When it comes to life insurance, finding a reliable and reputable company is crucial. In Iowa, several insurance providers stand out for their financial strength, customer service, and range of products.

Whether you’re looking for term life, whole life, or other types of coverage, these companies offer options worth considering. In this blog post, we’ll explore the largest companies in Iowa, highlighting their key features and offerings. Moreover, we will also discuss how you can reliably find the right insurance company for you.

Let’s get started!

Largest Companies in Iowa

Here is the list of the largest companies in Iowa:

- American Equity Investment Life Insurance Company

American Equity Investment Life Insurance Company is a leading provider of fixed index and fixed rate annuities. Founded in 1995 and headquartered in West Des Moines, Iowa, they are known for their competitive products and strong financial ratings. American Equity focuses on helping individuals and families achieve financial security and retirement goals through their annuity products.

- Farm Bureau Financial Services

Farm Bureau Financial Services offers a range of insurance and financial products, including life insurance, property and casualty insurance, and investment services. They are affiliated with the Iowa Farm Bureau Federation and serve clients in rural communities. Farm Bureau Financial Services is committed to providing personalised service and tailored insurance solutions to meet the unique needs of its clients.

- Principal Financial Group

Principal Financial Group is a global investment management and insurance company headquartered in Des Moines, Iowa. They offer a variety of life insurance products, retirement solutions, and asset management services. With a strong focus on financial wellness and retirement planning, Principal Financial Group is dedicated to helping individuals and businesses achieve financial security and success.

- Iowa Farm Bureau

Iowa Farm Bureau is a membership-based organization that offers a variety of insurance products, including life insurance, to its members. They focus on serving the needs of farmers, rural residents, and those in agricultural communities. Iowa Farm Bureau is known for its commitment to agriculture and rural communities, providing insurance products and services that are tailored to the specific needs of its members.

- Global Atlantic Financial Group

Global Atlantic Financial Group is a leading provider of annuities, life insurance, and reinsurance products. They have a strong presence in the life insurance market and are known for their innovative product offerings. With a focus on financial security and retirement planning, Global Atlantic Financial Group is dedicated to helping individuals and families achieve their long-term financial goals.

- Lincoln National

Lincoln National is a well-established life insurance company with a long history of providing financial protection and retirement solutions. They offer a range of life insurance products, including term life, universal life, and variable universal life insurance. With a commitment to financial education and planning, Lincoln National is a trusted partner in helping individuals and families secure their financial futures.

- Thrivent Financial for Lutherans

Thrivent Financial for Lutherans is a not-for-profit financial services organization that offers a variety of insurance and investment products. They have a strong presence in the Midwest and are known for their commitment to serving their members and communities. Thrivent Financial for Lutherans is dedicated to helping individuals achieve financial security and live generously through their financial products and services.

- Dai-Ichi Life Holdings Inc

Dai-Ichi Life Holdings Inc. is a Japanese insurance company with a global presence. They offer a range of life insurance and financial products and have a strong reputation for financial stability and customer service. With a focus on long-term relationships and customer satisfaction, Dai-Ichi Life Holdings Inc. is a trusted provider of life insurance and financial solutions.

- Minnesota Mutual

Minnesota Mutual, also known as Securian Financial, is a mutual life insurance company based in St. Paul, Minnesota. They offer a variety of insurance and financial products, including life insurance, annuities, and retirement planning services. Minnesota Mutual is committed to helping individuals and families achieve financial security and peace of mind through its comprehensive range of products and services.

These companies are among the largest life insurance providers in Iowa and offer a range of products and services to meet the needs of individuals and families in the state.

Feature Comparison of Largest Companies in Iowa: Table

| Company | Product Offerings | Financial Ratings | Customer Base | Specialization | Membership Benefits | Customer Service |

| American Equity Investment Life Insurance Company | Fixed index and fixed rate annuities | Strong | Individuals and families | Retirement and financial security | Not applicable | Personalized service |

| Farm Bureau Financial Services | Life insurance, property and casualty insurance, investment services | Strong | Rural communities | Rural and agricultural insurance | Membership discounts and benefits | Personalized service |

| Principal Financial Group | Life insurance, retirement solutions, asset management services | Strong | Global | Retirement planning | Not applicable | Not specified |

| Iowa Farm Bureau | Life insurance, other insurance products | Not specified | Members of the Iowa Farm Bureau | Agricultural insurance | Membership discounts and benefits | Personalized service |

| Global Atlantic Financial Group | Annuities, life insurance, reinsurance products | Strong | Individuals and families | Retirement and financial security | Not applicable | Not specified |

| Lincoln National | Life insurance, retirement solutions, asset management services | Strong | Individuals and families | Financial protection and retirement solutions | Not applicable | Not specified |

| Thrivent Financial for Lutherans | Life insurance, investment products | Strong | Members and communities in the Midwest | Financial services and insurance | Membership benefits and services | Not specified |

| Dai-Ichi Life Holdings Inc | Life insurance, financial products | Strong | Global | Global insurance and financial services | Not applicable | Not specified |

| Minnesota Mutual | Life insurance, annuities, retirement planning services | Strong | Individuals and families | Mutual life insurance | Not applicable | Not specified |

Cost Comparison of Life Insurance Plans in the USA

The cost of life insurance plans in the USA can vary significantly based on various factors such as age, health, coverage amount, and the insurance company. However, I can provide a general overview of the average monthly premiums for different types of life insurance plans based on age and coverage amount. Please note that these are approximate values and actual costs may vary.

Here’s a table showing the average monthly premiums for different types of life insurance plans in the USA:

| Age | Coverage Amount | Term Life Insurance | Whole Life Insurance | Universal Life Insurance |

| 30 | $250,000 | $15 – $20 | $100 – $200 | $75 – $150 |

| $500,000 | $25 – $30 | $200 – $400 | $150 – $300 |

| $1,000,000 | $40 – $50 | $400 – $800 | $300 – $600 | |

| 45 | $250,000 | $25 – $35 | $200 – $300 | $150 – $250 |

| $500,000 | $45 – $60 | $400 – $600 | $300 – $500 |

| $1,000,000 | $80 – $100 | $800 – $1,200 | $600 – $1,000 | |

| 60 | $250,000 | $80 – $100 | $700 – $900 | $500 – $700 |

| $500,000 | $150 – $200 | $1,400 – $1,800 | $1,000 – $1,400 |

| $1,000,000 | $300 – $400 | $2,800 – $3,600 | $2,000 – $2,800 | |

| 80 | $250,000 | $400 – $500 | $3,500 – $4,500 | $2,500 – $3,500 |

| $500,000 | $750 – $1,000 | $7,000 – $9,000 | $5,000 – $7,000 | |

| $1,000,000 | $1,500 – $2,000 | $14,000 – $18,000 | $10,000 – $14,000 |

These values are approximate and can vary based on individual circumstances and insurance providers. It’s recommended to obtain quotes from multiple insurance companies to compare costs and find the best plan for your needs.

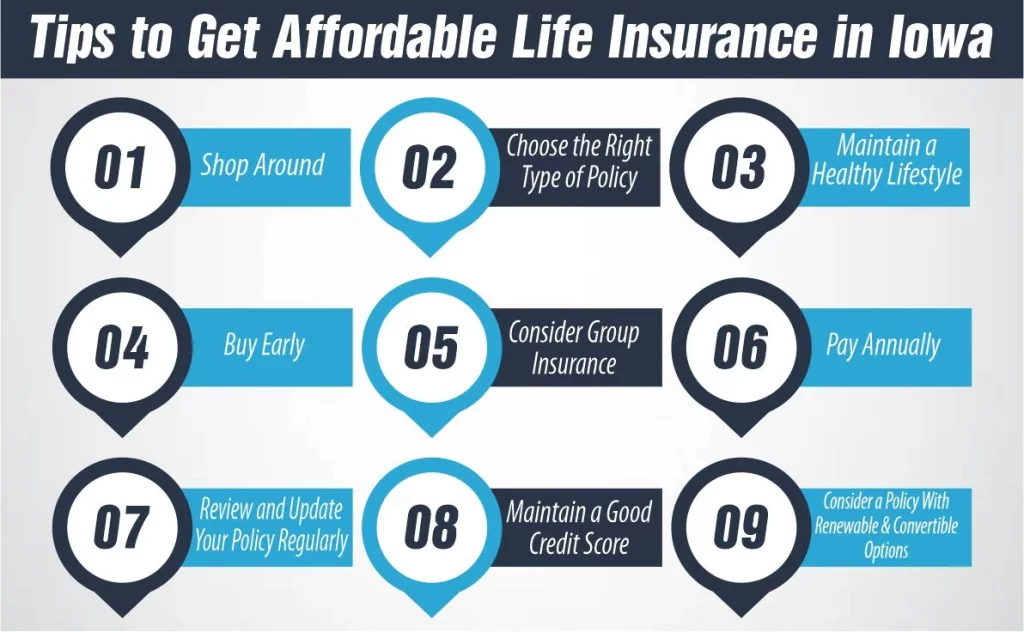

Tips to Get Affordable Life Insurance in Iowa

Getting affordable life insurance in Iowa, or anywhere, involves understanding your needs, comparing quotes, and potentially making lifestyle changes to improve your health. Here are some tips to help you get affordable life insurance:

- Shop Around:

Compare quotes from multiple insurance companies to find the most competitive rates. Consider working with an independent insurance agent who can help you compare options.

- Choose the Right Type of Policy:

Term life insurance is typically more affordable than whole life or universal life insurance. Consider your needs and budget when choosing a policy.

- Maintain a Healthy Lifestyle:

Insurance companies consider your health when determining rates. Quit smoking, maintain a healthy weight, and manage any health conditions to lower your premiums potentially.

- Buy Early:

Life insurance premiums increase with age. Buying a policy when you’re young and healthy can help you lock in lower rates.

- Consider Group Insurance:

Some employers offer group life insurance as part of their benefits package, which can be more affordable than individual policies.

- Pay Annually:

If possible, pay your premiums annually instead of monthly. Some insurance companies offer discounts for annual payments.

- Review and Update Your Policy Regularly:

Life changes, such as marriage, having children, or buying a home, may require you to adjust your coverage. Review your policy regularly to ensure it meets your current needs.

- Maintain a Good Credit Score:

Some insurance companies consider your credit score when determining rates. Maintaining a good credit score can help you get lower premiums.

- Consider a Policy With Renewable and Convertible Options:

A policy with these options allows you to renew your coverage or convert it to a permanent policy without undergoing a medical exam, which can be beneficial if your health changes.

By following these tips, you can increase your chances of finding affordable life insurance in Iowa that meets your needs.

The Bottom Line

In summary, Iowa is home to several reputable life insurance companies that offer a variety of products to meet the needs of individuals and families. Whether you’re looking for a simple term life policy or a more comprehensive permanent life insurance policy, these companies have options worth exploring. When choosing a life insurance company, it’s important to consider factors such as financial strength, customer service, and product offerings. By doing your research and comparing options, you can find the right life insurance company to protect your financial future.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.