In life’s complex puzzle, planning for the inevitable can bring peace of mind amidst uncertainty. Enter the realm of Irrevocable Funeral Trusts (IFTs), a pragmatic and thoughtful approach to addressing the inevitable with grace and preparation. Having this as your personal safety net helps you ensure your final journey is orchestrated according to your wishes while sparing your loved ones from the financial burden.

Navigating the realm of IFTs is akin to unlocking a door to a well-prepared future. These trusts stand as a testament to responsible planning, allowing individuals to design their final farewells while safeguarding their family’s financial well-being.

In this comprehensive guide, we’ll delve into the world of Irrevocable Funeral Trusts, uncovering their essence, workings, advantages, and potential considerations. So, let’s explore together how IFTs can be a beacon of preparation and serenity in planning for life’s inevitable conclusion.

What Is an Irrevocable Funeral Trust?

An Irrevocable Funeral Trust (IFT) stands as a dedicated financial arrangement established during an individual’s lifetime to cover anticipated funeral and burial expenses. It operates as a specialized trust account specifically designed to earmark funds for end-of-life costs, ensuring that these expenses are prearranged and financed according to the grantor’s preferences.

The core characteristic defining an IFT is its irrevocability, meaning once established, it’s typically immutable and cannot be altered or canceled by the grantor. This immutability ensures the safeguarding of funds solely for funeral arrangements, providing a layer of financial security for both the individual and their loved ones.

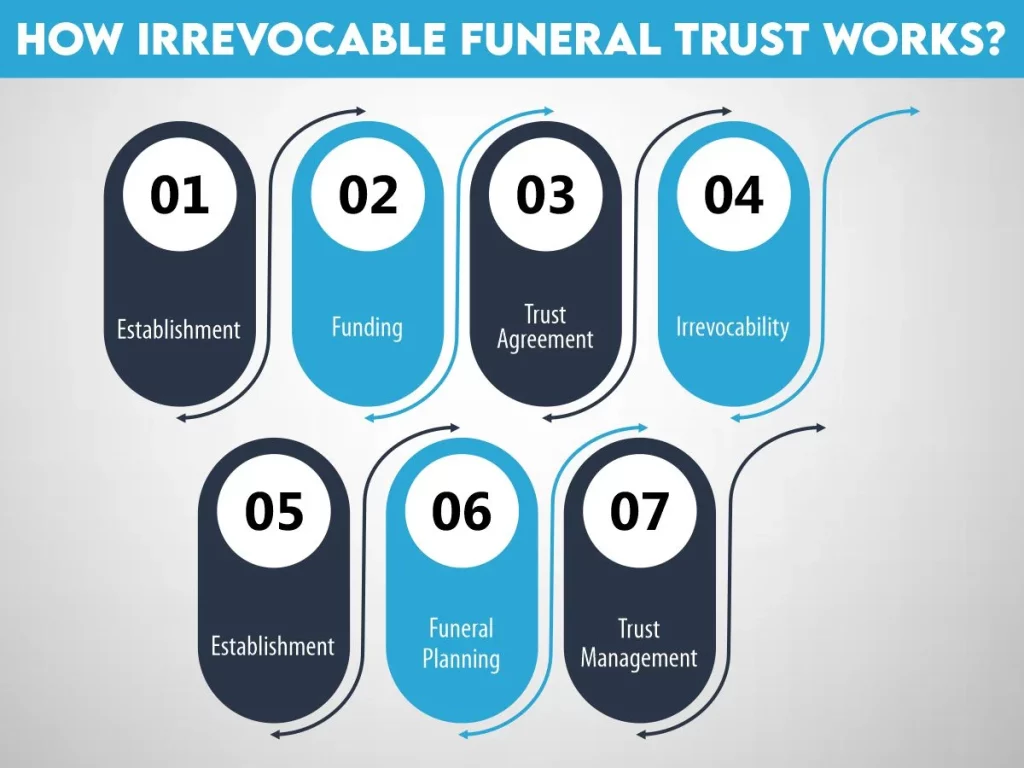

How Irrevocable Funeral Trust Works?

The functionality of an Irrevocable Funeral Trust (IFT) revolves around its purpose: to systematically allocate and safeguard funds designated for an individual’s funeral expenses. Here’s a breakdown of how an IFT typically works:

Establishment

The process begins with the individual (the grantor) deciding to set up an IFT. This is usually done in collaboration with a funeral home, financial institution, or an attorney specializing in trusts.

Funding

The grantor determines the amount of funds to allocate to the trust. This predetermined sum is set aside exclusively for funeral and burial costs.

Trust Agreement

A formal trust agreement is drafted, outlining the terms and conditions of the trust. This includes specifying funeral service preferences, costs, and how the funds will be managed and disbursed.

Irrevocability

Once the IFT is established and funded, it typically becomes irrevocable, meaning the grantor generally cannot alter or cancel it. This ensures that the allocated funds remain dedicated solely to funeral expenses.

Funeral Planning

The grantor collaborates with the chosen funeral home to plan and arrange their desired funeral services, knowing that the funds within the IFT are secured for these purposes.

Trust Management

The financial institution or trustee responsible for managing the IFT ensures that the funds are appropriately disbursed to cover the specified funeral expenses when the time arises.

How to Set Up an Irrevocable Funeral Trust?

Setting up an IFT involves working with a funeral home or a financial institution that specializes in such trusts. The individual (grantor) selects the desired funeral services and specifies the funds allocated for those services in the trust agreement.

Who Can Set Up an Irrevocable Funeral Trust?

Generally, anyone can establish an IFT, allowing them to take control of their funeral arrangements and ease the financial burden on their loved ones. It’s especially beneficial for those who wish to ensure their funeral wishes are honored and financed according to their preferences.

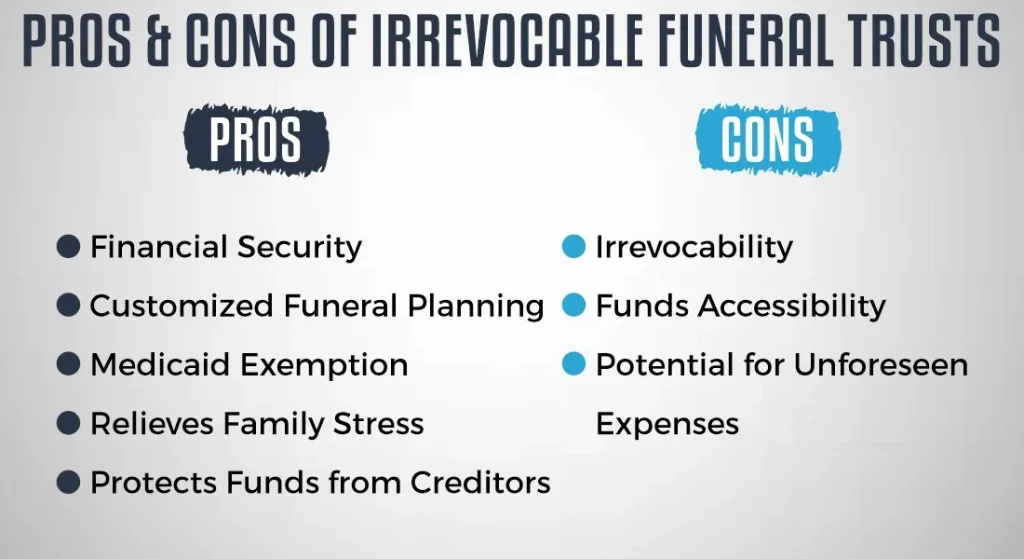

Pros & Cons of Irrevocable Funeral Trust

Let’s have a look on benefits and drawbacks of Irrevocable Funeral Trust

Pros of Irrevocable Funeral Trusts:

Financial Security

IFTs offer financial protection by setting aside funds exclusively for funeral expenses, ensuring that these costs are covered without burdening surviving family members.

Customized Funeral Planning

Grantors can pre-plan and personalize their funeral arrangements, specifying their preferences and ensuring their wishes are honored.

Medicaid Exemption

In many cases, funds in an IFT are exempted from Medicaid calculations, allowing individuals to preserve eligibility for Medicaid benefits.

Relieves Family Stress

IFTs alleviate the emotional and financial stress on loved ones by pre-funding and organizing funeral arrangements in advance.

Protects Funds from Creditors

Assets placed in an IFT are often protected from creditors, ensuring that the designated funds are preserved solely for funeral expenses.

Cons of Irrevocable Funeral Trusts

Irrevocability

Once established, an IFT is typically unchangeable, limiting flexibility and modifications to the trust terms.

Funds Accessibility

The funds allocated to an IFT may not be accessible for other needs or emergencies since they are specifically designated for funeral expenses.

Potential for Unforeseen Expenses

In some cases, if the pre-allocated funds in the IFT fall short of covering all funeral expenses due to unforeseen circumstances, additional costs may need to be covered by the family.

What Expenses Can Be Paid with an Irrevocable Funeral Trust?

An Irrevocable Funeral Trust (IFT) is designed to cover a wide range of funeral-related expenses, ensuring that various costs associated with end-of-life arrangements are pre-funded. Some of the typical expenses that can be paid using funds from an IFT include:

- Funeral Director Services: Fees associated with the services provided by the funeral director, including coordinating the funeral arrangements and handling necessary paperwork.

- Casket or Urn Costs: Expenses for purchasing a casket or an urn as per the grantor’s preferences.

- Cemetery or Burial Plot Expenses: Costs related to purchasing a burial plot or cemetery space for interment.

- Embalming and Preparation Fees: Charges for embalming, dressing, and preparing the deceased for visitation or viewing.

- Transportation Costs: Expenses associated with transporting the deceased to the funeral home, cemetery, or place of burial.

- Grave Marker or Headstone: Costs for selecting, purchasing, and installing a grave marker or headstone.

- Floral Arrangements: Expenses for floral displays, wreaths, or bouquets used for the funeral service or interment.

- Memorial Service Costs: Charges related to holding a memorial service, including venue rental, clergy or celebrant fees, and audio-visual equipment if needed.

- Reception Expenses: Costs for organizing post-funeral receptions, catering, and refreshments for attendees.

It’s important to note that the specific expenses covered by an IFT may vary based on the terms outlined in the trust agreement and the policies of the funeral home or financial institution managing the trust.

Value of Irrevocable Funeral Trusts

The value of Irrevocable Funeral Trusts (IFTs) lies in their multifaceted advantages, serving as a strategic and compassionate financial tool for individuals and their families:

Financial Security and Peace of Mind

Pre-funded Funeral Expenses: IFTs ensure that funeral and burial expenses are prearranged and financially secured, relieving loved ones from the burden of covering these costs during an emotionally challenging time.

Financial Planning: Grantors can meticulously plan and specify their funeral preferences, guaranteeing that their wishes are honored and financed according to their desires.

Medicaid Eligibility

Medicaid Exemption: Funds held in an IFT are often excluded from Medicaid asset calculations. This exemption can help individuals preserve their Medicaid eligibility while safeguarding funds for funeral expenses.

Family Relief and Comfort

Reduced Emotional Stress: Pre-planning and pre-funding funeral arrangements alleviate the emotional stress on surviving family members, allowing them to focus on grieving and healing without financial concerns.

Asset Protection

Protection from Creditors: Assets placed within an IFT are typically shielded from creditors, ensuring that these dedicated funds are preserved specifically for funeral expenses.

Personalization and Control

Customized Funeral Arrangements: Grantors retain control and decision-making authority over their final arrangements, enabling them to personalize and tailor their funeral services to reflect their preferences.

What Is the Cost of Irrevocable Funeral Trust?

The cost of setting up an Irrevocable Funeral Trust (IFT) varies based on several factors, including the chosen funeral services, geographic location, administrative fees charged by the funeral home or financial institution, and any additional associated expenses. Here are key considerations regarding the costs involved:

Factors Influencing the Cost

- Funeral Service Selection: The cost of an IFT depends on the specific funeral services and arrangements chosen by the individual. Different services, casket choices, or burial preferences can impact the overall expenses.

- Geographic Location: Funeral costs can vary significantly based on the region or city where the services will be held. Local market rates and expenses can affect the overall cost of setting up the IFT.

- Administrative and Trust Fees: Funeral homes or financial institutions may charge administrative fees for managing the trust, drafting legal documents, or overseeing the trust’s disbursement.

Tips for Understanding Costs

- Detailed Inquiries: When considering an IFT, it’s advisable to inquire about all associated costs upfront, including a breakdown of fees for services and administrative charges.

- Comparative Analysis: Comparing costs and services offered by different funeral homes or financial institutions can help in making an informed decision regarding the most cost-effective IFT option.

- Transparency in Pricing: Seek transparency in pricing and ensure a clear understanding of what services and expenses the IFT will cover to avoid unexpected costs later on.

Where to Get an Irrevocable Funeral Trust

Irrevocable Funeral Trusts (IFTs) can typically be obtained through various reputable sources specializing in funeral planning and trust management. Here are common places where individuals can obtain an IFT:

Funeral Homes

Direct Arrangements: Many funeral homes offer pre-planning services that include setting up IFTs. They assist in creating trust agreements and funding funeral expenses according to individual preferences.

Financial Institutions

Trust Departments: Banks, credit unions, or financial institutions often have trust departments that specialize in managing various types of trusts, including IFTs. They can help establish and administer the trust.

Estate Planning Attorneys

Legal Professionals: Estate planning attorneys specialize in creating legal documents, including trusts. They can assist in drafting the necessary trust agreements and ensuring compliance with legal requirements.

Online Funeral Planning Services

Online Platforms: Some online funeral planning services provide options for setting up IFTs. These platforms offer information and assistance in creating trusts remotely.

Recommendations and Research

Referrals and Reviews: Seek recommendations from trusted sources, friends, or family members who have experience with setting up IFTs. Additionally, researching and reading reviews about reputable providers can guide the decision-making process.

When considering where to obtain an IFT, individuals should assess the credibility, reliability, and reputation of the provider. It’s essential to choose a trusted source that offers clear terms, comprehensive services, and transparent information regarding the establishment and management of the IFT.

What Is Irrevocable Funeral Trust Medicaid?

Irrevocable Funeral Trust Medicaid refers to a strategic planning tool used to protect assets allocated for funeral expenses while maintaining eligibility for Medicaid benefits. In essence, it involves establishing an Irrevocable Funeral Trust (IFT) to safeguard funds designated for funeral arrangements while seeking to preserve eligibility for Medicaid assistance.

Key Aspects of Irrevocable Funeral Trust Medicaid

- Asset Exemption: Funds placed in an IFT are often exempted from Medicaid asset calculations. This exemption means that Medicaid does not consider the funds within the trust as countable assets for eligibility purposes.

- Preserving Medicaid Eligibility: By allocating funds to an IFT, individuals aim to protect a portion of their assets from Medicaid spend-down requirements. This strategic planning allows them to qualify for Medicaid assistance while ensuring funds are reserved for funeral expenses.

- Strategic Financial Planning: Irrevocable Funeral Trust Medicaid serves as a way for individuals to plan for their funeral expenses, protecting those funds from being used for Medicaid-required spend-downs.

Irrevocable Funeral Trusts’ Impact on Medicaid Eligibility

Irrevocable Funeral Trusts (IFTs) can have a significant impact on Medicaid eligibility. Here’s how IFTs may affect Medicaid eligibility:

Impact on Asset Calculation

Exemption from Medicaid Asset Calculations: Medicaid often excludes funds placed in an IFT from asset calculations. This exemption means that the assets held within the trust typically do not count towards an individual’s total assets when determining Medicaid eligibility.

Preserving Medicaid Eligibility

Asset Preservation: By allocating funds to an IFT, individuals aim to protect a portion of their assets from Medicaid spend-down requirements. This strategic financial planning helps them qualify for Medicaid assistance while preserving a dedicated amount for funeral expenses.

State-Specific Regulations

Variation in Medicaid Rules: Medicaid rules regarding asset exemptions, IFTs, and eligibility criteria may vary by state. It’s crucial to understand the specific regulations governing IFTs and Medicaid in one’s state of residence.

Considerations for Medicaid Planning

Timing and Look-Back Periods: Medicaid has look-back periods to review asset transfers. Establishing an IFT well in advance of needing Medicaid assistance is crucial to avoid complications related to eligibility.

Professional Guidance: Seeking advice from financial advisors, estate planning attorneys, or Medicaid specialists can provide clarity on how an IFT may impact Medicaid eligibility and ensure compliance with state-specific regulations.

How Irrevocable Funeral Trusts Help Persons Qualify for Medicaid

Irrevocable Funeral Trusts (IFTs) can play a strategic role in helping individuals qualify for Medicaid by preserving a portion of their assets for funeral expenses while meeting Medicaid’s asset eligibility requirements.

Here’s how IFTs assist individuals in qualifying for Medicaid:

Asset Exemption

Excluding Trust Funds from Asset Calculations: Medicaid typically excludes funds allocated to an IFT from asset calculations. As a result, Medicaid often does not count these assets held within the trust towards an individual’s total assets when determining eligibility.

Asset Protection

Preserving Designated Funds: By placing funds in an IFT, individuals protect a portion of their assets specifically earmarked for funeral expenses. This allocation helps in preserving assets from Medicaid spend-down requirements while securing these funds for the intended purpose.

Medicaid Spend-Down Planning

Strategic Allocation of Funds: IFTs allow individuals to allocate resources for funeral expenses in a manner that aligns with Medicaid’s asset limits. This strategic financial planning ensures safeguarding a designated amount for funeral costs while meeting Medicaid eligibility thresholds.

Considerations

Look-Back Periods: Medicaid has look-back periods to review asset transfers. Establishing an IFT within the applicable look-back period can be essential to ensure compliance with Medicaid regulations.

State-Specific Regulations: Medicaid rules may vary by state, affecting the treatment of IFTs concerning asset exemptions and eligibility. Understanding state-specific regulations is crucial for effective Medicaid planning using IFTs.

Professional Guidance

Seeking advice from financial advisors, estate planning attorneys, or Medicaid specialists can provide individuals with tailored strategies to utilize IFTs effectively in Medicaid planning while complying with regulations and eligibility criteria.

Final Word

In conclusion, an Irrevocable Funeral Trust is a valuable financial tool that allows individuals to plan and fund their funeral arrangements in advance. It ensures financial security, preserves Medicaid eligibility, and honors final wishes. When considering an IFT, it’s crucial to conduct thorough research, understand associated costs, and consult with professionals to make informed decisions regarding end-of-life planning.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.