Imagine you’re going through life, and suddenly, you find out you have a heart problem called cardiomyopathy. It can make getting life insurance seem really tough. But don’t worry! Even though dealing with cardiomyopathy can be hard, getting life insurance isn’t impossible.

Welcome to our guide on “Cardiomyopathy Life Insurance: Coverage Insights.” Here, we’ll explore what cardiomyopathy is, how it affects getting life insurance, and ways to deal with it. Together, we’ll figure out how to make things work despite the challenges. So, get ready to learn about how to protect your future, even if you have cardiomyopathy making things a bit tricky.

What is Cardiomyopathy and What It Means for Life Insurance?

Cardiomyopathy is a medical condition that affects the heart muscle, making it harder for the heart to pump blood efficiently. This condition can result in symptoms like tiredness, shortness of breath, and swelling in the legs. When it comes to life insurance, having cardiomyopathy can impact the process of getting coverage.

Insurance companies might see it as a higher risk because heart-related issues are involved. They’ll carefully check your medical history and the severity of your condition to decide if they can offer you insurance and at what cost. In simple terms, having cardiomyopathy might make it a bit trickier to get life insurance, but it’s not impossible. Insurers will just want to know more about your health before giving you a policy.

Can You Get Cardiomyopathy Life Insurance?

Yes, it is possible to obtain life insurance if you have been diagnosed with cardiomyopathy. However, the process might be more complex compared to getting insurance without this medical condition. Individuals with cardiomyopathy might face higher premiums or limited coverage options due to the perceived increased risk associated with heart-related illnesses.

Insurance companies assess several factors before offering coverage to individuals with cardiomyopathy. These factors include the severity of the condition, the type of cardiomyopathy, your overall health, treatment plans, medications, and lifestyle choices. Insurance underwriters evaluate these details to determine the insurability and the cost of coverage.

While it might require more effort and possibly higher premiums, securing life insurance with cardiomyopathy is feasible. Seeking guidance from insurance agents specializing in high-risk cases or insurers experienced in underwriting policies for individuals with pre-existing conditions can significantly improve your chances of finding suitable coverage.

Life Insurance with Cardiomyopathy

Securing life insurance with a diagnosis of cardiomyopathy can be challenging, but it’s not impossible. Individuals with cardiomyopathy may face higher premiums or limited coverage options due to the perceived increased risk associated with heart-related conditions.

Insurance providers assess various factors before offering coverage to individuals with cardiomyopathy. They examine the severity of the condition, type of cardiomyopathy, overall health, treatment plans, medication adherence, and lifestyle factors to determine the insurability and cost of coverage.

However, it is recommended to work with a professional to get cardiomyopathy life insurance. Because working with experienced insurance agents or specialized insurers familiar with underwriting policies for individuals with pre-existing conditions can improve the chances of finding suitable coverage tailored to your needs despite having cardiomyopathy.

What Would Be Underwriting Expectations with Cardiomyopathy Life Insurance?

Underwriting expectations for cardiomyopathy life insurance involve a comprehensive assessment of various factors to evaluate the risk associated with the condition. Insurance underwriters meticulously review medical records, including details about the type of cardiomyopathy, its severity, treatment plans, and an individual’s overall health.

Here are some key aspects underwriters consider:

How Much Does Life Isurance Cost?

Medical History

Underwriters analyze your medical records to understand the history and progression of cardiomyopathy, including any related complications or surgeries.

Current Health Status

Your current health condition, including symptoms, treatments, medications, and how well you’re managing the condition, plays a crucial role in underwriting decisions.

Treatment Compliance

Consistency in following treatment plans, medication adherence, and compliance with medical advice demonstrates responsible management of the condition, potentially influencing underwriting outcomes.

Lifestyle Factors

Underwriters assess lifestyle habits such as smoking, alcohol consumption, diet, and exercise routines as they can impact the progression of cardiomyopathy and overall health.

Additional Medical Tests

In some cases, underwriters might request specific medical tests or examinations to better understand the condition’s severity and its impact on your health.

Insurance companies aim to accurately assess the risk associated with cardiomyopathy life insurance to determine insurability and premium rates. While having this condition might result in more detailed scrutiny during the underwriting process, working with insurance professionals experienced in high-risk cases or specialized insurers familiar with pre-existing conditions can help navigate the process more effectively.

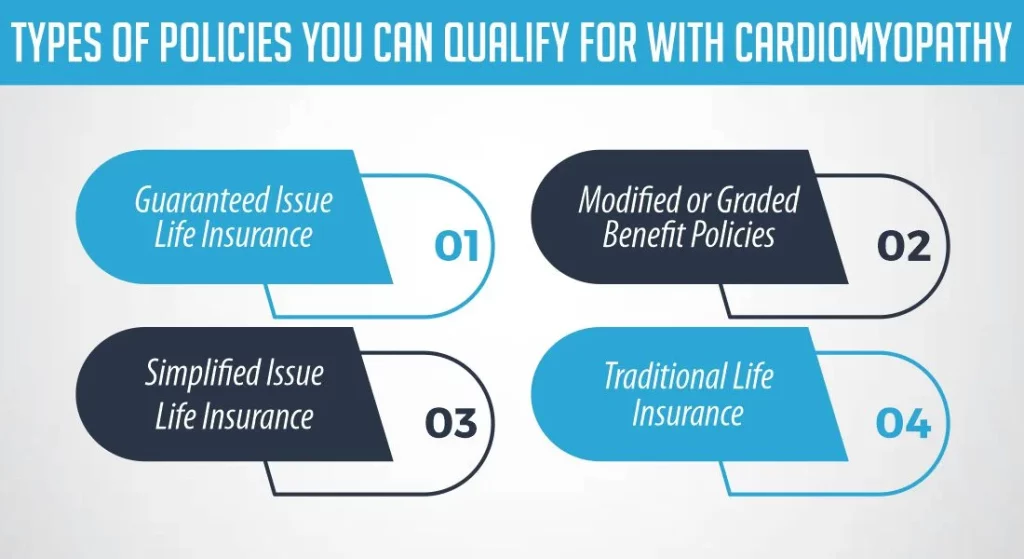

Types of Policies You Can Qualify For with Cardiomyopathy

If you have cardiomyopathy, there are several types of life insurance policies you might qualify for, depending on your specific situation. These policies cater to individuals with pre-existing health conditions and offer varying coverage options. Here are some types:

1- Guaranteed Issue Life Insurance

This policy doesn’t require a medical exam or health questionnaire. It’s designed for individuals with health issues like cardiomyopathy who might otherwise struggle to get coverage. However, these policies often come with higher premiums due to the lack of health assessments.

2- Modified or Graded Benefit Policies

These policies provide coverage for individuals with health conditions like cardiomyopathy but usually involve a waiting period before the full death benefit becomes available. During this waiting period, the policy may only offer a return of premiums paid or a percentage of the death benefit. Premiums might also be higher, and coverage amounts could be limited initially.

3- Simplified Issue Life Insurance

While these policies don’t usually require a medical exam, they may ask health-related questions. If your cardiomyopathy is well-managed and not severe, you might qualify for this type of policy. However, premiums might be higher compared to policies for individuals without health issues.

4- Traditional Life Insurance

Some traditional policies might still be available for individuals with cardiomyopathy, albeit with more stringent underwriting. These policies may require a medical exam and detailed health inquiries. Depending on the severity of your condition and other health factors, you might get approved, although with higher premiums or limitations on coverage.

Each policy type has its own terms, limitations, and costs. It’s essential to discuss your options with an experienced insurance agent who specializes in high-risk cases or insurers familiar with underwriting policies for individuals with pre-existing conditions like cardiomyopathy. They can help you navigate the complexities and find the best-suited policy for your needs.

Have You Been Declined Life Insurance Due to Cardiomyopathy?

If you’ve faced a rejection for life insurance due to cardiomyopathy, it might feel disheartening, but it’s not the end of the road. Rejection due to pre-existing health conditions like cardiomyopathy is not uncommon in the insurance world. However, being declined doesn’t mean you can’t get coverage elsewhere.

Several options are available for individuals who have been declined life insurance due to cardiomyopathy:

Seek Guidance

Consult with experienced insurance agents or specialized insurers who cater to high-risk cases or individuals with pre-existing conditions. They have expertise in navigating complex situations and might have access to insurers with more lenient underwriting criteria for cardiomyopathy.

Specialized Insurers

There are insurers who specifically focus on providing coverage for individuals with health issues like cardiomyopathy. These insurers might have policies tailored to accommodate your condition, offering coverage that traditional insurers might not.

Reapply with a Different Insurer

While one insurer might decline your application, another might be willing to offer coverage. Insurance companies have varying underwriting guidelines, so it’s worth exploring different options.

Alternative Policies

Consider alternative types of policies like guaranteed issue life insurance or modified benefit policies that cater to individuals with health issues. Though they may have limitations or higher premiums, they could provide the coverage you need despite being declined previously.

Don’t be discouraged by a rejection. By seeking guidance, exploring different insurers, and understanding specialized policies, you can increase your chances of finding suitable coverage tailored to your needs despite having cardiomyopathy. Working with experts in the field can significantly improve your prospects of securing the necessary life insurance coverage.

Conclusion

Securing life insurance with cardiomyopathy may present challenges, but it’s not an impossible feat. Understanding the underwriting process, exploring various policy options, and seeking guidance from experts in the field can significantly improve your chances of obtaining the right coverage for your needs despite this medical condition.

Remember, each insurance provider has its underwriting guidelines, so shopping around and exploring multiple options is essential. While cardiomyopathy might impact your life insurance journey, with patience and the right approach, you can find a policy that offers the protection you seek for yourself and your loved ones.

Frequently Asked Questions (FAQs)

1- Can you get life insurance without undergoing a medical exam if you have cardiomyopathy?

Certain policies, like guaranteed issue life insurance or simplified issue life insurance, may not require a medical exam but may ask health-related questions, if you want a cardiomyopathy life insurance plan.

2- How can you improve your chances of getting life insurance with cardiomyopathy?

Working with experienced insurance agents specializing in high-risk cases or insurers familiar with pre-existing conditions can significantly improve your chances. They can help navigate the complexities and find suitable coverage.

3- Will you have to pay higher premiums if you opt for cardiomyopathy life insurance?

Individuals with cardiomyopathy might face higher premiums due to the perceived increased risk associated with heart-related conditions. However, exploring different insurers and policy types can help find affordable coverage.

4- Will my lifestyle habits impact my ability to get cardiomyopathy life insurance?

Yes, lifestyle factors like smoking, alcohol consumption, diet, and exercise routines can influence underwriting decisions. Maintaining a healthy lifestyle might positively affect your insurability.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.