How are Survivorship Life Insurance Policies helpful in Estate Planning?

Last Updated on: August 27th, 2024

Reviewed by Joyce Espinoza

- Licensed Agent

- - @InsureGuardian

First thing, let’s define survivorship life insurance and how it can be helpful in your estate planning.

Most are familiar with regular life insurance, which covers a single person. When that person passes, the insurer pays the death benefit to their beneficiaries.

Table of Contents

ToggleSurvivorship life insurance is a type of permanent life insurance. It is often sold as whole or universal life insurance which can accumulate a cash value, enabling the policyholders to potentially take tax-free withdrawals from, or borrow against, their policy.

The policy covers two people, remaining in effect as long as the premiums are paid. The policy covers the duration of both policyholders’ lifetimes. When the first person dies, the surviving policyholder automatically retains ownership of the insurance with no tax issues.

Upon the death of the surviving policyholder, the insurer pays the death benefit to the designated beneficiaries, which can range from the adult children of the policyholders to qualified charitable entities or foundations, and more. Let’s find out more about how are survivorship life insurance policies helpful in estate planning.

Survivorship Insurance In Your Plan

If you are looking to use life insurance to integrate into estate planning then you need to understand whether a survivorship life insurance policy will suit your needs.

Honestly, this is one of the simplest choices to make most of the time. More specifically, if a policy covers two people, for example, a married couple, and it is improbable that the second person will need the payout for living expenses as soon as the first one passes, then it is most likely you will need to use a survivorship policy.

That way, the death benefit is transferred directly and free of taxes to the surviving spouse. The death benefit will then be transferred to the beneficiaries in the event of the death of the surviving spouse.

How Much Does Life Isurance Cost?

This is important because the current tax laws allow many marriages to apply the federal estate tax only when the second spouse dies to avoid selling the assets to pay the estate taxes.

Unlike the situation where the surviving spouse pays taxes, the surviving spouse is protected and the burden is passed to the beneficiaries who will inherit the property.

Why Do You Need An Estate Plan?

Many people think they don’t have much value, and as such, think an estate plan is unnecessary for their circumstances.

Let’s put that to rest. If you are reading this, you probably do have assets…and an estate. No matter how much you do or don’t have in terms of assets, ranging from a vehicle and a home to retirement accounts, savings, collectibles, lifetime season tickets, real estate, and much more, you do have an estate.

Given you worked hard to accumulate what you have, and probably have a family or charity or organization you’d like your assets to go to upon your passing, then an estate plan is a necessity.

And to ensure your plans are followed in terms of seeing those assets pass to whom you want them to in the quickest, most efficient way possible, again, you must have an estate plan.

Additionally, when properly configured, they can help ensure the tax liabilities due on an estate and your beneficiaries can be minimized to the fullest extent possible.

When Should You Start an Estate Plan?

Estate planning – many people think that estate planning is something only for the elderly – for people who are already retired or close to retirement.

The truth is that numerous advisors will encourage an eighteen-year-old legal adult to start a plan and be ready to make changes every three to five years as life progresses.

Why?

Again, no matter how many assets you own or their value, you want to protect them from creditors or in the event you get dragged into a lawsuit. You also want to be able to choose where they go when you pass on rather than your estate going to probate and be determined by a judge.

If you are among the majority of people who never made a plan at eighteen and wondering how are survivorship life insurance policies helpful in estate planning then the answer is you should start planning now to safeguard yourself, your beneficiaries, and your assets.

Pros and Cons of Survivorship Life Insurance Policies

Just as is the case with any kind of life insurance, survivorship life policies have both advantages and disadvantages.

– Some of the positive aspects may include:

- People can get more coverage than they would individually

- The policy can be less expensive than buying two life insurance policies

- You could receive certain tax advantages for estate planning purposes

- You will guarantee an inheritance for your loved ones

- Policyholders may be able to tap into a policy’s cash value while they are still alive

- Allows you to guarantee that a loved one or dependant who needs permanent care will get help after you die

- When you are having trouble qualifying for life insurance because of your age or health, survivorship policies can allow you to get coverage or increase the coverage you are eligible for

– The drawbacks to survivorship life insurance might include:

- A surviving partner will get no death benefit after the first person on the policy dies

- Divorce may complicate a second-to-die policy

- Your partner cannot be a beneficiary, so people hoping life insurance will provide for a partner after death need to get separate life insurance policies or a first-to-die joint life policy.

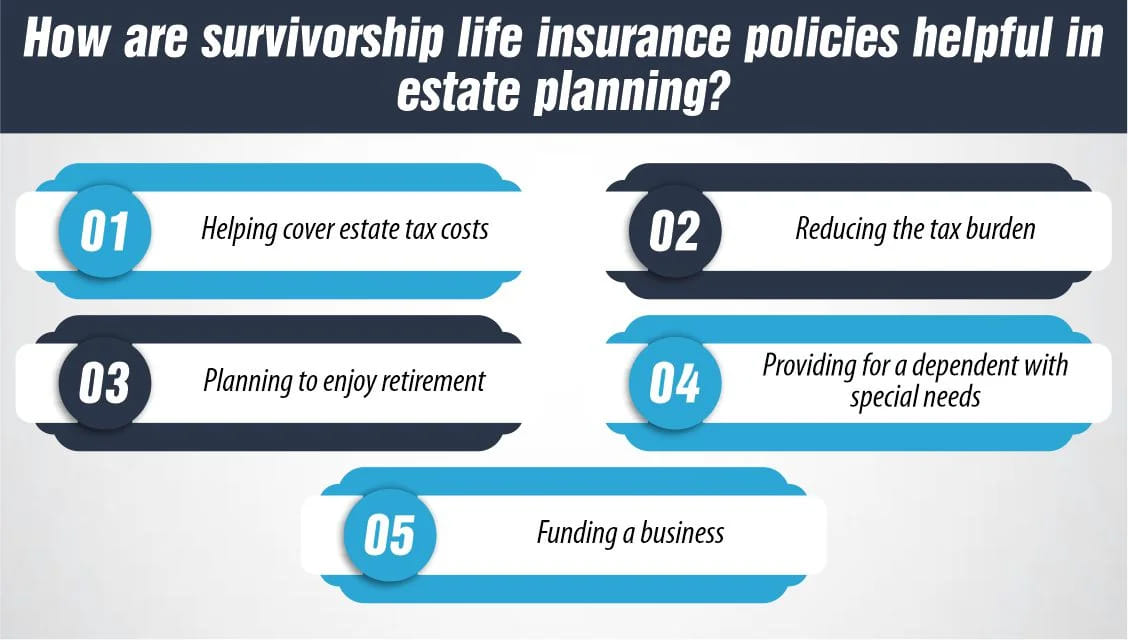

How are survivorship life insurance policies helpful in estate planning:

Several advantages come with having a survivorship life insurance policy for a married couple. Such a policy can be purchased by those who have a civil partnership, cohabit, or are business partners. These survivorship life insurance policies may be cheaper than two policies per two partners, but it doesn’t apply to all policies.

A survivorship life insurance policy can also come in handy when it comes to estate planning. Here is How are survivorship life insurance policies helpful in estate planning. Consider the following examples:

– Helping cover estate tax costs –

The unlimited marital deduction also shields an estate from paying an estate tax upon the death of a married individual before the spouse. In simple terms, if one of the partners dies, the other partner can inherit the whole estate from the deceased one free of tax. If one of the second spouses dies, then an estate tax may be due in the event the sum of the estate being transferred to the beneficiaries equals or exceeds the amount of the estate tax exemption. The death benefit from a survivorship life insurance policy could potentially help pay the estate taxes and other expenses in this situation.

– Reducing the tax burden –

The payout of the survivorship life insurance policy can be larger than that of an individual policy. Another reason is that the death benefits of a life insurance policy are not subject to taxation in Texas if the beneficiary is not an estate or any other legal entity.

– Planning to enjoy retirement –

Some people think that the survivorship life insurance policy is effective only if a pair has significant net assets. This is not always true. For any retiree who wants to spend their hard-earned money enjoying the balance of life post-retirement but does not feel comfortable with the idea of leaving behind little or nothing for the next generations, then the survivorship life insurance policy could work best.

– Providing for a dependent with special needs –

A survivorship life insurance policy can also be useful if a couple has a child or other dependent with a condition that requires extra care. The policy payout might be beneficial in catering to the needs of a dependent either directly or through a special needs trust.

– Funding a business –

Survivorship policy is also suitable for those with a business; this policy aims to keep a business running once the business owner has died. The proceeds from the survivorship life insurance policy could go straight to your business partners to keep the company going during the transition period. On the other hand, the death benefit could be assigned to the children, which would ensure that the organization is transferred to new leadership as smoothly as possible.

The specific way you use this type of policy in estate planning will depend on the specifics of your situation. Upon further review, you may decide this type of policy isn’t right for you.

Conclusion:

Survivorship life insurance policies can be a valuable tool in estate planning. They help ensure that your loved ones are financially protected, provide funds to cover estate taxes, and support charitable giving goals. By including survivorship life insurance in your estate plan, you can create a more secure financial future for your heirs while preserving your legacy. Regularly reviewing your policy ensures it continues to align with your evolving needs and estate planning objectives.

FAQs

1- What is the Purpose of Survivorship Life Insurance in Estate Planning?

Estate planning is a critical aspect of financial management, ensuring the efficient distribution of assets upon the death of the policyholder. Survivorship life insurance serves as a valuable tool for achieving estate planning goals, including preserving wealth, minimizing estate taxes, and providing financial security to beneficiaries.

2- How to Incorporate Survivorship Life Insurance Policies into Your Estate Plan?

To add survivorship life insurance to your estate plan:

- Set Your Goals: Decide what you want to achieve with your estate plan, like providing for your family or reducing taxes.

- Get Professional Advice: Speak with a financial advisor to see how this insurance fits your plan.

- Decide on Coverage: Choose an amount that suits your estate’s needs.

- Pick the Right Policy: Select a policy type that matches your situation.

- Keep It Updated: Review your policy regularly to ensure it still fits your goals and circumstances.

References:

- https://www.doaneanddoane.com/survivorship-life-insurance-in-estate-planning#:~:text=In%20the%20world%20of%20estate%20planning%2C%20Survivorship%20Life%20Insurance%20plays,and%20uphold%20your%20family%20values.

- https://www.dhclaw.com/faqs/estate-planning-survivorship-life-insurance.cfm

- https://www.usaa.com/inet/wc/advice-insurance-considering-survivorship-life-insurance?akredirect=true

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.