Ever wonder how police officers protect their families if something happens while they’re out keeping us safe? That’s where police life insurance comes in. But what exactly is it, and why is it so important for officers? Let’s dive into life insurance for police officers to understand how it works and why every officer should consider it a crucial part of their financial planning.

Why do police officers need life insurance?

Police officers often face unique risks due to the nature of their job, making life insurance an important consideration. The role of a police officer can be unpredictable and sometimes dangerous, increasing the risk of injury or fatality. Police Life Insurance provides financial security for their families in case of an unforeseen incident. It ensures that in the event of the officer’s death, their family can cover living expenses, debts, educational costs for children, and funeral expenses. Additionally, life insurance can offer officers peace of mind, knowing their loved ones will be financially protected.

How may working as a police officer affect your life insurance application?

Working as a police officer can impact life insurance applications in several ways. Insurance companies often consider the heightened risks associated with law enforcement careers. This might lead to higher premiums due to the increased risk of injury or death in the line of duty. Some insurers might also have specific policies or riders tailored for high-risk professions like policing. However, it’s also possible to find competitive rates, especially through providers who specialize in or are familiar with insuring law enforcement professionals. Police officers need to shop around and consult with insurance agents who understand the unique aspects of their profession.

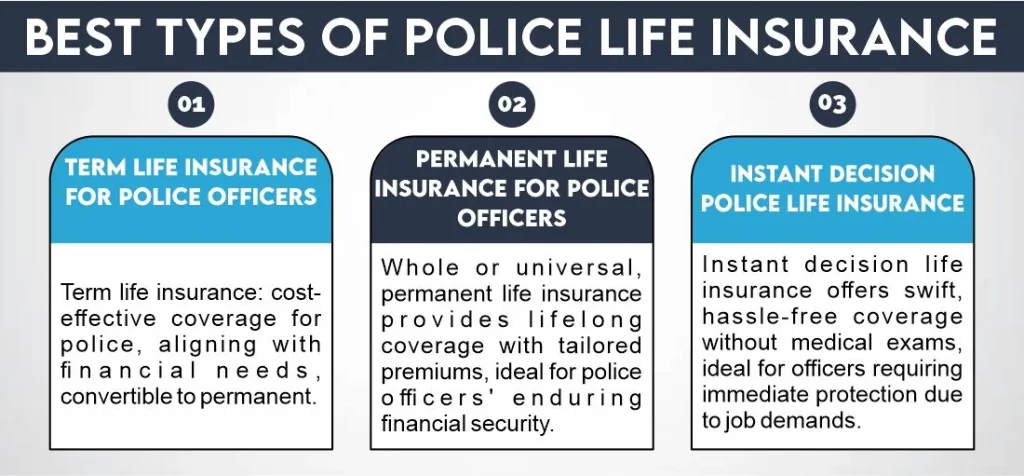

Best types of Police Life Insurance:

For police officers, selecting the right life insurance policy is crucial due to the inherent risks of their profession. Here are the best types:

Term Life Insurance for Police Officers:

Term life insurance is an excellent choice for police officers looking for a straightforward, budget-friendly option. This type of policy provides coverage for a specific period, which can align with key financial obligations like children’s education or a home mortgage. It’s a practical choice for those who need significant coverage at a lower cost, with the added flexibility of converting to a permanent policy later on.

Permanent Life Insurance for Police Officers:

Permanent life insurance, encompassing both whole and universal life policies, is ideal for officers seeking lifelong coverage. Whole life insurance offers the security of fixed premiums, a death benefit, and a growing cash value. On the other hand, Universal Life provides more flexibility in premium payments and the potential for greater cash value growth tied to market performance. These policies are excellent for long-term financial stability and estate planning.

Instant Decision Police Life Insurance:

Instant decision life insurance is convenient for officers needing quick, hassle-free coverage. This policy type often skips the medical examination and lengthy underwriting process, allowing for rapid policy issuance. It’s beneficial for officers who may need more time for a traditional insurance application process but need immediate protection due to the nature of their jobs.

When should police officers purchase life insurance?

Police officers should consider purchasing life insurance as soon as they begin their careers, given the inherent risks associated with law enforcement. Early purchase often leads to lower premiums and better coverage options. It’s also wise for officers with families or dependents to secure financial protection for them.

Key life events like marriage, having children, or buying a home are ideal times to purchase or review existing life insurance policies to ensure adequate coverage. Additionally, as retirement approaches, reviewing and adjusting life insurance can be crucial to align with changing financial needs and estate planning goals.

Law Enforcement for police life insurance Premiums:

When applying for life insurance as a police officer, the process initially mirrors that of civilians. However, once your occupation as a law enforcement officer is disclosed, insurers will pose additional inquiries to determine your premiums. These questions include:

- Your duty status: Are you primarily assigned to fieldwork or desk duty, or do you engage in active patrols, investigations, or canvassing?

- Your armament status: Do you routinely carry a firearm? This indicates heightened risk compared to unarmed officers.

- Your assignment: Are you involved in major crime investigations, which typically involve greater risk?

- Your specialized training: Insurers consider any additional training you’ve received related to your role.

- Your safety protocols: If you adhere to extra safety measures, insurers consider this.

- These inquiries enable insurers to assess the risk associated with your occupation and tailor your premiums accordingly.

Pros and cons of police life insurance:

Life insurance is a crucial consideration for police officers, given the inherent risks associated with their profession. However, like any financial product, it has advantages and disadvantages. Here’s a detailed breakdown of the pros and cons of life insurance for police officers:

Pros:

Financial Protection for Loved Ones: One of the primary benefits of life insurance is providing financial security to the beneficiaries in case of the insured officer’s death. This ensures that their loved ones are taken care of financially, including covering funeral expenses, mortgage payments, and other ongoing living expenses.

Income Replacement: Police officers often serve as the primary breadwinners in their families. Life insurance provides a safety net by replacing the lost income, allowing surviving family members to maintain their standard of living and meet financial obligations.

How Much Does Life Isurance Cost?

Peace of Mind: Law enforcement is inherently dangerous, and officers face daily risks while on duty. Having life insurance can offer officers peace of mind, knowing that their families will be financially protected if the worst should happen.

Flexible Coverage Options: Life insurance policies come in various forms, such as term life, whole life, or universal life insurance. Police officers can choose the type of coverage that best suits their needs and budget.

Group Policies: Many police departments offer group life insurance policies to their officers as part of their benefits package. Group policies often provide coverage at lower rates than individual policies and may offer additional benefits.

Tax Benefits: Life insurance death benefits are generally tax-free, providing an added advantage to the beneficiaries. This can help ensure that the full amount of the policy payout goes towards meeting the financial needs of the surviving family members.

Supplemental Coverage: In addition to any coverage provided by their department, police officers can purchase additional life insurance policies to supplement their existing coverage, ensuring that their families are adequately protected.

Cons:

Cost: Depending on the type and amount of coverage, Police Life Insurance premiums can be expensive, especially for officers working in high-risk areas or with pre-existing health conditions. This can strain the already limited budget of police officers, especially those with families to support.

Underwriting Challenges: Due to the nature of their profession, police officers often face challenges in obtaining life insurance. Insurers may view law enforcement as a high-risk occupation, leading to higher premiums or even denial of coverage in some cases.

Exclusions and Limitations: Some life insurance policies may have exclusions or limitations related to the insured’s occupation, such as coverage restrictions for death occurring during the performance of specific high-risk duties or activities.

Policy Complexity: Life insurance policies can be complex, with various terms, conditions, and riders that may be difficult for officers to understand fully. This complexity can make it challenging to select the right policy and may lead to misunderstandings about coverage.

Potential Coverage Gaps: Depending solely on employer-provided group life insurance may not always be sufficient to meet the financial needs of the officer’s family. There could be gaps in coverage if the officer leaves the department or the group policy needs to provide adequate benefits.

Health Considerations: Pre-existing health conditions or injuries sustained on duty may impact the insurability of police officers or result in higher premiums. Officers with health issues may find obtaining affordable life insurance coverage more challenging.

Policy Lapses: If an officer fails to pay their life insurance premiums on time, the policy may lapse, resulting in loss of coverage. This could leave their loved ones financially vulnerable in the event of the officer’s death.

Conclusion

In conclusion, police life insurance serves as a vital safety net for officers, providing financial security for their loved ones in the face of the uncertainties of their profession. By understanding the importance and benefits of this coverage, officers can ensure their families are protected, allowing them to serve their communities with peace of mind and confidence.

FAQs

Do police officers have good life insurance?

It depends on their department’s benefits package, but many police departments offer group life insurance, providing decent coverage for officers and their families.

Does life insurance pay for any death?

Life insurance typically pays out for most causes of death, including natural causes, accidents, and illnesses, as long as the policy is active and the death is not due to exclusions outlined in the policy.

Should police officers get life insurance?

Yes, police officers should get life insurance to protect their families financially in case of their death, considering the risks associated with their profession.

How much life insurance should a police officer get?

The amount of life insurance a police officer should get depends on various factors, including income, financial obligations, and family needs. Still, a common rule of thumb is having coverage at least 5-10 times their annual salary. Consulting with a financial advisor can help determine the appropriate amount for individual circumstances.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.