In the intricate tapestry of life, one thread often overlooked is the inevitability of our own mortality. The prospect of our final journey is a topic few relish delving into, yet it is an inescapable part of our existence. Amidst the uncertainties of the future, one way to provide a sense of security to your loved ones is through MetLife burial insurance.

MetLife, a name synonymous with reliability, offers a straightforward and practical solution to the complex question of end-of-life expenses. Burial insurance is designed to ensure that your family won’t bear the financial burden of your farewell. In this article, we’ll dissect the intricacies of MetLife’s burial insurance program, focusing on the crucial aspects: its functioning, the advantages, and the potential drawbacks.

It’s a subject that’s often left unspoken and shrouded in uncertainty. But through this exploration, we aim to strip away the mystery surrounding MetLife’s burial insurance, providing you with a clear understanding of what it entails. Join us as we navigate this practical aspect of life, ensuring your peace of mind while approaching the inevitable with a well-prepared stance.

Does MetLife Offer Burial Insurance?

Yes, MetLife does offer burial insurance. MetLife, a well-established insurance provider, includes burial insurance as one of its insurance products. This burial insurance program is designed to provide financial assistance to cover the costs associated with funeral and burial expenses. It aims to alleviate the burden on your loved ones during a challenging time, ensuring that they have the necessary funds to conduct a dignified farewell. One of the notable features of MetLife final expense burial insurance is that it typically offers guaranteed acceptance, meaning that individuals can obtain coverage without undergoing a medical examination. This accessibility makes it an attractive option for those who may have health conditions that could affect their eligibility for other types of insurance. So, if you want burial insurance to secure your family’s financial future, MetLife’s burial insurance program is worth exploring. It’s a pragmatic choice for individuals looking to ensure that their final arrangements are well taken care of without placing a financial burden on their loved ones.

How The MetLife Burial Insurance Program Really Works?

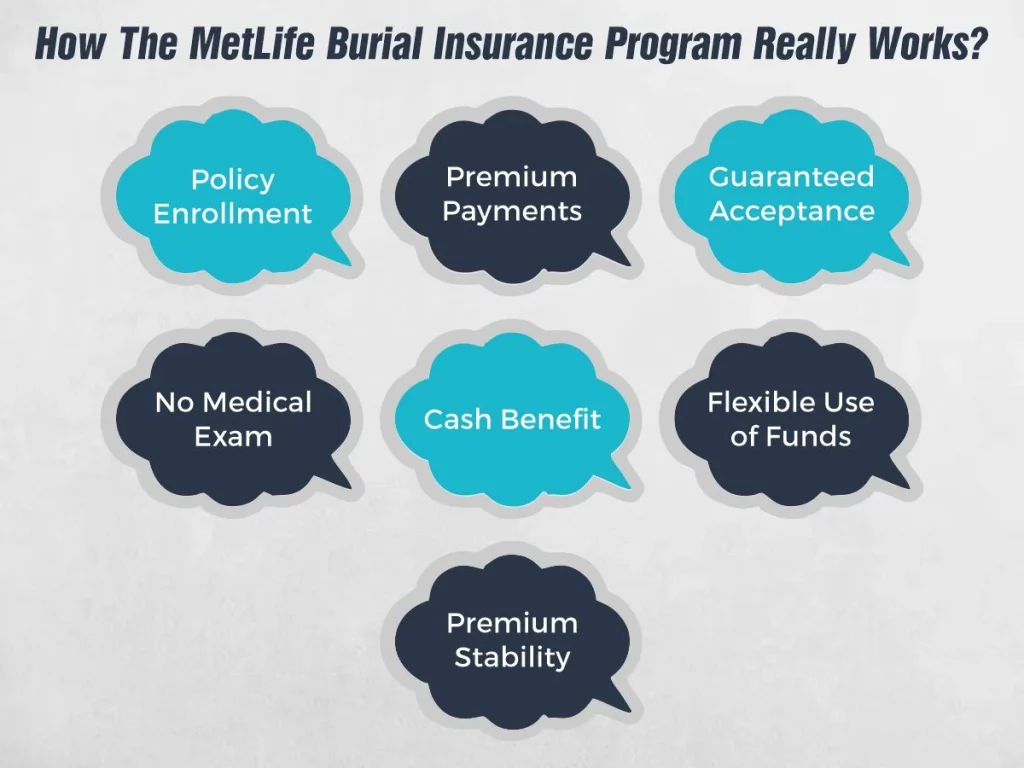

The MetLife Final Expense Insurance program operates in a straightforward and practical manner. It’s designed to provide financial security and peace of mind, ensuring that your loved ones are not burdened with the financial responsibilities of your final arrangements. Here’s how it really works:Policy Enrollment

To get started, you need to enroll in the MetLife Burial Insurance program. This typically involves contacting MetLife or a licensed insurance agent to initiate the application process.Premium Payments

As a policyholder, you’ll be required to make regular premium payments. Premiums can be paid on a monthly or quarterly basis, depending on the policy terms you choose. These payments are essential to maintain your coverage.Guaranteed Acceptance

One of the notable features of MetLife burial insurance is that it offers guaranteed acceptance. This means you can secure coverage regardless of your health condition, age, or other factors that might affect eligibility for traditional life insurance.No Medical Exam

Unlike many life insurance policies, MetLife final expense burial insurance typically does not require a medical examination. This makes it accessible and hassle-free for those with pre-existing health conditions.Cash Benefit

In the event of the policyholder’s passing, the beneficiary (usually a family member or a person of your choice) can make a claim. MetLife final expense insurance will provide a lump-sum cash benefit to the beneficiary. This payout is designed to cover the funeral and burial expenses.Flexible Use of Funds

The cash benefit provided is not restricted to funeral expenses. The beneficiary has the flexibility to use the money as they see fit. This can include covering the costs of the funeral, burial plot, cremation, memorial service, outstanding medical bills, and other related expenses.Premium Stability

Once you purchase a MetLife burial insurance policy, your premiums remain the same throughout the life of the policy. This provides predictability and ensures that your premium costs won’t increase over time. Some policies may have a waiting period before full coverage becomes effective. During this waiting period, if the insured individual passes away, the payout may be limited. Policyholders should carefully review the terms and conditions of their specific MetLife burial insurance policy to fully understand how it works and what it covers.

Pros & Cons of MetLife Burial Insurance

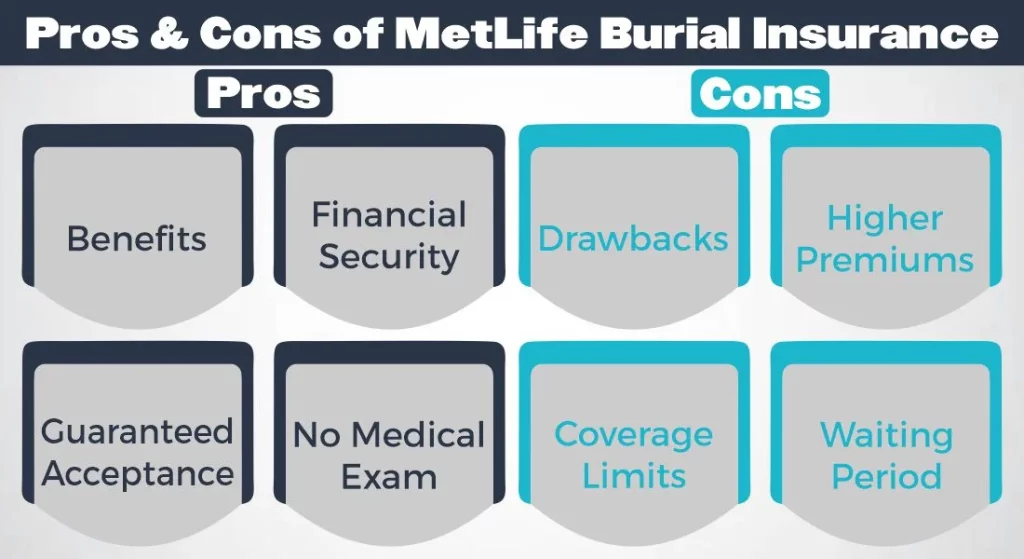

To make an informed decision about whether MetLife Burial Insurance is the right choice for you, it’s essential to weigh the pros and cons associated with this insurance program. Let’s take a look at the advantages and disadvantages:Benefits

- Financial Security: MetLife Burial Insurance provides peace of mind, knowing that your loved ones will have financial assistance when you’re no longer there to provide for them.

- Guaranteed Acceptance: MetLife offers guaranteed acceptance for applicants, regardless of their health condition. This accessibility makes it a viable option for individuals who may be denied coverage by other insurers due to pre-existing health issues.

- No Medical Exam: You don’t need to undergo a medical exam to qualify for MetLife Final Expense Burial Insurance. This can be a relief for those with health conditions that might affect their eligibility for traditional life insurance.

- Cash Benefit: The policy pays out in cash, giving your beneficiaries the flexibility to use the money as they see fit. They can cover funeral and burial expenses, outstanding debts, or any other financial needs that arise.

- Premiums Don’t Increase: Once you purchase a MetLife Final Expense Insurance policy, your premiums remain the same throughout the life of the policy. This predictability ensures that your premium costs won’t rise over time.

Drawbacks

- Higher Premiums: Burial insurance policies, including MetLife’s, tend to have higher premiums compared to traditional life insurance policies. This is primarily due to guaranteed acceptance and the lack of a medical exam.

- Coverage Limits: There may be coverage limits on MetLife Burial Insurance policies. It’s essential to ensure that the policy amount aligns with your expected funeral and burial costs. In some cases, the payout may not be sufficient to cover all expenses.

- Waiting Period: Some policies may have a waiting period before full coverage kicks in. If the insured individual passes away during this waiting period, the payout may be limited, typically to a return of premiums paid or a fraction of the death benefit.

What does MetLife Burial Insurance Cover?

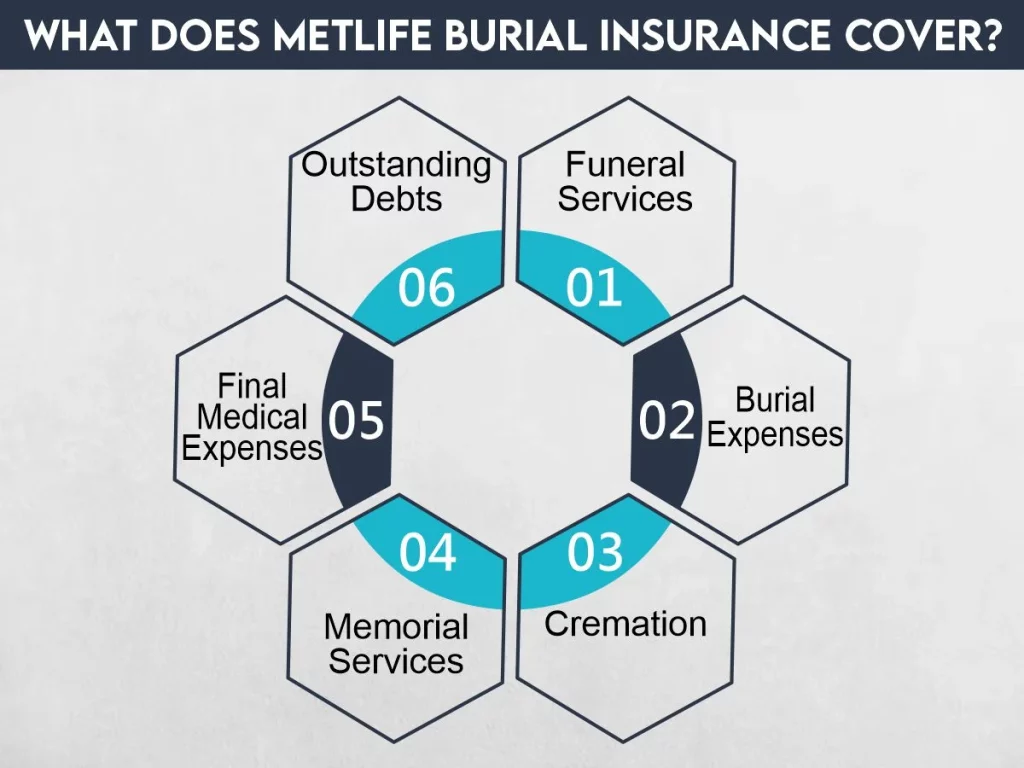

MetLife Burial Insurance is specifically designed to cover the costs associated with funeral and burial expenses. The coverage typically includes the following aspects:1- Funeral Services

MetLife burial insurance can help cover the various costs related to funeral services, including expenses for a casket, embalming, viewing, and transportation of the deceased. This ensures that your loved ones can provide a dignified and respectful farewell.2- Burial Expenses

The insurance can cover the costs associated with the burial itself, which includes the purchase of a burial plot, a grave marker or headstone, and any additional fees associated with the interment. This helps alleviate the financial burden of purchasing a final resting place.3- Cremation

If you prefer cremation over traditional burial, MetLife final expense burial insurance can also cover the costs associated with cremation. This includes expenses for cremation services, urns, and other related fees.4- Memorial Services

Some policies extend coverage to include the costs of memorial services and gatherings to honor and remember the deceased. This can include venue rental, catering, and other associated expenses.5- Final Medical Expenses

MetLife burial insurance may also cover outstanding medical bills or other healthcare expenses incurred by the insured individual before their passing. This can be a significant relief for the family, ensuring they are not left with unpaid medical debts.6- Outstanding Debts

In some cases, MetLife burial insurance policies may offer additional coverage to pay off any outstanding debts or loans left behind by the insured. This can provide added financial security to the family.

What Does MetLife Burial Insurance Cost?

The cost of MetLife Burial Insurance can vary significantly depending on several factors, including your age, the coverage amount you select, your health condition, and the specific policy you choose. Below, I’ll provide some approximate cost ranges based on data from the United States, but keep in mind that these are rough estimates, and individual rates may differ:Monthly Premiums

For a MetLife Burial Insurance policy, monthly premiums typically range from $20 to $100 or more. This range depends on your age and the amount of coverage you desire. Younger individuals will generally pay lower premiums, while older applicants may face higher costs.Coverage Amount

The coverage amount you select plays a significant role in determining the cost. A modest burial insurance policy with a coverage amount of $5,000 to $10,000 is more affordable, while policies with coverage amounts of $20,000 or more will have higher premiums.Age

Age is a crucial factor in pricing burial insurance. The younger you are when you purchase the policy, the lower your premiums will be. For instance, a 50-year-old might pay less than a 70-year-old for the same coverage.Health Condition

MetLife’s burial insurance is known for offering guaranteed acceptance, which means you won’t be denied coverage based on your health. However, if you have serious pre-existing health conditions, you may pay higher premiums than someone in good health.Gender

Some insurance providers differentiate between male and female policyholders, with males often paying slightly higher premiums due to generally shorter life expectancies.Smoking Status

If you are a smoker, your premiums are likely to be higher compared to non-smokers. Note that these are general estimates, and your individual rates may vary based on the factors mentioned. To get an accurate quote, it’s advisable to contact MetLife or a licensed insurance agent who can provide you with a personalized cost estimate based on your unique circumstances and needs. Additionally, be sure to carefully review the terms of your chosen policy, including premium payment options and any potential riders that may affect the cost.Conclusion

MetLife burial insurance offers a reliable option for individuals who want to ensure that their loved ones are not left with the financial burden of their final arrangements. With guaranteed acceptance, no medical exams, and the assurance of financial security, it’s a viable choice for those seeking peace of mind. However, to determine if it’s the right fit for your needs, you must carefully consider the policy details, including coverage limits and waiting periods.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.