What Happens to Unused Long-Term Care Insurance?

Last Updated on: May 21st, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Imagine paying monthly insurance premiums for a policy for years, only to never use it. This is the most common problem many long-term care insurance policyholders are facing. Here is a question: What actually happens to the money? Is this money vanishing into thin air?

Table of Contents

ToggleThe answer to this question is simple. The truth is, long-term care insurance doesn’t always work the way people expect. Some long-term care insurance policies may leave you with nothing if they are unused, but some of the policies offer surprising benefits, like refunds or life insurance payouts. In this article, we’ll uncover what really happens to unused long-term care insurance and how to make sure your money works for you, no matter what the future holds.

Long-Term Care Insurance Basics

Long-term care is a special kind of policy that will help you pay for services as you get older. The services include help at home, assisted living, going to an adult daycare, or staying in a nursing home, and so many other things that regular health insurance or Medicare usually don’t pay for. This insurance will help you to protect your savings, make things easier for your family, and give you more choices in where and how you receive care.

You usually pay for the long-term life insurance for many years, and hoping it will help you out if you need any care or services in your life. But unlike the insurance policies, such as car or health, you might never use this policy if you stay healthy all your life and pass away suddenly.

When You Don’t Use Your Long-Term Care Insurance Benefits

Most of the insurance companies and their plans don’t give your money back if you don’t use your long-term care insurance. The company keeps the premiums that you have paid, and there is no refund, and nothing goes to your family.

Why This Happens

Here is the question: Why does this happen?

Long-term care insurance is designed to work like a use-it-or-lose-it plan. This means that you are paying for protection, not to get money back. If you don’t need the care, you don’t get a refund. Insurance companies set prices based on the chance you will use the benefits, not to help you grow your money like an investment. But newer plans, like hybrid long-term care insurance, give you more options. We’ll explain those later.

Long-Term Care Insurance: Costs vs. Usage

Long-term care insurance is quite affordable. But not everyone ends up using their coverage. AALTCI says that about half of the people who buy long-term care insurance pass away without ever using the benefits from the policy. Only about 35% ever use their benefits. These are the people with plans that only start paying after 90 days of care.

How Much Does Life Isurance Cost?

Return of Premium Long-term Care Insurance

In most of the long-term care policies, if you do not use the policy and take the benefits from it, later you will not get your money back. But here are some exceptions;

Return of Premium Policies

Some of the long-term care insurance policies offer a return of premium option. This option means that your family will get some of the money back if you don’t use it before you pass away. These plans combine long-term care coverage with life insurance, so they also include a death benefit.

Each return-of-premium policy is different:

- Some policies give back all the money you paid and also pay a death benefit.

- Others return only the premiums you paid, minus any claims made.

- Some return less money as you get older.

Other Long-Term Care Coverage Options

There are some other options to get long-term care benefits besides regular insurance. Two common options are:

1. Annuities With Long-Term Care Benefits

Some fixed and indexed annuities have agreements that give you extra money if you need long-term care. Once it’s confirmed you need care, the annuity will start paying you more money each month, based on how much you’ve paid in.

2. Hybrid Long-Term Care Insurance

Hybrid long-term care life insurance is a type of life insurance that also helps pay for long-term care. It’s usually easier to get approved for than regular long-term care insurance. Some hybrid policies even give you coverage for long-term care for your whole life or without limits.

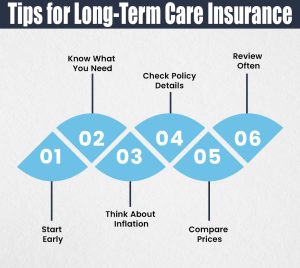

Tips for Long-Term Care Insurance

As we get older, planning for long-term care insurance is important. For that, here are some easy and simple tips to help you when you buy a long-term care insurance plan;

Start Early

Long-term life insurance is easy to get approved when you buy it in your early 50s or 60s, and this will also help you save money.

Know What You Need

Think about the kind of care you will need, like help at home, living in a special care home, or a nursing home. You have to make sure your insurance covers those.

Think About Inflation

Adding inflation protection means your insurance will pay more in the future as the cost of care gets higher. This is helpful if you buy insurance at a younger age because it keeps up with rising prices.

Check Policy Details

Don’t add extra features that cost more, but they will not going to help you.

Compare Prices

Insurance prices can be very different from one company to another. You have to check a few options to find the best deal and coverage for you.

Review Often

It might be possible that your needs change over time, so you have to check your policy regularly to make sure it still meets your needs. By following these tips, you can choose the right long-term care insurance that fits your health, budget, and future care plans.

Final Thoughts

Long-term care insurance is an important protection against future uncertainties, but it is considered a financial loss when you don’t use your long-term care insurance. If you don’t use a regular policy, you usually don’t get your money back. However, some new options like hybrid policies or return-of-premium plans can give money back or offer other benefits. It’s important to understand your policy and choose the one that fits your needs. If you’re unsure what to do with your current plan, talk to Insure Guardian to help you make the best choice for your future.

Frequently Asked Questions (FAQs)

1. What happens to long-term care insurance if you never use it?

Generally, no. Traditional long-term care insurance does not refund unused premiums, unless you have a return-of-premium option or a hybrid policy.

2. Can you cash out a long-term care policy?

If you decide you need the money for something else, you can typically receive a cash value that can be roughly equal to or less than the total premiums paid.

3. What happens to long-term care insurance when you die?

If it’s a traditional policy, the coverage ends, and no payout occurs. If it’s a hybrid policy, your heirs may receive a death benefit.

4. Should I keep paying for long-term care insurance if I think I won’t use it?

It depends on your health, financial situation, and the type of policy. Before canceling, explore adjusting your current plan or switching to a hybrid policy. Speaking with a financial advisor can help you make a better decision.

5. Is it a good idea for me to cancel my long-term care insurance?

It depends. Canceling could leave you without future coverage and no refunds. Consider policy adjustments or hybrid options before canceling.

Are you ready to make sure your long-term care insurance works for you, not against you? No matter if you’re considering a new policy or reviewing an existing one, it pays to understand your options. Don’t leave your future and your money to chance.

Speak with a licensed insurance advisor today to explore plans that protect your health, your finances, and your legacy.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.