Navigating the world of self-employment is an exhilarating journey filled with autonomy and opportunity. As you carve your path and shape your destiny, there’s a multitude of responsibilities that come with the territory. Amidst the hustle and bustle of entrepreneurial endeavors, there’s one aspect that often lingers in the background: life insurance.

While the idea of insurance might not spark immediate excitement, its significance for self-employed individuals cannot be overstated. Imagine it as a safety net, a shield of financial security that safeguards your loved ones and the hard-earned fruits of your labor.

In this complete guide to life insurance for self-employed, we’ll unravel the importance, demystify the options available, and empower you to make informed decisions. Let’s explore together how to secure your future while navigating the unique landscape of self-employment.

Should Self-Employed People Buy Life Insurance?

Yes, self-employed individuals should strongly consider purchasing life insurance. While it’s not mandatory, securing life insurance is a prudent step towards protecting oneself and loved ones from unforeseen circumstances. Unlike those in traditional employment who might have life insurance coverage through their employers, self-employed individuals bear the responsibility of arranging their own financial protection.

Life insurance serves as a crucial safety net for the self-employed, providing a financial cushion for their families in the event of an untimely death. It can cover various expenses such as outstanding debts, mortgages, funeral costs, and the continuation of living standards for dependents. By having life insurance, self-employed individuals can ensure that their loved ones are taken care of and that their financial obligations are met even in their absence.

Why is Life Insurance Important for the Self-Employed?

Life insurance holds significant importance for self-employed individuals due to several key reasons:

1- Financial Protection for Dependents

Self-employed individuals often do not have the safety net of employer-provided life insurance. Life insurance ensures that in the unfortunate event of the policyholder’s passing, their dependents are financially supported. It can cover daily living expenses, outstanding debts, mortgage payments, and even future education expenses for children.

2- Business Continuity

For self-employed individuals running businesses, life insurance can be crucial for business continuity. It can help cover business debts, facilitate the transfer of ownership, or provide funds to sustain the business during a difficult transition period.

3- Mental Satisfaction

Knowing that loved ones will be taken care of in the event of an unexpected tragedy can provide immense peace of mind. Life insurance offers reassurance that financial stability and security will be maintained, alleviating worries about the future.

4- Funeral and End-of-Life Expenses

Life insurance can cover funeral costs and other end-of-life expenses, relieving the financial burden on surviving family members during a difficult time.

In essence, life insurance serves as a safety net, offering financial security and stability to self-employed individuals and their families, ensuring they are prepared for any unforeseen circumstances.

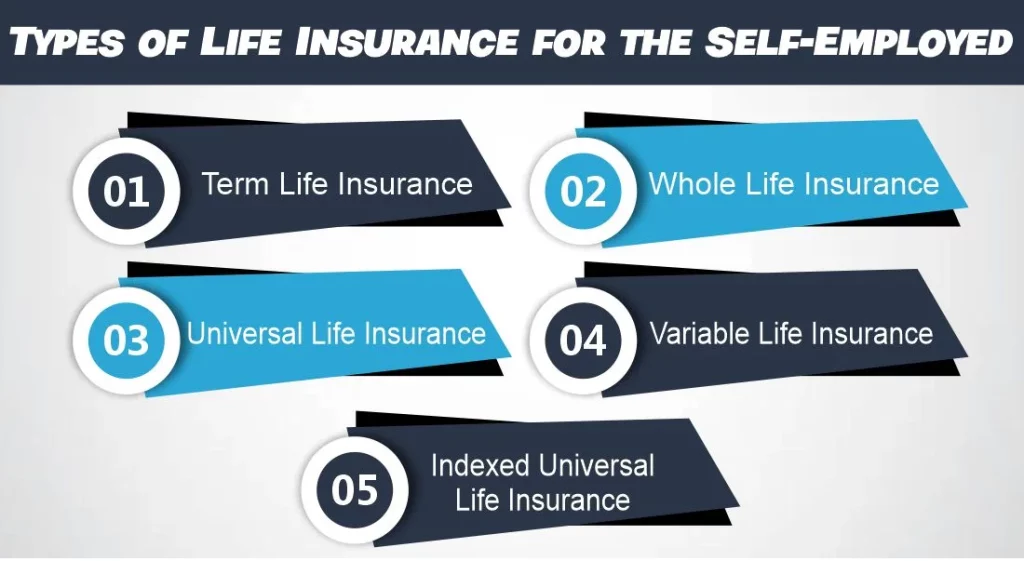

Types of Life Insurance for the Self-Employed

Self-employed individuals have various life insurance options tailored to their specific needs. Here are some common types:

Term Life Insurance

This policy provides coverage for a specified period, such as 10, 20, or 30 years. If the insured passes away within the policy term, beneficiaries receive the death benefit. It’s relatively affordable and straightforward, offering a fixed premium for the chosen term.

Whole Life Insurance

Unlike term life, whole life insurance provides lifelong coverage. It accumulates cash value over time, allowing policyholders to access funds through loans or withdrawals. Premiums typically remain fixed throughout the policy, providing stability but usually at a higher cost than term life.

Universal Life Insurance

This policy offers flexibility in premiums and death benefits. Policyholders can adjust the coverage and premium payments according to changing financial circumstances. It also accrues cash value, providing a savings component along with the death benefit.

Variable Life Insurance

This type of policy allows the policyholder to invest the cash value portion in various investment options, such as stocks or mutual funds. The policy’s cash value and death benefit fluctuate based on the performance of the chosen investments.

Indexed Universal Life Insurance

Combining features of universal life and investments tied to stock market indexes, this policy offers potential cash value growth linked to market performance while providing a level of protection against market downturns.

What is the average cost of getting Life Insurance for Self-Employed?

The cost of life insurance for self-employed individuals can vary significantly based on several factors such as age, health, coverage amount, type of policy, and insurer. Here is a tabular representation of potential monthly premiums for different coverage amounts and age groups:

| Age Group | Coverage Amount ($500,000) | Coverage Amount ($1,000,000) | Coverage Amount ($2,000,000) |

| 25-35 | $20 – $50 | $30 – $70 | $50 – $100 |

| 35-45 | $30 – $80 | $50 – $120 | $80 – $160 |

| 45-55 | $60 – $150 | $100 – $220 | $170 – $320 |

| 55-65 | $150 – $400 | $250 – $550 | $400 – $800 |

Please note that these figures are estimates and can vary significantly based on individual circumstances. Factors like health conditions, lifestyle, occupation, and the type of policy can impact the actual cost of life insurance. It’s advisable to obtain personalized quotes from insurance providers to get a more accurate understanding of the costs associated with life insurance for the self-employed.

How Much Life Insurance Do the Self-Employed Need?

Determining the appropriate amount of life insurance for self-employed individuals depends on various factors specific to their financial situation and the needs of their dependents. Here’s a guideline to help assess the necessary coverage:

Evaluate Financial Obligations

Start by assessing your financial responsibilities, including outstanding debts, mortgages, loans, and any other financial obligations. Calculate the total amount needed to settle these debts.

Consider Future Expenses

Factor in future expenses such as children’s education costs, ongoing living expenses for your family, healthcare expenses, and any other foreseeable financial needs.

Maintain Standard of Living

Determine the standard of living you wish to sustain for your family after your passing. This includes regular expenses like utilities, groceries, insurance premiums, and other daily costs.

Business-related Considerations

If you’re a self-employed business owner, consider the financial needs of your business for its continuity or potential succession.

How to Get Life Insurance for the Self-Employed?

Getting life insurance as a self-employed individual involves several steps:

1- Research and Compare

Explore various insurance providers and their offerings. Compare policies, coverage options, premium rates, and customer reviews to find companies that align with your needs.

2- Assess Your Needs

Evaluate the coverage amount you require based on your financial obligations and future expenses. Consider factors like outstanding debts, mortgages, living expenses, education costs for dependents, and any other financial goals you want the policy to fulfill.

3- Choose the Right Policy

Select a life insurance policy that suits your requirements. Options typically include term life insurance, whole life insurance, or universal life insurance. Term life provides coverage for a specific period, while whole and universal life policies offer lifelong coverage with potential cash value accumulation.

4- Complete the Application

Fill out the insurance application accurately and truthfully. Be prepared to provide personal information, medical history, and details about your finances.

5- Undergo Medical Examination (if required)

Depending on the policy and coverage amount, you may need to undergo a medical examination as part of the underwriting process. This helps the insurance company assess your health status.

6- Review and Finalize

Review the terms and conditions of the policy thoroughly before finalizing. Ensure you understand the coverage, premiums, exclusions, and any additional riders or benefits included in the policy.

7- Purchase the Policy

Once you’re satisfied with the terms, proceed to purchase the life insurance policy. Pay the initial premium to activate coverage.

8- Stay Informed

Keep all policy documents in a safe place and stay updated on premium payments and any changes in the policy terms or coverage.

Remember, consulting with a qualified insurance agent or financial advisor can provide valuable guidance in navigating the process and choosing the most suitable life insurance coverage for your specific needs as a self-employed individual.

Factors to Consider When Choosing Life Insurance for the Self-Employed

When selecting life insurance as a self-employed individual, several critical factors merit consideration to ensure you choose the most appropriate coverage:

Coverage Amount

Assess your financial obligations, including outstanding debts, mortgages, future education costs, and ongoing living expenses. Choose a coverage amount that adequately addresses these needs.

Type of Policy

Understand the different types of life insurance available, such as term life, whole life, or universal life. Consider which type aligns best with your financial goals and long-term plans.

Premium Affordability

Ensure that the premium payments fit within your budget. While considering the coverage amount, weigh it against the premiums to avoid financial strain.

Insurer’s Reputation

Research and evaluate the reputation and financial stability of the insurance companies you’re considering. Opt for insurers with strong financial ratings and a track record of reliability in paying claims.

Policy Flexibility

Look for policies that offer flexibility in terms of adjustments, such as the ability to change coverage amounts or add riders. Flexibility can accommodate changes in your life circumstances.

The Bottom Line

Life insurance is a crucial component of financial planning for self-employed individuals. It provides a safety net and peace of mind, ensuring that loved ones are financially secure even in the absence of the primary breadwinner. Assess your needs, explore available options, and choose a policy that best suits your requirements to safeguard your family’s future.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.