Have you ever wondered if dental insurance is truly worth the investment? In a world where financial decisions can feel overwhelming, it’s essential to seek guidance from trusted sources. One such authority is Dave Ramsey, renowned for his practical advice on money matters.

But what does Ramsey have to say about dental insurance? Is it a wise financial move, or is there a better way to manage dental expenses? In this blog post, we will explore Dave Ramsey dental insurance’s perspective, discovering whether it aligns with his renowned financial principles.

Read out the blog post as we uncover insights into Dave Ramsey Dental Insurance to help you make informed decisions about your dental health and finances.

Understanding Dave Ramsey Dental Insurance’s Approach

Dave Ramsey dental insurance’s approach reflects his broader financial philosophy, which highlights debt-free living and responsible money management. When it comes to dental expenses, Ramsey advises his followers to consider whether the cost of insurance premiums outweighs the benefits, especially for routine care.

Ramsey often suggests that individuals save for dental expenses using health savings accounts (HSAs) or flexible spending accounts (FSAs). These accounts allow pre-tax contributions to be used for medical and dental costs. By saving in these accounts, individuals can cover routine dental care and potentially avoid the need for insurance that may have high premiums and limited coverage.

Ramsey’s approach encourages individuals to be strategic about their financial choices, including how they manage their dental expenses.

The Role of Dental Insurance

Dental insurance plays a crucial role in helping individuals manage the costs of dental care. It typically covers a portion of the expenses associated with preventive care, such as regular cleanings and exams, as well as more extensive procedures like fillings, crowns, and root canals.

Having dental insurance can provide financial peace of mind, as it can help offset the high costs of unexpected dental issues. Additionally, many plans offer discounted rates for in-network providers, making dental care more affordable.

However, it’s essential to carefully consider your needs and the terms of the insurance plan. Some plans may have limitations, such as waiting periods for certain procedures or exclusions for pre-existing conditions. It’s also important to note that dental insurance often focuses on preventive care and may not cover cosmetic procedures.

As a whole, dental insurance can be a valuable tool for managing dental expenses, but it’s essential to understand your coverage and explore alternative options, such as health savings accounts, to ensure you’re making the best financial decision for your situation.

What is Dave Ramsey Dental Insurance?

Dave Ramsey dental insurance refers to the approach advocated by financial expert Dave Ramsey regarding the purchase and use of dental insurance. Ramsey is known for his practical advice on managing money and avoiding debt. When it comes to dental insurance, Ramsey suggests being selective and only purchasing coverage that is necessary.

Ramsey generally recommends high-deductible, low-premium plans that cover major dental expenses, such as root canals or crowns, but may not cover routine care like cleanings or exams. He often advises against buying insurance for predictable expenses and instead suggests setting aside money in a health savings account (HSA) or flexible spending account (FSA) to cover routine dental costs. This approach aligns with Ramsey’s overall philosophy of avoiding unnecessary debt and being intentional about financial decisions.

What are 1Dental Plans?

1Dental plans, also known as dental discount plans, are membership-based programs that offer discounted rates on various dental services. These plans are an alternative to traditional dental insurance and are designed to help individuals and families save money on dental care costs.

Here’s how 1Dental plans typically work:

1- Membership

To access the benefits of a 1Dental plan, you need to become a member by paying an annual or monthly fee.

2- Discounted Rates

Once you’re a member, you can visit any participating dentist and receive discounted rates on a wide range of dental services. These services can include preventive care (like cleanings and exams), restorative treatments (such as fillings and crowns), and even cosmetic procedures (like teeth whitening).

3- No Deductibles

Unlike traditional dental insurance, 1Dental plans usually do not have deductibles or waiting periods. This means you can start using your plan and enjoying the discounts immediately.

4- No Annual Limits

Another advantage of 1Dental plans is that there are typically no annual limits on the amount of dental care you can receive. This can be particularly beneficial if you require multiple dental treatments in a year.

5- Flexibility

1Dental plans are flexible and can be used in conjunction with traditional dental insurance. They can also be used by individuals and families who do not have dental insurance and are looking for a cost-effective way to manage their dental care costs.

Overall, 1Dental plans offer a convenient and affordable way to access dental care at discounted rates, making them a popular choice for many people looking to save money on their dental expenses.

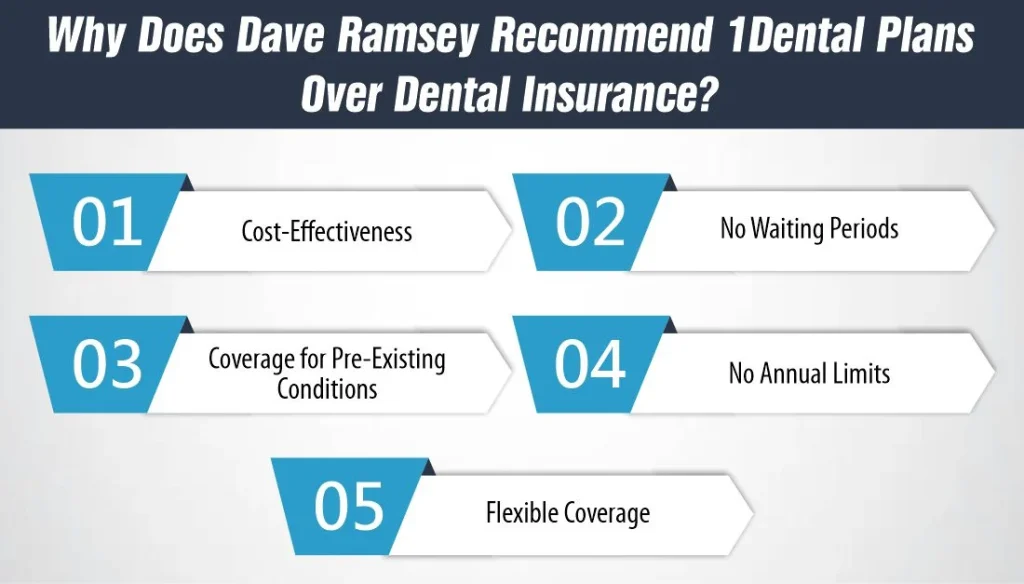

Why Does Dave Ramsey Recommend 1Dental Plans Over Dental Insurance?

Dave Ramsey often recommends 1Dental plans over traditional dental insurance for several reasons. 1Dental plans, also known as dental discount plans, offer a different approach to managing dental costs compared to traditional insurance.

Here’s why Ramsey favors these plans:

Cost-Effectiveness

1Dental plans often have lower monthly premiums compared to traditional dental insurance. Additionally, they typically do not have deductibles, which means you can start saving on dental care costs immediately.

No Waiting Periods

Many dental insurance plans have waiting periods before you can receive coverage for certain procedures. In contrast, 1Dental plans often have no waiting periods, allowing you to access discounted rates right away.

Coverage for Pre-Existing Conditions

Some dental insurance plans may exclude coverage for pre-existing dental conditions for a certain period. 1Dental plans, however, generally cover pre-existing conditions, making them more inclusive for individuals with existing dental issues.

No Annual Limits

Traditional dental insurance plans often have annual coverage limits, which can restrict the amount of dental care you can receive in a year. 1Dental plans typically do not have annual limits, allowing you to use the plan as needed throughout the year.

Flexible Coverage

1Dental plans offer flexibility in how you manage your dental care costs. You can use them alongside traditional insurance to supplement coverage gaps or as a standalone option if you do not have traditional insurance.

Dave Ramsey recommends 1Dental plans as a cost-effective and flexible alternative to traditional dental insurance, especially for those looking to save money on routine and preventive dental care.

How to Save on Dental Care?

According to Dave Ramsey Dental Insurance, saving on dental care involves a combination of smart financial decisions and proactive oral health practices. Here are some key strategies recommended by Dave Ramsey:

1- Practice Good Oral Hygiene

One of the best ways to save on dental care is by preventing dental problems before they start. This means brushing your teeth twice a day, flossing daily, and using mouthwash regularly to keep your teeth and gums healthy.

2- Schedule Regular Check-Ups

Regular dental check-ups and cleanings are essential for maintaining good oral health and catching any potential issues early. By staying on top of your dental appointments, you can prevent costly dental problems down the road.

3- Consider Preventive Treatments

Some dental treatments, such as sealants and fluoride treatments, can help prevent cavities and other dental issues. While these treatments may have upfront costs, they can save you money in the long run by avoiding more extensive dental work.

4- Explore Discount Plans

Dave Ramsey often recommends dental discount plans, such as 1Dental plans, as a cost-effective alternative to traditional dental insurance. These plans offer discounted rates on dental services and can help you save money on routine and preventive care.

5- Shop Around

Prices for dental services can vary widely depending on the provider and location. Before scheduling a dental procedure, it’s a good idea to shop around and compare prices from different dentists to ensure you’re getting the best deal.

6- Consider Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs)

FSAs and HSAs allow you to set aside pre-tax dollars for medical and dental expenses. By contributing to these accounts, you can save money on dental care costs while also reducing your taxable income.

By following these tips and being proactive about your oral health, you can save money on dental care and avoid unnecessary expenses in the long run.

Final Thoughts

In conclusion, Dave Ramsey dental insurance’s perspective highlights the importance of making informed financial decisions and prioritizing preventive care. While dental insurance can provide valuable coverage, Ramsey suggests considering alternatives such as 1Dental plans and health savings accounts to manage dental expenses effectively.

Moreover, by practicing good oral hygiene, scheduling regular check-ups, and exploring cost-effective options, individuals can save money on dental care while maintaining their oral health. Making smart choices about dental insurance and care can lead them to long-term financial stability.

Frequently Asked Questions (FAQs)

1- Can I use 1Dental plans alongside my existing dental insurance?

Yes, you can often use 1Dental plans in conjunction with traditional dental insurance to supplement coverage gaps or reduce out-of-pocket costs. Many individuals find this combination to be a cost-effective way to manage their dental care expenses effectively.

2- Are there any limitations to using 1Dental plans?

While 1Dental plans offer many benefits, it’s essential to understand that they are discount programs rather than insurance policies. As such, they may have limitations on the services covered or the network of participating dentists. Be sure to review the details of the plan carefully to ensure it meets your needs.

3- How can I determine if dental insurance is worth it for me?

The value of dental insurance depends on your circumstances, including your oral health needs, budget, and risk tolerance. Consider factors such as your likelihood of needing expensive dental treatments, the cost of insurance premiums, and any available alternatives like 1Dental plans or health savings accounts.

4- Is dental insurance necessary if I have good oral hygiene habits?

Maintaining good oral hygiene habits is crucial for preventing dental problems, but having dental insurance can still provide financial protection in case of unexpected issues or emergencies. While it’s not strictly necessary, dental insurance can offer peace of mind and help offset the costs of certain treatments.

5- What are some tips for finding affordable dental care?

In addition to exploring dental insurance and discount plans, you can save money on dental care by researching and comparing prices from different providers, scheduling regular check-ups to catch issues early, and practicing preventive care at home. Additionally, using flexible spending or health savings accounts can help you budget for dental expenses effectively.

References:

https://www.ramseysolutions.com/insurance/dental-insurance

https://blog.1dental.com/dave-ramsey-endorses-1dental-dental-plans/

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.