In a complex world where healthcare decisions can be emotional, blanket health policies and group insurance offer a practical and logical solution.

Blanket health policies and group insurance are two distinct approaches to securing comprehensive healthcare coverage, providing a sense of security and peace of mind to both individuals and groups. While they may lack sentiment, they provide a robust safety net that shields individuals and groups from the unpredictable costs of healthcare.

In this article, we will delve into the world of blanket health policies and group insurance, exploring their features, benefits, and the intricate details that make them an essential part of our modern healthcare landscape.

Understanding Blanket Health Policies

Blanket health policies are insurance policies typically designed to cover a specific group or category of individuals, such as students, employees, or members of an association. Unlike individual health insurance, where each person has their own policy, blanket policies provide coverage to all eligible members under a single master policy. This approach simplifies administration and often results in cost savings.

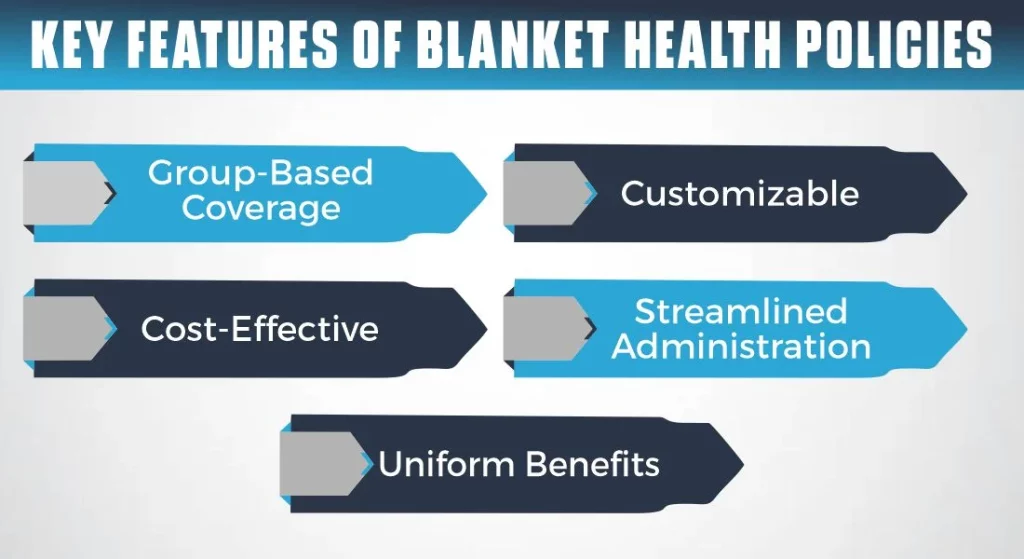

Key Features of Blanket Health Policies

- Group-Based Coverage: Coverage is extended to a specific group, often without the need for individual underwriting or medical exams.

- Customizable: Policies can be tailored to the specific needs of the group, allowing flexibility in the coverage offered.

- Cost-Effective: Due to the group nature of these policies, they can often be more cost-effective than individual plans.

- Streamlined Administration: Managing a single master policy is often easier and more efficient for both the insurer and the policyholder.

- Uniform Benefits: All members of the group receive the same benefits, promoting equality in healthcare access.

Understanding Group Insurance

Group insurance is a form of coverage typically offered by employers or associations to a defined group of individuals, such as employees or members. It is often a key component of employee benefits packages and can provide significant financial relief in the event of medical expenses.

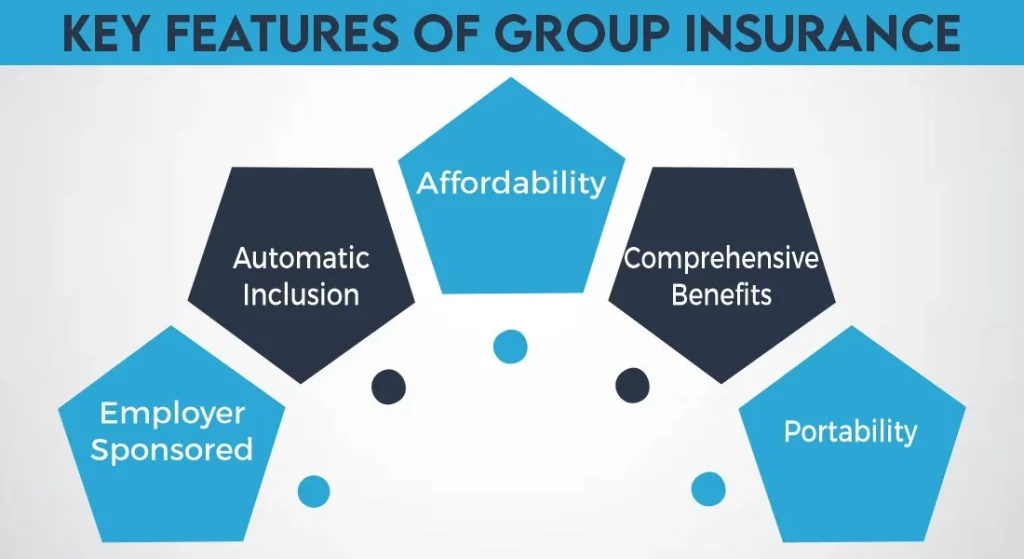

Key Features of Group Insurance

- Employer-Sponsored: Group insurance is commonly offered by employers to their workforce, forming a valuable part of the overall compensation package.

- Automatic Inclusion: Eligible individuals are automatically enrolled, eliminating the need for individual applications.

- Affordability: Group plans often have lower premium costs because the risk is spread across a larger pool of members.

- Comprehensive Benefits: These plans typically offer a wide range of coverage, including health, dental, vision, and sometimes life insurance.

- Portability: In some cases, individuals can retain group coverage even if they leave the group, such as when changing jobs.

Comparing Blanket Health Policies and Group Insurance

Now that we have a basic understanding of both blanket health policies and group insurance, let’s examine some of the crucial aspects that set them apart.

Eligibility and Inclusion

Blanket Health Policies: These policies are designed for specific groups, such as students, members of an association, or residents in a particular community. Eligibility is typically tied to group membership, and individuals within the group are automatically included.

Group Insurance: Group insurance, on the other hand, is often provided by employers to their employees. Eligibility is determined by employment status, and participation is typically automatic for eligible employees. Membership in an organization or employment with a particular company is usually a prerequisite.

Administration

Blanket Health Policies: Blanket policies are administered as a single master policy, simplifying management for both the insurer and the policyholder. This centralized approach streamlines the process of handling claims and ensures uniform coverage.

Group Insurance: Group insurance can be administered by the employer or a designated plan administrator. This flexibility allows employers to choose how they manage the plan and tailor it to their employees’ needs.

Customization

Blanket Health Policies: These policies are often customizable to suit the specific needs of the group they cover. Depending on the policy and the group’s requirements, coverage options can be adjusted to provide targeted benefits.

Group Insurance: While group insurance plans offer some degree of flexibility, they may have somewhat standardized plan options. Employers can choose from available plans and, in some cases, offer additional coverage options.

Cost Sharing

Blanket Health Policies: The costs associated with blanket policies are usually shared among the group members. This collective approach can result in lower premium costs per individual.

Group Insurance: In the case of group insurance, employers often subsidize a portion of the premium costs as part of the employee benefits package. Employees may also contribute through payroll deductions.

Portability

Blanket Health Policies: The portability of blanket policies can vary depending on the policy and the group’s unique requirements. Some may allow individuals to retain coverage even if they leave the group, while others may not.

Group Insurance: Some group insurance plans offer portability options, allowing individuals to maintain coverage after leaving the group, such as when changing jobs. This can provide a degree of continuity and flexibility.

Coverage Scope

Blanket Health Policies: Coverage can be tailored to the specific health needs of the group, making it possible to provide benefits that address the group’s unique circumstances.

Group Insurance: Group insurance plans often provide a broader range of benefits, including health, dental, vision, and sometimes life insurance. These plans aim to offer comprehensive coverage for a wide range of healthcare needs.

Tax Implications

Blanket Health Policies: The tax treatment of blanket health policies can vary, depending on factors such as the type of policy, the group it covers, and its purpose.

Group Insurance: Group insurance premiums paid by employers are generally tax-deductible as a business expense, which can be a significant financial benefit for employers.

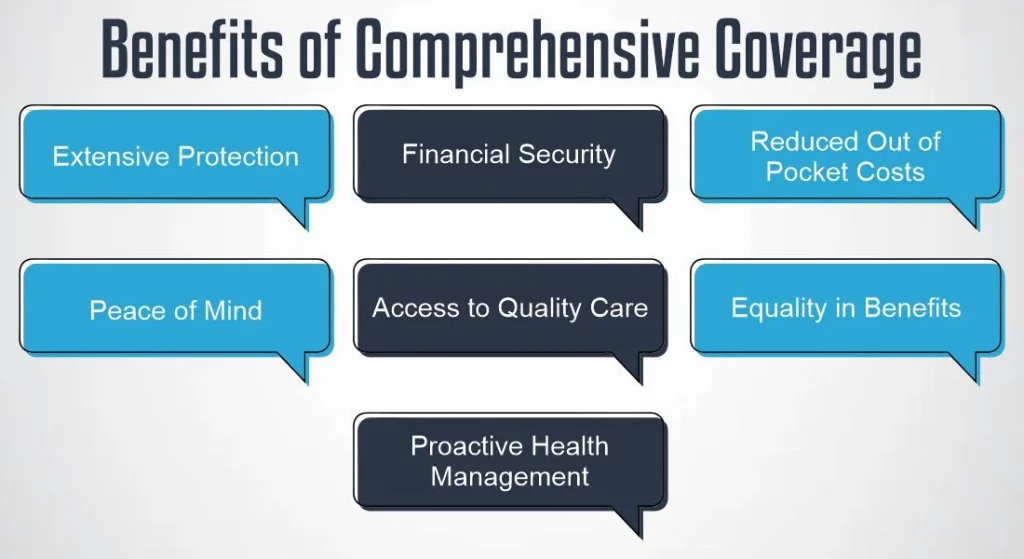

Benefits of Comprehensive Coverage

Both blanket health policies and group insurance provide comprehensive coverage to their respective members. Here are some of the key benefits:

1- Extensive Protection

Comprehensive coverage provides protection against a wide range of potential risks and perils, ensuring that policyholders are financially safeguarded in various circumstances.

2- Financial Security

Policyholders have the assurance that they will not face significant financial burdens in the event of unexpected events, accidents, or health issues. Comprehensive coverage acts as a financial safety net.

3- Reduced Out-of-Pocket Costs

Comprehensive policies often cover a large portion of the costs associated with covered events. This can result in lower out-of-pocket expenses for policyholders, making healthcare or repairs more affordable.

4- Peace of Mind

The extensive protection provided by comprehensive coverage helps individuals and organizations to focus on their daily lives or business operations with confidence, knowing that they are prepared for unforeseen circumstances.

5- Access to Quality Care

In the case of health insurance, comprehensive coverage often includes access to a wide network of healthcare providers and facilities, ensuring that policyholders can receive high-quality medical care.

6- Equality in Benefits

Group plans or blanket policies that offer comprehensive coverage typically provide uniform benefits to all members, promoting equality in healthcare access.

7- Proactive Health Management

Many comprehensive health insurance plans include preventive care services, encouraging policyholders to take a proactive approach to their health by receiving regular check-ups and screenings.

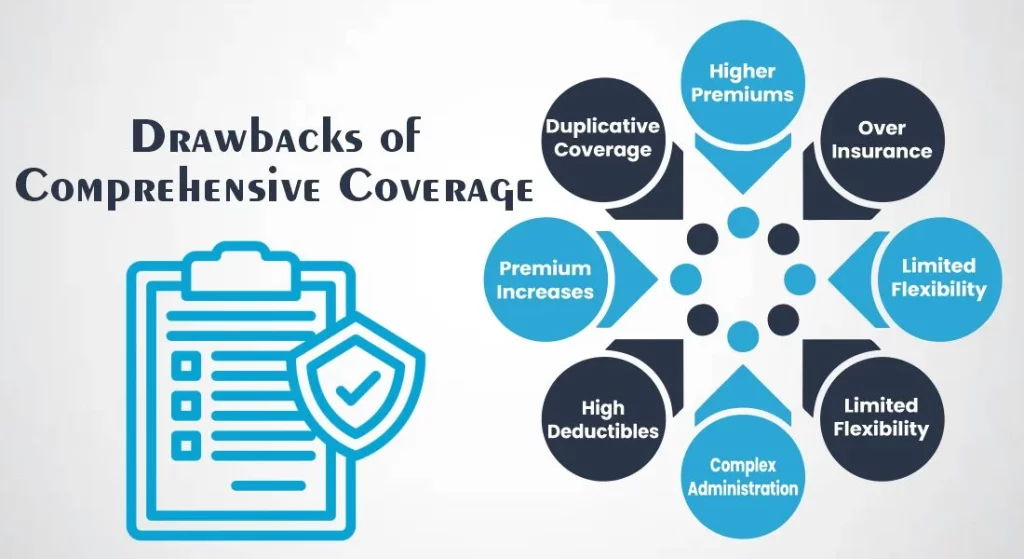

Drawbacks of Comprehensive Coverage

While comprehensive coverage, whether through blanket health policies or group insurance, offers a wide range of benefits, it’s important to consider the potential drawbacks that may arise in parallel with these advantages:

1- Higher Premiums

The cost savings associated with comprehensive coverage, especially in group plans, can be offset by higher premium costs. Comprehensive coverage tends to come with more expensive monthly premiums, which can be a financial burden for individuals or organizations.

2- Over-Insurance

The extensive coverage provided by comprehensive policies may include protection against risks that are not relevant to an individual or group’s specific situation. This can result in over-insurance, where individuals or organizations pay for coverage they don’t need.

3- Limited Flexibility

Comprehensive plans may limit the choice of healthcare providers or service options. Policyholders may be required to use a specific network of doctors or healthcare facilities, reducing flexibility and control over healthcare decisions.

4- Complex Administration

The complexity of comprehensive coverage can make administrative tasks, such as filing claims and managing paperwork, more challenging and time-consuming.

5- High Deductibles

To access the benefits of comprehensive coverage, policyholders often have to pay higher deductibles or out-of-pocket costs. This can be a barrier to accessing healthcare services, especially for those with limited financial resources.

6- Premium Increases

Making claims under comprehensive coverage can lead to premium increases in subsequent years. This can make the coverage less affordable over time.

7- Duplicative Coverage

Comprehensive coverage may include protection for situations already covered by other insurance policies, potentially resulting in duplicative coverage and added expenses.

Choosing What’s Right for You between Blanket Health Policies & Group Insurance

Choosing between blanket health policies and group insurance is a decision that should be based on your specific needs, circumstances, and preferences. To determine what’s right for you or your organization, it’s essential to consider a few key factors:

Group Characteristics

Consider the size of the group. Blanket health policies are often ideal for smaller groups, such as students or members of an association, while group insurance is typically associated with larger organizations or employers.

Customization Needs

Assess the specific healthcare needs of the group. Blanket health policies can often be tailored to the unique needs of the group, providing flexibility in coverage. Group insurance might present various plan options but could limit customization

Budget Constraints

Examine the budget of the group or organization. Consider whether comprehensive coverage with potentially higher premiums, as seen in group insurance, aligns with the financial resources available.

Administrative Capacity

Evaluate the administrative capacity to manage the insurance. Managing blanket health policies is typically more straightforward since they operate as a single master policy, while administering group insurance may demand more extensive administrative resources.

Benefit Preferences

Determine the level of coverage required. If the group or organization needs a broader range of benefits, such as dental, vision, or life insurance, group insurance may be more suitable.