In a world where uncertainty often lingers around life’s unexpected turns, insurance serves as a beacon of security and reassurance. Amidst the vast insurance market, there exists a key player that simplifies the process, making it smoother and more accessible for both insurance agents and customers: Insurance Marketing Organizations (IMOs).

Imagine a bustling marketplace where insurance options abound, each tailored to diverse needs and preferences. IMOs stand at the heart of this marketplace, offering a treasure trove of insurance products from various carriers, providing agents with a one-stop-shop for all their clients’ protection needs.

But what exactly are these IMOs? How do they function, and why are they becoming a go-to choice for insurance professionals? Let’s embark on an exploration into the realm of IMO insurance, uncovering the behind-the-scenes magic that brings together insurance agents and a myriad of insurance options under one roof.

What is IMO insurance?

IMO, short for Insurance Marketing Organization, represents a specialized entity within the insurance industry. An IMO functions as a crucial intermediary, connecting insurance agents or advisors with a multitude of insurance carriers. Rather than focusing on underwriting policies like traditional insurance carriers, IMOs concentrate on facilitating the marketing, sales, and distribution of various insurance products.

Think of IMOs as a marketplace aggregator, offering a diverse array of insurance products—ranging from life insurance and annuities to health insurance—sourced from multiple carriers. This aggregation simplifies the process for agents, providing them access to a broad spectrum of insurance options, all within one consolidated platform.

In essence, IMOs act as a bridge, streamlining the interactions between insurance agents and insurance companies. They play a pivotal role in supporting agents by offering training, marketing materials, sales support, technology tools, and managing administrative tasks related to agent compensation and regulatory compliance. Through these efforts, IMOs enable agents to effectively sell insurance products while ensuring compliance with state and federal regulations.

What is an IMO insurance company?

An IMO insurance company, or Insurance Marketing Organization, operates as a specialized entity within the insurance industry that focuses on the distribution and marketing of insurance products rather than underwriting policies. Unlike traditional insurance carriers that primarily focus on assessing risks, setting premiums, and issuing policies, IMOs specialize in facilitating the sales and distribution process of insurance products.

These organizations serve as intermediaries between insurance agents or advisors and insurance carriers. They collaborate with multiple insurance companies, offering a wide range of insurance products, including life insurance, annuities, health insurance, and more, to independent agents or advisors affiliated with the IMO.

The key functions of an IMO insurance company revolve around:

- Product Aggregation: IMOs curate and aggregate diverse insurance products from various carriers, providing agents with a comprehensive selection to offer their clients. This consolidation streamlines the process for agents, allowing them to access multiple insurance products through a single platform.

- Agent Support and Training: IMOs offer extensive support to agents, providing training programs, marketing materials, sales support, technology tools, and ongoing assistance. This support equips agents with the knowledge, resources, and tools necessary to effectively market and sell insurance products.

- Contracting and Commissions: IMOs manage the contracting process between agents and insurance carriers, handling administrative tasks related to agent compensation, commissions, and ensuring timely payments.

- Regulatory Compliance: They assist agents in navigating complex regulatory frameworks, ensuring adherence to state and federal regulations governing the sale of insurance products.

Overall, an IMO insurance company serves as a crucial link between insurance agents and insurance carriers, focusing on marketing, training, support, and administrative functions to facilitate the distribution of insurance products, creating a symbiotic relationship that benefits agents, carriers, and ultimately, the clients seeking insurance coverage.

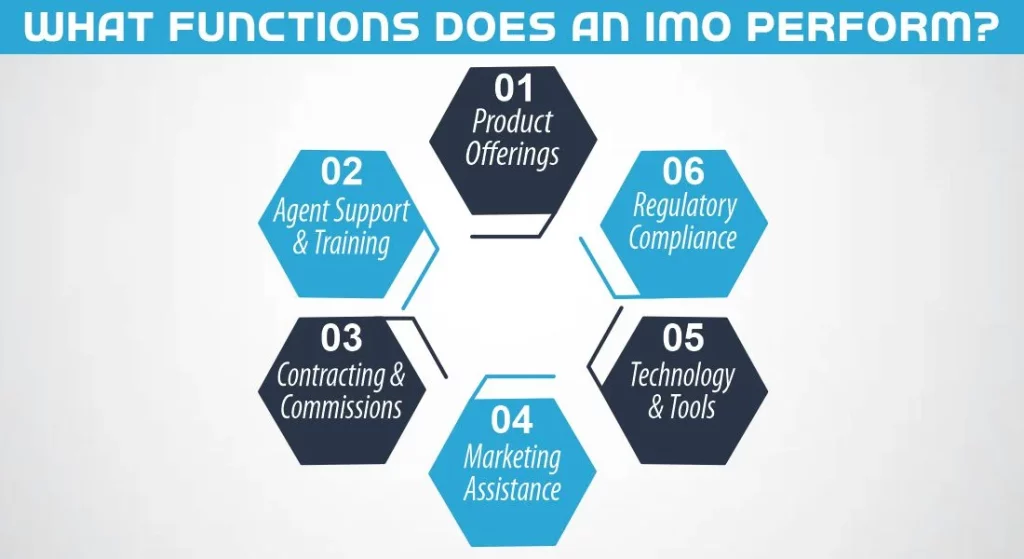

What Functions Does an IMO Perform?

An IMO serves several vital functions within the insurance industry, acting as a facilitator and support system for insurance agents or advisors. These functions are pivotal in streamlining the process of selling insurance products and ensuring the smooth operation of agents’ businesses. Here are the primary functions performed by an IMO:

1- Product Offerings

IMOs offer a wide array of insurance products sourced from multiple insurance carriers. They curate and aggregate diverse policies, including life insurance, annuities, health insurance, and more, providing agents with access to a comprehensive range of options to cater to their clients’ needs.

2- Agent Support and Training

IMOs provide extensive support and training programs for insurance agents. They offer resources such as marketing materials, sales training, technology tools, and ongoing assistance. These resources empower agents with the knowledge and skills necessary to effectively market, sell, and service insurance products.

3- Contracting and Commissions

IMOs manage the contracting process between agents and insurance carriers. They handle administrative tasks related to agent contracts, commissions, and compensation, ensuring accurate and timely payments to agents for the policies sold.

4- Marketing Assistance

IMOs offer marketing support to agents by providing access to marketing materials, strategies, and campaigns. They assist agents in developing marketing plans to reach potential clients and promote insurance products effectively.

5- Technology and Tools

IMOs often provide agents with access to advanced technology tools and platforms. These tools streamline administrative tasks, facilitate client interactions, and enhance the overall efficiency of the sales process.

6- Regulatory Compliance

IMOs assist agents in navigating the complex regulatory landscape governing the insurance industry. They ensure that agents comply with state and federal regulations, providing guidance and support to mitigate potential compliance risks.

How Does an IMO Insurance Generate Revenue?

An Insurance Marketing Organization (IMO) generates revenue through a variety of channels within the insurance sales process. The primary sources of revenue for an IMO include:

Commission from Insurance Carriers

IMOs receive commissions from insurance carriers for the insurance products sold by the agents affiliated with the IMO. These commissions are a percentage of the premiums paid by policyholders and are typically agreed upon between the IMO and the insurance carrier.

Override or Bonus Commissions

In addition to standard commissions, IMOs may negotiate override or bonus commissions with insurance carriers based on the volume of business generated by the agents associated with the IMO. These bonuses are often tied to specific sales targets or performance metrics.

Fee-Based Services

Some IMOs may offer fee-based services to agents in exchange for additional support or specialized services beyond standard offerings. These services could include access to exclusive training programs, specialized marketing tools, or personalized support, generating revenue through service fees.

Administrative Fees or Charges

IMOs may charge administrative fees or service charges to cover the costs associated with agent contracting, compliance management, administrative support, technology tools, and other operational expenses.

Contingent and Performance-Based Incentives

Some IMOs establish contingent or performance-based incentives with insurance carriers. These incentives are linked to achieving specific sales targets or meeting predetermined performance criteria, resulting in additional revenue for the IMO based on the agents’ performance.

Overall, the revenue generation model of an IMO revolves around commissions, bonuses, fees, and incentives earned through facilitating the sale of insurance products, providing support services to agents, and maintaining partnerships with multiple insurance carriers.

What Are the Reasons to Work With an IMO Insurance Company?

Here are some of the reasons explaining why you have to work with an IMO insurance company:

- Access to Multiple Carriers: IMOs provide access to a wide array of insurance products from various carriers, allowing agents to offer diverse options to clients based on their needs.

- Training and Support: They offer comprehensive training, marketing resources, and ongoing support, equipping agents with the tools necessary for success in the competitive insurance market.

- Efficiency and Convenience: Working with an IMO streamlines the process for agents by centralizing product offerings, contracting, commissions, and administrative tasks in one place.

- Compliance Assistance: IMOs help agents navigate complex regulatory requirements, ensuring compliance and minimizing potential legal risks.

Best Practices to Find the Best IMO

Finding the right Insurance Marketing Organization (IMO) is crucial for insurance agents or advisors looking to enhance their business and expand their offerings. Here are some best practices to consider when searching for the best IMO:

Research and Due Diligence

Conduct thorough research on different IMOs. Consider their reputation, industry standing, years of operation, and reviews from other agents or advisors who have worked with them. Look for IMOs with a strong track record of success, reliability, and ethical business practices.

Evaluate Carrier Partnerships

Assess the insurance carriers partnered with the IMO. A diverse portfolio of reputable carriers ensures a wide range of quality insurance products for agents to offer their clients.

Commission Structures

Understand the commission structures offered by the IMO. Compare commission rates, payment schedules, and any potential hidden fees or deductions. Ensure transparency in commission arrangements.

Support and Training Programs

Evaluate the quality and depth of training programs, marketing support, technology tools, and ongoing assistance provided by the IMO. Comprehensive support is crucial for agents’ success.

Agent Feedback and References

Seek feedback from other agents or advisors who have experience working with the IMO. Ask for references to gain insights into their experiences and satisfaction level.

The Bottom Line

In conclusion, Insurance Marketing Organizations (IMOs) play a crucial role in the insurance industry, offering valuable support and resources to insurance agents. They serve as a conduit between agents and insurance carriers, simplifying the process of selling insurance products while providing agents access to multiple carriers and comprehensive support services. When considering working with an IMO, it’s essential to evaluate their offerings, support, reputation, and commission structures to find the best fit for your needs and career aspirations.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.