In our ever-changing world, we all share a fundamental desire: to protect and provide for our loved ones. This desire transcends generations, borders, and cultures. It is a universal pursuit of security and peace of mind. Amidst the uncertainties of life, insurance offers a lifeline. USA Family Protection Life Insurance stands tall as a guardian, providing financial security for countless families.

USA Family Protection is here to ensure that your loved ones remain sheltered from life’s unexpected storms. Welcome to a world where protection is paramount, where the future is secure, and where you’re in control.

In this comprehensive guide, we will discuss USA Family Protection Life Insurance, providing insights into their services, benefits, costs, and differences between term and permanent coverage. We will also provide you with USA family protection reviews so by the end of this article, you’ll be well-informed and better equipped to make an informed decision to protect your family’s future.

What is USA Family Protection?

USA Family Protection is an insurance provider specializing in life insurance products. Their primary mission is to help individuals and families protect their loved ones from the uncertainties of life. With a strong presence in the insurance industry, having served customers for over [insert years] years, USA Family Protection is dedicated to offering financial security and peace of mind to its clients. They offer a range of insurance services tailored to meet the diverse needs of their clients. These services include life insurance, personalized coverage, and customized plans. Their life insurance products encompass various types, such as term life insurance, permanent life insurance, and USA family protection final expense insurance.How does USA Family Protection life insurance work?

The core principle of how USA Family Protection life insurance works is simple: policyholders pay regular premiums, and in return, their beneficiaries receive a payout (death benefit) upon the policyholder’s passing. The exact details and benefits of each policy vary depending on the type chosen. USA Family Protection plan prides itself on providing financial security, peace of mind, and customized coverage, all while helping customers navigate the complexities of the insurance landscape. This insurance provider is committed to assisting individuals and families in securing their financial future and protecting their loved ones from the unexpected challenges life may present.What Types of Life Insurance Products Does USA Family Protection Offer?

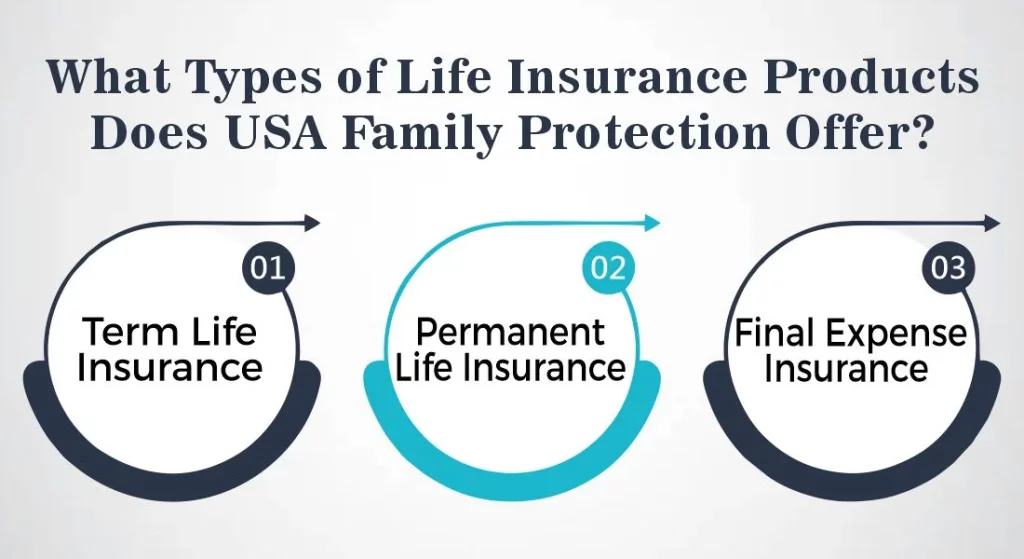

USA Family Protection offers a variety of life insurance products to cater to the diverse needs of their customers. Some of the main types of life insurance products offered by USA Family Protection include:1- Term Life Insurance

Term life insurance provides coverage for a specified term, typically ranging from 10 to 30 years. It is often more affordable than permanent life insurance and is an excellent choice for individuals seeking temporary coverage to protect their family during specific financial obligations or phases of life.2- Permanent Life Insurance

Permanent life insurance provides lifelong coverage, as long as premiums are paid. It can include different policy types, such as whole life or universal life insurance, and typically accumulates cash value over time. Permanent life insurance is often chosen for long-term financial planning and estate protection.3- Final Expense Insurance

This specialized form of life insurance is designed to cover end-of-life expenses, such as funeral and burial costs. It provides a payout to help your family handle the financial burden associated with these expenses when you pass away. These various life insurance products from USA Family Protection allow customers to choose the type of coverage that best suits their individual financial situations and long-term goals. Whether you need temporary protection, lifelong coverage, or specific coverage for end-of-life expenses, USA Family Protection offers options to address your unique needs.What are the Benefits and Drawbacks of USA Family Protection Life Insurance?

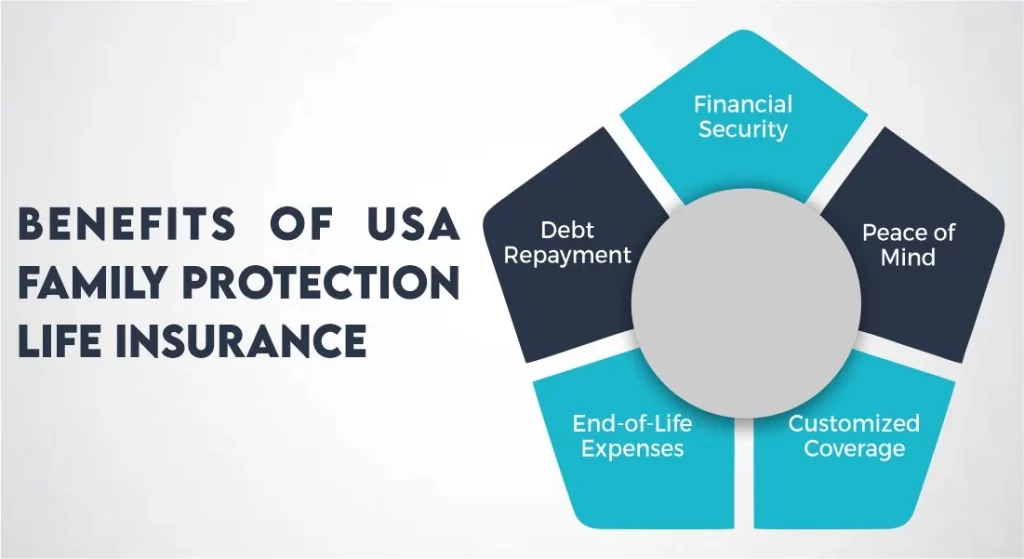

Benefits of USA Family Protection Life Insurance

Financial Security: USA Family Protection’s life insurance provides a safety net for your loved ones. In the event of your passing, your beneficiaries will receive a payout (death benefit). This financial support can be used to cover living expenses, outstanding debts, and future financial needs. Peace of Mind: Knowing that your family is protected through life insurance can provide you with peace of mind. You can enjoy life with the knowledge that your loved ones will have a financial cushion if the unexpected occurs. Customized Coverage: USA Family Protection plan understands that every individual and family is unique. They tailor coverage plans to meet your specific needs, ensuring that you get the right amount of protection. End-of-Life Expenses: Life insurance can cover the costs associated with end-of-life expenses, such as funerals and burials. This can relieve your family of a significant financial burden during a difficult time. Debt Repayment: Life insurance can be used to pay off outstanding debts, such as mortgages, personal loans, or credit card balances. This ensures that your family is not left with financial liabilities after your passing.

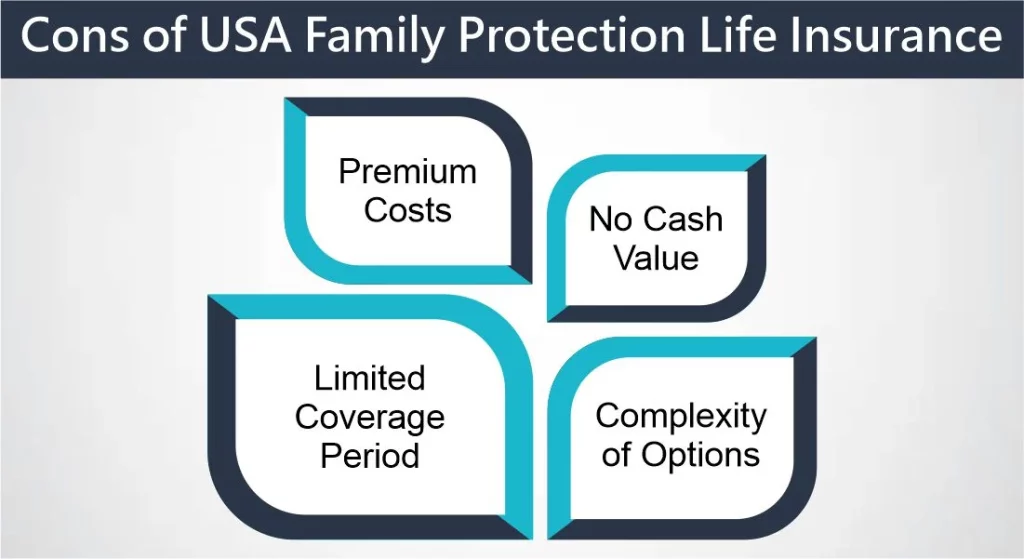

Cons of USA Family Protection Life Insurance

While USA Family Protection Life Insurance offers many advantages, it’s important to consider the potential drawbacks or cons: Premium Costs: The cost of life insurance can be a significant expense, especially for those with specific health issues or older applicants. Premiums are an ongoing financial commitment that policyholders must maintain to keep their coverage active. No Cash Value (for Term Policies): Term life insurance policies do not accumulate cash value over time. Unlike some permanent life insurance policies, where a portion of your premiums may be invested, term policies provide coverage only and do not offer a savings or investment component. Limited Coverage Period (for Term Policies): Term life insurance provides coverage for a specified term, typically ranging from 10 to 30 years. This means that if you outlive the policy, you won’t receive any benefits or returns. It’s purely for temporary financial protection. Complexity of Options: Insurance policies can be complex, and it may require some effort to understand all the terms, conditions, and options available. To make informed decisions, individuals may need to invest time in research or consult with insurance professionals.What Is USA Family Protection Coverage?

USA Family Protection coverage encompasses various aspects that are designed to provide financial protection and support in various situations. Some of the key components of their coverage may include: Medical Expenses: In the event of a critical illness or injury, your USA Family Protection life insurance may cover medical expenses and treatments. This can help ensure that you or your beneficiaries have the financial means to access necessary healthcare. Funeral Expenses: Life insurance can cover the costs associated with funerals and burials. This relieves your family of the financial burden of arranging a proper farewell in the event of your passing. Debts and Loans: Life insurance can be instrumental in repaying outstanding debts and loans. This may include mortgages, personal loans, credit card balances, or other financial obligations, ensuring that you are not leaving your family with these liabilities. Income Replacement: Life insurance can replace the income you provide to your family. This ensures that your loved ones have financial support to maintain their standard of living after your passing. USA Family Protection offers coverage designed to provide comprehensive protection, giving you and your beneficiaries the financial security needed to face life’s uncertainties. The specific details and coverage options can vary based on the type of policy you choose and your individual needs.

USA Family Protection Life Insurance Cost

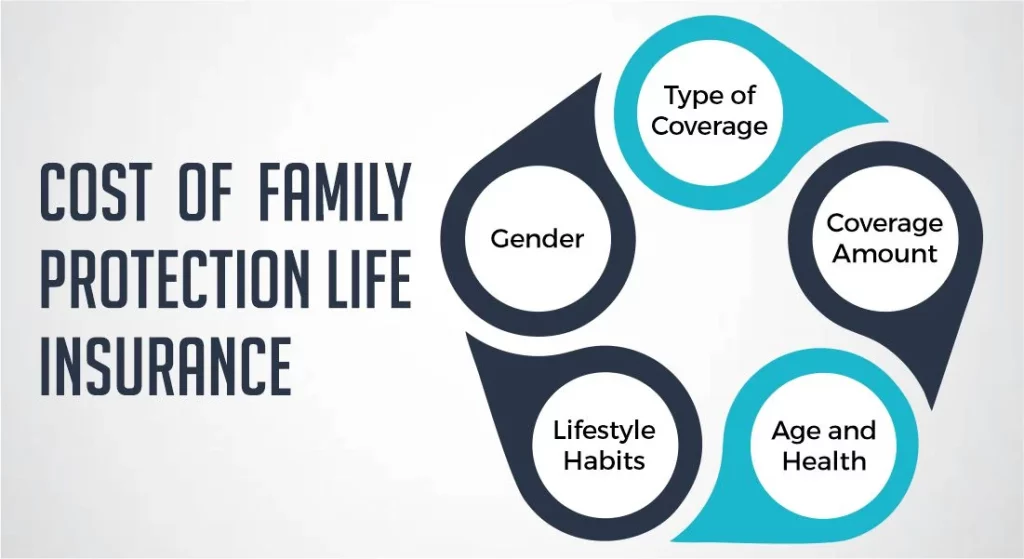

The USA Family Protection Life Insurance cost can vary depending on several factors:Type of Coverage

The choice between term life insurance and permanent life insurance significantly impacts the cost. Term life insurance is generally more affordable because it provides coverage for a specified term, while permanent life insurance offers lifelong protection and comes with higher premiums.Coverage Amount

The amount of coverage you choose, known as the death benefit, directly influences the premium. The higher the death benefit, the higher the premium will be.Age and Health

Your age and health status are crucial factors in determining the cost of your life insurance. Young and healthy individuals typically pay lower premiums, while older individuals or those with health issues may face higher costs.Lifestyle Habits

Certain lifestyle choices, such as smoking or engaging in risky activities, can also affect the premium. Insurers may charge higher premiums to individuals with riskier habits.Gender

In some cases, gender can impact the cost of life insurance, with women often paying lower premiums due to longer life expectancies. To determine the precise cost of family protection life insurance from USA Family Protection, it’s essential to get a personalized quote based on your individual circumstances and needs. Insurance agents can provide you with detailed information and help you choose a policy that aligns with your budget and coverage requirements.Differences between Term and Permanent USA Family Protection Life Insurance

The primary differences between term and permanent USA Family Protection Life Insurance lie in their coverage duration, cost, and financial features. Here’s a breakdown of the distinctions:Coverage Duration

Cost

Cash Value Accumulation

Use of Funds