Can I Use Life Insurance to Buy a House: A Complete Guide

Buying a house is a monumental step in life, representing stability, security, and a place to call your own. Yet, the path to homeownership often involves navigating complex financial terrain. One question that frequently arises is “Can I use life insurance to buy a house” or whether life insurance can play a role in this process.

This comprehensive guide will explore the nuances of using life insurance to purchase a house. From understanding the types of life insurance policies available to exploring how cash value can be leveraged, we aim to clarify this often-debated topic. Whether you’re a first-time homebuyer or considering your options for financing a new home, join us as we unravel the intricacies of integrating life insurance into your home-buying journey.

Can I Use Life Insurance to Buy a House?

Yes, you can use life insurance to buy a house. Life insurance policies, particularly permanent life insurance, accumulate cash value over time. From this cash value, you can make some withdrawals or loans which can be then used as a down payment or to pay the deposit of the house. However, some crucial points of awareness should be considered before using life insurance as an avoidance technique.

It is however too necessary to consider that a life insurance company would be spent on mortgage would affect the death benefit of the house, hence the policyholder needs to be informed on how to get payment long more than term. Not to mention, extra fees may come if you need any services such as withdrawing the cash value. In such cases, make sure that you visit a financial professional to assess your circumstances by establishing whether your house purchase will be in line with your overall financial agenda and tendencies.

How to Use Your Life Insurance to Buy a House

Using your life insurance to buy a house involves several steps and considerations. Here’s a guide on how to do it:

Evaluate Your Life Insurance Policy:

This is just another life insurance policy with any cash values accrued. As permanent life insurance policies, like the whole and universal life, result in building a cash value gradually, part of it can be withdrawn to be spent on, for example, buying a house.

Assess Cash Value:

Check your life insurance policy on the current balance. You might want to look up your policy to know what is covered. If you don’t understand, a call to your provider should be able to bring your concerns to a close. The cash value of any given cash value life insurance policy represents the current amount you can spend.

Understand Your Options:

The cash value of your policy may be accessed through several means when there is a need for it:

Withdrawals:

The equity portion that is paid out can be used as a down payment on a housing unit. The first option readily fulfills your cash needs but in exchange, can dilute your death benefit and may also incur tax liabilities.

Policy Loans:

Towards increasing the liquidity of life, you can take out a loan against the policy and the cash as a guarantee. Tax-exempt policy loans and borrowed resources can be applied in support of purchasing a house. But, it will certainly involve interest payment or would be taken from the payable benefits.

Surrendering the Policy:

If you drop in need of a life insurance program, you can surrender the policy to receive the cash value that you have held. In this scenario, you will use this equity mortgage to pay for the house which you may have bought. It is also necessary to remember that giving up the policy for expert advice could have a tax impact on you and also you might not have a life insurance cover anymore.

Consider Alternative Financing Options:

Although utilizing a life insurance cash value to buy the house can prove to be a functional approach, one must consider the alternative financing options that do exist besides the mortgage. Compare the costs of getting your device with its benefits and risks. Thereafter, make your final decision whether you need to buy or not.

How Much Does Life Isurance Cost?

Through a thoughtful review of your life insurance policy, being aware of your opportunities, and obtaining guidance from a financial expert, you can smartly decide on whether to use your life insurance to purchase a home.

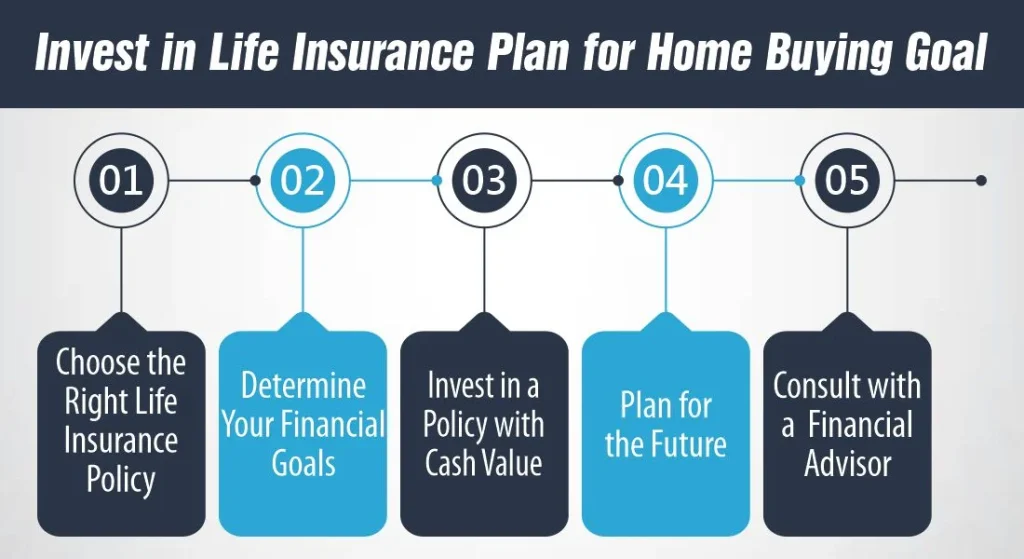

Invest in Life Insurance Plan for Home Buying Goal

Invest in Life Insurance Plan for Home Buying Goal

Getting life insurance is a strategic move that may help you yearn to get the dream home of your own. Here’s how you can approach it:

- Choose the Right Life Insurance Policy: Consider going with permanent life insurance, such as whole life or universal life, which may help accumulate the cash value over time. This saved money can be conveniently employed to buy the house.

- Determine Your Financial Goals: Estimate how much the total cost of your targeted house will be and discover for yourself how far you can find yourself to afford to pay your life insurance premium each month.

- Invest in a Policy with Cash Value: The constant repayments of your life insurance premiums will not only provide you and your loved ones with the security and continuity of a permanent life insurance policy but also accumulate the cash value over time. This is the value that can be stipulated through policy with loans and withdrawals.

- Plan for the Future: Consider how getting the cash value of your policy for a home purchase would impact your long-term financial goals and your family’s financial security. Make sure you have your goals achieved or the impact any possible financial action can have to you and your family.

- Consult with a Financial Advisor: Before going ahead, it is better to consult your financial planner to confirm with him that taking a life insurance policy goes with your general financial plan and home-buying goals.Having a life insurance plan and funding is a wise thing you should opt for if you really want a home of your own, as it ensures being covered with life insurance as a whole as well as an opportunity to accumulate savings for your house purchase.

Considerations Before Using Life Insurance to Buy a House

Before using life insurance to buy a house, it’s essential to consider the following factors:

Impact on Death Benefit:

Tapping the cash value or borrowing through a policy loan will, however, result in a smaller benefit amount after your death. Think the reverse through, how will this curtail your beneficiaries and if another means to realize this objective is feasible with them being excluded from the life insurance coverage?

Tax Implications:

Whether you take the disbursement on death or surrender the policy early, tax implications vary and you must know these. Typically withdrawals are tax-free to equivalent amounts of premiums paid, but anything in excess will be taxed. Policy loans, on the other hand, are not taxable. However, if the policy ceases to exist by just canceling it, or by surrendering it, the amount of loan may be subjected to tax.

Loan Repayment:

If you take the policy loan, then the prime necessity is to repay the loan with interest added to it. Not paying the insurance premium might mean the life insurance policy not being able to cover the whole sum stated, or its lapse. To find the terms before signing the loan document to see how it will influence you financially.

Alternative Financing Options:

If you intend to borrow, it is worth reviewing alternative financing options like a conventional mortgage and comparing them to other options based on costs and benefits. Bring into consideration the question of whether it is the best to use life insurance to fund your homebuying process.

Long-Term Financial Goals:

When determining how to use your life insurance, keep in mind the overall impact it could have on your remaining lifetime financial goals. Will the money be now absorbed into your everyday expenses, leaving you incapable of reaching other financial goals?

Through a thorough examination of these criteria, so by listening to a financial advisor, you could realize that using your life insurance policy to buy a house fits you.

The Bottom Line

Using life insurance to purchase a home or real estate may be a feasible choice for a lot of individuals, especially those who have been for a good number of years holding the policy and have built up a considerable amount of money in cash value.

Nevertheless, on the positive side, you must make an allowance for the hazards and be a good counselor before signing. Engaging in a housing transaction is a big financial matter, and we must make a sound and well-considered decision about it in light of our exclusive conditions.

Frequently Asked Questions (FAQs)

1- Are there tax implications when using life insurance to buy a house?

Yes, there is a possible issue of taxes. Distributions of the Plan during living may be tax-free up to the tribute of premiums paid, but an overage beyond that may be subject to taxes. Policy loans will most often not attract tax, but they will have to be classified as taxable where the policy lapses with a loan balance. Tax advisor, I advise you to consult with him to know the concrete examples of your situation.

2- What happens if I don’t repay a policy loan used to buy a house?

Besides the failure to repay the policy loan, the outstanding balance, inclusive of interests, will also be deducted from the death benefit payable to your rights holder. The risk is that if the loan amount exceeds the cash value, then the policy may be cancelled and this may lead to the loss of coverage.

3- How can I ensure that using my life insurance to buy a house aligns with my long-term financial goals?

Before taking any action, meet a financial adviser to avoid any unforeseen expenses. They can assist you in measuring your options, grasping the possible effects, choosing your long-term objectives, and whether you decide to use your life insurance to buy a house or not depending on various reasons.

References:

https://www.investopedia.com/can-you-use-life-insurance-to-buy-a-house-7559583

https://www.canarahsbclife.com/blog/life-insurance/how-to-use-your-life-insurance-to-buy-a-house

https://tomneedhaminsurance.com/how-to-use-life-insurance-to-buy-a-house-the-key-steps/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.

Invest in Life Insurance Plan for Home Buying Goal

Invest in Life Insurance Plan for Home Buying Goal