Can the IRS Take Life Insurance from a Beneficiary?

Last Updated on: June 30th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Life insurance is all about giving protection to your family after you are gone. But here the thought often comes to your mind that what if the IRS steps in? What will happen if the money you left for a family can be taken to pay off debts, especially your unpaid taxes? Though these are scary thoughts, the answer is not as simple as yes or no. You have to learn about so many things while having the question Can the IRS seize life insurance benefits?

Table of Contents

ToggleLet’s clear up the confusion and learn when the IRS can take life insurance money, when they are not able to get it, and how to protect your family’s future.

Who Gets the Life Insurance Money and How

If someone passes away, their life insurance usually pays the whole amount to the person who is chosen as a beneficiary. This money has not gone through the process called probate, and the amount is not taxed as income. This happens only when the state is named as the beneficiary.

Can the IRS Seize Life Insurance Benefits?

Yes IRS can take life insurance money, but under certain conditions. Most of the time, the life insurance money goes directly to the person who is named as a beneficiary, and this is safe from the person’s debts. But if no one is named as a beneficiary or if the money is left to the estate, it becomes part of the estate. In that case, the IRS can step in and take money to cover any taxes the person owed.

What is the Tax on the Estate?

If you are worried that the money from your insurance will be taken by the IRS. It’s important to know what is estate tax is.

If someone dies, the government taxes the value of everything they own, and this is called the estate tax. It includes a lot of things like a house, money, stocks, and personal items. The good thing is that not all the estate is taxed. There is a percentage that on 40% of the value of the estate, there will be no tax. The one thing you have to keep in mind is that there are some states that have their own estate or inheritance taxes that are separate from the federal tax. Before getting into any surprises, just talk to the advisor for a better understanding.

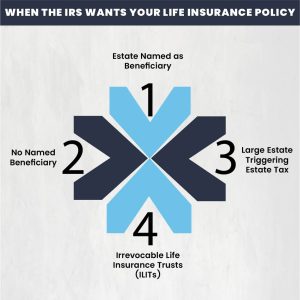

When the IRS Wants Your Life Insurance Policy

The IRS does not take the life insurance money without a reason, and when it takes it depends on a few important things.

1. Estate Named as Beneficiary

If the person who named the state as a beneficiary. Then, after he passes away, the payout will become a part of the estate’s money and property. At this point IRS can step in and take the charge that is needed to cover the unpaid taxes. Only after those debts the rest of the money goes to the heirs or anyone named in the will.

How Much Does Life Isurance Cost?

2. No Named Beneficiary

In case there is no beneficiary named, or the person who is named as the beneficiary has died, and there is no other beneficiary available. When this happens, the life insurance payout becomes part of the estate, and the IRS can take some or all of it to cover any unpaid taxes.

3. Large Estate Triggering Estate Tax

The money from life insurance is not usually taxed, but if the total value of someone’s estate is very large, this means that it could be taxed. In 2025, estates over $13.61 million may be taxed. If the life insurance payout makes the estate go over that amount, the IRS can ask for payment from the estate. This could include using the life insurance money to help cover those taxes.

4. Irrevocable Life Insurance Trusts (ILITs)

ILIT is the way that you can save your money from the IRS. This special type of trust owns the life insurance policy instead of the person. Because of this, the death benefit is not counted as part of the estate and is usually safe from the IRS.

What Assets Can the IRS Seize?

The IRS has strong powers to collect unpaid taxes and can legally take (or “levy”) many types of assets. These assets include:

- Bank accounts

- Wages (through garnishment)

- Social Security benefits

- Real estate

- Automobiles

- Business assets

- Investment accounts

Moreover, there are some assets that are harder for the IRS to take. For example, retirement accounts like IRAs and 401(k)s have some protection, but they’re not completely safe. The IRS usually goes after assets that are easy to turn into cash.

When it comes to life insurance, the IRS can seize:

- Cash value in a whole life policy owned by the taxpayer

- Death benefits if the estate is the beneficiary.

Consequences of Naming an Estate as the Beneficiary

It looks like a smart idea you name your estate as a beneficiary of your life insurance, but it can actually cause problems for your family. When you name your estate as a beneficiary instead of your loved one or a family member, then the money from the life insurance will go into your estate when you die, and then your money is used to pay off debts, including any money you owe to credit card companies or the IRS.

This will lead you to the serious issues.

- Long delays: It may take months or even years before your family receives any money.

- Legal fees: The money goes through probate court, which can cost a lot in legal fees.

- Less money for your family: Creditors and taxes are paid before your family gets anything, sometimes leaving very little.

A better option:

It’s better to add one of the people from your family as a beneficiary of your life insurance. If you add a specific person, your money from the insurance company will directly go to that person.

Always review and update your beneficiaries regularly to make sure your wishes are clear and your family is protected.

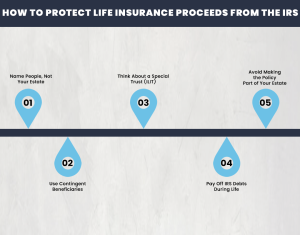

How to Protect Life Insurance Proceeds from the IRS

There are some important steps you have to take when buying life insurance to protect it from IRS seizure

1. Name People, Not Your Estate

Avoid naming the estate; instead, always name a real person (like your spouse or kids) as the beneficiary.

2. Use Contingent Beneficiaries

Contingent beneficiaries are the people who will receive the money if the main beneficiary passes away. This keeps the money from ending up in your estate by accident.

3. Think About a Special Trust (ILIT)

An Irrevocable Life Insurance Trust (ILIT) takes the policy out of your estate. This can protect the payout from taxes and creditors.

4. Pay Off IRS Debts During Life

Don’t leave unpaid taxes behind. Try to settle them while you’re alive. Planning helps protect your family from losing part of the insurance money.

5. Avoid Making the Policy Part of Your Estate

Make sure your policy is not owned by the estate. Ownership, not just beneficiary designation, affects estate inclusion.

Conclusion

Life insurance is all about protecting your loved ones and family, but you have to make sure that you add a beneficiary while buying the insurance policy, if no,t the IRS can take the money, but under certain conditions, such as when your estate is the beneficiary or you owe a lot in taxes. To protect your family, always name real people as beneficiaries, use backup (contingent) beneficiaries, and consider using a trust like an ILIT. Also, try to pay off IRS debts while you’re still alive. With smart planning, you can keep your life insurance safe and make sure it goes to the people who need it most.

FAQs

1. Can the IRS seize life insurance?

Yes, but only if the proceeds become part of the deceased’s estate. Named beneficiaries are typically protected.

2. Can the IRS take money from a beneficiary?

Only if the beneficiary themselves owes the IRS or the money becomes part of the deceased’s estate.

3. What assets that the IRS seize?

The IRS can seize bank accounts, wages, real estate, and any asset with liquid value, including certain life insurance policies.

4. When does the IRS want your life insurance policy?

If you have unpaid taxes, the IRS can take some or all of the insurance money when you named your estate as the beneficiary.

5. Are the life insurance proceeds I received taxable?

Usually no, but interest and certain transactions can trigger taxes. Consult a tax professional if in doubt.

Keep your life insurance safe from the IRS, name the right beneficiaries, and consider a trust.

Talk to an expert today and protect your family’s future.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.