When it comes to life insurance, affordability and accessibility are at the forefront of many minds. Colonial Penn $9.95 Plan has emerged as a beacon of hope, beckoning those seeking a financial safeguard for their loved ones without breaking the bank. At first glance, the promise of life insurance for a mere $9.95 per month sounds almost too good to be true. Is it a lifesaver, or just another financial mirage?

In this detailed exploration, we’ll peel back the layers surrounding the Colonial Penn $9.95 Plan, delving into its features, its caveats, and the underlying facts. No gimmicks, no sales pitches; just a comprehensive understanding of what this plan offers, its advantages, and its shortcomings.

In this guide, you will find a breakdown of how this plan works, insights into its pros and cons, and a peek into the real experiences of policyholders through Colonial Penn $9.95 Plan reviews. If you’re looking for clarity in the world of affordable life insurance, you’ve arrived at the right place. Let’s begin our journey into the heart of this policy to unveil the truth, layer by layer.

What is the Colonial Penn $9.95 Plan?

The Colonial Penn $9.95 Plan is a specific type of life insurance policy offered by Colonial Penn Life Insurance Company. This plan is designed to provide affordable coverage for individuals, particularly those who might have health issues that could make it challenging to qualify for traditional life insurance policies.

Colonial Penn $9.95 Plan is tailored to provide accessible and affordable life insurance coverage, particularly for those who may not qualify for traditional policies due to health issues. It offers the peace of mind of knowing that your loved ones will have financial support in the event of your passing.

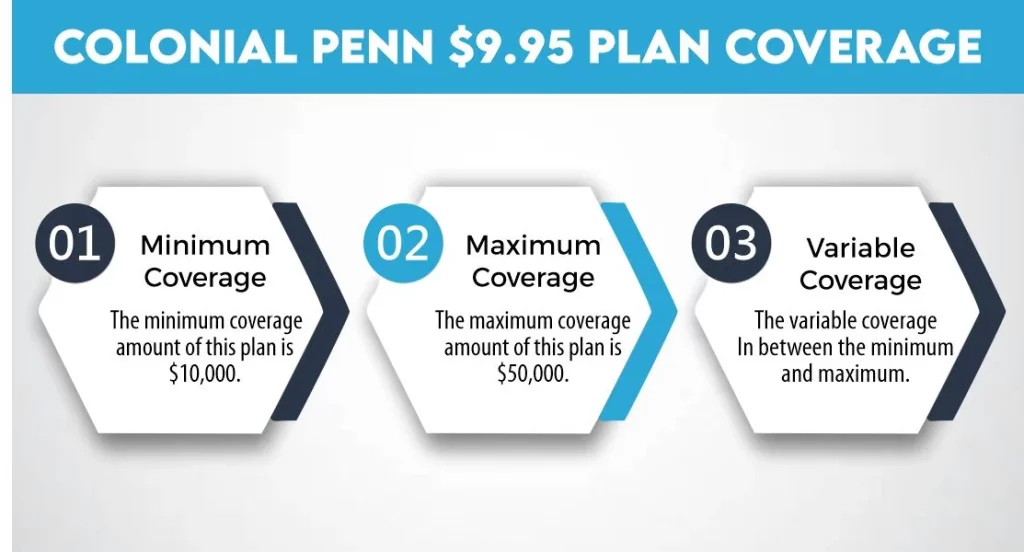

Colonial Penn $9.95 Plan Coverage

The amount of coverage you can obtain with the Colonial Penn $9.95 Plan depends on several factors, including your age, gender, and state of residence. This plan is designed to be flexible and accessible, but it provides coverage in a relatively limited range compared to some other life insurance policies.

Here’s a breakdown of the typical coverage amounts available with the Colonial Penn $9.95 Plan:

- Minimum Coverage: The minimum coverage amount that is often available with this plan is around $1,000. This is the smallest amount you can purchase, and it is suitable for covering minor expenses, such as final burial costs.

- Maximum Coverage: The maximum coverage amount offered by the Colonial Penn $9.95 Plan is generally capped at $50,000. This represents the upper limit of coverage available under this policy.

- Variable Coverage: In between the minimum and maximum, you can choose coverage amounts that suit your needs, within the range offered by Colonial Penn. The specific coverage amount can be determined based on your financial obligations and the level of financial protection you want to provide to your beneficiaries.

Note that the amount of coverage you select will impact your monthly premium, which is set at $9.95 per unit. Therefore, the more coverage you need, the more units you will have to purchase, and consequently, your monthly premium will increase.

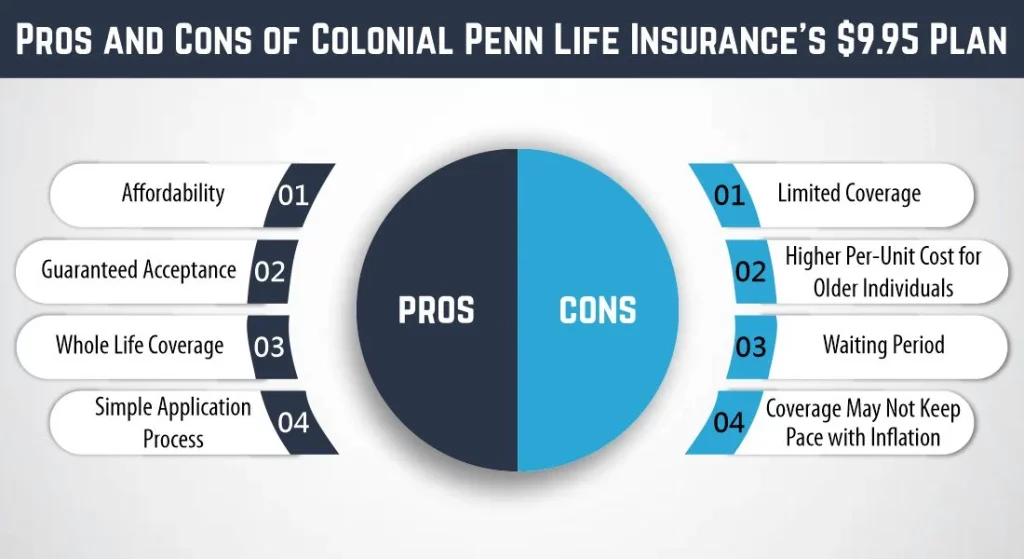

Pros and Cons of Colonial Penn Life Insurance’s $9.95 Plan

To make an informed decision about the Colonial Penn $9.95 Plan, it’s important to consider both its advantages and disadvantages. Let’s explore the pros and cons of this life insurance policy:

Pros:

1- Affordability

The most notable advantage of the Colonial Penn $9.95 Plan is its affordability. With a monthly premium of just $9.95 per unit, it’s one of the most budget-friendly life insurance options available. This makes it accessible to individuals on a tight budget.

2- Guaranteed Acceptance

The plan is typically a guaranteed issue, which means you can secure coverage without undergoing a medical examination or answering extensive health-related questions. This is especially advantageous for individuals with pre-existing health conditions who may have difficulty qualifying for other life insurance policies.

3- Whole Life Coverage

It’s a whole life insurance policy, which means it provides coverage for your entire lifetime, as long as you keep paying the premiums. Additionally, whole life policies build cash value over time, which you can borrow against or use for various purposes.

4- Simple Application Process

Applying for the Colonial Penn $9.95 Plan is often straightforward, and it can be done online or over the phone, making it convenient for those who prefer minimal hassle.

Cons:

1- Limited Coverage

The most significant drawback of this plan is the relatively small coverage amount it provides, typically ranging from $1,000 to $50,000. This may not be sufficient for individuals seeking to provide substantial financial security for their loved ones or cover significant expenses, such as a mortgage or college tuition.

2- Higher Per-Unit Cost for Older Individuals

While the monthly premium remains low at $9.95 per unit, the per-unit cost for this plan can be relatively high for older individuals. As you age, you may need to purchase more units to maintain the same coverage amount, which increases your monthly cost.

3- Waiting Period

Some policyholders may face a waiting period, usually the first two years of the policy, before the full death benefit becomes payable. During this waiting period, beneficiaries typically receive a return of premiums paid plus interest if the policyholder passes away, rather than the full death benefit.

4- Coverage May Not Keep Pace with Inflation

The fixed coverage amount may lose value over time due to inflation. This means that the real purchasing power of the policy’s benefit may decrease over the years.

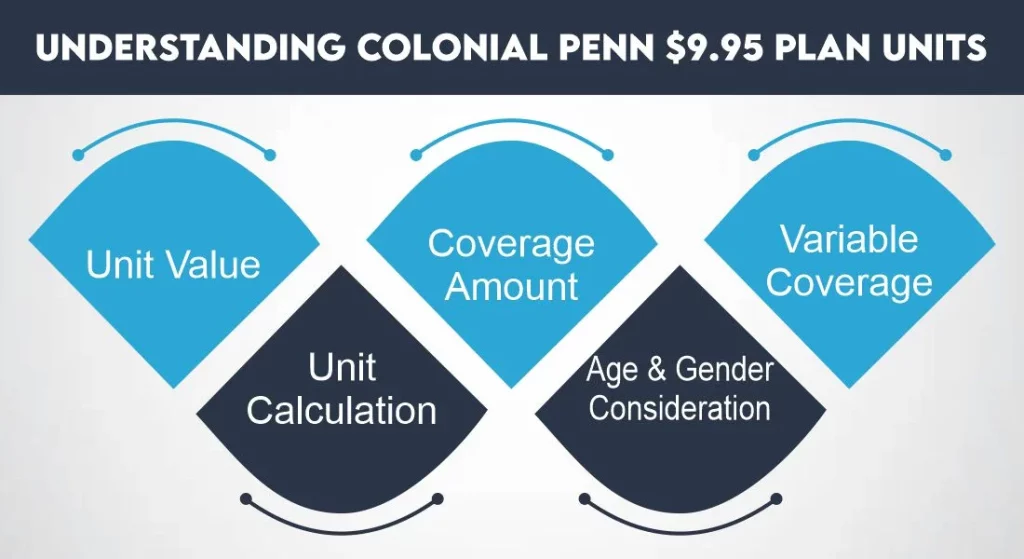

Understanding Colonial Penn $9.95 Plan Units

Understanding the concept of units in the Colonial Penn $9.95 Plan is essential for grasping how this life insurance policy operates. Units are a fundamental component of this plan’s pricing structure and are used to determine both the coverage amount and the monthly premium. It’s a transparent way to determine how the plan aligns with your budget and financial objectives.

Let’s break it down:

Unit Value

Each unit in the Colonial Penn $9.95 Plan represents a fixed monthly cost of $9.95. This means that if you purchase one unit, you will pay $9.95 per month for your insurance coverage.

Coverage Amount

The number of units you need to purchase depends on the coverage amount you desire. The more units you buy, the higher your coverage will be. For example, if you need $10,000 in coverage and each unit costs $9.95, you would need to purchase approximately 1,005 units (10,000 / 9.95) to achieve that coverage level.

Variable Coverage

The flexibility of this plan allows you to choose the coverage amount that aligns with your specific needs. This means you can adjust the number of units you buy to suit your financial obligations and provide adequate financial protection for your beneficiaries.

Unit Calculation

The specific number of units required for your desired coverage amount can be calculated using the simple formula:

Number of Units = Desired Coverage Amount Unit Value Number of Units / Unit Value Desired Coverage Amount

Age and Gender Consideration

It’s worth noting that your age and gender can influence the number of units you need. In general, as you get older, you may need more units to maintain the same coverage, which can result in a higher monthly premium.

Colonial Penn $9.95 Plan Rate Chart

The colonial penn life insurance $9.95 per month rate chart determine the cost of the policy. This chart helps you understand how the monthly premium, which is $9.95 per unit, varies based on your age and gender. The rate chart is a crucial tool for potential policyholders, as it provides transparency about the pricing structure of the plan.

| No of Units | Monthly Cost |

|---|---|

| 1 | $9.95 |

| 2 | $19.90 |

| 3 | $29.85 |

| 4 | $39.80 |

| 5 | $49.75 |

| 6 | $59.70 |

| 7 | $69.65 |

| 8 | $79.60 |

| 9 | $89.55 |

| 10 | $99.50 |

| 11 | $109.45 |

| 12 | $119.40 |

| 13 | $129.35 |

| 14 | $139.30 |

| 15 | $149.25 |

Please note that 15 units is the maximum you can purchase for this plan. The monthly cost increases linearly with the number of units you select, as shown in the table.

How does Colonial Penn $9.95 Plan Rate Chart work?

Here’s how the Colonial Penn $9.95 Plan rate chart typically works:

- Units: The rate chart displays the number of units you need to purchase to achieve your desired coverage amount. Each unit represents $9.95 of the monthly premium cost.

- Age: The chart is divided into age brackets, usually in five-year increments, starting from the youngest eligible age (often around 18 or 20) up to the oldest age at which the policy is available (often around 75 or 80).

- Gender: In some cases, the rate chart may differentiate between male and female policyholders, with different premium rates for each gender.

- Monthly Premium: The chart provides the corresponding monthly premium cost for each combination of age and gender. For example, a 30-year-old male may need 10 units for his desired coverage, resulting in a monthly premium of $99.50 (10 units x $9.95 per unit).

- Total Cost: The rate chart can also be used to calculate the total annual premium cost by multiplying the monthly premium by 12.

Note that as you get older, you will typically need to purchase more units to maintain the same coverage, which means your monthly premium increases. The rate chart offers transparency, allowing potential policyholders to calculate their expected costs based on their specific circumstances and coverage needs.

Is the Colonial Penn $9.95 Plan Guaranteed Issue With a Waiting Period?

Yes, the Colonial Penn’s $9.95 Plan is generally marketed as a guaranteed issue policy, meaning you won’t be denied coverage due to your health. However, it’s important to note that there may be a waiting period, usually the first two years, during which the full death benefit is not payable.

This waiting period is a common feature in many guaranteed issue life insurance policies and is designed to mitigate the insurer’s risk. If the policyholder passes away during this waiting period, the beneficiaries typically receive a return of premiums paid plus interest instead of the full death benefit. After the waiting period expires, the full death benefit is available.

Final Verdict

In conclusion, Colonial Penn’s $9.95 Plan suits those seeking affordable life insurance, especially with health challenges making qualification difficult for other policies. However, it’s crucial to carefully consider the coverage amount, per-unit cost, and the waiting period before making a decision. Read reviews, consult experts for an informed insurance choice tailored to your needs.