Welcome to the world of tailored financial security and legacy preservation! For high-net-worth individuals navigating the complexities of wealth management, safeguarding assets and ensuring the well-being of loved ones is paramount. Enter the realm of high-net-worth life insurance; a specialized avenue designed to cater to the unique needs and substantial wealth of affluent individuals.

Life insurance isn’t merely a safety net; it’s a strategic tool meticulously crafted to protect and preserve the legacy you’ve worked tirelessly to build. In this comprehensive guide, we’ll unravel the significance of high-net-worth life insurance, explore its vital role in estate planning, delve into available options, and provide key insights for those seeking to fortify their financial fortress.

Join us on this journey as we unlock the nuances and benefits of high-net-worth life insurance, empowering you to make informed decisions and secure your lasting legacy with confidence.

What is High-Net-Worth Life Insurance?

High-net-worth life insurance stands as a specialized financial safeguard meticulously designed for individuals with substantial wealth and intricate financial portfolios. Unlike standard life insurance policies, which may not sufficiently address the extensive assets of affluent individuals, high-net-worth life insurance offers tailored coverage and flexible benefits uniquely crafted to accommodate their specific financial circumstances.

This form of insurance is not solely about providing a death benefit; it’s a strategic tool meticulously crafted to protect and perpetuate the legacy painstakingly built over time. Its key distinguishing factor lies in its ability to cater to the intricate financial needs of those with considerable wealth, ensuring that their estate planning, wealth transfer, and financial security needs are comprehensively met.

Furthermore, high-net-worth life insurance serves as a vital component of a comprehensive financial strategy, tailored to protect significant assets, secure the future of beneficiaries, and facilitate seamless wealth transfer in a tax-efficient manner.

Why is High-Net-Worth Life Insurance Important?

High-net-worth life insurance holds profound significance for affluent individuals due to several pivotal reasons:

Estate Planning Excellence

For those with substantial estates, this specialized insurance facilitates effective estate planning. It ensures that assets are passed on seamlessly to beneficiaries, minimizing potential tax liabilities and preserving the wealth for future generations.

Financial Security for Beneficiaries

High-net-worth life insurance provides a financial safety net for loved ones, ensuring they maintain their quality of life and financial stability in the absence of the primary wealth holder.

Business Continuity

In cases where high-net-worth individuals have business interests, this insurance can serve as a crucial tool for business continuity, providing liquidity to navigate the complexities of succession planning or funding buy-sell agreements.

Tax Efficiency

Tailored policies often come with tax advantages, helping to mitigate tax burdens associated with wealth transfer and providing an efficient means of wealth preservation.

Ultimately, high-net-worth life insurance isn’t just about protecting against the unforeseen; it’s a strategic tool enabling affluent individuals to preserve their legacy and ensure the financial well-being of their loved ones and business ventures.

Do High-Net-Worth Individuals Need Life Insurance?

The necessity of life insurance for high-net-worth individuals revolves around the overarching goal of preserving wealth and securing the financial future of their beneficiaries. While these individuals may have a diverse array of financial instruments and strategies in place, life insurance remains a crucial element within their comprehensive financial plan.

High-net-worth individuals typically have substantial assets, complex financial structures, and diverse investment portfolios. Life insurance, tailored specifically for this demographic, provides a safety net that complements these assets and strategies. It serves as a valuable tool to:

- Protect Wealth: Life insurance ensures the preservation of substantial assets and mitigates potential financial disruptions caused by the loss of the primary income earner or wealth holder.

- Facilitate Estate Planning: It plays a pivotal role in facilitating seamless wealth transfer, protecting beneficiaries from excessive tax burdens, and maintaining the integrity of the estate.

- Provide Liquidity: Life insurance can offer liquidity precisely when it’s needed most, whether for covering estate taxes, funding buy-sell agreements, or addressing other financial obligations without the need to liquidate assets hastily.

Therefore, while the necessity for life insurance might vary for different individuals, for high-net-worth individuals, including life insurance in their financial blueprint can be crucial for ensuring comprehensive wealth protection and successful estate planning.

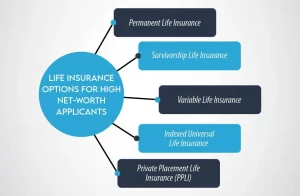

Life Insurance Options for High-Net-Worth Applicants

High-net-worth individuals have access to a range of specialized life insurance options tailored to accommodate their unique financial circumstances and objectives. Some of the key life insurance options available for affluent applicants include:

1- Permanent Life Insurance

This category includes whole life and universal life insurance policies. These policies offer coverage throughout the insured’s lifetime and may accumulate cash value over time. They provide a death benefit along with a savings or investment component, offering potential growth of cash value that can be accessed during the policyholder’s lifetime.

2- Survivorship Life Insurance

Also known as second-to-die insurance, this policy insures two individuals and pays out the death benefit upon the passing of the second insured. Often used for estate planning purposes, survivorship life insurance can provide substantial coverage while potentially reducing overall premiums compared to individual policies.

3- Variable Life Insurance

Variable life insurance policies combine a death benefit with an investment component. Policyholders can allocate funds into various sub-accounts, often linked to investment options such as stocks or bonds. The cash value of these policies can fluctuate based on the performance of the selected investments.

4- Indexed Universal Life Insurance

This type of policy ties the policy’s cash value growth to a stock market index, providing potential for higher returns while protecting against market downturns. It offers flexibility in adjusting premiums and death benefits, catering to the evolving needs of high-net-worth individuals.

5- Private Placement Life Insurance (PPLI)

PPLI is a specialized form of life insurance designed for affluent clients seeking customized solutions. It allows for a high degree of customization, potentially providing access to unique investment opportunities and tax advantages.

These diverse life insurance options provide high-net-worth individuals with flexibility, customization, and tailored benefits to align with their specific financial goals, estate planning needs, and risk tolerance levels. Choosing the most suitable policy requires a careful evaluation of individual circumstances and objectives, often necessitating guidance from experienced financial advisors and insurance specialists.

Applying for Life Insurance as a High-Net-Worth Applicant

When high-net-worth individuals consider applying for life insurance, several essential considerations come into play due to their intricate financial positions. Here’s a guide to navigating the application process:

Assessment of Financial Needs

High-net-worth applicants should evaluate their specific financial needs, including existing estate plans, potential tax implications, liquidity requirements, and the financial well-being of beneficiaries. This evaluation helps in determining the appropriate coverage amount and policy type.

Seek Professional Guidance

Collaborating with experienced financial advisors, estate planners, and insurance specialists is crucial. These professionals can provide personalized guidance, assess the most suitable policy options, and navigate complex financial structures to optimize benefits.

Underwriting Process

High-net-worth individuals might undergo a more extensive underwriting process due to their substantial wealth. Insurance companies may require detailed financial documentation and assessments to determine eligibility and coverage.

Policy Customization

Tailoring the policy to align with specific needs is vital. This includes determining the duration of coverage, death benefit amounts, potential riders or additional features, and the flexibility to adjust the policy as financial circumstances evolve.

Consideration of Trusts and Ownership Structures

Exploring ownership structures, such as placing the policy within a trust, can offer advantages in terms of estate planning, asset protection, and tax efficiency.

Evaluation of Premiums and Payment Options

High-net-worth applicants should assess premium payment options, considering whether a single premium or flexible payment schedule suits their financial strategy best.

Review and Reassess Regularly

Financial circumstances evolve, so it’s crucial to periodically review the life insurance policy and make adjustments as needed to ensure it continues to align with changing objectives.

Navigating the life insurance application process as a high-net-worth individual involves meticulous planning, professional guidance, and a thorough understanding of one’s financial situation. Taking these steps ensures that the chosen policy effectively protects wealth, addresses estate planning needs, and secures the financial future for beneficiaries.

The Bottom Line

High-net-worth life insurance is a critical component in the financial arsenal of affluent individuals. It offers a tailored approach to preserving wealth, ensuring the well-being of beneficiaries, and facilitating estate planning. While the necessity of life insurance may vary, its inclusion in a comprehensive financial plan can provide peace of mind and security.

Frequently Asked Questions (FAQs)

1- Can high-net-worth individuals benefit from term life insurance?

Term life insurance may offer temporary coverage, but for long-term financial planning and wealth preservation, permanent life insurance often provides more comprehensive benefits for high-net-worth individuals.

2- Are high-net-worth life insurance premiums more expensive?

Premiums for high-net-worth life insurance policies might be higher due to the increased coverage and specialized nature of these policies. However, they offer tailored benefits and substantial coverage to safeguard substantial wealth.

3- How can life insurance help in estate planning?

Life insurance can be a valuable tool in estate planning by providing liquidity to cover estate taxes, ensuring beneficiaries receive their inheritance without the need to sell assets to cover tax liabilities. It also facilitates wealth transfer and helps preserve assets for future generations.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.