Are you the only source of income in your family? Do you have an idea about what your family will do in case any mishap happens to you? Well! If not, then it’s time to think about it now. Smart universal life insurance could save you and your loved ones in difficult situations.

This insurance plan comes with considerable flexibility to adjust the coverage according to the policyholder’s needs change. It is specifically designed to meet the needs of the insured throughout the life stages of the insured. So it can be an affordable choice for your overall financial plan.

In this blog post, we will delve into the details of smart universal life insurance plans. We will also explore different other types of universal life insurance along with smart and how to get their quotes. Let’s get started!

What is a Smart Universal Life Insurance Plan?

A smart universal life insurance policy is a type of universal insurance that is designed in an all-in-one life insurance solution. It offers you flexibility, affordable protection, as well as an opportunity to save for the future of whom you care about.

It provides the security of guaranteed coverage for the first 10 years as long as the premiums are paid. Being a product of universal life insurance, smart life insurance comes with a cash value component that has the potential to build value aside from the death benefit. This will grow at a guaranteed minimum interest rate of 3% per year. In addition, the insured can also access the accumulated cash during his life for particular needs like buying a house or paying down a mortgage.

How does smart universal insurance work?

Here’s how this policy works:

The premiums the insured person pays go into his account value.

A part of this account is used to cover the insurance cost and any other monthly charges including maintaining records and others.

However, the other portion goes to the cash value component. It will grow depending on the interest accompanied by the certificate’s account value.

Generally, cash value accumulates on a tax-free basis until the policyholder withdraws it as cash. He can also use this amount to pay the costs of his insurance policy.

What is the minimum age limit for smart universal life insurance?

Coverage for smart universal life insurance is available for the ages 0 to 85 with the initial coverage amount of $25,000. However, it may be as low as $10,000 for kids and juveniles. Smart UL is underwritten on a non-medical basis (for 75 or plus), which means insurability based on answers to medical and other application queries along with underwriting searches and reviews. Furthermore, the policy is available on an accelerated or medically underwritten basis.

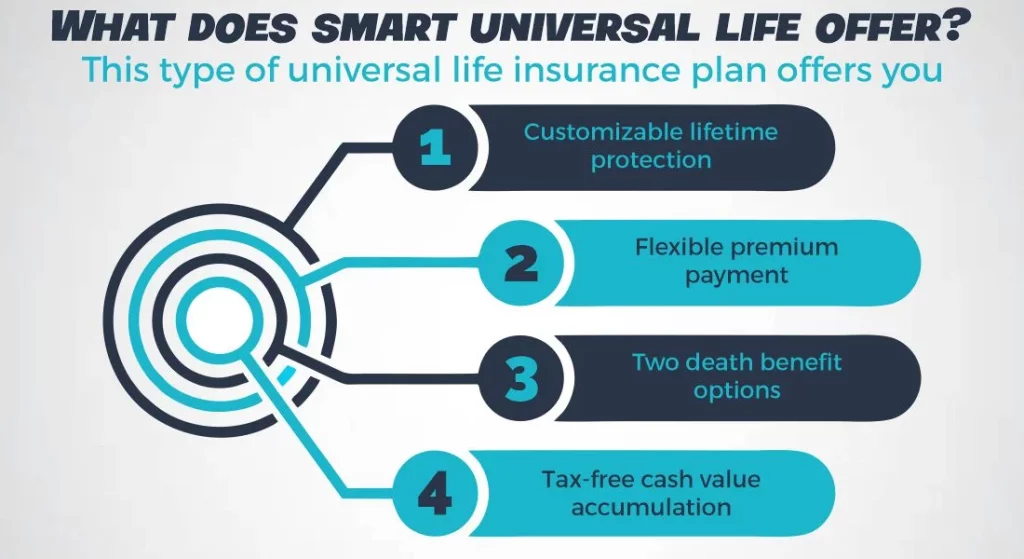

What does smart universal life offer?

This type of universal life insurance plan offers you:

How Much Does Life Isurance Cost?

- Customizable lifetime protection to meet the needs of the middle market.

- Flexible premium payment with minimum and maximum amounts.

- Two death benefit options.

- Optional riders for added flexibility

- Tax-free cash value accumulation

Does smart UL come with two death benefit options?

Yes, you heard it right! There are 2 death benefit options available with smart universal life insurance. The first one is the Level death benefit and the other is the Increasing death benefit. In level death benefit, the death benefit amount is equal to the payout at any given time. However, the amount at risk can be calculated by taking the face amount and subtracting the account value.

On the other hand, the death benefit of increasing death benefit is equal to the face amount as well as account value at any given time. The amount at risk will be the face amount at any given time of the plan.

How is smart universal insurance an affordable option?

This life insurance plan can be an affordable starting point for the financial plan you are setting for yourself and your family. It helps you by supporting the important changes and challenges in your life. It offers your lifetime (permanent) life insurance coverage and a death benefit that is typically free of any income tax and probate.

Additionally, the premium of the policy is very flexible, lying within maximum and minimum limits and tax-free growth on the cash value component. However, some restrictions may also apply to cash value components. The insured can withdraw funds or surrender the policy anytime for cash and get loans from the cash value.

What are the different types of universal life insurance plans?

Generally, there are three types of universal life insurance policies. These are:

- Indexed Universal Life

- Variable Universal Life

- Smart Guaranteed Universal Life

Let’s discuss them in detail.

1- Indexed Universal Life

Indexed universal life insurance, also abbreviated as IUL, allows the policyholder to earn interest that’s tied to the performance of index funds like the S&P 500. However, the insurance provider can limit the rate of return. However, the insured may be able to select to earn all or a part of the cash value in a fixed-rate account.

2- Variable Universal Life

A type of universal life insurance abbreviated as VUL allows the policyholders to choose how to invest their policy’s cash value component. They may have options like bonds, stocks, and mutual funds to invest in different accounts.

3- Smart Guaranteed Universal Life

Guaranteed universal life insurance is also known as no-lapse guarantee universal life insurance. It offers a guaranteed death benefit and premiums to the insured that remain the same throughout the policy. These policies often come with an end date that the insured selected at the time of policy purchase.

Policyholders are allowed to go for an advanced age like 95, 102, 121, etc. and the plan will remain active until that age. Meanwhile, unlike other types of permanent insurance, a GUL may or may not have a cash value portion.

How to get universal life insurance quotes?

When exploring universal life insurance options, it’s imperative to get accurate quotes to make informed decisions about your future. Here is a step-by-step guide to help you with the process:

1- Research: First you have to search for some famous and reputable insurance companies offering universal life insurance coverage. Opt for those who are giving online quotes for easy access.

2- Give information: To obtain an accurate quote you have to provide exact information about your age, health condition, gender, coverage amount, and any benefits or additional riders you want to add to your insurance plan.

3- Compare different quotes: Once you have some quotes, take some time to compare them. While comparing not only consider the premium cost but also policy features, cash value potential, and other essential things.

4- Contact a professional: After doing all the above steps, if you are still unsure about any information or need further guidance, contact a professional. Don’t hesitate to consult an insurance advisor as he gives you expert advice according to your situation.

Final Thoughts

Smart universal life insurance offers you a modern evolution of traditional coverage being adaptable to alternative circumstances while securing the financial future of the insured. However, it’s important to understand different types of universal life insurance and get accurate quotes. These things will help you to make a well-informed decision that aligns with your insurance policy goals.

Frequently Asked Questions (FAQ)

1- Is it possible to change the coverage of Smart Universal Life Insurance according to your needs?

Yes, smart universal insurance offers considerable flexibility to the insured. It allows them to adapt the coverage according to their changing needs which makes it one of the most adaptable options among other insurance plans.

2- What are the benefits of Smart UL over other insurance types?

It offers you lifelong protection, tax-free cash value accumulation, and comprehensive coverage. All these advantages make it a versatile option that can be adaptable at various life stages.

3- What is the difference between level and increasing death benefit options?

Well-level death benefit remains equal to the payout while the increasing death benefit equals the face amount and the account value. Furthermore, the amounts at risk are different in both these options.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.