Life insurance is like a financial safety net, a promise that your loved ones will be taken care of when you’re no longer around. It’s that reassuring pat on the back, knowing that your family’s future is secured. But, life insurance can sometimes feel like a locked treasure chest, particularly for those with health conditions or tight budgets.

That’s where State-Regulated Life Insurance Programs come into play. They’re like the Robin Hood of the insurance world, designed to level the playing field and ensure that everyone gets a shot at financial security. But are they too good to be true? Are State-Regulated Life Insurance Programs legit?

In this blog post, we’ll unveil the mysteries surrounding these programs. We’ll explore what they are, how they work, and whether they’re a smart choice for you. So, fasten your seatbelts as we journey into the realm of state-regulated insurance, debunking myths and discovering the truth. Your financial peace of mind might just be a few paragraphs away.

What Is a State-Regulated Life Insurance Program?

State-Regulated Life Insurance Programs, also known as State-Run Life Insurance or State-Backed Life Insurance, are insurance programs provided by state governments. These programs are designed to offer life insurance coverage to individuals who might not easily obtain coverage through traditional private insurance companies. They are typically aimed at helping those with health conditions that may be considered high-risk by private insurers or individuals with low income.

What sets State-Regulated Life Insurance Programs apart from private insurance is the state’s involvement. These programs are funded by the state and often carry certain eligibility criteria. They can be particularly appealing to individuals who find it challenging to secure life insurance through the private market.

How Does a State-Regulated Life Insurance Program Work?

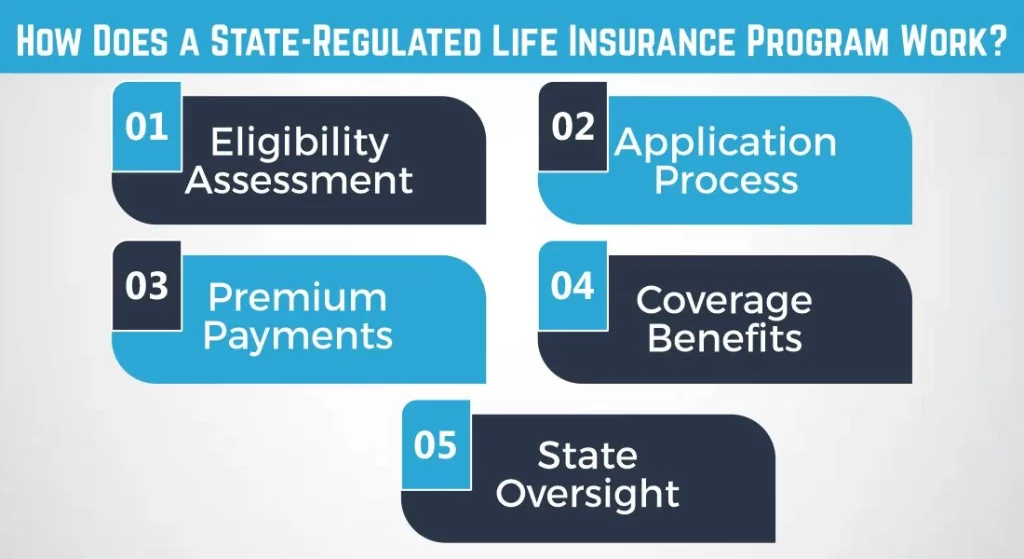

Understanding how State-Regulated Life Insurance Programs work is essential for making an informed decision. These programs typically involve the following key steps:

Eligibility Assessment: To qualify for a state-regulated program, individuals must meet specific eligibility criteria set by the state government. These criteria may include factors like income, health status, or age.

Application Process: Once eligible, you will need to apply for the program. The application process may require you to provide personal information and undergo underwriting.

Premium Payments: If approved, you will be required to pay regular premiums. The cost of these premiums is usually determined by your age, health condition, and the coverage amount you choose.

Coverage Benefits: State-regulated programs offer life insurance coverage, which means that if the policyholder passes away, their beneficiaries will receive a death benefit.

State Oversight: State governments regulate and oversee these programs to ensure that they meet their stated objectives and provide legitimate insurance coverage.

What Is the Cost of a State-Regulated Life Insurance Program?

The cost of a State-Regulated Life Insurance Program can vary widely depending on the specific program, the coverage amount, and the individual’s eligibility. In many cases, these programs offer affordable premiums, making life insurance more accessible to a broader range of people. However, it’s essential to understand that these programs may have limitations in coverage and benefits compared to private insurance options.

Here is a table to provide you a clear overview of the potential costs associated with a State-Regulated Life Insurance Program:

| Age Group | Monthly Premium | Coverage Amount |

| 18 – 30 | $20 – $50 | $50,000 – $100,000 |

| 31 – 45 | $40 – $80 | $50,000 – $150,000 |

| 46 – 60 | $60 – $120 | $50,000 – $200,000 |

| 61+ | $100 – $200 | $50,000 – $250,000 |

Please keep in mind that these numbers are estimates, and actual costs may vary depending on the specific State-Regulated Life Insurance Program, your health status, and other factors. It’s essential to contact your state’s insurance department or the program provider for precise and up-to-date pricing information tailored to your situation.

What Are the Benefits of State-Regulated Life Insurance?

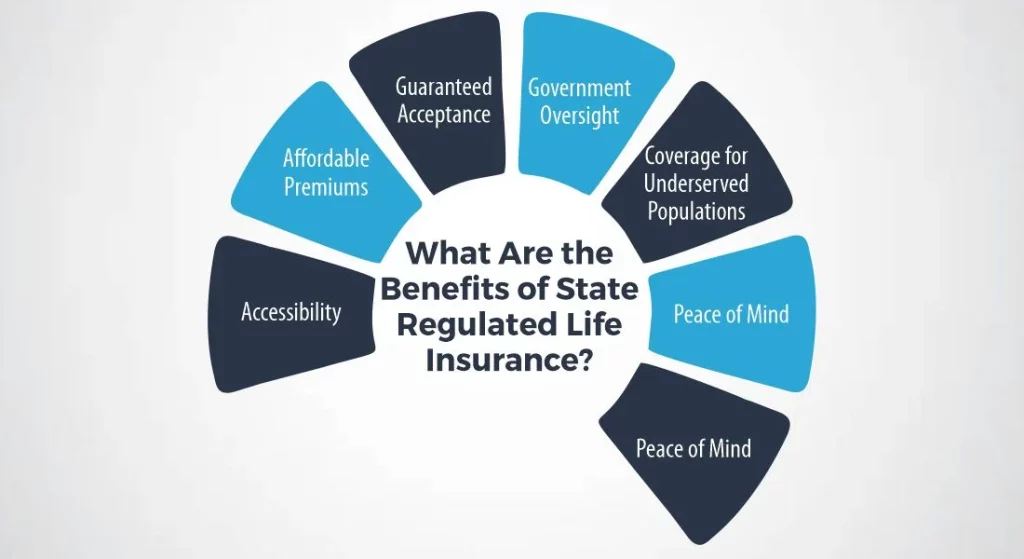

State-Regulated Life Insurance Programs offer several potential benefits, making them an appealing option for certain individuals. Here are some of the key benefits of these programs:

Accessibility

State-Regulated Life Insurance Programs are designed to provide life insurance coverage to individuals who may have difficulty obtaining it through traditional private insurers. This includes people with pre-existing health conditions or those with lower incomes who might not qualify for or afford coverage elsewhere.

Affordable Premiums

State-regulated programs often offer competitive premiums, making life insurance more affordable for individuals who might be on a tight budget. These lower premiums can be especially attractive to those who need coverage but have limited financial resources.

Guaranteed Acceptance

In some cases, these programs offer guaranteed acceptance, meaning you won’t be denied coverage based on your health condition. This is a significant advantage for individuals with serious medical issues who might face rejection from private insurers.

Government Oversight

State involvement in these programs adds an extra layer of oversight and regulation. This can provide a sense of security for policyholders, knowing that the program is subject to government scrutiny, which can help prevent fraud and ensure the program operates as intended.

Coverage for Underserved Populations

State-Regulated Life Insurance Programs are often targeted at underserved populations, addressing the insurance needs of those who might otherwise be left without coverage options.

Peace of Mind

By securing life insurance through these programs, policyholders gain the peace of mind that their loved ones will be financially protected in the event of their passing. This peace of mind is a significant benefit for policyholders and their families.

Flexibility

These programs may offer flexibility in terms of coverage options and premium payments, allowing policyholders to tailor their insurance to their specific needs and financial situation.

Are State-Regulated Life Insurance Programs Legit?

Yes, State-Regulated Life Insurance Programs are typically legitimate. These programs are overseen and regulated by state insurance authorities, ensuring they meet specific standards and provide genuine insurance coverage. While the concept of state-backed insurance may raise questions, it’s important to understand that the primary aim of these programs is to make life insurance more accessible to individuals who face difficulties securing coverage through private insurers.

However, like any financial decision, it’s crucial to exercise due diligence and carefully research any State-Regulated Life Insurance Program you consider. While they are generally legitimate, it’s possible that some unscrupulous entities may attempt to take advantage of consumers. To ensure you’re dealing with a legitimate program, verify its authenticity through your state’s insurance department or regulatory authority and review the program’s terms and conditions thoroughly.

Is There Government Sponsorship for State-Regulated Life Insurance Programs?

Yes, State-Regulated Life Insurance Programs typically have government sponsorship. State governments initiate, fund, and administer these programs. The primary aim of government involvement in these programs is to make life insurance more accessible and affordable for individuals who might face challenges obtaining coverage through private insurers.

Government sponsorship serves several purposes:

Affordability

By providing funding and resources, state governments can help keep the premiums for these programs affordable, making life insurance coverage attainable for a broader range of individuals, including those with lower incomes.

Accessibility

State-sponsored programs often have less stringent underwriting requirements, making it easier for people with health conditions or other factors that might lead to denial from private insurers to obtain coverage.

Consumer Protection

Government oversight ensures that these programs adhere to established standards and provide legitimate insurance coverage. This regulatory role helps protect consumers from potential fraud or abuse.

Targeted Assistance

Government sponsorship allows the state to target specific underserved populations or groups facing challenges in accessing life insurance.

Social Responsibility

State governments view these programs as a means to fulfill a social responsibility of ensuring that their residents have access to basic financial security in the form of life insurance.

The extent of government sponsorship can vary from one state to another, as each state may have its own approach to providing state-regulated insurance programs. The specific eligibility criteria, coverage options, and funding sources can also differ from state to state. Therefore, it’s essential to review the details of the particular State-Regulated Life Insurance Program in your state to understand the level of government involvement and the benefits it offers to policyholders.

Here’s What They Mean by “Government Regulated”

When we refer to “government-regulated” in the context of State-Regulated Life Insurance Programs, it means that these programs are subject to oversight and regulation by state insurance authorities. These regulatory bodies ensure that the programs adhere to specific standards and provide legitimate insurance coverage.

Should you choose State-Regulated Life Insurance?

Whether you should opt for a State-Regulated Life Insurance Program depends on your individual circumstances. These programs cater to individuals facing challenges in obtaining private life insurance, like those with pre-existing health conditions or low income.

However, before making a decision, it’s essential to carefully review the specific program’s terms, coverage limits, and costs. Additionally, you should compare these state-regulated options with private insurance to determine which one best meets your needs and financial situation.

Final Thoughts

In conclusion, State-Regulated Life Insurance Programs are a legitimate and valuable option for many individuals who need life insurance coverage. They offer accessibility and affordability, especially for those who may face difficulties in the private insurance market. However, it’s crucial to conduct thorough research, understand the program’s terms, and assess your specific needs before making a decision. Always consider seeking advice from a financial advisor or insurance expert to make an informed choice.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.