Does Life Insurance Cover Skydiving? Coverage Insights

Life insurance is a crucial safety net for many families, providing financial security in the face of unexpected events. However, for those who enjoy adventurous activities like skydiving, there’s a common question: does life insurance cover skydiving? This query is essential because the nature of high-risk sports can impact insurance policies in unique ways. Understanding how your life insurance handles such activities can help ensure that you and your loved ones are fully protected, even when you’re chasing adrenaline-fueled thrills.

When it comes to skydiving, life insurance premiums depend on various factors, including how often you’re jumping out of an airplane. Read on if you’re wondering how your skydiving experience will impact your ability to get, or retain, life insurance coverage.

Does life insurance cover skydiving?

Contact your insurance provider — you may be surprised as often insurance won’t exclude skydiving! Insurance companies do not have the same standpoint in risky life activities where some insurance companies accommodate some insurance policies for risky activities. Most traditional life insurance policies do not allow for skydiving or anything related to risky, adventure sports and will not pay if such incidents end in death.

When applying for a life insurance policy, one has to complete a questionnaire that is related to insurer lifestyle and the types of activities that one engages in that could be considered risky. From there, the carrier will determine whether the policy will pay out if you die while participating in any of these activities.

Everyone, who is a fan of skydiving or considering becoming a skydiver, might be interested in considering insurance. The first step is to look at some insurance carriers and their insurance plans. Some insurance providers offer insurance policies for risky activities, such as skydiving, and their policies are different from ordinary insurance. Look for insurers that are familiar with the specific risks that are involved in skydiving and the right measures that should be taken to ensure that the right coverage is provided.

Sky Diving and Associated Risks

Though skydiving sport is considered an extreme sport, its safety standards and quality of gear have continuously improved over the decades. Nevertheless, there are some risks associated with skydiving – and insurance companies take good note of those risks. The risks include landing problems (late deployment, malfunctioning gear, potential collisions with other skydivers or objects, etc.).

According to the United States Parachute Association, there were 10 skydiving fatalities in the U.S. in 2021 (per 3.57 mil jumps), meaning a fatalities rate of 0.28 per 100,000 jumps. That translates into 1 fatality per ~360,000 jumps. That is a 3-time improvement from 2011, which saw 1 fatality per ~123,000 jumps, and an almost 5-time improvement from 2001 with 1 fatality per ~74,000 jumps.

Can You Get Life Insurance if You Skydive?

The quick answer to the question: does life insurance cover skydiving? it depends. Several factors impact your ability to get life insurance, such as:

- One-time or recurring activity

- Level of risk (difficult solo jump vs safer tandem jump)

- Affiliation with a parachute/skydiving club

For example, one of the life insurance companies we work with would charge standard rates for your life insurance policy as long as it is one jump and you have no intention to repeat it or become an avid skydiver.

Also, affiliation with a parachute or skydiving club results in standard rates as you will likely be exposed to high safety standards and surrounded by experienced divers.

In some cases, an insurer will issue a life insurance policy but will exclude your skydiving activity from potential claims. In this case, the policy pays out if a policyholder passes away for any other reason than skydiving.

How Much Does Life Isurance Cost?

In any case, should you answer a skydiving question positively, you will need to complete an additional sub-questionnaire explaining exactly your skydiving intentions.

Does Skydiving Affect Life Insurance?

Yes, skydiving does impact life insurance and you have to inform an insurer of it when applying for a life insurance policy. Otherwise, there might be no insurance for any possible accident that could happen in the future.

Depending on your skydiving intentions, an insurance company will do one of the following:

- A policy that will cover any skydiving accident at the usual rate.

- Give you a policy but you are required to pay a higher price for it

- Sell you a policy but tell you that if you die in a skydiving accident, they will not compensate

- Decline your application

Still, if you’re considering it to be just a low-risk, one-time jump (for instance, in case, to try it, in the tandem jump with an instructor), you have a great opportunity to obtain a standard-rated life insurance policy.

However, you would like to verify whether such a risk is taken into account here; you must inform the insurance company of your desire to implement this policy.

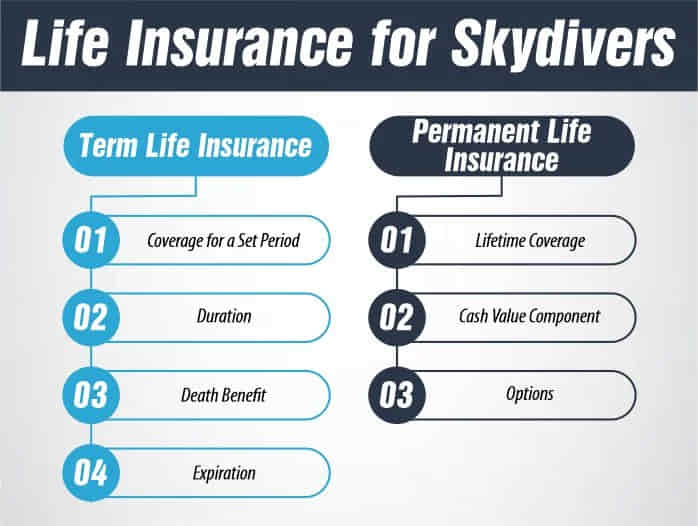

Life Insurance for Skydivers

Does life insurance cover skydiving? Like every other person, skydivers have options for life insurance. They have the opportunity to select among many policies that are provided by different companies and it can be term insurance or permanent insurance. Consulting an insurance agent or utilizing an online life insurance calculator can assist in identifying the right type and amount of insurance.

Term Life Insurance

Coverage for a Set Period: Perfect if you are interested in specific risks, such as tuition fees for a skydiving course, or a mortgage.

Duration: Policies are usually for 10 to 30 years.

Death Benefit: Pending if the policyholder dies during the term of the policy.

Expiration: If this policy is not renewed and the person above is deceased, the policy expires without any payout.

Permanent Life Insurance

Lifetime Coverage: Expires when premiums are paid.

Cash Value Component: This can be used as security when the policy gets to maturity, providing both risk management and value addition.

Options: This type comprises whole life and universal life insurance policies.

Riders for Skydivers

Rider is an optional feature that you can include in your policy to modify how your life insurance policy pays out. Consider these options for a more comprehensive skydiving insurance policy:

Accidental Death and Dismemberment (AD&D): Provides for some types of accidents that involve death or loss of body parts, such as hands, arms, legs, and other extremities. If skydiving is included, the beneficiaries receive the cash from the death benefit when there is a skydiving mishap.

Waiver of Premium Rider: Beneficial when the premiums are high it reduces the premium amount in the event of disability of the insured person to earn any income.

Family Income Benefit Rider: Ideal for those daring individuals who rely on family members such as skydivers. Pays the beneficiary a fixed amount of money for a stated number of years following the death of the insured.

Return of Premium Rider: Refunds the premiums at the end of the term for term life insurance policies. It may still be preferable for skydivers as it costs more.

It’s therefore important for skydivers to be aware of these choices and once in consultation with an insurance expert, they can be assured of being sold the policy that meets their daring lifestyle and financial capability.

Why Extreme Sports Matter for Life Insurance

Understanding the relationship between life insurance and extreme sports needs a little explanation. Even if an individual has no health complaints, they can engage in adventurous sports, which entails a high probability of an accident. Because of that, insurance companies pay much attention to each case.

Examples of extreme sports include but are not limited to:

- Alpine skiing

- Skydiving/parachuting

- Scuba diving

- Rock climbing

- Bungee jumping

- Flying small (light and ultra-light) planes

Thus, here we find out does life insurance cover skydiving, its possible risks, and implications for insurance companies and individuals who seek life insurance, including term life insurance, whole life insurance, and other types of life insurance when skydiving.

Does Life Insurance Cover Skydiving Accidents?

This depends on what your life insurance policy covers. Some term life insurance policies might still pay out if something happens while skydiving.

Coverage and Exclusions

- What’s Covered? Many life insurance policies do cover deaths from skydiving accidents. But not all of them do.

- Exclusions? Some policies specifically exclude high-risk activities like skydiving. Even if they exclude it, they might still offer a reduced payout to support your family.

- Why Be Honest? Misrepresenting your skydiving or other high-risk hobbies can void your policy. Or it might reduce the payout when you die.

- What Should You Do? does life insurance cover skydiving? Be honest during your application. It’s better to avoid problems later.

What Should You Ask?

- Questions for Your Insurer: If you’re worried about coverage, ask your insurer directly. Understand what they will and won’t cover.

- Policy Details: Review your policy’s terms and conditions. Look for any exclusions or limitations, especially for high-risk activities like skydiving.

Skydiving is fun, but it is also a risky kind of adventure sport. Ensure that you have good coverage on your life insurance. Speak up, tell the truth, and do not skip the small print of an agreement about does life insurance cover skydiving? For your family, it may be a matter of life or death and could be the deciding factor in a financial crisis.

References:

https://www.skydivecarolina.com/blog/does-skydiving-void-life-insurance/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.