Face Amount of Insurance Policy: Key Insights and Benefits

When you buy life insurance, you’re buying assurance that when you die, your insurer will pay out a sum of money to your loved ones. That number is known as your policy’s face amount or face value, and it affects how much you’ll pay in premiums.

While it usually stays the same, there are a few situations that can trigger a change in face amount of insurance policy. Understanding these terms can give you a better sense of what your policy covers and how it will benefit your heirs.

What is the face amount of insurance policy?

In short, the face amount of insurance policy is the amount of money that a policyholder’s beneficiaries will receive from the insurance company when the policyholder dies. If you’ve purchased life insurance, the face value should be listed on your policy (likely under policy benefits) as a specific sum. If you have any trouble locating this information, you can call your insurer for help.

How to determine your face amount of insurance policy:

The face amount of insurance policy should be able to cater to all your needs as an individual and as a family. Typically, people use the 10 to 15 times rule for determining the amount of life insurance but it depends on one’s financial portfolio.

To determine the right face value of your policy, account for covering the following expenses:

- Outstanding debts

- The further expense relating to taking care of your dependents

- College tuition

- Everyday bills and expenses

- Final medical bills

- How much your funeral will cost

Try out the life insurance coverage calculator to know the face amount that would better cover you.

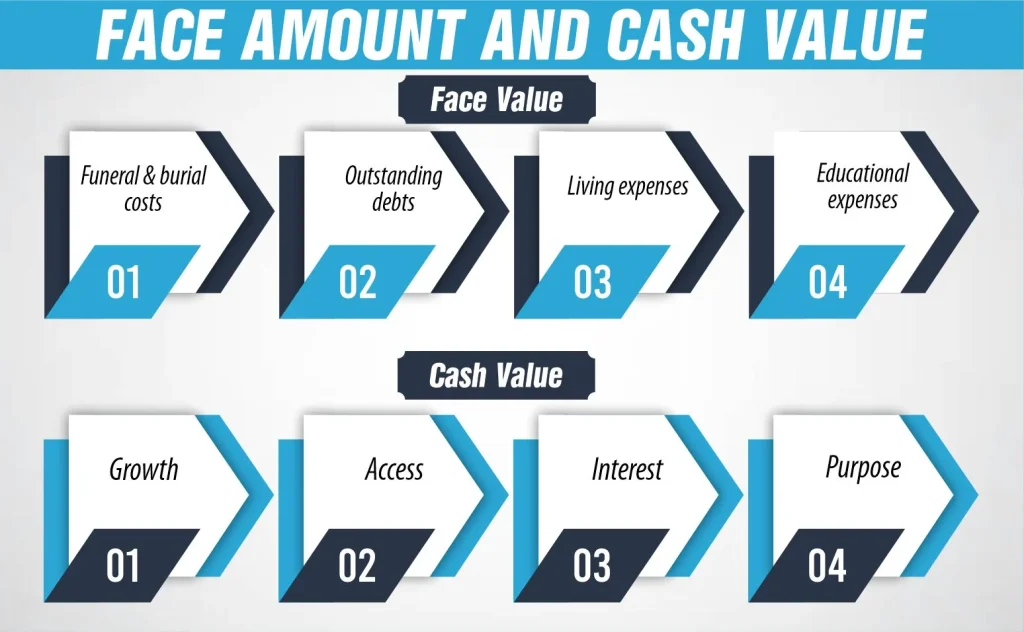

Face amount and cash value

Life insurance can be confusing, but understanding some key terms can make a big difference. Have you ever wondered what the face value and cash value of a life insurance policy mean? Let’s break it down.

Face Value

The face value, also known as the death benefit, is the amount of money your beneficiaries will receive when you pass away. Think of it as the main reason you get life insurance. For example, if you have a policy with a $200,000 face value, your family gets $200,000 when you die. This money can be used for:

- Funeral and burial costs: Funerals can be expensive, and this ensures your family isn’t burdened.

- Outstanding debts: Any remaining debts, like a mortgage or car loan, can be paid off.

- Living expenses: This helps your family maintain their standard of living.

- Educational expenses: It can fund your children’s or grandchildren’s education.

Cash Value

Now, what about cash value? This feature is part of permanent life insurance policies, like whole life or universal life insurance. It’s like a savings account within your policy. Here’s what you need to know:

- Growth: As you pay your premiums, the cash value grows. It’s a bit like building savings.

- Access: You can borrow against it or withdraw from it. This is handy for emergencies or extra income in retirement.

- Interest: If you take out a loan against your cash value, you’ll have to pay it back with interest. If you don’t, it reduces the death benefit.

Key Differences Between Face Value and Cash Value

- Purpose:

- Face Value: This is for your beneficiaries after you’re gone.

- Cash Value: This is for you to use while you’re still alive.

- Accessibility:

- Face Value: Only available to your beneficiaries after your death.

- Cash Value: You can access this during your lifetime.

- Stability:

- Face Value: Stays the same throughout the policy.

- Cash Value: Grows over time as you pay premiums.

So, what’s the takeaway? Face value is the financial support your loved ones get after you pass away. Cash value, on the other hand, is a living benefit that you can use while you’re still here. Knowing the difference helps you make better decisions about your life insurance. Have you considered how these features can fit into your financial plans?

How Much Does Life Isurance Cost?

Can you apply for any face value?

You need to apply for the face amount as part of your financial obligations associated with the insurance policy. Before approving your insurance policy, insurers determine your proof of insurability. This means they will ensure that you qualify for the face amount of money that you are applying for based on your age, income, and other assets.

Your income and age define the amount of coverage, though some factors (like how many dependents you have) can explain some requests for the face value that are not justified compared to your net worth.

For instance, if you are 30 years of age, most insurance companies will let you borrow up to 30 times your current annual income or even more. You have an opportunity to earn significantly more in the rest of your working years because you have consistently high earning capability.

But let’s suppose you are 60, and you have a mortgage, guess what! You no longer owe anyone any money. This means that while the insurers may only provide cover up to 10 times the annual income, this is because you have fewer working years ahead and less debts.

How can you change the face amount of insurance policy?

Most often the face value and the death benefit are equal to the same amount of money and both remain unchanged throughout the period of the insurance policy. However, your face amount of insurance policy may vary depending on the riders you select, any loans that have been granted to you (if your policy is permanent, and it has cash value), or falsehoods stated on your application form during the initial policy purchase.

Using certain riders

Some riders allow the policyholder to receive a portion of the death benefit while they are still alive depending on some circumstances.

There are features such as the accelerated death benefit rider that entitle the client to the death benefit if they get a terminal illness diagnosis.

An accidental death and dismemberment (ADD) is an endorsement that will make a payment if you lose the use of a limb in an accident.

Any of these riders that you included on your policy and you are eligible for a claim, the amount you receive will be reduced from the face amount. This will have an impact on the face value of your policy.

For example, if you initially took a policy with a face amount of $500,000 and were eligible to receive $100,000 as accelerated under this provision your heirs will receive $400,000 when you die.

Taking out a loan against the policy’s cash value

If the policyholder has a permanent life insurance plan with cash value, then the way the policyholder manages the cash value will directly influence the actual face value of the policy.

If something is borrowed against the cash value and not paid up before one dies, the face value will reduce.

First, any outstanding balances that you might have will be used to pay up your insurer, and there could be nothing left for the beneficiaries, then they will receive whatever is remaining from the death benefit.

For instance, if you have a policy with a face amount of $500000 and cash worth $100000. Subsequently, you withdraw a $50,000 cash value loan from the insurance policy. Even if the person who borrowed the $50,000 dies, his or her family can only claim $450,000 in this case, and not $500,000. The other part of the cash value is retained by the insurer, apart from the face amount.

In most cases, borrowing money using your life insurance policy is something that should be avoided because it poses a danger to your family’s future financial well-being.

What should the face value of your life insurance policy be?

You may wish to have a policy with a high face value to more adequately provide financial support for your beneficiaries. But keep in mind that the higher your policy’s face amount, the more you’ll likely pay for it. Picking the right face amount of insurance policy comes down to balancing your loved one’s future needs and your current budget.

Insurers will generally cap a policy’s face value at a certain amount based on factors such as your age and your salary. A 20- or 30-year-old might be able to get a policy with a face value that’s roughly 50 times their salary right now, while a 60-year-old might only be able to get a face amount worth 10 times their current salary. That’s because insurers assume younger people will live longer, meaning the insurance company can make more money off their premiums to cover their policy’s face amount.

Ultimately, the right face amount of insurance policy for you will depend on:

- Your salary

- Your outstanding debts, like a mortgage

- The anticipated financial needs of your partner/spouse or children with special needs

- The total number of dependents you have

- The likelihood your children will need money for their education

Determining the appropriate face amount of insurance policy for your circumstances may require research and careful thought.

Conclusion

You should track the face amount of insurance policy so you know how much your loved ones will receive after you pass away. This calculation can be tricky on policies with rider benefits as well as those with cash value. You can track the face value yourself using your policy statements, but if you’re unsure, contact your insurance agent to get the most up-to-date figure.

References

https://www.policygenius.com/life-insurance/face-value-of-a-life-insurance-policy/

https://fidelitylife.com/life-insurance-basics/life-insurance-101/face-value-life-insurance/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.