Affordable Burial Insurance for Seniors: A Comprehensive Guide

Last Updated on: December 5th, 2024

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Introduction

Choosing the affordable burial insurance program for seniors depends on your needs, but according to Investopedia, burial insurance is available in smaller coverage amounts, typically starting at $5,000 or $10,000. Planning for end-of-life expenses is an important step in ensuring peace of mind for both seniors and their loved ones. With funeral costs continuing to rise—reaching a national median of $8,300 for a traditional burial and $6,280 for cremation in 2024—it’s essential to find practical solutions.

Table of Contents

ToggleBurial insurance, a type of life insurance created to handle funeral costs and other associated expenses after death, provides an effective solution for alleviating these financial challenges. Additionally, shifting preferences, such as a projected cremation rate of 61.9% in 2024, highlight the growing need for accessible and affordable options. Burial insurance for seniors provides financial relief and flexibility to accommodate evolving funeral movements, including green funeral options, which are gaining interest among 68% of consumers for their cost-saving and environmental benefits.

Read More: What is Burial Insurance for Seniors?

Choosing an Affordable Burial Insurance Program For Seniors Depends on Your Needs.

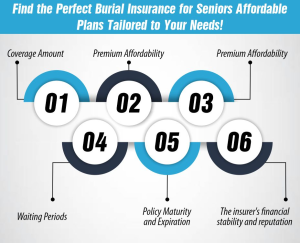

Selecting an affordable burial insurance program for seniors requires careful consideration of individual needs. Key factors to assess include:

- Coverage Amount: Assess the required funds to address funeral costs, medical expenses, and any unpaid debts. Burial insurance plans generally provide coverage options between $5,000 and $25,000. Information Source

- Premium Affordability: Make sure the premium payments are affordable for your budget now and in the long term, as certain policies might have premiums that rise over time.

- Policy Type: Decide between simplified issue policies, which may require health questionnaires, and guaranteed issue policies that have no medical questions but often come with higher premiums and waiting periods.

- Waiting Periods: It’s important to note that certain policies include a waiting period before the full death benefit becomes available. If the policyholder passes away during this time, beneficiaries may only receive a partial payout or a refund of the premiums paid.

- Policy Maturity and Expiration: Confirm that the policy does not expire at a certain age, ensuring lifetime coverage without unexpected termination.

- The insurer’s financial stability and reputation: Select a well-established insurance provider with a solid financial foundation to guarantee dependability when it comes time to process claims.

Read More: MetLife Burial Insurance: Coverage and Benefits

What Is the Average Cost of Burial Insurance for Seniors?

The average cost of burial insurance for seniors can range from as little as $18 per month to as much as $286 per month. Several factors influence these premiums, including your age, gender, coverage amount, health condition, and the insurance provider you select. If you’re in good health and can confidently answer “no” to any health-related questions on the application, you may qualify for lower rates. While some insurers might require a medical examination for approval, many plans do not. For individuals with prior health concerns or those taking specific medications, insurers may offer modified or substandard policies, which often come with higher premiums to account for increased risk.

Cost-Effective Burial Insurance for Seniors Depending on age

The cost of burial insurance for seniors varies significantly depending on factors such as age, gender, health, and coverage amount. Understanding these cost dynamics helps seniors choose affordable options tailored to their specific needs. Below is a breakdown of typical burial insurance premiums based on age groups, highlighting how affordability can be achieved at different stages of life.

How Much Does Life Isurance Cost?

1. Affordable Cost of Burial Insurance for Seniors Over 60

Different companies offer a wide range of rates, and the cost of burial insurance for seniors over 60 often depends on their specific policy structure. For example:

- Some insurers provide policies where costs range between $18 and $188 per month for seniors aged 60 to 65, depending on health status and coverage options.

- Other sample average costs include:

| Age & Gender | $5,000 to $10,000 Coverage | Up to $25,000 Coverage |

| Female (age 60) | $18–$33 | Up to $76 |

| Male (age 60) | $23–$43 | Up to $103 |

| Female (age 65) | $22–$41 | Up to $97 |

| Male (age 65) | $29–$54 | Up to $130 |

These ranges reflect the variance between simplified issue policies (requiring health questions) and guaranteed issue policies (with no health questions but higher premiums).

– Factors Affecting Cost

- Health Status: Seniors in good health often qualify for lower rates with simplified issue policies.

- Gender: Women generally pay less than men, as they tend to live longer.

- Coverage Amount: Smaller policies, such as $5,000 or $10,000, are more affordable than larger coverage amounts like $25,000.

- Insurance Company: Rates differ across providers, so shopping around is crucial to finding a cost-effective option.

– Tips for Seniors Over 60 Seeking Affordable Policies

- Compare Rates Across Providers: Obtain estimates from various providers to secure the most competitive rate for your requirements.

- Apply Early: Rates increase with age, so applying in your early 60s can help lock in lower premiums.

- Consult an Independent Agent: Agents who work with multiple insurers can help you explore a variety of plans and find the most affordable option.

- Choose the Right Policy Type: If you’re in good health, opt for a simplified issue policy to avoid higher premiums associated with guaranteed issue plans.

Read More: End-of-Life Burial Insurance

2. Affordable Cost of Burial Insurance for Seniors Over 65 to 70

The average cost of burial insurance for seniors aged 65 to 70 ranges between $22 and $93 per month, depending on factors such as gender, health, and whether health questions are answered during the application.

- Women: Monthly premiums range from $22 to $77.

- Men: Monthly premiums range from $29 to $93.

- For a $5,000 death benefit:

- Women (Good Health): $22–$27 | No Health Questions: $28–$33

- Men (Good Health): $29–$37 | No Health Questions: $35–$42

2. For a $10,000 death benefit:

- Women (Good Health): $41–$51 | No Health Questions: $55–$77

- Men (Good Health): $56–$70 | No Health Questions: $68–$93

These premiums reflect options available across different providers, emphasizing the importance of comparing plans to secure the most affordable rates.

Read More: Difference Between Burial Insurance and Funeral Life Insurance

3. Average Cost of Burial Insurance for Seniors Over 70 to 75

The monthly cost of burial insurance for seniors aged 70 to 75 typically falls between $28 and $116, influenced by factors such as the insurer, gender, health condition, and the chosen coverage amount. Women are generally cheaper to insure than men in this age group.

– Premium Ranges by Coverage Amount

- For a $5,000 death benefit:

- Women (Good Health): $28–$35

- Women (No Health Questions): $35–$43

- Men (Good Health): $38–$48

- Men (No Health Questions): $44–$58

2. For a $10,000 death benefit:

- Women (Good Health): $53–$68

- Women (No Health Questions): $69–$85

- Men (Good Health): $74–$93

- Men (No Health Questions): $88–$116

4. Average Cost of Burial Insurance for Seniors Over 75 to 80

The average cost of burial insurance for seniors aged 75 to 80 ranges between $38 and $162 per month, depending on factors like health, gender, and coverage amount. Women typically pay lower premiums than men in this age group.

– Premium Ranges by Coverage Amount

- For a $5,000 death benefit:

- Women (Good Health): $38–$48

- Women (No Health Questions): $46–$64

- Men (Good Health): $51–$65

- Men (No Health Questions): $63–$82

2. For a $10,000 death benefit:

- Women (Good Health): $72–$93

- Women (No Health Questions): $90–$125

- Men (Good Health): $100–$126

- Men (No Health Questions): $125–$162

Read More: Burial Insurance with No Waiting Period

5. Average Cost of Burial Insurance for Seniors Over 80 to 85

The average cost of burial insurance for seniors aged 80 to 85 ranges between $51 and $268 per month, depending on factors like health, gender, and whether medical questions are answered. Women generally pay lower premiums than men in this age group.

– Premium Ranges by Coverage Amount

- For a $5,000 death benefit:

- Women (Good Health): $51–$66

- Women (No Health Questions): $69–$94

- Men (Good Health): $68–$88

- Men (No Health Questions): $89–$135

2. For a $10,000 death benefit:

- Women (Good Health): $98–$129

- Women (No Health Questions): $135–$187

- Men (Good Health): $133–$173

- Men (No Health Questions): $175–$268

6. Average Cost of Burial Insurance for Seniors Over 85 to 90

The average cost of burial insurance for seniors aged 85 to 90 can reach $300 or more per month, with women typically paying less than men. These higher premiums reflect the increased risk associated with this age group and the limited availability of policies.

– Premium Ranges by Coverage Amount

- For a $5,000 death benefit:

- Women (Good Health): $70–$107

- Women (No Health Questions): $103 or more

- Men (Good Health): $93–$145

- Men (No Health Questions): $150 or more

2. For a $10,000 death benefit:

- Women (Good Health): $136–$211

- Women (No Health Questions): $204–$286

- Men (Good Health): $183–$286

- Men (No Health Questions): $299 or more

Read More: Burial Insurance For a Sibling

Why Is Burial Insurance Important?

The cost of funerals and associated expenses has been steadily rising. According to the National Funeral Directors Association (NFDA), the median cost of a funeral with viewing and burial is $7,848. This doesn’t include additional expenses such as medical bills or travel for family members.

Key reasons burial insurance is important:

- Financial Relief: Alleviates the financial burden on family members.

- Quick Payout: Benefits are paid out promptly, ensuring immediate access to funds.

- Simplified Process: Policies often have minimal qualification requirements, making them easier to obtain.

How Does Burial Insurance for Seniors Work?

Burial insurance operates as a whole life insurance policy, meaning it provides permanent coverage as long as premiums are paid. Here’s how it works:

- Application Process: Most policies do not require a medical exam. Seniors typically answer a few health-related questions, or in some cases, policies are guaranteed issues, requiring no health information at all.

- Premiums: Fixed premiums remain consistent throughout the policyholder’s lifetime.

- Cash Value: Over time, the policy accumulates cash value that can be borrowed against if needed.

- Payout: Upon the policyholder’s passing, the insurer disburses the death benefit to the beneficiary, who can use the funds for funeral expenses, debts, or other needs.

Read More: Above-Ground Burial Vaults

What Does Burial Insurance Cover?

Burial insurance is designed to cover a wide range of end-of-life expenses, including:

- Funeral and Burial Costs: Casket, embalming, cremation, and gravesite services.

- Headstone or Memorial Expenses: Custom headstones or monuments.

- Medical Bills: Unpaid medical bills that remain uncovered by health insurance.

- Travel Expenses: Costs for family members traveling to the funeral.

- Outstanding Debts: Credit card balances, loans, or other financial obligations.

Flexibility of Coverage: Beneficiaries can use any remaining funds for personal use, such as settling estate taxes or managing other financial needs.

Read More: State Farm Burial Insurance Review

Pros and Cons of Burial Insurance for Seniors

Pros

- Affordable Premiums: Smaller coverage amounts lead to lower monthly costs.

- No Medical Exams: Accessible for seniors with pre-existing health conditions.

- Fixed Premiums: Premiums remain unchanged for the life of the policy.

- Peace of Mind: Relieves families of financial stress during a difficult time.

Cons

- Smaller Death Benefits: Coverage amounts are limited compared to traditional life insurance.

- Higher Costs for Coverage: Premiums can be higher relative to the benefit amount.

- Waiting Periods: Guaranteed issue plans often impose a waiting period for non-accidental deaths.

How to Choose the Best Burial Insurance for Seniors?

Choosing the appropriate burial insurance policy requires assessing your specific needs and exploring various options:

- Determine Coverage Needs: Calculate funeral costs, debts, and other expenses you want covered.

- Compare Policies: Request quotes from multiple providers to find the most affordable rates.

- Work with Independent Agents: Agents with access to multiple insurers can help you find the best match.

- Read Reviews: Check the reputation and financial stability of the insurer.

Read More: Burial Insurance for Parents

Top Burial Insurance Providers for Seniors

Here are some of the best insurers offering burial insurance:

Tips for Finding Affordable Burial Insurance

- Apply Early: Premiums are lower when you apply at a younger age.

- Answer Health Questions: If possible, opt for a simplified issue policy to avoid waiting periods.

- Compare Multiple Quotes: Get personalized quotes from different providers.

- Consult an Expert: Work with an independent agent to navigate the options and secure the best deal.

Read More: Burial Insurance for Inmates

Final Thoughts

Planning for end-of-life expenses is an important step in securing peace of mind for both seniors and their loved ones. Burial insurance offers a practical and affordable solution to rising funeral costs, ensuring families are not left with financial burdens during an already difficult time. By understanding the different policy types, comparing options, and selecting coverage tailored to individual needs, seniors can make informed decisions that provide lasting benefits. Whether you prioritize affordability, flexibility, or immediate coverage, burial insurance serves as a reliable tool to protect your family’s future and honor your final wishes.

FAQs

Q1: What is the difference between burial insurance and life insurance?

A: Burial insurance is a type of whole-life insurance with smaller death benefits, tailored to cover end-of-life expenses.

Q2: Can seniors over 80 qualify for burial insurance?

A: Yes, many providers offer coverage up to age 85 or even 89, though premiums are higher.

Q3: Are burial insurance benefits taxable?

A: No, the death benefit is typically tax-free for beneficiaries.

Q4: Can I buy burial insurance for my parents?

A: Yes, with their consent, you can purchase a policy on their behalf to cover their final expenses.

Q5: What happens to unused burial insurance funds?

A: Beneficiaries can use leftover funds for personal or financial needs.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.