Life insurance serves as a crucial financial safety net, offering...

Read More

- Home

- Services

- Premium Rates

- Open Care Senior Plan Rates for 50 to 55 years

- Open Care Senior Plan Rates for 56 to 60 Years

- Open Care senior plan rates for 61 to 65 years

- Open care senior plan rates for 66 to 70 years

- Open care senior plan rates for 71 to 75 years

- Open Care Senior Plan Rates for 76 to 80 Years

- Open Care Senior Plan Rates for 81 to 85 Years

- Open Care Senior Plan Rates for 86 to 90 Years

- Tools

- Blogs

- About US

- Contact Us

Best Life Insurance And Burial Insurance Policies

We are offering you all types of life insurance and final expense insurance policies.

Both term and whole life insurance for the parents and kids.

Life insurance Calculator

How much life insurance is right for you? Find out

Discover financial peace of mind with our Life Insurance Calculator.

Get free quotes for Life insurance and Burial insurance.

Get a No Obligation life Insurance Quote Today

Insure Guardian is committed to providing the best life insurance policies by its association with the best life insurance companies in the USA. Our objective is to keep away our clients from the difficulties that life brings us. We provide them with incredible options and help them in making the right decision.

Discover What Everyone Should Know with Our Free eBook!

Common Myths about Life Insurance

Are you unsure about life insurance? Our latest eBook, “Common Myths about Life Insurance,” uncover the myths and clears up all the misconceptions. Take the First Step Towards a Secure Future.

Our New Life Insurance For Parents

In our life insurance policies for parents, we have cared for seniors whose children are looking for life insurance plans for their parents. All types of policies including whole life, term life, universal life, and family plans are available.

Whole Life Insurance With Dividends

Many life insurance policies provide dividends that reflect some of the earnings that the insurance company pays to the policyholders.

Life Insurance For Parents

How much is the life of a parent worth? Surely, no children in the world want to consider something like this.

Final Expense For Parents

Death is obvious and you can plan your parent's funeral and burial expenses now with our final expense insurance.

Our unique life insurance & burial insurance policies

With the help of these plans, you will be able to pay the final expenses of your parents, such as medical bills, care in the care center, and funeral expenses, among others.

Demand for life insurance policies is increasing

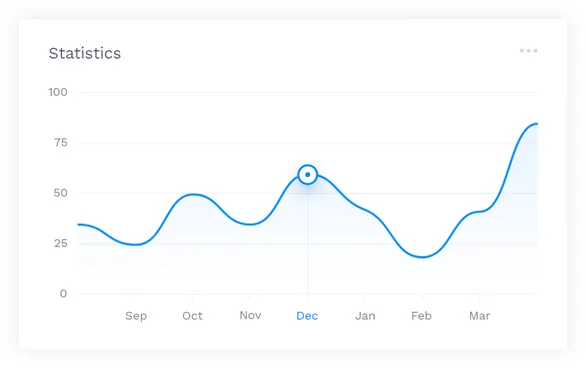

The graph illustrates the demand for life insurance, final expense insurance, and burial insurance in the USA over time. There’s been a high hike in the demand for all types of life insurance and burial policies after the wave of COVID-19. So don’t wait, get free life insurance and burial insurance quotes now.

Read Our Blogs

We have covered many aspects of the life insurance policies in our blog posts.We are inviting you to read all the blog posts before buying any type of life insurance policy.The blog posts are written in such a way that it covers the questions of the life insurance policy seekers and surely help you to get the best plan for you.

What Not To Do When Someone Dies: List of Things to Avoid

Losing a loved one is a profoundly emotional experience that...

Read MoreUsing Life Insurance To Buy A House: A Comprehensive Guide

Buying a house is a monumental step in life, representing...

Read MoreDo You Need Life Insurance If You’re Single? Complete guide

Life insurance is often seen as a financial tool reserved...

Read MoreCan You Get Life Insurance After a Stroke? Explore

Securing life insurance is a crucial step in planning for...

Read MoreAre Online Insurance Quotes Accurate: Discover Now

The internet has completely changed the way we buy insurance....

Read MoreEmpowering Success Through Our Trusted Partners

Why Choose Us

Insure Guardian represents a wide variety of amazing life insurance policies. We carefully analyze the requirements of your life insurance policy. Our experts are here to serve you in choosing the best life insurance policies for you and your family.

We are here to help you and your family choose the right life insurance policies.

Partners

All state Insurance

Global life Insurance

GEICO Insurance

Colonial Penn Life Insurance

Fidelity insurance Company

Metlife

M-Life Insurance

Contact Info

Phone: +1(800)695-6528

Email: [email protected]

Copyright 2024 Insure Guardian