When most people think about life insurance, they often associate it with protecting their family in the event of their death. Usually, it’s with a term or permanent “whole life” policy. It protects the future of their loved ones by providing peace of mind and stability during a trying time. While that is the most common and practical use, there are more! You can use life insurance for business as well.

What if you could provide your business with the same stability and peace of mind in the event of a death? In this blog, we will explore what are business uses of life insurance and how it can provide value to your company and your employees.

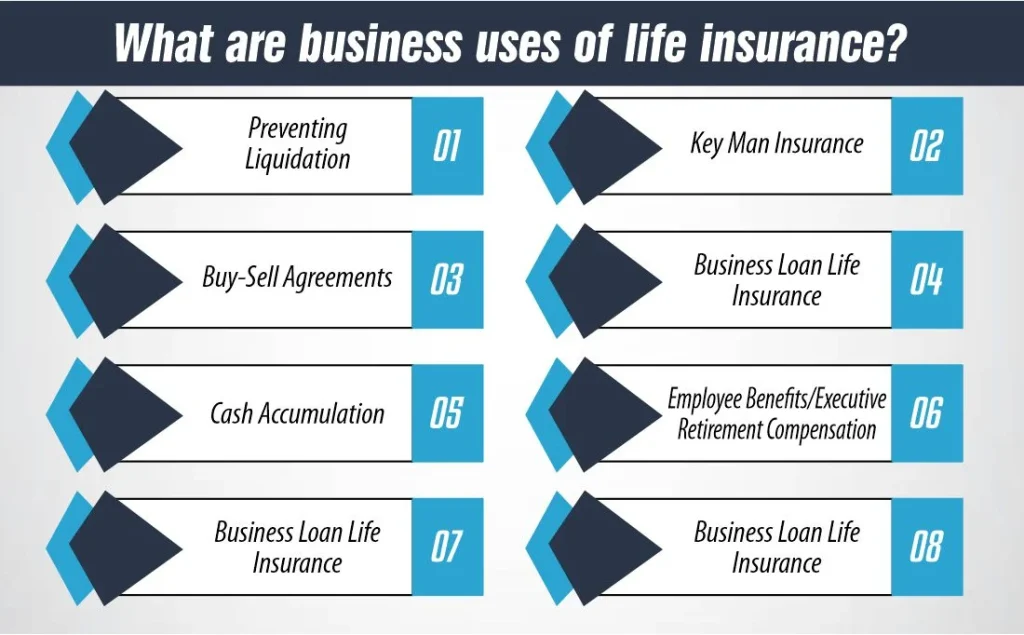

What are business uses of life insurance?

What are business uses of life insurance?

Historically regarded as a private financial protection net, life insurance also plays a crucial role in business. Companies leverage life insurance for diverse strategic purposes, from securing loans to enhancing worker benefits. Let’s delve into what are business uses of life insurance, exploring how it supports company goals and contributes to a corporation’s financial health and stability.

Preventing Liquidation

Life insurance offers companies vital protection on the internet, saving you from liquidation in financial misery or following the lack of a key parent. Through strategic planning, lifestyle coverage policies can offer immediate liquidity, ensuring business continuity and defensive against the chance of having to sell off belongings. For example, cash fee existence coverage guidelines act as a financial reserve that can be tapped into to cover emergencies or repay money owed, preventing forced asset liquidation.

Key Man Insurance:

Key man coverage is an essential risk management tool that protects an enterprise on the occasion of the death or incapacitation of an essential employee. This coverage compensates for the ability loss in sales and covers the prices related to finding and educating an alternative. By securing key man coverage, agencies can maintain operational stability and reassure investors and lenders of their resilience in the face of unexpected demanding situations.

Buy-Sell Agreements

Buy-sell agreements, funded via life coverage, are a cornerstone for ensuring a commercial enterprise’s continuity upon the death of an owner or a key stakeholder. These agreements are pre-organized contracts among business partners or shareholders that outline how a companion’s proportion of the enterprise can be redistributed if they die or are otherwise forced to leave the corporation. Life coverage regulations offer the important liquidity to purchase the deceased companion’s hobby from their estate, allowing the business to continue operating easily without the need for outside financing. This setup now prevents capability disputes among surviving companions and family individuals and secures the business’s future.

Business Loan Life Insurance

When businesses take out loans, lenders frequently require life coverage on key individuals whose demise substantially affects the company’s potential to repay the debt. This form of coverage, known as collateral mission life insurance, designates the lender as a beneficiary as much as the amount owed on the mortgage. If the insured man or woman dies, the insurance payout goes without delay to the lender to cover the outstanding loan balance, making sure that the debt does not become a burden to the business or its other property.

Cash Accumulation

Certain kinds of life insurance guidelines, which include entire lifestyles or normal lifestyles, feature a cash price element that grows through the years. Businesses can now use those rules for their loss of life benefits and as a financial tool for coin accumulation. The coin’s value inside those rules may be accessed through loans or withdrawals and used for diverse purposes, along with investment enterprise expansions, making an investment in new projects, or masking unexpected fees. This cash accumulation characteristic provides businesses with a bendy, tax-advantaged monetary useful resource.

Employee Benefits/Executive Retirement Compensation

Life insurance is a key detail in comprehensive worker benefits packages, particularly for key executives. Companies use life coverage to offer supplemental executive retirement plans (SERPs) or other deferred reimbursement arrangements, enhancing their reimbursement applications and incentivizing key personnel. These plans are frequently designed to provide executives with a lifestyles insurance policy whose blessings may be used as retirement earnings, similar to the coverage’s death benefit. This approach aids in attracting and preserving pinnacle expertise by imparting blessings on past salary and popular retirement plans.

Recruitment

In an aggressive task market, groups strive to provide compelling benefits to draw skilled experts. Offering life insurance as a part of a worker advantages package can be a sizable appeal. It affords employees the peace of thoughts that their families will be financially included in the event of their premature death. This gain is especially valued by personnel looking for security for their dependents for a lengthy period, making groups that provide existing coverage more attractive to employers.

Stock-Redemption Life Insurance

In organizations with more than one shareholder, stock-redemption life insurance is a strategic approach to managing commercial enterprise continuity and possession transition. Under this association, the enterprise purchases existing insurance guidelines for the lives of each shareholder. If a shareholder dies, the organization uses the loss of life advantage to shop for back the deceased shareholder’s shares, redistributing stocks to many of the remaining shareholders or maintaining them inside the employer. This approach guarantees that the management of the agency remains with the modern-day shareholders and enables an easy transition of possession without monetary stress.

How Much is Enough Business Coverage?

Determining the proper amount of life insurance coverage for a business involves numerous elements, including the form of insurance chosen and the specific motives behind the need for a life insurance plan. Here’s a guide to help you navigate those issues.

Types of Insurance and Coverage Needs

Key Person Insurance: The coverage amount should align with the predicted financial impact of losing the key person. Consider the person’s contribution to the enterprise’s sales, the cost of finding and training an appropriate alternative, and any ability losses or money owed that might be incurred at some stage in the transition period. A not unusual technique is to insure for multiple times the key man or woman’s annual salary, regularly starting from 5 to 10 times. However, this could vary based on the man or woman’s particular contribution to the enterprise.

Buy-Sell Agreements: The insurance quantity for a buy-promote settlement funded via life coverage should replicate the fee of the proprietor’s or accomplice’s percentage in the commercial enterprise. This can be determined through a business valuation, which must be frequently updated to mirror the organization’s contemporary worth. The purpose is to ensure enough funding to buy out the deceased partner’s stake without monetary stress.

Business Loan Protection: For existing coverage guidelines used as collateral for commercial enterprise loans, the coverage quantity must be at the least the same as the mortgage quantity. This guarantees that the loan may be completely repaid if a key individual, whose contribution is essential to repaying the mortgage, passes away.

Employee Benefits: When supplying life coverage as part of an employee benefits package deal, organizations normally provide coverage with a dying gain ranging from one to two instances of the employee’s annual earnings. However, the insurance quantity can be adjusted primarily based on the role, compensation, and the strategic importance of keeping pinnacle skills.

Why You Need the Life Insurance Plan?

The reason for obtaining an existing coverage plan notably impacts the quantity of coverage needed. Here are some not-unusual commercial enterprise goals that life coverage allows gain:

Continuity Planning: Ensuring the enterprise can run smoothly after lacking a key individual or owner. Coverage must be enough to offset any on-the-spot monetary effects and support the commercial enterprise through a transition length.

Loan Repayment: Securing a business mortgage with life coverage requires coverage that matches or exceeds the loan quantity, providing lenders with a warranty that the loan can be repaid even in worst-case eventualities.

Attracting and Retaining Talent: A competitive employee benefits package, such as life coverage, maybe a determining element for high-quality professionals. The coverage should replicate the value you place on your employees’ well-being and their importance to your enterprise.

Tax Planning and Liquidity: For some agencies, life insurance can be a device for tax planning and offering liquidity for estate taxes or other monetary responsibilities associated with the enterprise proprietor’s estate.

Conclusion

Life insurance within the business world is a lot greater than just a backup plan. It allows things to stroll easily if something surprising happens, like if a key person within the agency passes away. It’s additionally an intelligent way to make sure cash is available for crucial deals between business proprietors, to cowl loans, or to keep up cash for destiny wishes. Plus, it is remarkable to provide something more to employees, making their experience valued and stable. Whether it’s keeping a business from having to close down, assisting in appealing to and maintaining accurate employees, or ensuring there’s enough cash for large actions, existence coverage is a key participant in making groups more potent and greater solid. Its all about what are business uses of life insurance? Stay in touch for informations!

FAQs

How do businesses use life insurance?

Businesses use existence insurance to defend against the economic effect of losing a key employee, to help buy-promote agreements and stable loans, to provide worker blessings, and to accumulate coins for future needs.

What is not a business use of life insurance?

Life insurance is not used to provide personal health coverage or as a direct investment tool for short-term business operations.

References:

https://www.byarswright.com/how-to-use-lifeinsurance-to-benefit-your-business/

https://www.linkedin.com/pulse/business-uses-life-insurance-julio-ricky-gonzalez-rmip-/

https://cfainsure.com/business-uses-for-life-insurance-when-and-why-you-may-need-it/

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.

What are business uses of life insurance?

What are business uses of life insurance?