Have you ever thought about how farmers protect themselves from the many risks that come with running a farm? Farmer’s liability insurance is their safety net. It covers a range of situations that could otherwise lead to big financial losses, like accidents on the farm, damage caused by livestock, or issues from using farm chemicals.

Essentially, this insurance helps farmers deal with unexpected problems without risking their business or personal finances. Whether you’re deeply involved in farming or just curious about how it all works, understanding what is farmers liability insurance coverage? Understanding farmers liability insurance is key to appreciating the behind-the-scenes stability it provides.

What is farmers liability insurance coverage?

As a farmer or enterprise owner in the field of agriculture, many people depend on you for their basic wishes. However, the nature of your profession can make you and your enterprise vulnerable to sudden price rises due to injuries and unforeseen events.

Liability Insurance protects you and your property against claims resulting from bodily injuries and property damages.

One of the functions of farm liability coverage is to ensure the safety of individuals who are touring your farm. Should there be any twist of fate, your coverage will cover scientific fees–no matter who is at fault. In the same manner, farm liability insurance additionally offers monetary protection in the event your farm’s operations cause damage to the belongings of others. As a result, you can relax and be confident that your enterprise, investments, and belongings are secured from unexpected economic blows that may arise from a lot of situations.

Farm liability policies cover a number of regions that cater to the precise desires of enterprise proprietors. In addition to presenting private legal liability coverage for individuals who set foot on the farm, one-of-a-kind agricultural businesses have exclusive operations and natures in which their assets are also put at chance.

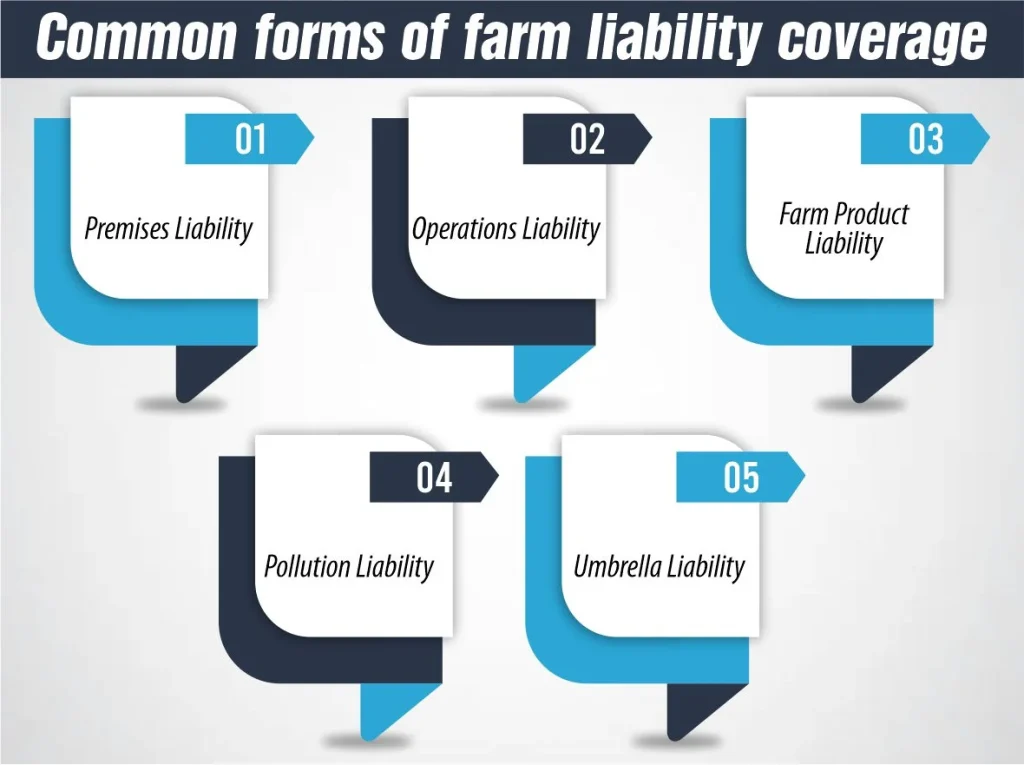

Common forms of farm liability coverage:

Farm liability insurance is crucial for safeguarding agricultural businesses against potential legal and financial risks. This specialized type of coverage addresses the unique liabilities associated with farming operations. Here’s an overview of the common forms of farm liability coverage:

1. Premises Liability:

This coverage protects farm owners from legal and medical costs arising from accidents or injuries that occur on their property. For instance, if a visitor or a customer is injured by tripping over equipment while touring the farm, premises liability can cover the costs of their medical care and potential legal fees. This insurance is essential for any farm with public access or employee presence.

2. Operations Liability:

Farms engage in a variety of operational activities that can pose risks, from the use of heavy machinery to animal handling. Operations liability insurance covers incidents related directly to these farming activities. For example, if a piece of farm equipment accidentally damages a neighbor’s property, this insurance can help cover the repair costs and any legal expenses.

3. Farm Product Liability:

This coverage is vital for farms that sell their products directly to consumers or through distributors. Farm product liability insurance protects against claims of illness, injury, or damage caused by farm products. This could include cases where farm produce is contaminated or mislabeled, leading to consumer health issues. This insurance helps manage the risks associated with product safety and consumer satisfaction.

4. Pollution Liability:

Given the nature of farming, there’s a potential risk of environmental pollution, such as pesticide runoff or waste contamination of water sources. Pollution liability insurance covers the costs related to the cleanup of accidental pollution and shields the farm from claims related to environmental damage. This is particularly important for farms that use chemicals or manage large quantities of organic waste.

5. Umbrella Liability:

Umbrella liability insurance provides an additional layer of security that extends beyond the limits of other liability policies. For farms facing significant legal claims or accidents that exceed the coverage of standard policies, umbrella liability can cover the excess costs. This type of insurance is a safety net, offering extended coverage that helps protect a farm’s financial stability against catastrophic losses.

Each type of farm liability coverage addresses different aspects of the risks involved in running a farm. By combining these coverages, farm owners can ensure a comprehensive protection plan that covers various potential liabilities, from everyday operations to unexpected disasters. This layered approach to insurance helps secure the continuity and financial integrity of the farming business.

Other Liability Coverages:

In addition to the extra not unusual varieties of farm liability coverage, there are several other precise coverages that farm owners should consider to ensure comprehensive safety towards a wide range of risks. These additional liability coverages cater to particular components of agricultural operations and can be crucial in dealing with unique liabilities:

1. Acts of Your Pets or Livestock:

This insurance covers the harm or injuries as a result of pets or cattle owned with the aid of the farm. Livestock, especially, can pose considerable dangers if they break out of enclosures and damage belongings or cause accidents on public roads. This sort of insurance is critical for farms with massive numbers of animals or the ones placed close to populated regions, as it can guard against claims due to incidents with livestock causing car accidents or pets injuring visitors.

2. Fire Legal Liability:

Often covered as a part of a preferred legal liability coverage, this insurance is specifically applicable to farms because of the high danger of fireplaces in agricultural settings. Fire criminal legal liability insurance covers damages resulting from hearth to houses that are rented or leased through the farm, along with barns or garage facilities. Given the presence of flammable substances like hay, grains, and different farm products, along with equipment that can overheat, this insurance offers critical protection against probably devastating financial losses from fireplace damage.

3. Farm Chemicals Limited Liability:

This coverage addresses the dangers associated with the use and handling of agricultural chemicals, together with pesticides and fertilizers. Farm chemical substances restricted liability coverage is essential for protection against claims related to chemical spills, incorrect utility, or unintentional contamination of plants or neighboring lands. It helps cowl the expenses of criminal defense and damages, ensuring that a farm can maintain operations without the crippling outcomes of big chemical-related legal liability claims.

Each of these different legal liability coverages serves to fill gaps that might not be blanketed by more excellent, fashionable farm legal liability policies. They offer specialized protection against the specific and regularly unforeseen risks that come with managing a farm, including the unpredictable behavior of animals or the complex rules surrounding chemical use. By securing these extra coverages, farm owners can similarly mitigate the monetary dangers related to their agricultural operations, safeguarding their livelihoods and ensuring the steadiness of their business in the face of capability prison challenges.

Although your farm’s risk exposures may change and evolve, what’s certain is the importance of ensuring you’re covered for any risk. When evaluating your farm liability insurance needs, some important parts of the coverage to review are:

- Who’s covered—If your policy includes employer liability or workers’ compensation insurance, verify coverage for seasonal and short-term employees. Also, take note of whether independent contractors—such as custom farmers or sprayers—are covered.

- If the policy covers accidents on the road, this includes accidents involving farming equipment and trucks or vehicles used as part of your operations.

- What is excluded from the policy—Review your policy exclusions and purchase any necessary riders to provide full coverage for your farm’s needs.

Your farm is your way of life, and that’s why it’s important to annually review your farm liability insurance and purchase any needed options to minimize insurance gaps and reduce your risk exposures. For additional insurance resources, contact us today.

Conclusion

As we wrap up what is farmers liability insurance coverage? In essence, farmers liability insurance coverage is like a shielding guard for the ones in the farming or enterprise. It offers peace of mind with the aid of overlaying diverse dangers that could doubtlessly disrupt farm operations and cause severe monetary lines. From accidents and injuries at the farm to environmental harm and product-associated problems, this insurance ensures that farmers can preserve their essential work of feeding the country without the consistent fear of ability liabilities. For all people worried about agriculture, securing a farmer’s legal liability coverage is not only a smart choice—it’s an essential step toward sustainable farming and long-term success.

FAQs

What is farmers liability insurance coverage?

Farmers liability insurance coverage is a specialized type of coverage designed to defend farmers from criminal and financial dangers associated with their farming operations. This includes injuries on the farm, damage resulting from farm animals, and problems arising from farm merchandise or operations.

Why do farmers need liability coverage?

Farming involves numerous risks, from the usage of heavy equipment and chemical substances to the management of large areas and animals. Liability coverage protects farmers from potential complaints or monetary losses because of injuries or damages that arise on their property or as a result of their farming activities.

How much does a farmer’s liability insurance cost?

The cost of a farmer’s liability coverage varies primarily based on numerous factors, including the dimensions of the farm, the varieties of sports performed, the cost of the plants and cattle, and the extent of risk involved. Farmers must seek advice from an insurance provider to get a quote tailor-made to their precise desires.

References:

https://www.teamais.net/blog/what-does-a-farm-liability-policy-cover/

https://www.nationwide.com/business/agribusiness/farm-insurance/optional-coverages/type/liability

https://www.christensengroup.com/article/understanding-what-farm-liability-insurance-includes

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.