurance policies typically offer coverage ranging from a few thousand dollars to $25,000 or more. It’s important to consider the anticipated costs of your final expenses and any outstanding debts when deciding on the coverage amount. State Farm provides flexible options to ensure the coverage aligns with your specific requirements and budget.

Is it worth the cost of having burial insurance with State Farm?

Yes, having burial insurance with State Farm is worth the cost for many individuals. It provides financial security for your loved ones, guarantees acceptance regardless of health, and offers fixed premiums for predictable budgeting. It is a valuable investment in ensuring a seamless and stress-free transition during challenging times.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.