Do you have a family member who is getting older and worried about the expense of their funeral? Well! Burial insurance plans can be a solution for them. By getting a burial insurance policy you will be doing a huge favor to your family as it covers your final expenses.

Burial insurance with no waiting period covers you whether your death is natural or accidental as soon as you have paid the first premium. It means you do not have to wait for a waiting period before you get covered. It might be hard to believe but many insurance companies are offering these plans nowadays.

In this blog post, we will explore what is burial policy with no waiting period and how to get it. We will also discuss some other aspects like why it’s important for seniors and other important queries. Let’s get started.

What is Burial Insurance with No Waiting Period Mean?

Burial insurance with no waiting period is a specialized form of life insurance designed to cover end-of-life expenses, including funeral and burial costs, without the typical waiting period associated with traditional burial policies.

The waiting period, found in some insurance plans, mandates a specific period during which the policyholder must be insured before the full death benefit becomes available. In contrast, burial insurance with no waiting period offers an immediate payout, which can be incredibly valuable for those who need quick access to funds in times of loss.

What is the Best Burial Insurance with No Waiting Period?

Determining the best burial insurance with no waiting period can be subjective and highly dependent on an individual’s specific needs and circumstances. Additionally, the availability of insurance policies can vary by location and over time, so it’s essential to research and compare options to find the most suitable policy for your situation.

Best No Waiting Period Burial Insurance Companies

That said, here are some best no waiting period burial insurance companies known for offering burial insurance policies with no waiting period. It’s important to check their current offerings and compare them to find the best fit for your needs:

1- AARP Burial Insurance

AARP offers a range of burial insurance plans for its members that typically include immediate coverage with no waiting period. These plans are provided through partnerships with insurance companies.

2- Colonial Penn

Colonial Penn is known for providing straightforward burial insurance policies with immediate coverage and no waiting period. They offer a variety of options tailored to meet your specific requirements.

3- Mutual of Omaha

Mutual of Omaha offers a Guaranteed Issue Whole Life Insurance policy, which is designed for individuals who may have difficulty obtaining traditional life insurance due to health issues. This policy usually comes with no waiting period.

4- Gerber Life Insurance

Gerber Life Insurance provides immediate coverage for individuals between the ages of 50 and 80 through their Guaranteed Life Burial Expense policy.

How Does Burial Insurance with No Waiting Period Work?

Burial insurance with no waiting period is relatively straightforward. Here’s how it typically works:

How Much Does Life Isurance Cost?

- Application: To obtain this type of insurance, you’ll need to apply for a policy. The application process may include providing personal and medical information.

- Underwriting: Some burial insurance policies require limited underwriting, making it easier for individuals with pre-existing medical conditions to get coverage.

- Premiums: Premiums are the regular payments made to keep the policy in force. Premiums can often be paid on a monthly or annual basis.

- Coverage: Once you’ve been approved for the policy and have made your first premium payment, you’re covered immediately. In the event of your passing, the full death benefit is paid to your designated beneficiary, offering financial support for burial expenses.

Worth of Burial Insurance with No Waiting Period?

The worth of burial insurance with no waiting period varies from person to person and depends on individual circumstances. To determine its worth, you need to consider several factors:

Financial Situation

Assess your current financial situation and whether you have sufficient savings or assets to cover your funeral and burial expenses. If your savings fall short of covering these costs, burial insurance can be worth considering.

Immediate Financial Needs

Burial insurance with no waiting period is valuable if you have immediate financial needs to cover your final expenses. It ensures that your loved ones do not bear the financial burden when you pass away.

Age and Health

Your age and health can impact the cost of the insurance premiums. For younger and healthier individuals, the cost may be lower, making it a more attractive option. Conversely, if you’re older or have pre-existing health conditions, the cost may be higher, so you should weigh the premiums against the potential benefits.

Family and Dependents

Consider the financial impact on your family and dependents. If you have family members who rely on your financial support or if your funeral costs could cause a financial strain on your loved ones, burial insurance can offer peace of mind.

Desire for Simplicity

Burial insurance provides a straightforward solution for covering funeral and burial expenses. If you prefer a simple, easily accessible financial tool, this type of insurance may be worth it.

Alternative Options

Explore alternative methods of covering final expenses, such as setting up a separate savings account or prepaying for funeral expenses. Compare these options with burial insurance to determine the most cost-effective choice for your situation.

Overall Financial Goals

Consider your long-term financial goals and whether the premiums for burial insurance fit within your budget without compromising your broader financial objectives.

Ultimately, the worth of burial insurance with no waiting period depends on your specific needs, goals, and financial circumstances. Carefully evaluate your situation and consult with a financial advisor if necessary to make an informed decision.

Pros & Cons of Burial Insurance with No Waiting Period

Pros:

- Immediate Coverage: The absence of a waiting period ensures that the policyholder’s beneficiaries receive the full death benefit right away.

- Accessible: Burial insurance with no waiting period is often more accessible to individuals with pre-existing medical conditions or those who might not qualify for traditional life insurance.

- Customized Policies: Many policies can be tailored to your specific needs, allowing you to choose coverage that aligns with your burial and final expense requirements.

Cons:

- Higher Premiums: Insurance companies may charge higher burial insurance premiums, particularly for older individuals, compared to other life insurance policies.

- Limited Coverage: The death benefit might not be as substantial as what you’d get from a traditional life insurance policy, making it less suitable for other financial needs beyond burial expenses.

Coverage of Burial Insurance with No Waiting Period

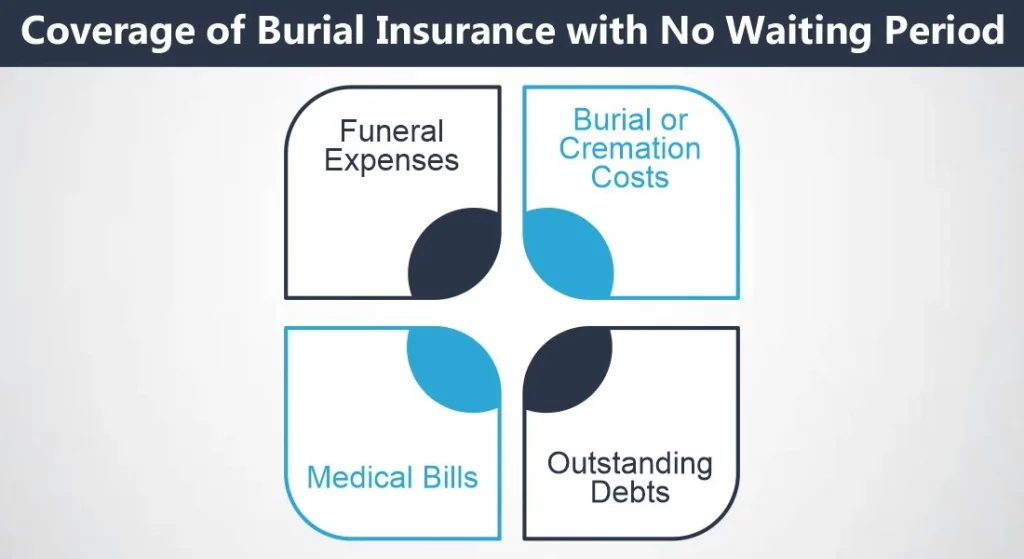

Burial insurance with no waiting period is designed to provide coverage for a specific set of expenses associated with a person’s funeral and burial. The coverage typically includes the following components:

Funeral Expenses: This insurance covers various costs related to the funeral service, including expenses such as the casket, embalming, funeral home services, visitation, and the graveside service.

Burial or Cremation Costs: The insurance policy can cover the expenses associated with the burial or cremation process, including the purchase of a burial plot, headstone or urn, grave opening and closing fees, and cremation services.

Medical Bills: Some policies may provide coverage for any outstanding medical bills incurred by the insured individual prior to their passing. This can be helpful in relieving financial burdens for the family.

Outstanding Debts: Depending on the policy, it may offer coverage for any remaining debts or loans left behind by the insured person. They can ensure meeting their financial obligations even after their passing

It’s essential to note that the specific coverage and benefits can vary among insurance providers and policies. Therefore, it’s crucial to review the terms and conditions of your chosen burial insurance policy carefully. Additionally, you should communicate with the insurance company to understand the extent of coverage and the specific items and services included in your policy.

Conclusion

Burial insurance with no waiting period plays a crucial role in relieving your loved ones from the financial burden of your final arrangements. While it may have its pros and cons, this type of insurance can provide peace of mind for those who need immediate financial support during challenging times. To determine the best burial insurance for your needs, carefully evaluate your financial situation and explore the offerings from reputable insurance companies.

FAQs (Frequently Asked Questions)

1- What is the waiting period for burial insurance with no waiting period?

There is no waiting period for burial insurance with no waiting period. Once you pay the first premium, coverage begins, regardless of whether your death is natural or accidental

2- Can I get burial insurance with no waiting period if I have pre-existing medical conditions?

Yes, some burial insurance policies do not require extensive medical underwriting. This makes it easier for individuals with pre-existing medical conditions to obtain coverage.

3- Is burial insurance with no waiting period the same as traditional life insurance?

Burial insurance covers funeral costs without waiting, tailored for funeral and burial expenses. Traditional life insurance policies serve broader purposes, including income replacement and legacy planning.

4- How can I determine the amount of burial insurance coverage I need?

The amount of coverage you need depends on your specific funeral and burial expenses. You can calculate this by estimating the costs of a funeral, burial or cremation, medical bills, and any outstanding debts.

5- Can I purchase burial insurance for a family member?

Yes, you can purchase burial insurance for a family member. Giving the gift of covering final expenses can ease the burden on your family, ensuring practical and thoughtful support.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.