Life insurance is like a financial safety net, a promise that ensures your loved ones have a cushion to fall back on when you’re no longer around. In this fast-paced world, securing the future of your family is a priority, and that’s where FintechZoom comes into play. It’s not just any insurance; it’s a trusted companion in your journey towards financial peace of mind.

But before you dive in, you need to understand your options, make informed choices, and find the best fit for your unique circumstances. That’s where this comprehensive guide steps in. We’ll take you on a journey through FintechZoom Insurance, explaining what it is, the types available, how it works, and even help you weigh the advantages and disadvantages.

Whether you’re a financial expert or just starting to dip your toes into the world of life insurance, this guide is your compass in the realm of FintechZoom. So, let’s explore your options and pave the way for a secure and stable future.

FintechZoom Life Insurance Overview

Life insurance, a financial product designed to provide financial security to your loved ones in the event of your passing, is the core of FintechZoom’s insurance offerings. FintechZoom is a popular choice for those seeking reliable coverage.

What is FintechZoom?

FintechZoom Insurance is a financial product offered by FintechZoom, a leading fintech company. It provides policyholders with a death benefit that is paid out to their beneficiaries upon their passing. This death benefit can be used to cover various expenses, such as funeral costs, outstanding debts, and providing financial support to dependents.

Fintechzoom Life Insurance: Key Features

Let’s talk about the cool stuff in Fintechzoom. It’s not just a policy; it’s a bunch of features that make it stand out:

Your Way Coverage: Fintechzoom lets you pick what works for you. It’s like choosing your favorite toppings; they’ve got options for every taste.

Time or Forever: Whether you need coverage for a bit or forever, Fintechzoom has plans for both. You choose what fits your life.

Money Support: If things get tough and you’re not around, Fintechzoom makes sure your people get a chunk of money. It’s like a safety fund for them.

Cash on the Side: Some Fintechzoom plans let you save up a bit of cash. It’s like having your own little money stash for later. Simple and handy!

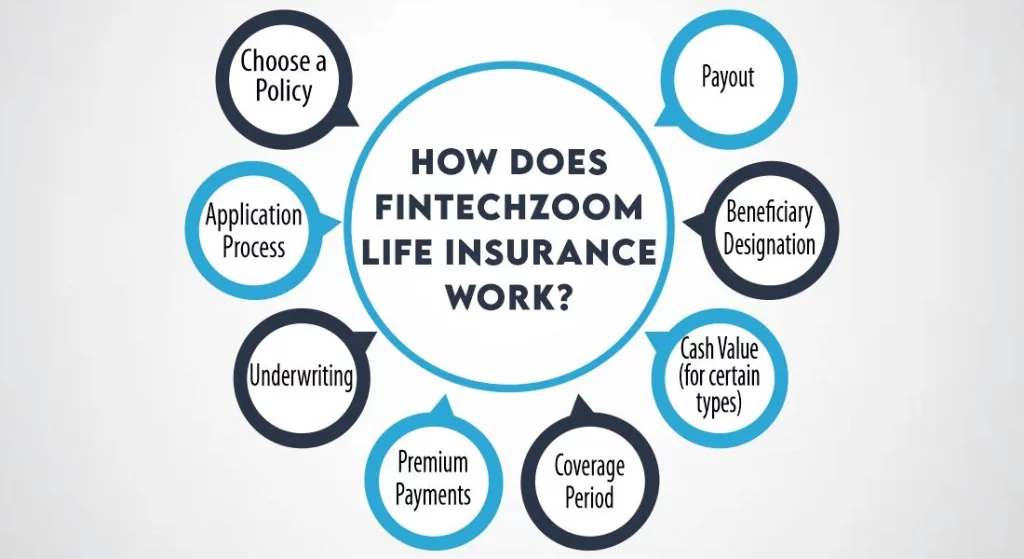

How Does FintechZoom Life Insurance Work?

The specifics of how FintechZoom works may vary depending on the type of life insurance policy you choose. Here’s a general overview of how life insurance typically works, which should provide you with a basic understanding:

1- Choose a Policy

Start by selecting the type of life insurance policy that aligns with your needs and goals. FintechZoom may offer various options such as term life, whole life, universal life, or others.

2- Application Process

You’ll need to complete an application for the chosen policy. During this process, you’ll provide personal information, answer health-related questions, and select your coverage amount.

3- Underwriting

FintechZoom will assess your application, which may include a review of your medical history and, in some cases, a medical examination or other health assessments. This helps determine your risk profile and the associated premium costs.

4- Premium Payments

If your application is approved, you’ll be required to make regular premium payments. Premiums can typically be paid on a monthly, quarterly, semi-annual, or annual basis, depending on your preference.

5- Coverage Period

For term life insurance, the policy provides coverage for a specified term, such as 10, 20, or 30 years. If you pass away during the term, the death benefit is paid out to your beneficiaries.

6- Cash Value (for certain types)

In policies like whole life or universal life, a portion of your premium payments goes into a cash value component, which can grow over time. You may be able to borrow against this cash value or use it to supplement retirement income.

7- Beneficiary Designation

You will designate one or more beneficiaries who will receive the death benefit in the event of your passing. This is a crucial decision, so choose your beneficiaries carefully.

8- Payout

When the policyholder passes away, the insurance company pays out the death benefit to the designated beneficiaries. This payout is generally tax-free and can be used by the beneficiaries to cover various expenses, such as funeral costs, debts, or income replacement.

It’s important to read and understand the terms and conditions of your specific FintechZoom Insurance policy. Policies may have additional features, riders, or options that can further customize your coverage.

Types of FintechZoom Life Insurance

FintechZoom offers several types of life insurance policies to cater to diverse needs and preferences:

- Term Life Insurance: This is a straightforward, affordable option that provides coverage for a specific term, typically 10, 20, or 30 years.

- Whole Life Insurance: Offers lifelong coverage, with a cash value component that grows over time.

- Universal Life Insurance: Provides flexibility in premium payments and the death benefit, allowing policyholders to adjust coverage as their needs change.

- Variable Life Insurance: Combines life insurance with investment options, offering the potential for cash value growth through investments.

- Final Expense Insurance: A type of whole life insurance specifically designed to cover end-of-life expenses, such as funeral costs and medical bills.

- Guaranteed Issue Life Insurance: Typically available without a medical exam and designed for individuals who may have difficulty obtaining coverage elsewhere due to health issues.

- Mortgage Protection Insurance: Pays off the remaining mortgage balance if the insured individual passes away, providing peace of mind for homeowners.

How to Navigate Your Options with FintechZoom Life Insurance?

Navigating your options with FintechZoom, like any life insurance provider, requires careful consideration and a systematic approach. Here are the steps to help you make informed decisions:

Assess Your Financial Goals

Start by evaluating your financial objectives. Consider what you want to achieve with your life insurance. Are you primarily looking to provide for your family’s financial security, pay off outstanding debts, or leave a financial legacy? Understanding your goals is the first step.

Determine the Coverage Amount

Calculate the coverage amount you need. This should account for outstanding debts, future expenses (like your children’s education), and income replacement for your family. An online life insurance calculator or consultation with a financial advisor can help you determine the appropriate coverage amount.

Choose the Right Type of Policy

FintechZoom may offer various types of life insurance, such as term life, whole life, universal life, or others. Each type has its unique features and benefits. Select the one that aligns with your financial situation and goals.

Understand the Terms and Conditions

Carefully read and understand the terms and conditions of the policy. This includes details about premium payments, coverage duration, and any additional riders or features that may be available. Make sure you’re comfortable with the policy’s provisions.

Assess Premium Affordability

Evaluate your budget and determine how much you can comfortably afford to pay in premiums. Be aware that the type of policy you choose and your health may affect the premium amount. Ensure that the premiums are within your financial means.

Compare Multiple Quotes

Don’t settle for the first quote you receive. Obtain quotes for different policy options from FintechZoom to compare prices, features, and coverage. This will help you find the best value for your money.

Seek Professional Advice

If you’re uncertain about which policy is right for you or if you have complex financial needs, consider seeking advice from a financial advisor or insurance expert. They can help you make well-informed decisions.

Review and Update Your Policy

After you’ve selected a policy, regularly review it to ensure it continues to meet your evolving needs. Life changes, and your life insurance policy should change with it.

Stay Informed

Keep yourself informed about changes in the life insurance industry, such as updates to FintechZoom’s policies or new products they may offer. This can help you make adjustments when necessary.

Advantages & Disadvantages of FintechZoom Life Insurance

Advantages of FintechZoom Life Insurance

Convenience

FintechZoom’s online platform simplifies the application process, policy management, and claims processing. This convenience is especially appealing to those who prefer managing their finances online.

Competitive Premiums

FintechZoom strives to provide competitive rates, making life insurance more accessible to a broader range of individuals.

Diverse Coverage Options

FintechZoom offers various types of life insurance policies, catering to a wide range of needs and preferences. This diversity allows you to choose a policy that aligns closely with your financial goals.

Efficient Customer Service

FintechZoom’s customer service is designed to be responsive and efficient, allowing you to get the support you need when managing your policy or filing a claim.

Transparency

FintechZoom typically provides clear and transparent policy terms and conditions, making it easier for policyholders to understand their coverage.

Disadvantages of FintechZoom Life Insurance

Health Considerations

As with most life insurance providers, your health and medical history can significantly impact your premiums. Individuals with certain health conditions may face higher insurance costs.

Lack of Physical Branches

FintechZoom operates primarily online, which means there are no physical branches for face-to-face interactions. Some customers may prefer in-person meetings and personalized service, which may not be available with FintechZoom.

Potentially Limited Product Selection

While FintechZoom offers diverse coverage options, there may be certain specialized policies or riders that are not available, which could limit the ability to tailor coverage to very specific needs.

Changing Terms and Conditions

Like any financial institution, FintechZoom may modify terms and conditions of their policies over time. While this is common in the insurance industry, it’s essential to stay informed about changes that could affect your coverage.

Risk of Coverage Denial

FintechZoom, like other insurance providers, has the right to deny coverage based on underwriting criteria. If you have certain health conditions or present a higher risk, you may not qualify for a policy or could face limitations in your coverage.

Different Premium Payment Options of Fintech Zoom Life Insurance

FintechZoom typically offers several premium payment options to provide flexibility for policyholders. These payment options can cater to different budgetary preferences. Here are some common premium payment options you may encounter with FintechZoom Insurance:

- Monthly Premiums: Paying on a monthly basis is one of the most common and convenient options. It spreads the cost over the year and is suitable for those who prefer regular, smaller payments.

- Annual Premiums: Some policyholders opt to pay their premiums once a year. This option can provide cost savings because insurance providers often offer discounts for annual payments.

- Semi-Annual Premiums: Policyholders can choose to pay their premiums every six months. This option strikes a balance between monthly and annual payments, offering convenience and potential cost savings.

- Quarterly Premiums: Paying premiums every quarter, or every three months, can be another suitable option. It allows for smaller, more frequent payments, which can help with budgeting.

- Automatic Bank Withdrawals: FintechZoom often offers automatic premium withdrawals from your bank account. This option ensures that your premiums are paid on time, reducing the risk of policy lapses

Retirement Planning with Fintechzoom Life Insurance

Thinking about retirement? Fintechzoom is extra than only a safety internet for your own family; it’s your price ticket to a stable retirement. Here’s how:

Fintechzoom gives permanent lifestyles coverage that will become more treasured over the years. It’s like a money-bsaed sidekick, growing in power as time is going by using. And bet what? When the ones golden retirement years roll round, you could tap into the cash fee. Think of it as your non-public financial savings account inside your lifestyles coverage plan. Use it to your retirement income or hold it as a cozy financial cushion for peace of thoughts. Fintechzoom isn’t always pretty much the future; it’s about making your retirement goals a fact.

Why Choose FintechZoom Life Insurance?

Choosing FintechZoom can be a sound decision based on several compelling reasons. While individual circumstances and preferences may vary, here are some key factors that might make FintechZoom Insurance an attractive choice for many individuals:

Convenience

FintechZoom’s online platform streamlines the entire insurance process. From applying for a policy to managing your coverage and filing claims, the convenience of digital access can save time and effort.

Competitive Premiums

FintechZoom aims to provide competitive premium rates, making life insurance more affordable for a broader range of people. Affordable premiums are a critical consideration when selecting a policy.

Diverse Coverage Options

FintechZoom offers a range of life insurance products, including term life, whole life, universal life, and more. This diversity allows you to select a policy that aligns closely with your unique financial goals and needs.

Efficient Customer Service

FintechZoom’s customer service is designed to be responsive and efficient. Should you have questions, concerns, or need assistance with your policy, a helpful customer support team can provide guidance and solutions.

Transparency

FintechZoom typically provides clear and transparent terms and conditions for their policies. This transparency can help you understand your coverage better, ensuring that there are no hidden surprises.

FintechZoom Life Insurance vs. Traditional Life Insurance

Comparing FintechZoom to traditional life insurance can help you make an informed choice based on your specific needs and preferences. Here’s a comparison of the two:

FintechZoom Life Insurance

Competitive Premiums

FintechZoom aims to provide competitive premium rates, making life insurance more affordable for a broader range of people.

Diverse Coverage Options

FintechZoom offers various types of life insurance policies, allowing you to choose a policy that aligns closely with your unique financial goals.

Efficient Customer Service

FintechZoom’s customer service is designed to be responsive and efficient, making it easier to obtain assistance when needed.

Transparency

FintechZoom typically provides clear and transparent policy terms and conditions.

Innovation

As a fintech company, FintechZoom is often at the forefront of technological innovation, which can translate to advanced digital tools and improved customer experiences.

Traditional Life Insurance

In-Person Service

Traditional insurance companies often have physical branches and in-person agents, making it more suitable for those who prefer face-to-face interactions and personalized service.

Wider Range of Products

This insurers may offer a broader range of insurance products, including specialized or niche policies that cater to specific needs.

- Longer Operating History

Many traditional insurance companies have a long-standing history and a proven track record of financial stability.

Policy Flexibility

Traditional insurers may offer more customized or flexible policies, allowing for tailored coverage.

Paper Documentation

Traditional insurers often use paper documents for policies and claims, which may be preferred by some individuals.

When choosing between FintechZoom and traditional life insurance, consider factors like your comfort with technology, your preferred mode of communication, the specific type of coverage you need, and your budget. Both options can provide reliable life insurance, but the choice depends on your individual requirements and priorities.

Conclusion

FintechZoom is a viable option for individuals seeking reliable and convenient life insurance coverage. By understanding the types, payment options, and advantages and disadvantages, you can make an informed decision to protect your family’s financial future. Whether you choose FintechZoom or traditional life insurance, the key is to select a policy that aligns with your goals and financial situation.

FAQs

1- Is FintechZoom Insurance a reputable option?

FintechZoom Insurance is a reputable choice, known for its convenience and competitive rates. However, it’s essential to compare it with traditional insurers to find the best fit for your needs.

2- Can I change my FintechZoom Insurance policy type?

FintechZoom may allow you to change your policy type, but it’s subject to specific terms and conditions. Contact their customer service for details.

3- What happens if I miss a premium payment with FintechZoom?

FintechZoom typically provides a grace period for premium payments. If you miss a payment, contact them to understand your options and potential consequences.

4- Can I have multiple FintechZoom Insurance policies?

Yes, you can have multiple FintechZoom Insurance policies, depending on your needs and financial situation. It’s essential to manage them effectively and ensure that the coverage aligns with your goals.

5- How do I file a claim with FintechZoom Life Insurance?

FintechZoom offers an online claims process. Contact their customer service for guidance and assistance when filing a claim.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.