Tips Before Buying Life Insurance: What You Need to Know

Last Updated on: June 10th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Thinking about the future has never been an easy thing, but it is very important, especially when it comes to protecting your family and loved ones. This is the time when life insurance comes in to protect your family after you. But still, most people don’t understand the insurance policies and how they work. Some people feel they’re too young to need it, while others get so serious about all the options. The truth is, life insurance matters at every stage of life. No matter if you are just starting out buying life insurance, raising a family, or getting close to retirement, it’s always a good time to start planning for the future.

Table of Contents

ToggleBuying life insurance does not have to be very confusing or stressful. You just need to have the right planning and better policies guided by the insurance companies, and that’s all you will be able to make the smart choices that will give you and your family peace of mind. Life insurance helps to make sure that your loved ones will be safe financially if something happens to you. It can help to cover your daily living expenses, loans, funeral costs, or even college tuition for your children.

In this article, we will explain everything you need to know before buying a life insurance policy. Also, we will discuss the helpful tips, how to choose the best policy, and smart ways to save your money on monthly payments.

Why Life Insurance Is a Smart Move

Life insurance acts as a safety net for your family and loved ones. Insurance policies will make sure that if something ever happens to you, your family will not suffer; the insurance amount is more than enough for them to handle the funeral expenses, home loans, your unpaid debts, and even your children’s college fees. All you need to know is how to choose the right life insurance plan, and taking the right policy will give you confidence that your family will be taken care of.

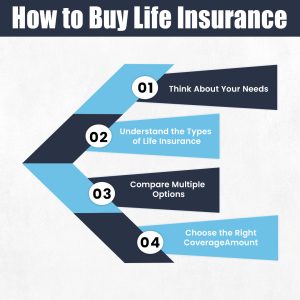

How to Buy Life Insurance

If you are thinking, How do I buy life insurance?, this is not the thing to be worried about. It might feel a little stressful at first, but it doesn’t have to be. Here’s a simple step-by-step guide to help you understand it:

1. Think About Your Needs

Before looking at the different life insurance options, you have to take a moment to think about your current situation. Are you the main person who is bringing in income for your family? Do you have kids or others who depend on you? Are you paying off things like a home loan or student loans? Your answers to these questions will help you figure out how much coverage you really need.

2. Understand the Types of Life Insurance

There are two main categories:

- Term Life Insurance: This offers coverage for a set number of years (e.g., 10, 20, or 30 years). It is more affordable and suitable for most people.

- Permanent Life Insurance: This policy includes whole and universal life insurance. It provides coverage for your entire life and also builds cash value over time. While it usually costs more, it can be a good fit if you have long-term financial goals.

3. Compare Multiple Options

It’s important to compare the options around. You can use online tools or talk to independent agents to get price quotes from different insurance companies. Each company looks at things like your health, age, and lifestyle in its way, so prices can vary a lot.

How Much Does Life Isurance Cost?

4. Choose the Right Coverage Amount

A good rule to follow when buying life insurance is to get coverage that’s about 10 to 15 times your yearly income. But everyone’s situation is different. Things like your debts, upcoming expenses, and family needs might mean you need more or less than that, and choose the policy according to your needs.

Easy Tips to Find the Right Life Insurance

1. Buy When You’re Young and Healthy

Life insurance policies will cost you less when you are young, healthy, and fit. Getting a low rate early on can save you thousands of dollars over time.

2. Get a Medical Exam If Needed

No-exam life insurance is quite easy to get, but it usually costs more. If you’re healthy, choosing a policy that asks for a medical exam can help you get lower rates.

3. Avoid Overbuying

It’s easy to want a big life insurance policy, but buying more than you need can waste your money. Make sure to figure out your financial needs carefully.

4. Think About Adding Extra Options

Riders are extra benefits you can add to your life insurance, like coverage for serious illness or accidents. Only add them if you think they really help you.

5. Check Your Policy Every Year

Life changes, like getting married, having kids, or buying a house, can change what kind of coverage you need. Take a look at your policy each year to make sure it still fits your life.

How to Save Money on Life Insurance – Smart Tips

You can save money and still get good life insurance if you follow these easy tips:

- Bundle Your Insurance

Some companies will give you discounts if you buy other policies, like car or home insurance, along with life insurance.

- Stay Healthy

If you are not smoking, stay at a healthy weight, and keep yourself active, your life insurance will usually cost less.

- Pick Level Term Insurance

With level term insurance, your payments stay the same for the entire time, so you won’t have any surprise increases later.

- Pay Once a Year

Paying your premium once a year instead of every month can save you money because monthly payments sometimes have extra fees.

- Choose a Trusted Company

Low prices are good, but make sure the company is reliable and strong. Check their ratings from trusted agencies like A.M. Best or Moody’s.

What Should You Consider Before Buying Life Insurance?

Here are the most important things you have to think about before buying an insurance policy:

- How much do you earn, and do you have any loans?

This helps decide how much coverage you need.

- How many people count on you

Like your kids, spouse, or anyone else you support?

- Your health and medical history

This can affect the type of policy and cost.

- Future costs

Such as your kids’ college or possible long-term care needs.

- What you can afford

Know what you’re comfortable paying each month or year.

At What Age Should I Look Into Life Insurance?

There is no perfect age, but the best time is as early as possible. Monthly payments are lowest in your 20s and 30s. Even if you don’t have dependents yet, getting life insurance early can save you money and make sure you’re covered later when you might need it most.

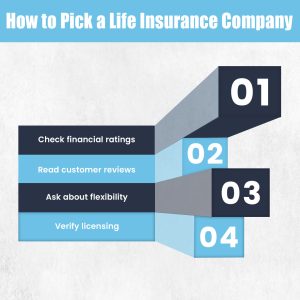

How to Pick a Life Insurance Company

Choosing the right insurer is just as important as picking the right policy. Here’s how:

- Check financial ratings. Look for an A or higher rating from A.M. Best, Moody’s, or S&P.

- Read customer reviews. How does the company handle claims and customer service?

- Ask about flexibility. Can you upgrade, convert, or add riders easily?

- Verify licensing. Ensure the company is licensed to sell insurance in your state.

FAQs

What should you consider before buying life insurance?

Think about your income, loans, family who depends on you, your future goals, and your health. Also, figure out how much coverage you need and what fits your budget.

At what age should I look into life insurance?

It’s better to buy as soon as possible. People in their 20s and 30s usually get the cheapest rates. Buying early also means you lock in coverage before any health problems start.

What to ask before getting life insurance?

Make sure to ask about the kinds of policies, how long they last, what’s not covered, if you can renew them, and if the company is strong and trustworthy. Pick a policy that works for you today and in the future.

How to pick a life insurance company?

Pick a company that has strong financial ratings, good reviews from customers, a track record of paying claims on time, and offers flexible policies.

Final Thoughts

Buying life insurance is an important decision in your life in order to protect your family and secure their future. You can choose a policy that fits your budget and current situation, You have to make sure that your needs are met, comparing the options, and asking the right questions.

You can save your money by starting life insurance early, staying healthy, and reviewing your coverage regularly. This will also give you and your family peace of mind. Remember, it’s not just about getting insurance, it’s all about getting the right insurance. These simple tips will help you make good choices to keep your loved ones safe no matter what.

Ready to take the next step?

Don’t wait to protect what matters most. Start comparing life insurance plans today and find the one that fits your needs and budget. Your future self and your loved ones will thank you.

Get started now and secure peace of mind for tomorrow.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.