Fintech Zoom Life Insurance Reviews & Guide 2025

Last Updated on: June 21st, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

We cannot predict the future, but planning for it is important. That’s why choosing the right insurance policy makes all the difference. With so many options, buying the right insurance can be confusing. That’s where Fintech Zoom Life Insurance comes in. Fintech Zoom makes life insurance easier to understand, more affordable, and simpler to buy. This guide will help you make the best choices, including a Fintech Zoom life insurance review, claim process, policy types, and how it compares to traditional providers.

Table of Contents

ToggleBasics of Fintech Zoom Life Insurance

Fintech Zoom Life Insurance is a modern and easy-to-use online life insurance service using the latest financial technology that is helping people to quickly and easily find and buy the best life insurance. With Fintech Zoom, you can explore different insurance options. This will help you to understand what you’re getting and choose a plan that fits your needs, all from your computer or phone. It’s a smart and simple way to get life insurance.

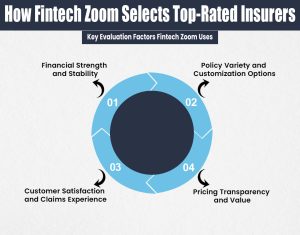

How Fintech Zoom Selects Top-Rated Insurers

When selecting the top insurance providers, Fintech uses a thoughtful and easy process to look at the many factors that will help people choose the best policy according to their needs.

Key Evaluation Factors Fintech Zoom Uses

1. Financial Strength and Stability

Fintech Zoom gives importance to the insurance companies that have high financial ratings from the different trusted agencies like AM Best, Moody’s, and Standard & Poor’s. These strong ratings show that the company has enough money to pay out claims in the future without any problems or delays.

2. Policy Variety and Customization Options

Fintech Zoom also prioritizes insurance companies that provide many different types of coverage, like term life, whole life, auto, health, and renters insurance, to get better scores. It prefers companies that let customers customize their policies, so people can choose the coverage that fits their own needs.

3. Customer Satisfaction and Claims Experience

Fintech Zoom looks at real feedback from customers and trusted surveys to see how happy people are with the insurance company. They also check how good the customer service is.

4. Pricing Transparency and Value

Fintech Zoom focuses on companies that give a good mix of low cost and strong coverage. Also, the Insurance companies that show clear prices and offer affordable rates get better ratings.

How Much Does Life Isurance Cost?

Top Insurance Options Recommended by Fintech Zoom

Using its careful review process, Fintech Zoom suggests the following insurance options as some of the best options available:

Health Insurance

Fintech Zoom points to health plans that cover a wide range of needs, including doctor visits, hospital stays, medicines, and preventive care. The best policies have strong networks of doctors and offer flexible coverage choices.

Life Insurance

For life insurance, Fintech Zoom prefers policies that help protect your family financially if something happens to you. They offer term life, whole life, and universal life policies that have fair prices, flexible terms, and are reliable when it comes to paying benefits.

Auto Insurance

Fintech Zoom prefers car insurance that covers things like damage to other people (liability), repairs to your car (collision), and other damages (comprehensive). They also look for the plans with low prices, having fast claims handling, and extra benefits like roadside assistance.

Homeowners Insurance

For home insurance, Fintech Zoom favors policies that protect your home from damage, theft, liability, and natural disasters. They highlight insurers who offer full coverage plans that fit the specific needs of homeowners.

Types of Life Insurance Offered by Fintech Zoom

When choosing a life insurance policy, it’s very important to consider what type of insurance policy you are selecting and what benefits are specifically being offered by that type. Let’s have a look at what types of life insurance Fintech Zoom is offering.

1. Term Life Insurance

Term life is the most affordable option and offers coverage for a fixed period (e.g., 10, 20, or 30 years). It’s best for individuals seeking maximum coverage at lower premiums.

2. Whole Life Insurance

This permanent policy provides lifetime coverage and includes a cash value component. It’s more expensive but builds equity over time.

<h3style=”font-size: 1.5em; color: #32b5cd;”>3. Universal Life Insurance

Universal life insurance offers flexible premiums and adjustable death benefits. It also builds cash value, which can be used during the policyholder’s lifetime.

4. No Medical Exam Life Insurance

Designed for those with health concerns or who prefer convenience, this policy doesn’t require a medical exam and offers fast approval.

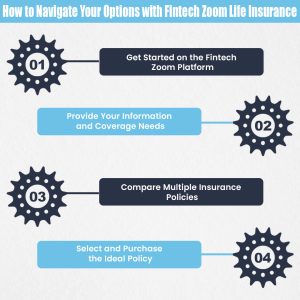

How to Navigate Your Options with Fintech Zoom Life Insurance

Understanding insurance policies can be confusing, but Fintech Zoom makes it much easier. Their easy-to-use platform helps you every step of the way. No matter if you’re looking for life, health, auto, or home insurance, this simple guide will show you how to use Fintech Zoom to find the best policy for your needs

Step 1: Get Started on the Fintech Zoom Platform

Visit the Fintech Zoom website

Begin by searching for the official Fintechzoom website. Once you’re there, you’ll notice the clean design and easy-to-use navigation. The homepage is simple and well-organized, making it easy to get started.

Create an Account

Sign up by entering some basic personal information. This will give you full access to helpful tools, let you save your searches, and get personalized insurance suggestions. With your account, you can also keep track of all your insurance policies in one convenient place.

Step 2: Provide Your Information and Coverage Needs

Enter Your Details

After creating an account, add the important information like your age, ZIP code, and job. These details help Fintech Zoom show you the best policy options and prices based on your situation.

Set Your Insurance Goals

Then choose the type of insurance you need, whether auto, home, life, or health. This helps the platform find and recommend the most suitable policies for you.

Step 3: Compare Multiple Insurance Policies

Use Fintech Zoom’s Comparison Tools

Take advantage of Fintech Zoom’s built-in features to compare different insurance policies side by side. Also, look at important details like

- Coverage limits

- Monthly or yearly premiums

- Deductibles

- What the policy doesn’t cover (exclusions)

- Extra benefits included

Analyze and Shortlist Options

Look over the advantages and disadvantages of each policy. Fintech Zoom offers expert advice and user reviews to help you understand the details and avoid any hidden surprises.

Step 4: Select and Purchase the Ideal Policy

Pick the Best Policy

After comparing all your options, choose the policy that gives you the right mix of price and coverage for your needs.

Finish Buying Your Policy

Follow the simple steps to complete your purchase. Fintech Zoom helps with online forms, verifying your identity, and secure payment to make the process easy and safe.

Step 5: Manage Your Policy with Ease

Go to Your User Dashboard

Once you have bought your policy, log in to your dashboard to manage everything in one place. You can:

- View your policy documents

- Make your payments

- Update your personal details

- Submit and track insurance claims

Get Support When You Need It

If you have questions or need help, no matter if it’s about billing or claims, Fintech Zoom’s friendly customer support team is ready to assist you.

Conclusion

If you’re seeking a simple, fast, and modern way to secure your financial future, Fintech Zoom Life Insurance might be your best option. It helps people at all life stages, no matter if you’re a young professional, a family, or planning for the future. But it’s important to review your needs first, compare policies, and read the details carefully before deciding. For anyone wanting a simple and smart insurance solution, Fintech Zoom offers the perfect mix of technology and protection, making it a top choice in today’s market.

Ready to Secure Your Future with Confidence?

Don’t wait to protect what matters most. Whether you’re just starting or planning, get your free Fintech Zoom life insurance quote today and protect your family’s future with affordable coverage. Click here to explore your options and get your free quote now!

FAQs

1. Is Fintech Zoom Life Insurance Legitimate?

Yes, FintechZoom partners with reputable insurers and uses advanced digital tools to offer real-life insurance policies that are legally binding and trustworthy.

2. Do I Need a Medical Exam to Get Fintech Zoom Life Insurance?

Not always. Fintech Zoom offers no medical exam life insurance options, particularly for healthy individuals or smaller policy amounts.

3. Can I Modify My Policy Later?

Some policies, like universal life, allow adjustments to coverage or premiums. Always check the terms before buying.

4. How Are Claims Handled?

Fintech Zoom life insurance claims are filed online or via support channels. The process is fast, requiring minimal paperwork compared to traditional methods.

5. What’s the Main Benefit of Fintech Zoom Life Insurance?

The main benefit of Fintech Zoom is convenience and speed. You can get covered within minutes, manage everything online, and access a wide array of policy types with transparent pricing.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.