Final Expense Insurance While On Medicaid: Comprehensive Guide

Final expense insurance is a crucial consideration for individuals seeking financial security for their loved ones after their passing. However, for those on Medicaid, the process can be a bit more complex. But don’t worry, we have got you a solution in this blog post.

Many users asked a very common query that is: “Can You Have Final Expense Insurance While on Medicaid?” Well! To get answers to this question and many others, you may have to go through this blog thoroughly.

In this comprehensive guide, we will explore the possibilities and challenges of having final expense insurance while on Medicaid. Let’s explore it together!

What is Medicare final expense?

Medicare does not offer a specific “final expense” insurance policy. However, Medicare Part A and Part B do cover some of the costs associated with hospice care for individuals who are terminally ill. This coverage includes services such as pain relief, symptom management, and emotional support for both the patient and their family.

For other final expenses not covered by Medicare, such as funeral and burial costs, individuals may choose to purchase a separate final expense insurance policy. These policies are designed to cover specific end-of-life expenses, including funeral costs, medical bills, and other debts. They are typically smaller policies with lower premiums compared to traditional life insurance policies, and they provide a lump sum payment to beneficiaries to cover these expenses.

How many types of final expense insurance are there?

Final expense insurance typically comes in three versions:

1- Regular final expense insurance

This type of policy provides immediate coverage without a waiting period. It pays out the full death benefit from the start of the policy, covering funeral and burial expenses, medical bills, and other debts.

2- Graded benefit final expense insurance

This type of policy has a waiting period, usually 2-3 years, before it pays out the full death benefit. If the policyholder dies within the waiting period, the beneficiary may receive a portion of the death benefit or just the premiums paid. After the waiting period, the full benefit is paid out.

3- Guaranteed issue final expense insurance

This type of policy is typically for individuals who may not qualify for other types of life insurance due to health issues. It has no medical underwriting, so acceptance is guaranteed. However, it often has a waiting period before the full death benefit is paid out, similar to graded benefit policies.

Each type of final expense insurance has its features and benefits, so it’s important to carefully consider your needs and options before choosing a policy.

Can You Have Final Expense Insurance While On Medicaid?

Absolutely, you can have final expense insurance while on Medicaid. There’s a common misconception that being on Medicaid disqualifies you from obtaining additional coverage, but that’s not the case. Final expense insurance serves a specific purpose – covering funeral and burial costs, ensuring your loved ones aren’t burdened with expenses during an already challenging time.

How Much Does Life Isurance Cost?

However, it’s important to navigate this path carefully. While Medicaid focuses on providing health coverage for low-income individuals, final expense insurance is designed to address end-of-life expenses. Understanding the eligibility criteria and potential implications is crucial.

In our exploration, we’ll explore the details, demystifying the process and empowering you to make informed decisions. Stay with us as we uncover the possibilities of securing final expense insurance without compromising your Medicaid benefits. It’s a delicate balance, but one that ensures your legacy is both financially secure and respectful of your unique circumstances.

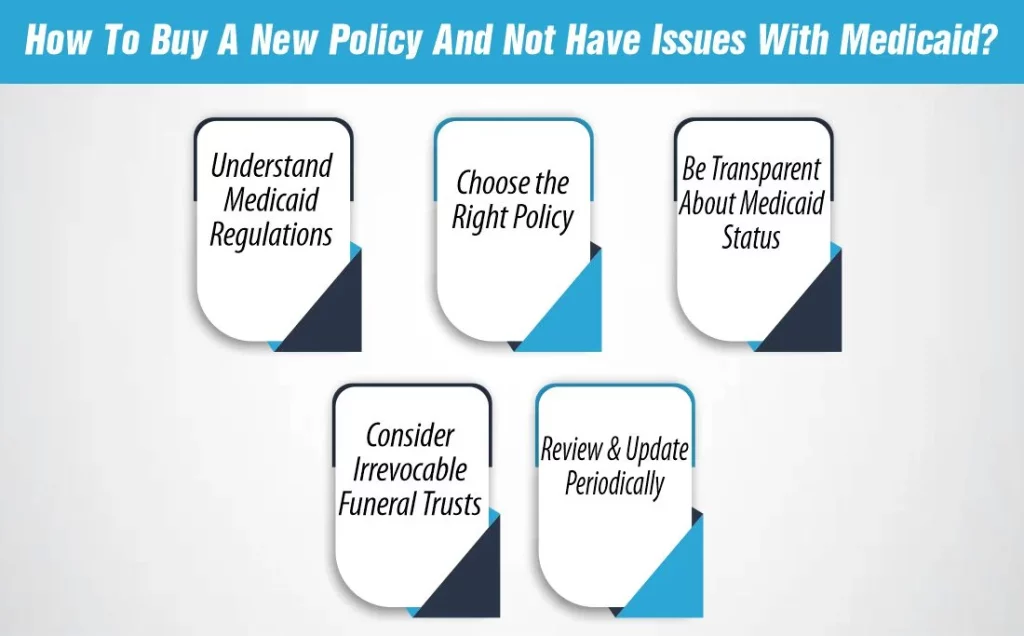

How To Buy A New Policy And Not Have Issues With Medicaid?

Getting a new final expense insurance policy while on Medicaid requires a strategic approach to avoid potential issues. Let’s break down the process into actionable steps to ensure a seamless experience without threatening your Medicaid benefits:

1- Understand Medicaid Regulations

Before diving into the world of final expense insurance, familiarize yourself with Medicaid regulations in your state. Each state may have specific rules regarding income thresholds and asset limits. Knowing these details will help you navigate the purchase without running afoul of Medicaid guidelines.

2- Choose the Right Policy

Opt for a final expense insurance policy that aligns with Medicaid requirements. Some policies have minimal face values, making them Medicaid-friendly. Ensure the policy complements your existing coverage and doesn’t exceed the permissible asset limits set by Medicaid.

3- Be Transparent About Medicaid Status

When applying for a new policy, be transparent about your Medicaid status. Hiding information can lead to complications later on. Insurance providers can tailor policies to accommodate your Medicaid situation, ensuring a smoother integration.

4- Consider Irrevocable Funeral Trusts

Explore options like irrevocable funeral trusts, which set aside funds exclusively for funeral expenses. These trusts are often exempt from Medicaid asset calculations, providing a dedicated resource for your end-of-life arrangements without affecting your Medicaid eligibility.

5- Review and Update Periodically

Life circumstances change, and so should your financial plan. Regularly review and update your final expense insurance policy to reflect any adjustments in your Medicaid status or overall financial situation.

By following these steps, you can confidently navigate the process of purchasing a new final expense insurance policy while maintaining harmony with Medicaid. Remember, proactive and informed decision-making is the key to securing your financial future without complications.

The Impact of Medicaid and Burial Insurance on Beneficiaries:

Understanding the impact of Medicaid and burial insurance on beneficiaries is significant for comprehensive end-of-life planning. Let’s check out the profound implications these financial instruments have on the loved ones left behind:

Financial Security for Beneficiaries

Medicaid and burial insurance collectively contribute to the financial security of your beneficiaries. Medicaid may cover medical expenses, while burial insurance specifically addresses funeral and burial costs. This dual coverage ensures that your loved ones aren’t burdened with substantial financial responsibilities during an emotionally challenging period.

Streamlined Funeral Arrangements

Burial insurance facilitates streamlined funeral arrangements. The funds from the policy can cover funeral service expenses, casket costs, burial plots, and other associated costs, allowing your beneficiaries to focus on honoring your memory rather than navigating financial intricacies.

Preserving Medicaid Benefits

Careful planning is essential to preserve Medicaid benefits for your beneficiaries. Irrevocable funeral trusts, for example, can shield the funds allocated for funeral expenses from Medicaid asset calculations, ensuring that your loved ones can access necessary healthcare support without disruption.

Reducing Emotional and Financial Stress

The emotional toll of losing a loved one is challenging enough without the added stress of financial burdens. Medicaid and burial insurance work together to alleviate this stress, providing a financial safety net that allows your beneficiaries to grieve without the added pressure of immediate financial concerns.

Ensuring a Dignified Farewell

The combined impact of Medicaid and burial insurance ensures a dignified farewell. Your beneficiaries can honor your legacy with a meaningful funeral service and burial, creating a lasting tribute to your life. This financial support is a crucial component of leaving a positive and lasting impact on those you care about.

Furthermore, the impact of Medicaid and burial insurance on beneficiaries is multifaceted. It not only safeguards their financial well-being but also provides peace of mind during a challenging time. By carefully considering these factors in your end-of-life planning, you empower your loved ones to navigate the aftermath with grace and focus on celebrating your life rather than grappling with financial uncertainties.

Does Medicaid Help With Funeral Costs?

Medicaid can offer some assistance with funeral costs, although the extent of the support varies by state. While Medicaid is primarily designed to provide health coverage for low-income individuals, some states recognize the financial challenges associated with funeral expenses and provide limited assistance.

Here are ways in which Medicaid may help with funeral costs:

Medicaid Funeral Expense Trusts

Some states offer Medicaid Funeral Expense Trusts or similar programs. These are special accounts set up to specifically cover funeral and burial expenses. Funds in these trusts are typically exempt from Medicaid asset calculations, ensuring they don’t affect eligibility for Medicaid coverage.

Burial Plots and Services

Medicaid may cover certain burial expenses such as the cost of a burial plot and some funeral services. However, it’s crucial to check with your state’s Medicaid office to understand the specific services covered and any limitations on reimbursement.

Individual State Programs

Some states have individual programs to assist with funeral expenses for Medicaid recipients. These programs may provide a fixed amount to cover funeral costs or offer reimbursement for specific services. Contact your local Medicaid office or social services agency to inquire about available programs in your state.

Asset Recovery Policies

It’s important to note that Medicaid has policies for recovering expenses from the estates of deceased beneficiaries. This could include recovering funds spent on medical care, including long-term care, but the policies vary by state. Funeral and burial expenses are generally considered exempt from Medicaid estate recovery.

While Medicaid can provide some support for funeral costs, it’s advisable to plan comprehensively and explore additional options such as burial insurance or funeral trusts to ensure that your loved ones have adequate financial resources for end-of-life arrangements. Understanding the specific policies and programs in your state is crucial for effective funeral cost planning with Medicaid.

What is the difference between life insurance and final expense insurance?

Life insurance and final expense insurance are both types of insurance policies designed to provide financial protection to beneficiaries, but they serve different purposes and have different features:

Coverage amount:

Life insurance policies typically offer higher coverage amounts than final expense insurance. Life insurance is meant to replace lost income and provide for the financial needs of dependents after the policyholder’s death, while final expense insurance is intended to cover specific end-of-life expenses, such as funeral costs.

Premiums:

Final expense insurance generally has lower premiums than traditional life insurance policies, as the coverage amount is smaller and is meant to cover a specific expense rather than provide long-term financial support.

Coverage duration:

Life insurance policies can provide coverage for a specified term (term life insurance) or the entire life of the insured (whole life insurance). Final expense insurance is typically a whole-life policy, providing coverage for the rest of the insured’s life.

Underwriting:

Life insurance policies often require medical underwriting, which means the applicant’s health is taken into consideration when determining eligibility and premium rates. Final expense insurance may have simplified underwriting or guaranteed acceptance, making it easier for individuals with health issues to qualify.

Benefit payout:

Life insurance policies pay out a lump sum benefit to the beneficiary upon the insured’s death, which can be used for various purposes. Final expense insurance pays out a smaller benefit specifically designated for funeral and burial expenses.

Overall, while both types of insurance provide financial protection after the policyholder’s death, life insurance is more comprehensive and provides broader coverage, while final expense insurance is focused on covering specific end-of-life expenses.

What are final expenses in the USA?

In the USA, final expenses typically refer to the costs associated with a person’s funeral, burial or cremation, and other related expenses that arise after their death. These expenses can include:

- Funeral services: Costs related to the funeral home, casket or urn, embalming, viewing, and ceremony.

- Burial or cremation: Costs associated with the burial plot, headstone, cremation process, and urn.

- Medical expenses: Any outstanding medical bills or expenses not covered by health insurance.

- Credit card bills: Any remaining credit card debt or other outstanding debts.

- Legal fees: Costs related to probate or estate settlement.

Final expense insurance is designed to help cover these costs, providing a lump sum payment to the beneficiary to cover these expenses quickly and efficiently. The coverage amounts for final expense plans typically range from $5,000 to $30,000, although the actual amount can vary depending on the policy and the insurer.

What Are the Options If You Already Have A Policy?

If you already have a final expense insurance policy and find yourself on Medicaid, there are several options to consider. Here’s a guide to help you navigate this situation:

- Review Your Policy: Start by reviewing the terms and conditions of your existing final expense insurance policy. Understand the coverage, benefits, and any restrictions associated with the policy.

- Check for Medicaid Compliance: Ensure that your current policy is in compliance with Medicaid regulations. Some policies may need adjustments to align with Medicaid’s asset limits and eligibility criteria.

- Explore Irrevocable Funeral Trusts: If your policy allows, consider converting it into an irrevocable funeral trust. Irrevocable trusts are often exempt from Medicaid asset calculations, providing a dedicated fund for funeral expenses without impacting Medicaid eligibility.

- Adjust Coverage if Necessary: Depending on your financial situation and Medicaid eligibility requirements, you might need to adjust the coverage of your existing policy. This could involve reducing the face value or making other modifications to ensure compliance.

- Consult with Your Insurance Provider: Reach out to your insurance provider for guidance. They can provide information on how to make changes to your policy, ensure Medicaid compliance, or explore additional options that may be available to policyholders in your situation.

- Consider Supplemental Coverage: If your existing policy doesn’t fully address your needs or if adjustments are not feasible, you might explore supplemental coverage. Additional final expense insurance or burial insurance policies can be tailored to complement your existing coverage and align with Medicaid guidelines.

- Legal and Financial Advice: Seek advice from legal and financial professionals who specialize in Medicaid planning. They can provide insights into the best strategies for managing your existing policy while ensuring continued Medicaid eligibility.

- Plan Ahead for Estate Recovery: Keep in mind that Medicaid has estate recovery policies. While funeral and burial expenses are typically exempt, it’s essential to plan ahead and understand how your existing policy may impact estate recovery.

Remember, each individual’s situation is unique, and the best course of action depends on various factors. Consulting with professionals and understanding the specifics of your policy and Medicaid guidelines will help you make informed decisions tailored to your circumstances.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.