Are you thinking about how to protect your loved ones even after you’re gone? The Mutual of Omaha Whole Life Insurance Calculator makes planning for the future simple and stress-free. This handy tool helps you figure out how much coverage you need to keep your family secure, no matter what happens.

With just a few clicks, you can get a clear idea of the costs and ensure your loved ones will be taken care of financially. It’s all about making smart choices today to give you and your family peace of mind for tomorrow. Let’s start with us to check how this calculator can make planning for the future easier than ever!

What is mutual of Omaha whole life insurance calculator

The Mutual of Omaha Whole Life Insurance Calculator is a super helpful online tool that helps you figure out how much money your family would need if you weren’t around anymore. It’s like a smart assistant that makes it really easy to understand how much life insurance you should get. You just answer some simple questions about your life, like how much you earn and what kind of bills you pay, and the calculator does all the hard math for you.

It tells you how much insurance would be best to make sure your family doesn’t have to worry about money for things like daily living costs, paying off a house, or even college fees in the future. Using this calculator means you can make a really good decision about buying life insurance without guessing what’s right. It’s a way to ensure your family is taken care of, and it takes away much guesswork and stress.

How does the mutual of Omaha whole life insurance calculator work?

Using the Mutual of Omaha Whole Life Insurance Calculator is easy. Let’s discuss:

Go to the Calculator:

- Go to the Life Insurance Products area of the Mutual of Omaha website, or use your favourite search engine to find the Whole Life Insurance Calculator directly.

Provide your personal details:

- Enter your age, gender, state of residence, and other basic personal data first. By providing this information, the computations can be tailored to your unique area and demography.

Give Financial Specifics:

- Enter financial data after that, including your yearly income, current assets and savings, outstanding loans, and projected future spending. Ensure the calculations appropriately reflect your financial condition by being as precise as possible.

Indicate What Coverage You Need:

- Give details about your financial objectives, such as debt repayment, dependents’ income replacement, burial costs, and the coverage amount you are considering. With this data, the Calculator will determine the proper amount of coverage.

Review suggestions:

- The Calculator will provide suggestions for whole life insurance coverage depending on your inputs after you’ve supplied all pertinent data. Generally, many coverage alternatives will be displayed to you, along with the associated rates and benefits.

Compare Policies:

- Using the tool’s comparison feature, look at the various Mutual of Omaha whole life insurance possibilities. The optimum fit for your needs will be determined by considering premium prices, death benefits, cash value buildup, and policy features.

Examine and Save findings:

- Carefully review the findings once you’ve selected an appropriate policy or reduced the possibilities available. Any policies that stand out should be noted, and you should consider printing or storing the data for later use.

Take Action:

- Follow and seek professional advice before applying for the chosen whole life insurance policy. The experts of Mutual of Omaha are available to help you finish the application procedure and complete your coverage.

You can evaluate your insurance needs and make well-informed decisions about safeguarding your financial future using the Mutual of Omaha Whole Life Insurance Calculator described below.

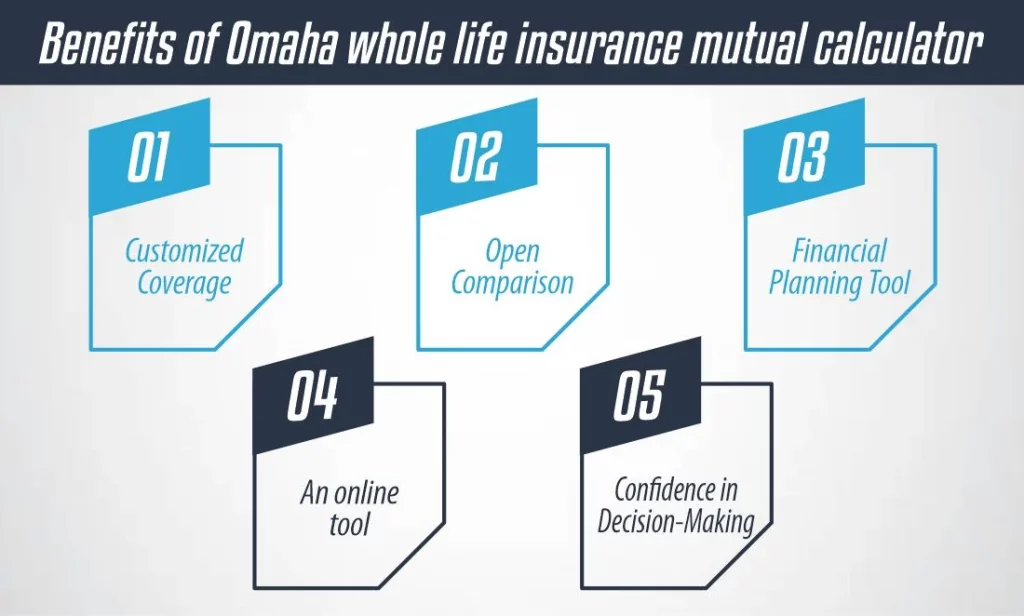

Benefits of Omaha whole life insurance mutual calculator

The Mutual of Omaha Whole Life Insurance Calculator provides several advantages to those looking to safeguard their financial future:

Customized Coverage:

Users are given suggestions for coverage amounts specifically customized to their needs based on personal data like age, income, expenses, and financial objectives. By doing this, you may be sure that the insurance coverage closely matches their unique requirements and situation.

Open Comparison:

The Calculator lets users examine and contrast the various Mutual of Omaha whole life insurance plans. This transparency empowers people to make educated decisions, allowing them to compare coverage features, rates, and benefits.

Financial Planning Tool:

The Calculator helps determine insurance needs and is a great financial planning tool. Users can make changes to their overall financial strategy by using it to evaluate their existing financial status and spot any coverage gaps.

An online tool:

The Mutual of Omaha Whole Life Insurance Calculator offers users easy access from any location with an internet connection. Without the necessity for in-person consultations, this convenience enables people to investigate their insurance alternatives at their own pace.

Confidence in Decision-Making:

By utilizing the Calculator to examine various situations and see the possible results, people may make life insurance decisions more assuredly. Knowing that they have chosen a policy that sufficiently safeguards the financial future of their loved ones gives them a sense of security.

The Mutual of Omaha Whole Life Insurance Calculator is a valuable tool for navigating the complexity of life insurance, providing consumers with clarity, customization, and peace of mind as they make plans.

How Much Does Life Isurance Cost?

Is Mutual of Omaha a good whole life insurance company?

Mutual of Omaha is a good choice if you’re considering getting whole-life insurance. They’ve been around for a long time, which means they know what they’re doing when it comes to insurance. People like them because they offer plans that are easy to understand, and they care about their customers.

They also have a bunch of different options, so you can find something that fits just right for what you need and how much you can spend. Plus, their whole life insurance policies come with the perk of paying out when you pass away and building cash value over time. This means you can use some of the money while you’re still around, which is neat. So, if you’re looking for a reliable company that’s got your back, Mutual of Omaha is worth considering.

Why Choose mutual of Omaha whole life insurance calculator?

There are several strong reasons to select Mutual of Omaha Whole Life Insurance.

Financial Security:

Whole life insurance offers lifetime protection, guaranteeing your beneficiaries will receive a death benefit upon your passing. This ensures your loved ones have enough money to pay burial fees, unpaid bills, and living expenses.

Cash Value Accumulation:

Mutual of Omaha whole life insurance plans gradually accumulate cash value, acting as a type of forced savings. Growing tax-deferred, the policy’s cash value can be accessed through loans or withdrawals for various purposes, including emergencies, college costs, and retirement income supplementation.

Level Premiums:

The whole life insurance premiums are fixed throughout the policy, giving you budgetary predictability and stability. You may fix low rates with Mutual of Omaha, which won’t increase as you age or your health changes.

Mutual Plans:

Mutual of Omaha provides a variety of whole life insurance plans tailored to accommodate a wide range of needs and preferences, including flexible coverage options. You can select a customized policy to meet your unique needs, regardless of whether you’re seeking basic coverage, improved cash value accumulation, or extra riders for further protection.

Sturdy Financial Position:

Mutual of Omaha has a solid record of sound financial management. With more than a century of expertise in the insurance business, the company has constantly shown policyholders that it is committed to them by keeping its financial word.

Outstanding Customer Service:

Mutual of Omaha is known for exceptional customer service and assistance. Their team of experienced professionals is here to help you at every stage, whether you have questions about your policy, need help with claims, or need advice on what coverage to choose.

Extra Benefits and Riders:

Mutual of Omaha has several extra benefits and riders you can add to your whole life insurance policy to improve. For further peace of mind and security for you and your loved ones, these may contain riders for expedited death benefits, long-term care, accidental death, and disability income.

Estate Planning:

A critical element of your estate planning approach may be whole life insurance from Mutual of Omaha. Ensuring stability and financial assistance for future generations enables you to leave a lasting legacy for your beneficiaries.

As a reliable option for safeguarding your financial future, Mutual of Omaha Whole Life Insurance offers complete coverage, monetary stability, flexibility, and peace of mind for you and your loved ones.

Conclusion

To sum up, the Mutual of Omaha Whole Life Insurance Calculator is an invaluable resource for anyone looking to use whole life insurance to protect their finances. The Calculator helps users make decisions based on their requirements and circumstances by providing clear comparisons, personalized recommendations, and educational insights. People may quickly and confidently navigate the intricacies of life insurance because of its easily navigable design.

Further enhancing Mutual of Omaha’s standing as a reliable supplier in the insurance sector is its dedication to sound financial management, first-rate client support, and adaptable coverage options. People can start their road toward long-term financial stability and peace of mind for themselves and their loved ones by utilizing the information offered by the Whole Life Insurance Calculator.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.