Settlement Option Life Insurance: Which is the best Option?

Last Updated on: September 5th, 2024

- Licensed Agent

- - @InsureGuardian

When it comes to life insurance, do you know how your beneficiaries will receive the payout? Settlement option life insurance determines how the death benefit is paid out, whether as a lump sum, in installments, or through other methods. There are several possibilities for how to phase the payments, meaning how to distribute them over a certain period. Choosing the right option can make a big difference in how your loved ones manage financially after you’re gone. Understanding what is available can assist in determining what is the best.

Table of Contents

ToggleKey Takeaways

Life insurance settlements can be paid out as a lump sum, annuity, or regular installments.

Life insurance settlements can be paid out as a lump sum, annuity, or regular installments.

Interest-only and interest-accumulation options allow your settlement funds to grow over time.

Fixed-period and fixed-amount settlements provide payments over a set period or in specific amounts.

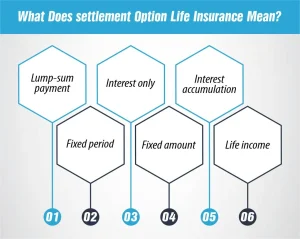

What Does settlement Option Life Insurance Mean?

Life insurance settlement options are the various ways life insurance death benefits can be paid out to beneficiaries. Which of the following settlement options in life insurance these include:

- Lump-sum payment

- Interest only

- Interest accumulation

- Fixed period

- Fixed amount

- Life income (also known as life-only or life annuity)

1. Lump-sum payment or single payment

It means that the entire amount of the death benefit is paid to the beneficiary at one time. A lump-sum payment is one of the most basic forms of insurance and the most common among the kinds of life insurance settlements. After underwriting and processing your life insurance claim, the insurance company pays your beneficiaries in a lump-sum, tax-free amount. Like with any other life insurance payments, there are no limitations to what can be done with the money. The beneficiary could use the entire death benefit to pay for debts, to invest, or even on boats and cars.

However, if the money is invested in any way, then any returns generated from that investment would constitute income for tax purposes.

How Much Does Life Isurance Cost?

Well, you can easily guess that the lump-sum payments are perfect if you can rely on a beneficiary. If you are worried that your beneficiary could easily exhaust the funds, then turn your search to the other type of settlement which would offer a series of installments.

2. Interest only

In an interest only option life insurance, the insurance company retains the principal of the death benefit and only pays any earnings generated from it to the beneficiary. That means you have to take your money and contribute to or fill this account for your loved one and this is what this formation of the settlement format looks like. The beneficiary could receive regular interest payments and may get additional balances of the principal upon request. But no large cash payment is made upfront, so you can worry less about your beneficiary spending the money all at once. The purpose of an interest only option life insurance is to provide a consistent income stream to support the beneficiary’s lifestyle while leaving the principal sum alone so it can continue growing and serve as an emergency fund if the need arises. This is useful when the beneficiary is a young person or does not have so much experience in handling money.

You should compel your insurance company to clarify the investment of the death benefit after your demise. If you can then estimate the growth rate, you can then project the size of the interest payments that your beneficiary would receive.

3. Interest accumulation

An interest accumulation settlement is not a payout at all. In this case, the insurance company holds the funds indefinitely on behalf of the beneficiary. The interest earned is added to the account balance. If the beneficiary needs to access the funds, he or she could request a withdrawal. As with an interest-only settlement, it’s wise to confirm that these funds will be invested to earn a competitive growth rate.

You’d select an interest accumulation payout when the beneficiary is financially stable and plans to use the money as an emergency fund.

4. Fixed period

The fixed-period settlement option leaves the death benefit and earned interest with the insurer, who distributes equal payments over a specific period. That monthly check functions as tax-free income and can help your beneficiary cover living expenses. The purpose of the fixed-period settlement option life insurance is to ensure your beneficiary receives a consistent stream of income over a set length of time. It’s most appropriate when the beneficiary has a debt like a mortgage that requires consistent payments. The option is also good if the beneficiary is a resident in a nursing home or assisted living because the regular payments make it possible to pay for being in such communities.

You can also indicate a contingent beneficiary who will receive the payments upon the death of the primary beneficiary.

5. Fixed amount

A fixed amount settlement structures the benefit as a fixed monthly payment. That payment will last until the principal and any earned interest are depleted. Your beneficiary may have the option to raise or lower the monthly amount. The fixed-amount settlement does discourage your beneficiary from spending the benefit all at once, but the money can still run out quickly if the payment is too high. You’d select this settlement format if your beneficiary needs temporary help with living expenses — to get through law school, for example.

6. Life income (also known as life-only or life annuity)

The life income option is comparable to an annuity. When deciding on this settlement option life insurance, the policy’s beneficiary will be promised to get an income for the balance of his or her life – irrespective of how long it may be.

The life income settlement format provides a stream of payments that lasts until the beneficiary passes away. A life annuity provides a reliable source of income, but there are drawbacks. If you request settlement as life-only, your beneficiary may not be able to change to a different settlement format. Extra withdrawals would not normally be allowed, either. It’s also likely you won’t know the payment amount. That’s because the payments would be calculated based on the death benefit and the beneficiary’s age when you pass away. Younger beneficiaries would get a longer stream of smaller payments. Older beneficiaries would get a shorter stream of larger payments. For that reason, life annuity settlements are often more advantageous to older beneficiaries.

Interest-Only vs. Interest-Accumulation Settlements

Interest only option life insurance is another type of life settlement. Instead of receiving a lump sum for your policy, the money gets invested and gains interest. Your beneficiary then receives this interest in monthly installments. They can also withdraw funds from the principal. Make sure to understand whether your settlement includes fixed or variable interest.

Interest accumulation settlements also involve the investment of proceeds of your life settlement. However, instead of paying the interest out each month, these settlements add that interest to the principal, growing the fund. This option is common for those who are financially stable and looking to invest in an emergency fund.

What Are the Pros and Cons?

Interest-Only Settlements

– Pros

- It keeps your beneficiary from spending all your settlement funds at once

- Can access the principal if needed

– Cons

- Payments are smaller than regular annuity payments

Interest-Accumulation Settlements

– Pros

- Principal will grow over time

- Can serve as an emergency fund

– Cons

- No regular payments

- Oversight is needed to ensure the funds are invested wisely

Strengths and Weaknesses of Settlement Options

Settlement options can meet the needs of common financial worries a beneficiary or policy owner might have about managing a large payout from a life insurance policy. However, the methods settlement options use to limit the amount of money a beneficiary will receive at one time are largely voluntary on behalf of the beneficiary.

This means that if the policy owner has serious concerns about the beneficiary’s ability or willingness to accept the limited payout from certain settlement options, the policy owner may require stronger legal impediments to the money such as a trust that receives the death benefit proceeds. The settlement option life insurance is not a substitute for more specialized legal and/or financial planning that seeks to protect beneficiaries from things such as bad financial habits or predatory financial advice.

Settlement options are instead best thought of as helpful systems to organize the distributions of funds in a manner more conducive to how a majority of Americans manage their financial lives.

Which settlement option life insurance Is Best?

As we wrap up all of these are settlement options for life insurance policies. Many policies provide settlement option life insurance and decisions about how the money is paid out to the individuals that you have selected. You could spend some time thinking about what payment schedule would be good for them once you are no more. Just like there is no “best life insurance” there is no best type of life insurance settlement option. It all depends.

The primary factors to consider are the speed and regularity with which payments will be dispersed. Don’t hesitate to consult with your life insurance agent if you have any questions.

Want to find out how much you could sell your life insurance for? Find out instantly with our free life settlement calculator.

FAQs

1- Which Life Insurance Settlement Option Guarantees Payments?

A life settlement can be structured as an annuity that will feature guaranteed payments until the death of the policy’s beneficiaries.

2- What Is a Single-Life Settlement Option?

In a single-life settlement, any payments agreed upon will cease upon the death of the annuitant or beneficiary. In contrast, a joint life settlement will continue paying out until the annuitant’s spouse also passes away (assuming they survive the annuitant).

References:

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.

“A life insurance settlement can be a sensible way to generate some cash. However, before you sell your policy, make sure you no longer need the financial protection it offers. If feasible, consult with a fiduciary financial advisor to assess your liquidity needs and explore all available options.”

Thomas J. Brock, CFA®, CPA Investment, Corporate Finance and Accounting Professional