Are you prepared for life’s uncertainties, especially when it comes to ensuring your loved ones’ financial security after you’re gone? Navigating the realm of final expense insurance can be daunting, with numerous options available. Among them stands Prosperity Final Expense Insurance, offering a practical solution for covering end-of-life expenses.

Consider a policy that provides a safety net for your family, ensuring they don’t face financial burdens during a challenging time. It’s like a guardian angel securing their future, allowing them to focus on cherishing memories rather than worrying about expenses.

In this review, let’s explore the simplicity, accessibility, and benefits of Prosperity Final Expense Insurance. From its straightforward application process to its guaranteed approval, discover how this policy could offer peace of mind for you and your loved ones.

What is Prosperity Final Expense Insurance?

Prosperity Final Expense Insurance is a specialized insurance policy designed to cover the costs associated with end-of-life expenses. It serves as a financial safety net for individuals and their families, aiming to alleviate the financial burden often incurred from funeral expenses, medical bills, and other debts left behind after one’s passing.

This type of insurance typically offers a lump sum payment to beneficiaries upon the policyholder’s death. What sets Prosperity Final Expense Insurance apart is its accessibility; often boasting a simplified application process and guaranteed approval, even for individuals with health issues or pre-existing conditions. This makes it an appealing choice for those seeking a straightforward and attainable option to secure their loved ones’ financial future after they’re gone.

Comparison: Insure guardian vs Prosperity

When considering final expense insurance options, two names often pop up: Insure Guardian and Prosperity. Let’s take a closer look at how these two insurance providers stack up against each other.

Insure Guardian

Insure Guardian offers a range of final expense insurance policies with competitive coverage amounts and premium rates. They provide various additional benefits and have a diverse application process that might suit different individuals’ needs.

Features:

- Coverage Amount: Generally offers higher coverage options.

- Premium Rates: Competitive rates compared to industry standards.

- Application Process: Varied, catering to different health conditions and ages.

- Approval Time: Varies based on individual circumstances.

- Additional Benefits: Provides a range of supplemental benefits.

Prosperity

On the other hand, Prosperity Final Expense Insurance focuses on providing a straightforward application process and guaranteed approval. While it may offer more simplified procedures, it might have limitations in coverage amounts and additional benefits compared to some competitors.

Features:

- Coverage Amount: Offers moderate coverage options.

- Premium Rates: Average rates that fit within most budgets.

- Application Process: Simplified, ensuring easier access for many individuals.

- Approval Time: Guaranteed approval, even for those with health issues.

- Additional Benefits: Offers limited supplemental benefits compared to some competitors.

Considerations

Choosing between Insure Guardian and Prosperity depends on your specific needs. Insure Guardian might be suitable if you prioritize higher coverage options and a broader range of supplemental benefits. On the other hand, Prosperity could be the right choice if you value a simplified application process, guaranteed approval, and manageable premiums.

How Does Prosperity Final Expense Insurance Work?

Prosperity Final Expense Insurance operates as a specialized form of insurance designed to provide financial coverage for end-of-life expenses. Here’s a breakdown of how it typically works:

1- Application and Enrollment

- Simplified Application Process: One of the key aspects of Prosperity Final Expense Insurance is its straightforward application. It usually involves filling out a simple form with basic personal information and medical history. Unlike some traditional life insurance policies, Prosperity often requires minimal to no medical underwriting, making it accessible to individuals with various health conditions.

- Guaranteed Approval: One of the most attractive aspects of Prosperity is its guaranteed approval feature. Even individuals with pre-existing health issues who might have difficulty obtaining coverage from other insurance providers can usually secure a policy.

2- Coverage and Benefits

- Lump Sum Payout: Upon the policyholder’s passing, Prosperity Final Expense Insurance provides a lump sum payment to the designated beneficiaries. This payout is intended to cover funeral expenses, medical bills, and other debts, offering financial support during a challenging time.

- Coverage Options: While Prosperity may not offer as high coverage amounts as some competitors, it provides a moderate level of coverage that is often sufficient to meet end-of-life expenses.

3- Premiums and Payments

- Affordable Premiums: Prosperity Final Expense Insurance generally comes with manageable premium rates that fit into most budgets. These premiums are paid regularly, usually on a monthly basis, ensuring continued coverage.

- Fixed Premiums: Some policies offer fixed premiums, meaning the rates remain constant throughout the policy’s duration, providing predictability in payments.

How Much Does Prosperity Life Funeral Insurance Cost?

The cost of Prosperity Final Expense Insurance varies based on several factors such as age, health status, and coverage amount. On average, premiums are affordable and can fit into most budgets, making it an attractive option for many.

While specific costs for Prosperity Life Funeral Insurance can vary based on individual factors, here’s an example table showcasing estimated monthly premiums for different age groups and coverage amounts:

| Age Group | Coverage Amount | Estimated Monthly Premiums |

| 50-55 | $5,000 | $30 – $40 |

| 56-60 | $10,000 | $40 – $50 |

| 61-65 | $15,000 | $50 – $60 |

| 66-70 | $20,000 | $60 – $70 |

Note that these estimated premiums are for illustrative purposes and may vary based on individual circumstances and the specific policy details. Additionally, rates can be influenced by factors such as smoking status, overall health, and the state of residence.

When considering Prosperity Life Funeral Insurance, it’s essential to request a personalized quote based on your age, health, and coverage requirements to get an accurate understanding of the premiums you might expect to pay.

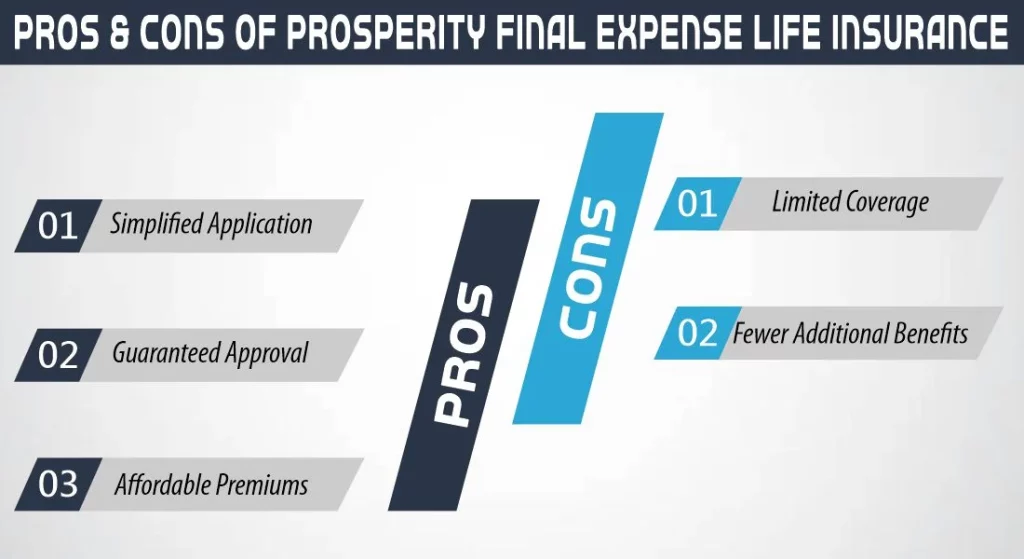

Pros & Cons of Prosperity Final Expense Life Insurance

Here are some pros and cons of Prosperity Final Expense Life Insurance to help you weigh your options:

Pros

1- Simplified Application

The streamlined application process makes it accessible to many individuals, requiring minimal medical underwriting. This aspect is particularly beneficial for those with health issues or pre-existing conditions.

2- Guaranteed Approval

One of its significant advantages is the guaranteed approval feature, ensuring coverage for individuals who might face challenges obtaining insurance elsewhere due to health concerns.

3- Affordable Premiums

Prosperity typically offers manageable premium rates that fit into most budgets. This affordability makes it an appealing option for many seeking to secure end-of-life expenses without overburdening their finances.

Cons

1- Limited Coverage

While offering coverage, Prosperity may not provide as high coverage amounts compared to some other final expense insurance providers. This limitation could be a drawback for individuals seeking extensive coverage.

2- Fewer Additional Benefits

Prosperity might offer fewer supplemental benefits compared to other policies. Some competitors might provide additional features or riders that enhance coverage or offer added flexibility, which Prosperity may lack.

What People Say about Property Final Expense

Reviews about Prosperity Final Expense Insurance often highlight several key aspects that policyholders appreciate:

- Ease of Application: Many individuals praise the simplified application process of Prosperity. They appreciate the minimal paperwork and hassle-free experience, making it accessible and convenient.

- Guaranteed Approval: Policyholders with health issues or pre-existing conditions often express gratitude for Prosperity’s guaranteed approval feature. This aspect allows them to secure coverage when they might have faced rejection from other insurance providers.

- Peace of Mind: Customers value the sense of security and peace of mind that Prosperity Final Expense Insurance provides. Knowing their loved ones will be financially supported during a challenging time is a common sentiment among policyholders.

- Prompt Payouts: Reviews often mention the timely and efficient payout process by Prosperity, ensuring beneficiaries receive the lump sum payment quickly after the policyholder’s passing.

- Customer Service: Positive remarks are made about the customer service experience, citing helpful and responsive representatives who assist throughout the application and claims process.

Verdict: Is Prosperity Burial Insurance Worth Buying?

The decision to purchase Prosperity Burial Insurance ultimately depends on your specific needs, priorities, and preferences. Here’s a summary to help you determine if it’s worth buying:

Consider Buying Prosperity Burial Insurance if:

Simplified Application Matters

You value a straightforward and simplified application process. Prosperity’s minimal medical underwriting and guaranteed approval feature could make it an attractive choice, especially if you have health concerns.

Guaranteed Approval is Essential

If you’ve faced challenges obtaining insurance due to health issues or pre-existing conditions, Prosperity’s guaranteed approval can provide the security you need.

Affordability is Key

The manageable premium rates offered by Prosperity fit comfortably into your budget, ensuring you can cover end-of-life expenses without financial strain.

Think Twice if:

Seeking Higher Coverage Amounts

If you require higher coverage amounts beyond what Prosperity offers, you might need to explore other providers that provide more extensive coverage options.

Additional Benefits Are Important

If you prioritize additional benefits or supplemental coverage options, other insurance providers might offer more extensive features that better suit your needs.

Conclusion

Prosperity Burial Insurance could be a suitable choice for individuals seeking a simplified application process, guaranteed approval, and manageable premiums. However, it might have limitations in coverage amounts and additional benefits compared to some competitors.

Weighing the pros and cons based on your unique circumstances will help you determine if Prosperity Burial Insurance aligns with your goals of securing your loved ones’ financial future. Additionally, always consider comparing multiple options and consulting with insurance professionals to make an informed decision.

Table Comparison: Insure Guardian vs. Prosperity

| Features | Insure Guardian | Prosperity Final Expense |

| Coverage Amount | High | Moderate |

| Premium Rates | Competitive | Average |

| Application Process | Varied | Simplified |

| Approval Time | Varies | Guaranteed |

| Additional Benefits | Some | Limited |

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.