Life is a journey filled with ups and downs, moments of joy and sorrow. While we celebrate milestones like weddings and birthdays, we also must prepare for the unexpected. This is where the Old Mutual Funeral Policy steps in, offering a helping hand when you need it most.

Imagine having the reassurance of knowing that, even in the toughest of times, your loved ones won’t have to worry about the financial burden that often accompanies a funeral. Old Mutual’s funeral policy is like a safety net, quietly waiting to support you and your family when you need it the most.

In this guide, we’ll take you on a journey through the world of Old Mutual Funeral Policy, unraveling its key features and benefits. From understanding what it is and how it works, to the advantages and disadvantages, we’ll help you make sense of it all. So, let’s embark on this informative voyage and discover the peace of mind that Old Mutual Funeral Policy can bring to your life.

What is Old Mutual Funeral Policy?

The Old Mutual Funeral Policy is a financial product offered by Old Mutual, a reputable financial services provider. It is designed to provide financial support to individuals and their families during a difficult and often emotionally challenging time—funeral arrangements and costs. This policy is essentially a form of funeral insurance that helps policyholders prepare for and alleviate the financial burden associated with the passing of a loved one.

In essence, when you purchase an Old Mutual Funeral Policy, you are making a financial arrangement to ensure that, in the event of your passing or that of a covered family member, the policy will pay out a sum of money to help cover the expenses related to the funeral. These expenses typically include costs such as the burial, transportation, catering, and other funeral-related expenditures.

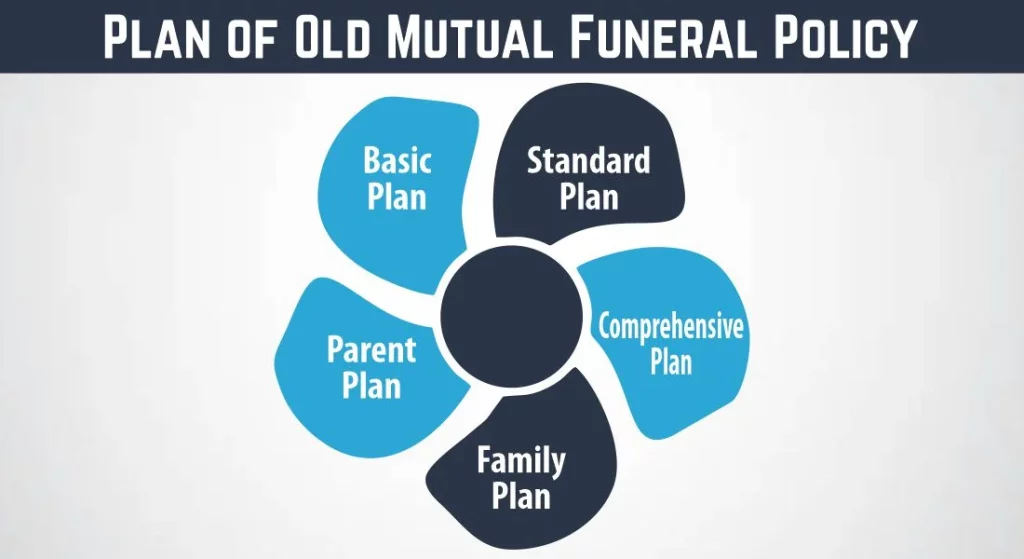

Plan of Old Mutual Funeral Policy

The Old Mutual Funeral Policy offers a range of plans designed to meet different needs and preferences. These plans vary in terms of coverage, benefits, and premiums. Here’s an overview of the typical plans available under the Old Mutual Funeral Policy:

1- Basic Plan

This plan offers the most essential coverage, providing a payout to cover basic funeral expenses such as the cost of a burial plot, the coffin, and other basic funeral services. It’s a budget-friendly option that ensures financial support during a time of need.

2- Standard Plan

The Standard Plan is a step up from the Basic Plan, offering more comprehensive coverage. In addition to the essentials, it may cover additional expenses like transportation of family members to the funeral, catering, and memorial services.

3- Comprehensive Plan

The Comprehensive Plan is the most extensive coverage option. It provides a higher payout amount and includes a wider range of benefits. In addition to the services covered in the Basic and Standard Plans, it may also offer repatriation of remains, assistance with legal documentation, and additional support services for the grieving family.

4- Family Plan

Some Old Mutual Funeral Policies allow you to extend coverage to immediate family members, such as your spouse and children. This ensures that your entire family can benefit from the financial support in the event of a covered loss.

5- Parent Plan

This plan is specifically designed to cover the funeral expenses of your parents. It can be added as an extension to your policy, giving you the peace of mind that you can provide for your parents in their time of need.

It’s essential to carefully evaluate these plan options and choose the one that best aligns with your specific requirements and budget. Old Mutual’s flexibility allows you to select the coverage that suits your family’s unique circumstances, ensuring that you have the right level of protection in place.

Benefits of Old Mutual Funeral Policy

Financial Relief

One of the primary benefits of the Old Mutual Funeral Policy is that it provides financial support to your family during a difficult time. This coverage can help with funeral costs, including the burial, catering, and other related expenses.

Customizable Plans

Old Mutual offers flexibility in its plans, allowing you to tailor your coverage based on your unique needs. You can choose the level of coverage that best aligns with your budget and requirements.

No Medical Exam Required

Old Mutual Funeral Policy typically does not require a medical examination, making it accessible to a wide range of individuals, regardless of their health status.

Immediate Payout

In the event of a valid claim, Old Mutual aims to provide a quick payout to beneficiaries, ensuring they have the financial resources they need during a difficult time.

Added Benefits

Some Old Mutual Funeral Policies offer additional benefits, such as repatriation of remains, memorial services, and transportation of family members to the funeral.

Disadvantages of Old Mutual Funeral Policy

While Old Mutual Funeral Policy offers numerous advantages, it’s essential to consider the potential drawbacks:

Premium Costs

Premiums can vary based on factors such as age, coverage level, and chosen plan. Some may find the monthly premiums challenging to manage.

Exclusions

Like any insurance policy, Old Mutual Funeral Policy has exclusions and waiting periods. It’s crucial to understand these limitations before making a commitment.

Claim Requirements

Filing a claim can be a complex process, and non-compliance with Old Mutual’s requirements may lead to claim denials.

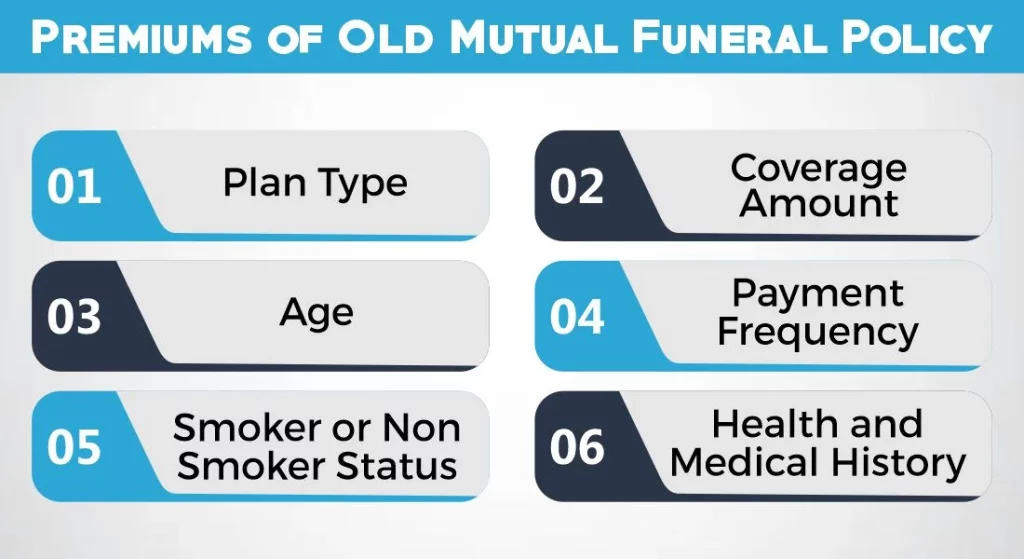

Premiums of Old Mutual Funeral Policy

The premiums for an Old Mutual Funeral Policy can vary based on several factors, including the plan you choose, your age, the coverage amount, and the payment frequency. Here are some key factors that influence the premiums for an Old Mutual Funeral Policy:

Plan Type

The specific plan you select will have a significant impact on your premium. Basic plans with more limited coverage typically come with lower premiums, while comprehensive plans with extensive coverage will have higher premiums.

Coverage Amount

The amount of coverage or the sum assured you choose will also affect your premium. A higher coverage amount will result in higher premiums, as the insurer is committing to a larger payout in the event of a claim.

Age

Your age plays a crucial role in determining the premium. Generally, younger policyholders can expect lower premiums compared to older individuals. This is because younger individuals are statistically less likely to make a claim in the near future.

Payment Frequency

Old Mutual typically offers flexible payment options, such as monthly, quarterly, or annual premium payments. Paying premiums annually might be less expensive in the long run compared to monthly payments, as some insurers offer discounts for annual payments.

Smoker or Non-Smoker Status

Some insurers differentiate between smokers and non-smokers when determining premiums. Smokers often pay higher premiums due to the increased health risks associated with smoking.

Health and Medical History

While Old Mutual Funeral Policies generally do not require a medical examination, your overall health and medical history may still be considered when calculating your premium.

How does Old Mutual Funeral Cover Work?

Old Mutual Funeral Cover operates on a straightforward and practical principle. When you purchase an Old Mutual Funeral Policy, you are essentially making a financial arrangement to provide support to your beneficiaries or nominated beneficiaries in the event of your passing. Here’s how it works:

1- Policy Purchase

You begin by selecting the Old Mutual Funeral Policy that suits your needs and budget. This policy outlines the terms and conditions, the amount of coverage, and the premium payments you are required to make.

2- Regular Premium Payments

As a policyholder, you are responsible for making regular premium payments to Old Mutual. These payments can be scheduled on a monthly, quarterly, or annual basis, depending on your preference. The premium amount is determined by factors such as your age, the selected plan, and the amount of coverage.

3- Policy Activation

Your Old Mutual Funeral Policy becomes active as soon as you make your first premium payment, provided that all the required documentation and application processes have been completed.

4- Coverage Commences

From the moment your policy is active, you and your beneficiaries have the assurance that, in the event of your passing, the policy will provide a predetermined sum assured or coverage amount. This payout is designed to assist with covering the funeral expenses.

5- Filing a Claim

In the unfortunate event of a covered loss, your beneficiaries must notify Old Mutual as soon as possible. They will need to provide the necessary documentation, which typically includes a death certificate, a completed claim form, and any other documents specified in the policy.

6- Claim Evaluation

Old Mutual will review the claim to ensure it meets the policy’s terms and conditions. If the claim is valid, Old Mutual will initiate the payout process.

7- Beneficiary Payout

Once the claim is approved, Old Mutual will provide a lump-sum payout to the beneficiaries. This amount can be used to cover the various expenses associated with the funeral, including the cost of the coffin, burial plot, transportation, catering, and other related costs.

Old Mutual Funeral Cover for Parents & Extended Family

Old Mutual Funeral Cover extends its coverage beyond just the policyholder to include immediate family members, such as parents and children. This feature allows you to provide financial support and protection for your loved ones during their time of need. Here’s how Old Mutual Funeral Cover can benefit parents and extended family members:

Coverage for Parents

- Parents are often a source of guidance, support, and love throughout our lives. Old Mutual recognizes the importance of ensuring they receive a dignified farewell when the time comes.

- By adding your parents to your Old Mutual Funeral Policy, you can extend the coverage to include them. This means that in the event of the passing of a covered parent, the policy can provide financial support to cover their funeral expenses, including the cost of the burial, transportation, catering, and other related costs.

- This added coverage can ease the financial burden on your family during a challenging period and ensure that your parents receive the farewell they deserve.

Coverage for Extended Family

- Old Mutual Funeral Cover for extended family members allows you to extend the protection even further, encompassing relatives beyond your immediate family.

- This feature is valuable for those who wish to provide financial support and peace of mind to their grandparents, siblings, aunts, uncles, or other close relatives.

- By extending coverage to your extended family, you are ensuring that they, too, have access to financial support during their time of need, making it easier to cover funeral expenses and related costs.

How Do I Claim My Old Mutual Funeral Policy?

In the event of a loss, the process of claiming the Old Mutual Funeral Policy can be broken down into several key steps:

- Notification: Inform Old Mutual about the claim as soon as possible. You can typically do this through their customer service hotline or by visiting a branch.

- Documentation: Old Mutual will require specific documents to process the claim. These may include the policyholder’s death certificate, a completed claim form, and any other documents specified in your policy.

- Review: Old Mutual will review the claim to ensure it complies with the policy terms and conditions.

- Payout: If the claim is approved, Old Mutual will initiate the payout to the beneficiaries. The funds can be used to cover funeral expenses and other related costs.

Cancellation of Old Mutual Funeral Policy

Effortlessly Cancel Your Old Mutual Policy in 6 Easy Steps:

Secure Your Form: Get the cancellation form from Old Mutual’s website or contact their support for a fast copy delivery.

Personalize Your Details: Fill in exact personal info—your full name, contact details, and policy number.

State Your Reason: Clearly indicate the cause for cancellation and provide necessary documents backing your decision.

Know Your Terms: Review cancellation terms, securing a grab of any possible penalties or fees.

Seal the Deal: Sign and date the form, confirming your cancellation request.

Send It Off: Submit the completed form via mail, email, or their online doorway, sticking to Old Mutual’s submission guidelines.

Pricing and Discounts of Old Mutual Funeral Policy Cover

Old Mutual offers a range of pricing options to cater to different budgets. Additionally, the company may provide discounts or promotions from time to time. It’s advisable to consult with an Old Mutual representative to get detailed information on available discounts and how they may apply to your specific policy.

Conclusion

Old Mutual Funeral Policy offers a practical solution to help you and your loved ones in times of need. With customizable plans, immediate payouts, and a reputation for reliability, it’s an option worth considering. However, it’s crucial to carefully review the terms and conditions, understand the premiums, and choose a plan that aligns with your unique circumstances.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.