Where can I find my title insurance policy? Quick Tips

You wouldn’t be the only one who accidentally throws away or puts important documents in a place no one remembers. Misplacing papers is quite common.

However, when it comes to your title insurance, there is always a way for you to procure another one. Title insurance is a document that protects the property owner from any damages that they could suffer when there are damages, mortgages, or other costs left by the previous Owner.

Have you ever wondered where your title insurance policy is? It’s like the secret shield that keeps your home safe from old problems you never knew about. Finding it can seem tricky, but don’t worry; it’s simpler than you think. Whether you’re a new homeowner or you’ve had your place for a while, this guide will help you find that special document. It’s your key to peace of mind, ensuring no old surprises can bother your happy home.

Don’t worry when you can’t find your title insurance because here are some ways you can get it back. Let’s find out where can I find my title insurance policy.

What is Title insurance:

Title coverage is sort of a safety net for your property possession. When you buy a house or a bit of land, you want to ensure it is yours with no hidden surprises. Title insurance protects you from troubles that won’t have been stuck before, like disputes over who virtually owns the assets, unpaid taxes from previous proprietors, or mistakes in public statistics. It’s a one-time purchase that gives you peace of mind, understanding that if any surprising issues pop up from the past, your investment in your property is safe.

Why Do You Need Title Insurance?

- Protection Against Title Defects: Title insurance guarantees that the asset’s name is aware of any encumbrances or criminal problems before you obtain the property. This includes, however, is sometimes constrained to wonderful liens, judgments, or claims of ownership from previous proprietors.

- Safeguards Your Investment: For most people, shopping for a home is the biggest unmarried investment they’ll ever make. Title insurance protects this funding towards past occasions that could affect ownership rights.

- One-time Cost: Unlike other kinds of coverage, which can also require ongoing rates, title insurance is purchased with a one-time top class at the time of the asset transaction.

- Peace of Mind: Having a title coverage approach means that your right to apply and occupy the property is legally protected against claims from preceding proprietors or others who might assert an interest in your house.

Is Title Insurance Required?

Title coverage isn’t legally required in every jurisdiction, but it may be a realistic necessity. For instance, lenders normally require a lender’s identity coverage as part of the financing system to protect their interest in the assets until the loan is paid off. While an owner’s name coverage policy is typically optionally available, it’s strongly encouraged to protect the Owner of a house’s interests.

The decision on whether or not to buy the Owner’s title insurance needs to consider the potential risk of present claims against the belongings. Given the considerable funding involved in purchasing belongings and the enormously low value of title insurance, many consider it a smart investment to protect against capacity prison troubles with the assets’ identity.

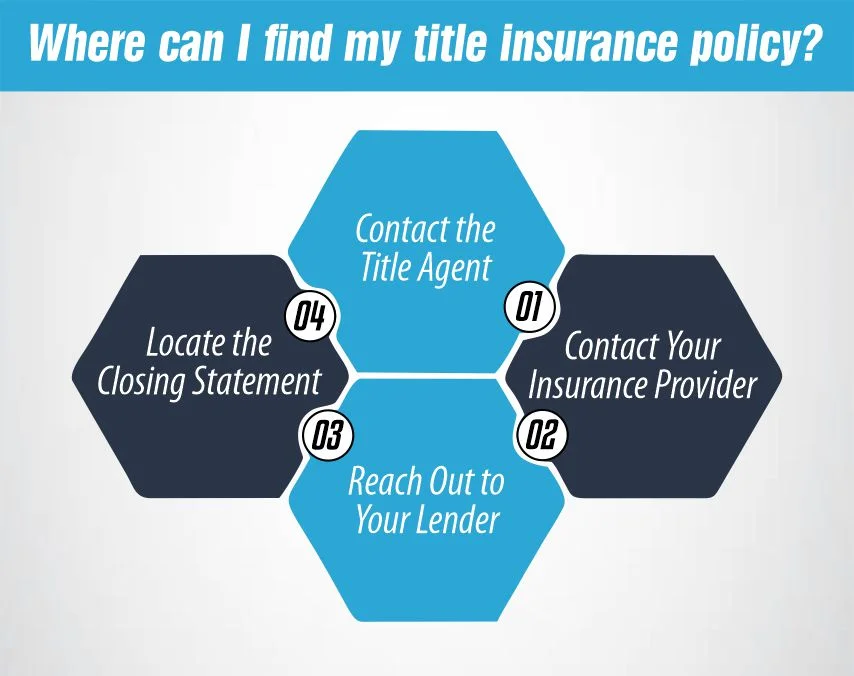

Where can I find my title insurance policy?

Where can I find my title insurance policy?

Title insurance is critical to your real property transaction, supplying safety against capacity prison troubles with your property’s title. If you’re seeking to find your identity coverage, there are numerous paths you can take to locate this essential record. Here are the steps you can follow to where can I find my title insurance policy:

Contact the Title Agent:

The identified agent or the title corporation that handled your remaining is a great first point of contact. They are answerable for undertaking the name search and issuing the identified insurance coverage. Reach out to them with your property information, address, and date of the remaining. They need records of your transaction and might provide you with a replica of your title insurance coverage.

Contact Your Insurance Provider:

If you already know the coverage company that underwrote your title coverage coverage, you may contact them at once. Please provide them with your private details, the property copes with them, and the approximate date of the transaction. They will have a document of all rules issued and will let you discover your unique coverage.

Reach Out to Your Lender:

If you financed your home purchase, your lender might require a lender’s name coverage policy to protect their hobby in your house. Your lender can offer records of the name insurance coverage they acquired at some stage in your final. While this policy protects the lender, the lender can still come up with details at the identified agency or insurance issuer you could contact for your proprietor’s identified insurance coverage.

How Much Does Life Isurance Cost?

Locate the Closing Statement

Your last declaration, also referred to as the HUD-1 Settlement Statement or Closing Disclosure, consists of info on all the financial transactions and services supplied at some point in your private home purchase, consisting of name coverage. Review this record to find information about your identified insurance policy, the title employer, and the policy’s value. This fact can lead you to the proper touch for acquiring a duplicate of your coverage.

Policy Types:

In real estate, identifying coverage is pivotal in safeguarding the interests of shoppers and creditors and promoting the capability to identify troubles. Title coverage comes in two forms: the Lender’s Policy and the Owner’s Policy. Each serves a distinct purpose and protects distinct events in a property transaction.

Lender’s Policy

A Lender’s Policy, also known as mortgage coverage, is designed to defend the lender’s interests inside the assets up to the mortgage loan amount. Should any problems with the belongings’s identity arise after the belongings have been purchased, the lender’s policy presents economic safety towards losses. This sort of coverage is a prerequisite for most mortgage lenders as a part of the loan approval method and stays in impact until the mortgage is paid off, refinanced, or the belongings are offered.

Key Features:

- Protection Amount: The coverage quantity normally equals the mortgage amount and decreases as the loan stability is paid down through the years till it reaches zero.

- Required by Lenders: Securing a mortgage is an obligatory requirement.

- Covers Lender’s Interest: It protects most superficially the lender’s economic pastimes, now not the homeowner’s fairness inside the property.

Owner’s Policy

An Owner’s Policy is designed to shield the Owner of a house’s funding or equity in the belongings. This coverage safeguards against financial loss because of name defects, liens, or other problems that were not found in the title search earlier than shopping the assets. Unlike the lender’s coverage, an owner’s coverage covers the entire purchase charge of the house. It remains in effect as long as the policyholder or their heirs are interested in the property.

Key Features:

- Protection Amount: The coverage amount is typically equal to the purchase price of the property and does not decrease over time.

- Optional but Recommended: While not mandatory, it is highly recommended to protect the homeowner’s interests.

- Comprehensive Coverage: It provides broader protection for the Owner, including legal defense costs against claims on the property’s title.

Title insurance premiums are lower in the following situations:

- Simultaneous Mortgage Issue: When Owners and Mortgage policies are issued at the same closing, a reduced rate known as the Simultaneous Mortgage Rate applies. The Owner’s policy is charged the full Owner’s rate, and the Mortgage Loan policy is charged 30% of the applicable Mortgage Loan rate.

- Refinance/Subordinate Mortgage: A discounted premium is applicable for a Mortgage Loan policy issued at the time of refinancing when issued within ten years of a previously insured mortgage or fee policy, and there has been no change in ownership and the property has not changed.

Conclusion

Finding your title insurance policy is like ensuring you have the key to a safety box that protects your home’s paperwork. It’s important to know where this key is so you can feel safe and sound about your home. You can look for it by talking to the person who helped you buy your home, asking the company that gave you the insurance, checking with the bank that helped you with your loan, or looking through your home-buying papers. In simple terms,where can I find my title insurance policy? it’s about ensuring you can quickly grab that protective shield for your home whenever needed.

FAQs

What is the basic title insurance policy?

The basic title insurance policy protects against legal issues with your property’s title, like old debts or mistakes in past sales. It ensures your ownership is legal and problem-free.

What is the distinction between identify coverage and proprietor’s policy?

Title coverage is a preferred time period for policies that protect against identified problems. Owner’s coverage mainly guards the customer’s interests in their belongings, ensuring they’re the rightful owners without prison issues.

Who pays for identify coverage in Texas?

In Texas, it’s common for the vendor to pay for the buyer’s Owner’s title insurance policy as a part of closing costs. However, this will be negotiated among the client and supplier.

References:

https://idfpr.illinois.gov/content/dam/soi/en/web/idfpr/faq/dfi/title-insurance-section-faqs.pdf

https://nationwidetitle.net/how-to-locate-a-copy-of-your-title-insurance-policy/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.

Where can I find my title insurance policy?

Where can I find my title insurance policy?