Are you curious about how much life insurance you really need to secure the future of your loved ones? The BNZ Insurance Calculator offers an innovative and straightforward solution. This handy tool helps you figure out just the right amount of life insurance to protect your family’s future without all the complicated processes.

Whether you’re a young professional starting, a parent safeguarding your family’s future, or approaching retirement, the BNZ Insurance Calculator tailors its guidance to fit your unique life stage and needs. Why leave such an important decision to guesswork? Let’s explore how this innovative calculator can help you confidently determine the right coverage for your peace of mind.

What is bnz life insurance?

BNZ (Bank of New Zealand) Life Insurance is a type of insurance product offered by the Bank of New Zealand, one of the country’s largest banks. It provides financial security and peace of mind to policyholders and their families. It typically offers a lump sum payment to the beneficiaries in the event of the policyholder’s death or terminal illness.

The key features of BNZ Life Insurance may include:

Death Benefit:

A lump sum payment to the beneficiaries upon the insured’s death, helping them manage financial obligations like debts, living expenses, and future costs like education.

Terminal Illness Benefit:

The policy often allows for an early payout if the insured is diagnosed with a terminal illness, providing financial support during a difficult time.

Flexible Coverage:

Policyholders can choose the coverage they need based on their financial situation and future goals.

Premium Options:

BNZ Life Insurance might offer different premium payment options to suit different budgets and payment preferences.

Additional Benefits:

Depending on the specific policy, additional benefits or features could include inflation adjustments, premium freezes, or optional add-ons for more comprehensive coverage.

Those interested in BNZ Life Insurance should carefully review the policy details, including any exclusions, limitations, and terms and conditions, to ensure they meet their needs.

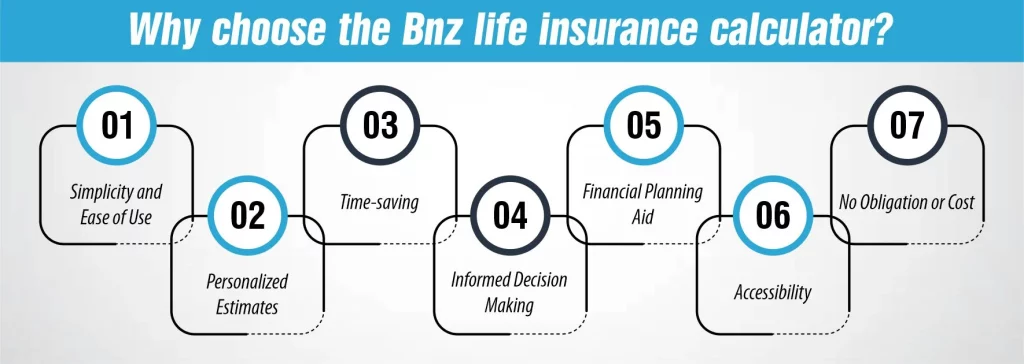

Why choose the Bnz life insurance calculator?

Choosing the BNZ Life Insurance Calculator can be a wise decision for several reasons, especially if you’re looking to simplify determining your life insurance needs. Here’s why it could be a beneficial tool:

Simplicity and Ease of Use:

The calculator is designed to be user-friendly. It allows you to input your details easily and get an estimate without needing extensive knowledge of insurance terminology or concepts.

Personalized Estimates:

It provides personalized estimates based on your circumstances, such as age, income, financial obligations, and family situation. This helps ensure that the coverage recommendation is tailored to your unique needs.

Time-saving:

Instead of manually calculating your insurance needs or consulting with an advisor, the calculator quickly gives you an estimate, saving time and effort.

Informed Decision-Making:

With the calculator’s help, you can make a more informed decision about your life insurance coverage. Understanding the potential financial impact on your family in the event of unforeseen circumstances can guide you in choosing the right level of coverage.

Financial Planning Aid:

It aids in your overall financial planning by helping you understand one aspect of your financial preparedness – life insurance. Knowing how much coverage you need can be critical to a comprehensive financial plan.

Accessibility:

This online tool can be accessed anytime and anywhere, allowing you to plan according to your schedule.

No Obligation or Cost:

Typically, such calculators are free to use and do not require a policy purchase. You can use them as a starting point for your insurance planning process.

However, while the BNZ Life Insurance Calculator is a helpful tool, consulting with a financial advisor for a more in-depth analysis of your insurance needs is always advisable. The calculator provides an estimate, but a professional can offer personalized advice, taking into account your entire financial situation.

Benefits of the BNZ life insurance calculator:

The BNZ Life Insurance Calculator offers several benefits to individuals considering life insurance coverage:

Customized Assessment:

The calculator provides a tailored assessment of your life insurance needs based on your circumstances, such as age, income, dependents, debts, and financial goals. This personalized approach ensures that you get coverage that fits your specific requirements.

Accurate Estimation:

By entering accurate information into the calculator, you can better estimate the amount of life insurance coverage you may need. This helps avoid underinsurance or over insurance, ensuring that you have adequate coverage to protect your loved ones financially.

Financial Security:

Life insurance provides financial security to your beneficiaries during your death. The calculator helps you determine the appropriate coverage amount to maintain your family’s standard of living, pay off outstanding debts, cover funeral expenses, and provide for future financial needs.

Ease of Use:

BNZ’s life insurance calculator is user-friendly and easy to navigate. It guides you through the process, making it simple to understand and complete. You don’t need to be a financial expert to use the calculator effectively.

Cost Savings:

By accurately assessing your life insurance needs, you can avoid purchasing excessive coverage that may result in higher premiums. Conversely, underestimating your coverage needs could leave your family financially vulnerable. The calculator helps strike the right balance, potentially saving you money in the long run.

Peace of Mind:

Knowing that you have sufficient life insurance coverage can provide peace of mind for you and your loved ones. The calculator helps you make informed decisions about your insurance needs, alleviating concerns about your family’s financial future in case of unforeseen circumstances.

Types of BNZ Life Insurance Policies

Explore the life insurance policies BNZ offers, tailored to suit the diverse needs of individuals and families across New Zealand. Below, you’ll find a breakdown of the various types of BNZ life insurance policies available:

LifeCare: BNZ’s flagship life insurance product, LifeCare, is crafted to provide crucial financial support during difficult circumstances like illness, injury, redundancy, or death. It offers comprehensive protection with customizable options to enhance your coverage.

Key Features:

Standard Cover:

- A lump sum payment is made in the event of death or terminal illness, covering expenses like funerals, outstanding loans, and ongoing living costs.

- Bereavement support offering an immediate $5,000 payment to family members upon the insured’s death.

- Child Death Cover provides a $2,000 immediate payment to help with the grieving process if the insured’s child passes away due to an accident between the ages of 3 and 10.

Optional Cover options include:

Critical Condition Benefit: This benefit provides a lump sum payment upon diagnosing critical illnesses, such as severe heart attacks or advanced cancer.

Permanent Disability Benefit: Offers a lump sum payment if the insured becomes permanently disabled and unable to work.

Temporary Disability Benefit: Provides income protection for up to two to five years in case of disability, with limited cover available for those caring for dependents at home.

Redundancy Benefit: This is income protection cover for up to six months in case of redundancy, helping to mitigate lost income.

These BNZ life insurance policies are designed to provide comprehensive coverage and financial assistance to policyholders and their families during unforeseen life events, ensuring peace of mind and security for the future.

How does the BNZ life insurance calculator work?

The BNZ Life Insurance Calculator is an online tool designed to help individuals accurately assess their life insurance needs. Here’s how it typically works:

Input Personal Information: Users begin by entering specific details about themselves, such as age, gender, marital status, annual income, existing savings, outstanding debts, and number of dependents. These inputs give the calculator essential information to tailor its recommendations to the user’s circumstances.

Specify Financial Goals: Users are prompted to specify their financial goals and obligations. This may include paying off mortgages, funding children’s education, covering living expenses for dependents, and other financial commitments. The calculator can better estimate the life insurance coverage needed by understanding these goals.

Consider Existing Coverage: Users can input any existing life insurance coverage they may already have. This ensures that the calculator considers current protection when determining the additional coverage required.

Receive Recommendations: Based on the information provided, the calculator generates recommendations for the appropriate amount of life insurance coverage needed to meet the user’s financial objectives and adequately protect their loved ones. It typically presents this recommendation as a suggested sum assured or coverage amount.

Review Options: Depending on the calculator’s design, users may have the opportunity to explore different coverage options and adjust variables to see how changes affect the recommended coverage amount. This interactive feature allows users to fine-tune their coverage preferences and understand the implications of different scenarios.

Access Additional Resources: Sometimes, the calculator may offer additional resources or information about BNZ’s life insurance products and features. Users can explore these resources to learn more about the available options and make informed decisions about their life insurance needs.

Seek Professional Advice: While the calculator provides valuable insights, users are encouraged to seek advice from a qualified insurance advisor or financial planner. These professionals can offer personalized guidance based on individual circumstances and help users select the most suitable life insurance coverage.

Overall, the BNZ Life Insurance Calculator simplifies determining the appropriate amount of life insurance coverage, empowering users to make informed decisions to protect their financial future and the well-being of their loved ones.

Conclusion

In conclusion, the BNZ Life Insurance Calculator is your trusted partner in securing a brighter financial future for you and your loved ones. Its user-friendly interface and personalized recommendations simplify the complex task of assessing your life insurance needs. Empower yourself today with the confidence that you have the right coverage in place, ensuring peace of mind for whatever life may bring.

Explore the BNZ Life Insurance Calculator now and take the first step towards safeguarding your family’s future prosperity.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.