Are you living with COPD and wondering if you can secure life insurance to safeguard your loved ones’ future? The journey to finding the right life insurance coverage with Chronic Obstructive Pulmonary Disease might seem like a maze, but worry not – you’re not alone! Understanding the ins and outs of COPD’s impact on life insurance eligibility is the first step toward securing the protection you need.

Amidst concerns about COPD affecting insurance rates and coverage options, there’s good news: obtaining life insurance with COPD is feasible. From unraveling eligibility criteria to exploring tailored insurance options, this guide aims to simplify the process, ensuring you navigate the world of life insurance for COPD with confidence and clarity. So, let’s dive in and uncover the pathways to securing the best life insurance coverage while managing COPD.

Can You Get Life Insurance With COPD?

Yes, it’s possible to obtain life insurance even if you have COPD (Chronic Obstructive Pulmonary Disease). However, securing life insurance with COPD might involve some considerations and possibly higher premiums due to the associated health risks. COPD affects the lungs and breathing, which can raise concerns for insurance companies regarding the level of risk involved.

Insurers evaluate various factors such as the severity of COPD, treatment plans, overall health, age, and lifestyle habits, particularly smoking history, to determine eligibility and premium rates. While having COPD may impact insurance rates, many insurance companies offer policies tailored to individuals with pre-existing conditions like COPD.

Understanding the specifics of COPD’s impact on life insurance eligibility is crucial. By providing accurate information about your health and diligently researching various insurance options, it’s possible to find suitable coverage that meets your needs and provides financial security for your loved ones.

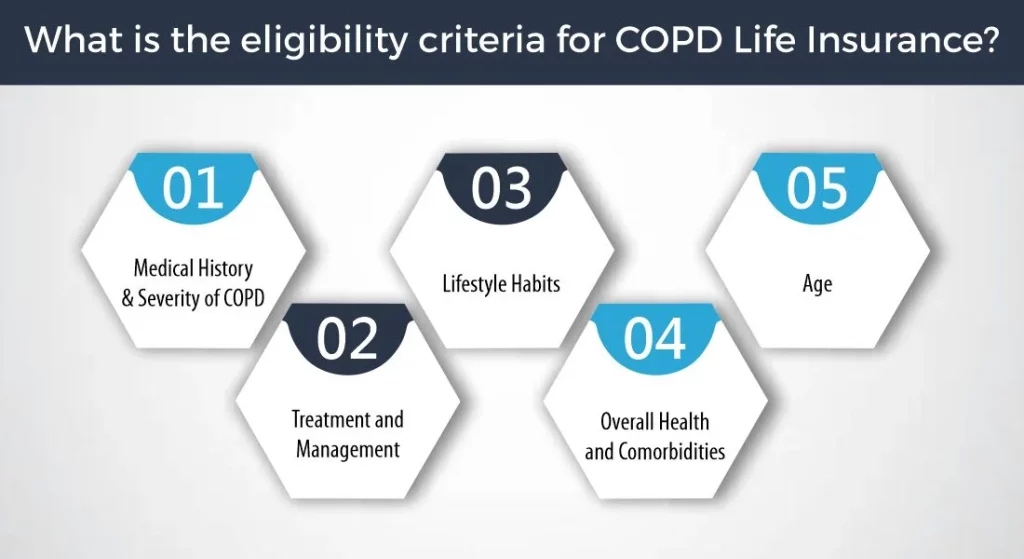

What is the eligibility criteria for COPD Life Insurance?

The eligibility criteria for COPD life insurance typically revolve around several key factors that insurers consider when assessing an individual’s application:

1- Medical History and Severity of COPD

Insurance companies evaluate the severity of COPD through medical records, diagnostic tests (like spirometry), and pulmonary function tests. They look at the stage of the disease, frequency of exacerbations, hospitalizations, and the effectiveness of treatments or medications.

2- Treatment and Management

Insurers are interested in understanding how the individual manages their COPD. This includes adherence to prescribed treatment plans, medication usage, pulmonary rehabilitation participation, and compliance with medical advice from healthcare professionals.

3- Lifestyle Habits

Smoking is a primary cause of COPD. Insurers often inquire about smoking habits, both current and past. Other lifestyle factors such as diet, exercise routine, and overall health may also be considered.

4- Overall Health and Comorbidities

In addition to COPD, insurers assess an individual’s general health condition and any other existing medical conditions or comorbidities. These can impact the overall risk profile.

5- Age

Age is a significant factor in determining insurance premiums. Older individuals with COPD might face higher premiums due to increased health risks associated with age.

Getting the Best Life Insurance For COPD

Securing the best life insurance when you have COPD involves strategic steps tailored to your specific health needs. Here’s how to navigate this process effectively:

How Much Does Life Isurance Cost?

Research and Compare

Explore multiple insurance providers. Some specialize in covering individuals with pre-existing conditions like COPD. Compare their offerings, premiums, coverage limits, and any exclusions related to COPD.

Honesty is Key

Provide accurate and comprehensive information about your COPD diagnosis. Disclose the severity of the condition, treatment plans, medications, hospitalizations, and any lifestyle adjustments you’ve made to manage COPD effectively.

Consider Specialist Insurers

Some insurance companies specialize in covering high-risk individuals, including those with COPD. These insurers might offer policies tailored to your specific needs and health situation.

Utilize Professional Advice

Consulting an insurance broker or agent experienced in handling cases involving COPD can provide valuable insights. They can guide you through the process, helping you find insurers more inclined to offer favorable terms.

Understand Policy Details

Thoroughly review policy terms and conditions. Pay attention to any clauses related to pre-existing conditions, waiting periods, coverage limits, and exclusions. Ensure the policy meets your requirements.

Explore Supplemental Coverage

Consider supplemental policies that can complement your primary life insurance. Critical illness or disability insurance might provide additional financial protection in case of severe health setbacks due to COPD.

Remember, while COPD might impact insurance rates or policy options, being proactive, transparent, and informed can significantly increase your chances of finding suitable life insurance coverage that meets your needs and provides peace of mind for your loved ones.

Term Life Insurance for COPD

Term life insurance can be a viable option for individuals with COPD seeking affordable coverage for a specific period. Here are some key points to consider regarding term life insurance:

- Affordability: Term life insurance often comes with lower premiums compared to permanent life insurance policies. This affordability can be beneficial for individuals with COPD looking for cost-effective coverage.

- Flexible Coverage: With term life insurance, you select a specific coverage period (such as 10, 20, or 30 years) based on your needs. This flexibility allows you to align the coverage duration with significant financial obligations like mortgage payments, children’s education, or other specific time-bound expenses.

- Renewability and Convertibility: Some term life policies offer the option to renew the policy at the end of the term or convert it into a permanent policy without undergoing additional medical underwriting. This feature can be advantageous if your health condition changes over time due to COPD progression.

- Underwriting Considerations: While individuals with COPD might face higher premiums due to the associated health risks, term life insurance can still be accessible. Insurance companies will evaluate the severity of COPD, treatment adherence, and overall health status to determine premiums.

Before getting term life insurance, thoroughly assess your coverage needs and consult with insurance professionals who understand COPD-related considerations.

Burial Insurance With COPD

Burial insurance, also known as final expense insurance, can be a viable option for individuals with COPD who are seeking coverage specifically to handle funeral and burial expenses. Here are some key aspects to consider about burial insurance for COPD:

- Simplified Underwriting: Many burial insurance plans have simplified underwriting processes, which means they often require minimal or no medical exams. This can be beneficial for individuals with pre-existing conditions like COPD, as the application process is typically more straightforward.

- Coverage for Final Expenses: Burial insurance is specifically designed to cover funeral and burial costs. It provides a lump sum benefit to beneficiaries upon the policyholder’s passing, helping cover expenses associated with funeral services, caskets, burial plots, and related costs.

- Affordable Premiums: Premiums for burial insurance policies are often more affordable and manageable, especially for seniors or individuals with health conditions like COPD. The coverage amounts are usually lower compared to traditional life insurance policies, making them more accessible.

- Guaranteed Acceptance: Some burial insurance plans offer guaranteed acceptance regardless of health conditions, age, or medical history. This feature can be particularly advantageous for individuals with COPD, ensuring they can obtain coverage without worrying about potential rejections.

Moreover, before opting for burial insurance, carefully assess your needs and compare policies from different insurers. Ensure the coverage amount aligns with the anticipated funeral expenses and that the policy terms suit your requirements.

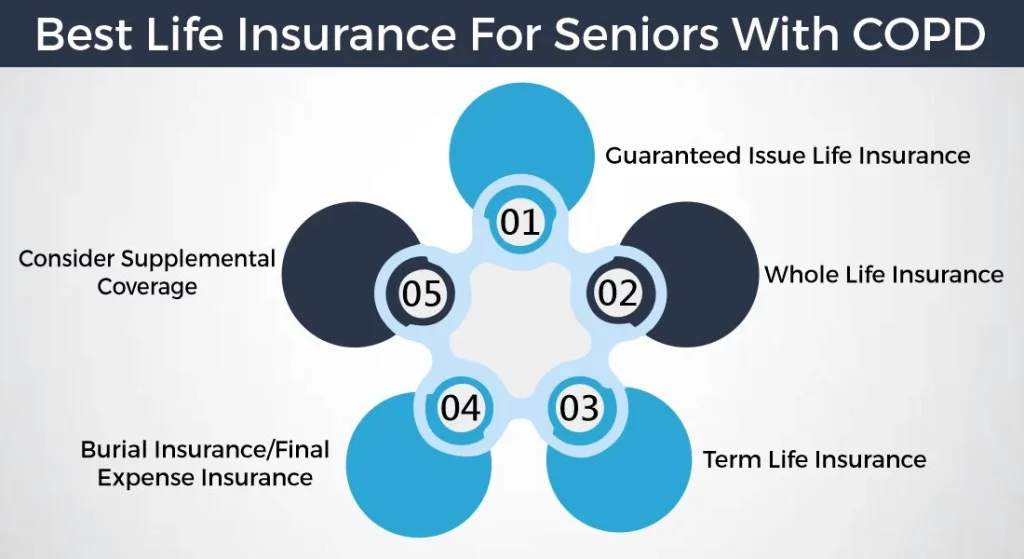

Best Life Insurance For Seniors With COPD

For seniors managing COPD, finding the best life insurance requires consideration of specific needs and health conditions. Here are some suitable life insurance options for seniors with COPD:

1- Guaranteed Issue Life Insurance

This type of policy guarantees acceptance without medical exams or health questions. Seniors with COPD, even with severe health conditions, can secure coverage. However, these policies often come with higher premiums and lower benefit amounts compared to traditional life insurance.

2- Whole Life Insurance

Seniors with COPD might benefit from whole life insurance, providing lifelong coverage and a cash value component. Premiums remain consistent throughout the policy, and the accumulated cash value can be utilized during the policyholder’s lifetime or passed on to beneficiaries.

3- Term Life Insurance

While term life insurance generally targets younger individuals, seniors with COPD might still find it beneficial for specific needs. Short-term financial obligations or legacy planning can be managed with term policies, but premiums might be higher due to age and COPD.

4- Burial Insurance/Final Expense Insurance

Tailored specifically for covering funeral and burial expenses, these policies are accessible for seniors with COPD. They offer smaller coverage amounts at affordable premiums without stringent medical underwriting.

5- Consider Supplemental Coverage

Critical illness or long-term care insurance might complement existing life insurance for seniors with COPD. These policies can provide additional financial protection against COPD-related healthcare expenses or unexpected health setbacks.

Frequently Asked Questions (FAQs)

1- Will COPD affect my insurance rates?

Yes, COPD may influence insurance rates. The severity of the condition, age, lifestyle choices, and overall health will impact premiums.

2- Is COPD classed as a critical illness?

COPD is often classified as a critical illness due to its chronic nature and significant impact on an individual’s health and daily life.

3- Can smokers with COPD get life insurance?

Smokers with COPD can obtain life insurance, but it might lead to higher premiums due to the elevated health risks associated with both smoking and COPD.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.