Last Updated on: June 11th, 2024

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Key Takeaways

In this blog you will learn:

- The process of how to cancel globe life family heritage insurance?

- Important Considerations to Cancel Globe Life Family Heritage Insurance

- Understanding the Cancellation Terms and Conditions

- Cancellation Notice in Writing

- Reasons to Cancel Globe Life Family Heritage Insurance

- Discussion on Can you Get My Money Back if Cancel Globe Life Family Heritage Insurance?

- Highlights the impact of cancellation, including lost investments, potential tax consequences, and penalties.

- Guidance on how to switch providers and avoid fees.

- Guidance on How to Switch to a New Insurance Company?

Are you thinking about canceling globe life family heritage insurance? But Confused in the process, how should I start, how to cancel globe life family heritage insurance? Let me write down all the process and steps to cancel the globe life family heritage insurance. To start the process of Cancel Globe Life Family Heritage Insurance, contact your agent or the business directly. The second requirement is that you send a written cancellation notice. And finally, there can be a cancellation fee. To cancel globe life insurance contract, follow these steps:

- Get in touch with the business or your agent directly.

- Send a cancellation notice in writing.

- Follow Up customer service.

Understanding Your Family Heritage Life Insurance Policy

Before you decide to Cancel Globe Life Family Heritage Insurance, let’s break down your Family Heritage Life Insurance. Know what it covers, the good stuff it offers, and what’s not included. This way, you’ll make a smart choice when deciding to cancel.

Family Heritage Life Insurance is like a financial safety net for you and your loved ones. It’s there to help out when things get tough. So, before you cancel, make sure you get how it works. It’s not just paperwork; it’s about making choices that fit your story

Table of Contents

ToggleKey Features of Family Heritage Life Insurance Policy

Before discussing the steps of how to cancel globe life family heritage insurance? Let’s dive into the useful functions of your Family Heritage Life Insurance. It’s like having a on hand toolkit with such things as a death advantage, developing coins, and a few tax blessings. These functions are all about providing you with more peace of thoughts and financial safety.

First up, the death benefit is the money your loved ones get when you’re now not around. It can help with things like funerals, money owed, and helping your own family all through hard times.

Then, there may be the coin’s cost boom. Part of what you pay turns into coins over time. You can use these coins later if you need it, like casting off a loan.

And bet what? Some Family Heritage Life Insurance plans even include tax perks. Depending on your plan and situation, your family could possibly get the total benefit without managing taxes.

Fine Print Regarding Cancellation

If you’re considering Cancel Globe Life Family Heritage Insurance, it’s important to delve into the fine print. To avoid unwanted surprises, check the fees, waiting periods, and penalties organized and listed in your policy. Understand the financial implications of a grant designed to cover planning costs, and decide whether it is worthwhile canceling now or waiting for the funding to decrease.

Also, be aware of the waiting periods in some programs that do not allow temporary use. This waiting period prevents people from developing a plan for a particular purpose and canceling it quickly. Knowing how long you wait is an effective plan, give power to make informed decisions tailored to your needs. A thorough review of the details gives you a clearer understanding of the globe life insurance cancellation process for your family estate life insurance policy, giving you the confidence to make the best decision for your financial well-being and future needs.

How Much Does Life Isurance Cost?

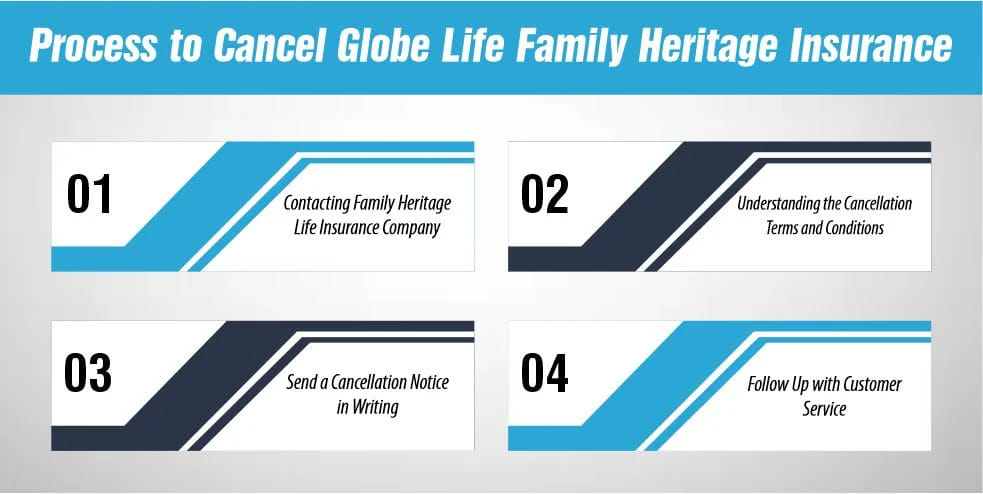

Process to Cancel Globe Life Family Heritage Insurance

Once you’ve decided to Cancel Globe Life Family Heritage Insurance, it’s very important to know the way to begin. Learn how to cancel globe life family heritage insurance? what you want to do and follow the policies to make certain the whole lot goes easily and there are not any troubles.

Contacting Family Heritage Life Insurance Company

To begin canceling your coverage, the primary aspect you need to do is contact the Family Heritage Life Insurance Company. You can name their customer service or attain out for your agent. Make sure you give them all the data they need about your policy and any documents they ask for. Keeping conversation clean and open helps make sure your request is handled quickly and easily.

When you touch the corporation, have your policy variety and personal data geared up. This makes it simpler for the customer support rep or agent to find your account and cancel your coverage quicker.

Understanding the Cancellation Terms and Conditions

When you first touch Family Heritage Life Insurance Company of America, ensure to ask for a copy of the rules for canceling your coverage. These rules let you know what you want to do and while you need to do it.

Take a while to study via those rules carefully. Pay interest to any closing dates or paperwork they mention. By following those guidelines, you may ensure the cancellation system goes smoothly and with no problems.

Send a Cancellation Notice in Writing

Write a formal letter requesting the cancellation of your policy. Cancellation letter Include:

- Your policy number

- Your full name and address

- Date you want the cancellation to be effective

Send It via Mail or email the notice to the address or email provided by customer service or manually submit at their office.

Follow Up with Customer Service

- Confirm Receipt: After sending your notice of Cancel Globe Life Family Heritage Insurance, follow up with customer service.

- Check Status: Verify that they received your request and that your policy has been canceled.

- Ask About Refunds: Inquire about any potential refunds you might be eligible for.

These are the steps on how to cancel globe life family heritage insurance? By following these steps, you can cancel your Family Heritage Life Insurance policy smoothly and efficiently.

So, to Cancel Globe Life Family Heritage Insurance, simply remember to invite for the cancellation policies, study them carefully, and follow them carefully. This way, you will be able to cancel your policy effectively and without problems.

Important Considerations to Cancel Globe Life Family Heritage Insurance

- Free Look Period: Utilize this period for a full refund.

- Prorated Refund: Understand the prorated refund policy if canceling after the free look period.

- Penalties: Be aware of any early cancellation penalties.

Reasons to Cancel Globe Life Family Heritage Insurance

Several justifications exist for wanting to revoke Globe Life Family Heritage Insurance coverage. They may no longer see a need for life insurance or cannot pay the premiums.

Regardless of the motivation, globe life family heritage cancel policy is a significant choice. Before canceling a life insurance policy, you keep the focus on a few things, such as whether there are cancellation fees and what benefits, if any, will be lost. Your Globe Life Family Heritage Insurance coverage should be canceled for the following two reasons:

1. You no longer need life insurance.

People frequently Cancel Globe Life Family Heritage Insurance because they no longer feel the need for it. They may have paid off their mortgage, or their children may be adults who are no longer financially dependent on them. Canceling your life insurance coverage makes sense if you no longer need it.

2. You can no longer afford the premiums.

People frequently Cancel Globe Life Family Heritage Insurance because they can no longer afford the premiums. Because life insurance is expensive, you can no longer make the premiums if your financial status changes. If so, terminating your insurance and saving money makes economic sense.

Ensure you know the repercussions before canceling your Globe Life Family Heritage Insurance coverage. You will forfeit the death benefit if you cancel, and there can be consequences for doing so. However, ending your coverage makes sense if you no longer require or can afford life insurance.

Tip:

Before canceling Globe Life Family Heritage Insurance, think about your current financial needs and whether you can afford losing the coverage. Canceling could mean giving up any cash value you've built and facing penalties. Make sure you no longer need the policy or can't afford it, and remember that getting a new one later could be harder or more expensive.

Can I Get My Money Back if I Cancel Globe Life Family Heritage Insurance?

Sure, here are a few key things to know about canceling Globe Life Family Heritage insurance and getting a refund:- This policy comes with a thirty-day free look period. You can cancel your membership within the first one month and you are eligible for a discount on any premiums you have paid.

- If you cancel after 30 day you may receive a part of the premiums depending upon the duration of policy. As for the most popular policies, it is essential to mention that they come with a pro-rata cancellation clause.

- There are some fees which can be taken from the amount that you receive if you cancel your policy after 30 days of the free look period. This may be policy fees or any other administrative charges as may be highlighted.

- If one wants to cancel a policy, they should contact Globe Life customer service through the phone or through writing. Tell them that you wish to cancel the order and enquire about the amount of money that you will be entitled to.

- Expect to be asked for a policy number, your complete name, phone number, address, explanation for the cancellation, and where would you prefer receiving the refund check. So to answer the question in short, yes, it is possible to get some refunded if you cancel the subscription but the amount largely depends on the particular date of canceling the subscription was done. The key is to act fast if you wish to be credited back your full amount without having to be charged any fee at all. If you need any other information, please let me know!

Potential Consequences Cancel Globe Life Family Heritage Insurance

Before you decide to cancel your Life insurance policy, it’s crucial to understand what would possibly show up next:Financial Implications of Policy Cancellation

- Lost Investments: If you cancel your coverage, you may wave goodbye to any cash or give up value you’ve constructed up. All those years of investment should vanish on the spot.

- Loan Headaches: Got superb loans towards your coverage? Cancelling should trigger immediate repayment demands. Don’t risk consequences and hobby expenses!

- Tax Troubles: Beware of potential tax implications! Depending on your coverage and local tax laws, globe life insurance cancellation policy should imply sudden tax liabilities. Get recommendation from a tax pro to keep away from surprises.

Impact on Future Insurance Purchases

- Coverage Challenges: Cancelling your policy could make it tough to get coverage later. Insurers look at factors like your health and age. After cancellation, changes in your health might lead to higher premiums or difficulty in getting coverage.

- Underwriting Do-Over: If you cancel and then want insurance again, brace yourself for the underwriting process all over again. That means sharing health details, maybe even medical exams. It’s a hassle that could delay getting the protection you need.

- Protect Your Loved Ones: Before you cancel, ponder your future needs. Your age, financial responsibilities, and dependents matter. Life insurance isn’t just about you—it’s about providing for your loved ones if something happens to you.

How Much Are Cancellation Fees?

Depending on the insurer, cancellation fees may differ. While other businesses charge a portion of the remaining premium, some charge a flat cost. Insurance might, for instance, impose a cancellation cost of $50 or 10% of the unpaid compensation, whichever is higher.How to Avoid Cancellation Fees?

Keeping your insurance until it expires is an excellent way to prevent cancellation fees. At the end of the term, cancel your insurance if you need to. They would not charge you in this manner. You can incur costs if you end your policy’s tenure in the middle. There are a few ways to prevent this, however. First, make an effort to bargain with your insurer. Ask them to waive the cost after outlining your position. The second option is to look for an insurer that doesn’t impose cancellation costs, given that most insurers do charge.

Tip:

Waiting until your policy term ends can help you avoid cancellation fees altogether.

Whether Globe Life Family Heritage Reviews are Good or not?

Reviews of Globe Life Family Heritage Division reflect a mixed range of opinions from customers. Positive feedback often highlights the ease of applying for policies and the quick approval process, particularly the “no medical exam” feature, which is appealing to many. Customers also appreciate the simplicity of the product offerings, like life and supplemental health insurance, and the availability of cash value accumulation over time. However, some customers express concerns about the high premiums and limitations in coverage as compared to other insurers.While Globe Life Family Heritage Division has solid financial backing and many positive aspects, its reviews suggest that while the product can be good for some, it’s important to thoroughly evaluate the terms and costs before purchasing to ensure it aligns with your financial goals. For Moe Updates you can check Globe Life Family Heritage Division Linkedin feed.How to Switch to a New Insurance Company?

Switching to a new insurance company can be a wise decision if you’re looking for better coverage, more affordable premiums, or superior customer service. If you’re currently with Globe Life Family Heritage Insurance and want to cancel your policy, you can consider switching to Insure Guardian, an insurance company known for its reliability and customer-centric approach.1- Evaluate Your Current Policy

Before making any changes, review your existing Globe Life Family Heritage Insurance policy. Note down the coverage details, premium amounts, and any outstanding benefits or claims.2- Research Your Options

Look for insurance companies that align with your needs and budget. Insure Guardian, for example, is known for its flexible coverage options and competitive rates. Compare the benefits, premiums, and customer reviews of different insurers to make an informed decision.3- Contact Insure Guardian

Once you’ve decided to switch, reach out to Insure Guardian to discuss your insurance needs. Their experienced agents can help you choose the right coverage options and provide guidance on the switching process.4- Apply for a New Policy

Fill out an application for insurance with Insure Guardian. Provide all necessary information accurately to avoid delays in processing your application.5- Review and Accept the Policy

Insure Guardian will provide you with a new policy detailing your coverage and premium amounts. Review the policy carefully to ensure it meets your needs before accepting it.6- Notify Globe Life Family Heritage Insurance

Once your new policy with Insure Guardian is in place, contact Globe Life Family Heritage Insurance to cancel your existing policy. Provide them with your policy number and effective date of cancellation.7- Request Refunds or Transfers

If you’ve paid premiums in advance to Globe Life Family Heritage Insurance, inquire about refunds or transferring the balance to your new Insure Guardian policy.8- Keep Records

Keep copies of all correspondence and documentation related to your insurance switch, including cancellation confirmation from Globe Life Family Heritage Insurance and your new policy from Insure Guardian.9- Stay Informed

Familiarize yourself with the claims process and any additional benefits offered by Insure Guardian. This will ensure a smooth experience in case you need to file a claim in the future.Switching to a new insurance company like Insure Guardian can be a straightforward process if you follow these steps. Always remember to review your policy carefully and consult with insurance professionals to make informed decisions.Conclusion

As we wrap up how to cancel globe life family heritage insurance? Canceling your Globe Life Family Heritage Insurance coverage is a simple procedure that may be finished in a short amount of time. The cancellation procedure should be started by contacting customer support, who should also be given any required paperwork and unpaid premiums and fees. By doing these actions, you can ensure that your policy is correctly canceled and that you won’t be held accountable for any more payments or obligations.FAQs

1- What Do Refund Fees Entail?

Certain businesses may charge cancellation fees when you terminate a service or contract. You may be subject to a cancellation fee when you cancel your insurance coverage before the end of the term.2- Why Do Insurers Charge Cancellation Fees?

An insurer can assess cancellation fees for several reasons. The first benefit is that it reduces the expense of bringing in new clients. Insurance companies invest much money in marketing and advertising to attract new clients. The insurer forfeits its investment when a policyholder cancels their coverage. Second, cancellation costs aid in preventing clients from terminating their insurance coverage. Customers are more inclined to stick with the policy if they know there will be a fine if they cancel. This contributes to maintaining the insurer’s steady customer base, which is crucial for long-term financial stability.References:

- https://www.globelifeinsurance.com/article/money-back-if-I-cancel-my-life-insurance-policy

- https://www.lifeinsurancepost.com/cancelling-your-globe-life-and-accident-insurance-company-life-insurance-policy/

- https://www.nerdwallet.com/article/insurance/cancel-life-insurance

- https://www.lifeant.com/faq/if-i-cancel-life-insurance-after-paying-my-premiums-will-i-get-a-refund/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.