Life insurance stands as a beacon of financial security, a safeguard ensuring our loved ones are cared for in our absence. Yet, amidst its protective embrace, disputes may emerge over its intended beneficiaries, creating a labyrinth of legal intricacies and emotional complexities.

Have you ever pondered what happens when the designated beneficiary of a life insurance policy is contested? Whether due to suspicions of foul play, changes in life circumstances, or misunderstandings, the process of contesting a life insurance beneficiary can be perplexing.

Join us on a journey to demystify this intricate terrain. From understanding the legal aspects to knowing when and how to contest, we’ll navigate this sensitive subject with clarity and guidance. Let’s delve into the world of contesting life insurance beneficiaries, empowering you with knowledge to navigate this intricate realm with confidence and assurance.

Is Contesting a Life Insurance Beneficiary Legal?

Yes, contesting a life insurance beneficiary can be legal under certain circumstances. Life insurance policies are legally binding contracts, and contesting a beneficiary involves challenging the designated recipient(s) named in the policy after the policyholder’s death.

However, it’s essential to note that contesting a beneficiary typically requires valid grounds supported by evidence. Some common reasons for contesting a beneficiary include:

- Fraud or Misrepresentation: If the beneficiary misrepresented facts or engaged in fraudulent activities related to the policy.

- Lack of Mental Capacity: If the policyholder was not of sound mind or lacked mental capacity when designating the beneficiary.

- Undue Influence: If the beneficiary exerted undue influence over the policyholder, manipulating their decision-making.

- Violation of Policy Terms: If the beneficiary’s claim contradicts the policy terms or legal regulations.

Contesting a life insurance beneficiary involves legal procedures, and the process may vary based on specific circumstances and jurisdiction. Consulting legal experts or professionals experienced in probate or insurance law can provide guidance on the legality and steps involved in contesting a life insurance beneficiary.

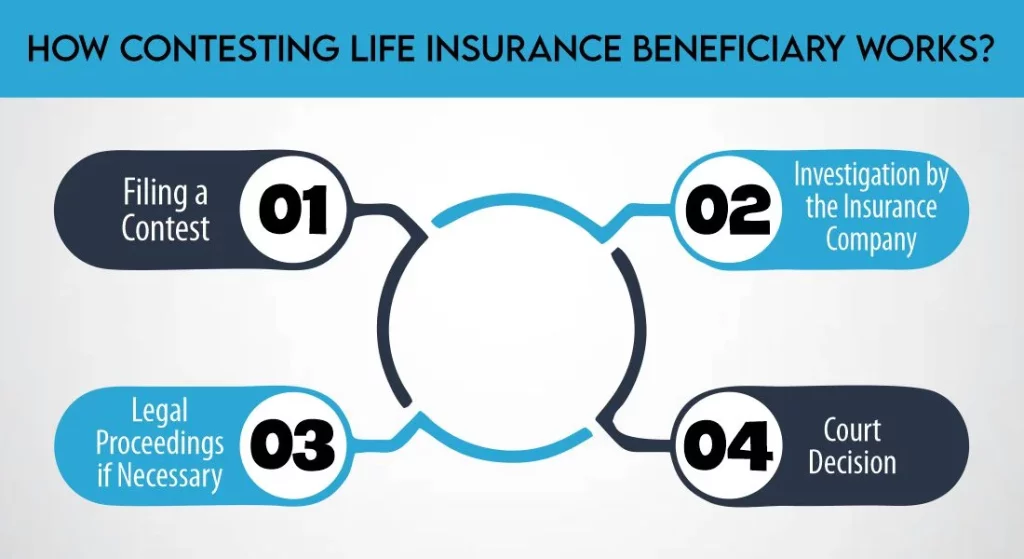

How Contesting Life Insurance Beneficiary Works?

Contesting a life insurance beneficiary involves a process that can be intricate and legally bound. Here’s an overview of how it typically works:

1- Filing a Contest

The individual contesting the beneficiary initiates the process by filing a formal complaint or contest with the insurance company. This usually involves submitting evidence or documentation supporting the claim that the designated beneficiary should be contested.

2- Investigation by the Insurance Company

Upon receiving the contest, the insurance company begins an investigation. They review the submitted evidence, policy documents, and any relevant information to assess the validity of the contest.

3- Legal Proceedings if Necessary

If the dispute remains unresolved after the initial investigation, legal action may be pursued. This may involve mediation, arbitration, or court proceedings to resolve the contested beneficiary designation.

4- Court Decision

In cases where legal action is taken, a court will review the evidence presented by both parties and make a decision based on the merits of the case.

It’s crucial to note that the specific steps and procedures involved in contesting a life insurance beneficiary can vary based on the circumstances, the policy terms, and the jurisdiction governing the policy. Seeking legal advice or guidance from experts in insurance law can provide clarity and guidance throughout the process.

When Should You Contest A Life Insurance Beneficiary?

Contesting a life insurance beneficiary is a significant step that should be considered under specific circumstances where there are valid reasons to challenge the designated recipient(s) listed on the policy. Here are situations that might prompt contesting a life insurance beneficiary:

How Much Does Life Isurance Cost?

Suspected Fraud or Misrepresentation: If there’s evidence or suspicion that the beneficiary obtained the designation through fraudulent means or misrepresented information related to the policy.

Questions About the Policyholder’s Capacity: When doubts arise regarding the mental capacity or competency of the policyholder at the time they designated the beneficiary.

Significant Changes in Life Circumstances: Instances where major life events occur after the beneficiary designation, such as divorce, remarriage, or family disputes, which might necessitate a review or update of the beneficiary.

Violation of Policy Terms or Legal Regulations: If the beneficiary’s claim contradicts the terms outlined in the policy or breaches legal regulations.

Contesting a life insurance beneficiary should be approached cautiously, and it’s advisable to gather substantial evidence before taking any action. Seeking legal counsel or advice from experts in insurance law can help navigate these situations effectively.

Step-by-Step Guide in Contesting Life Insurance Beneficiary

Contesting a life insurance beneficiary involves a structured process that requires careful consideration and adherence to specific steps. Here’s a step-by-step guide to contesting a life insurance beneficiary:

1- Gather Relevant Documentation

Begin by collecting all pertinent documents related to the life insurance policy, including the policy itself, communication records with the insurance company, and any evidence supporting your contention to contest the beneficiary.

2- Notify the Insurance Company

Inform the insurance company in writing about your intent to contest the beneficiary designation. Follow their specific procedures for contesting, which might involve filling out particular forms or providing detailed information about your claim.

3- Present Substantive Evidence

Prepare a clear and comprehensive case by presenting strong evidence that supports your contention. This evidence may include legal documents, witness statements, medical records, or any other relevant proof backing your claim.

4- Consider Legal Assistance

Seeking guidance from legal professionals experienced in probate or insurance law can be invaluable. They can provide expert advice, assess the strength of your case, and guide you through the legal process.

5- Engage in Communication

Maintain open and consistent communication with the insurance company throughout the process. Be prompt in responding to any requests for additional information or documentation they may require.

6- Follow Established Procedures

Adhere to the procedures and timelines outlined by the insurance company or legal authorities involved in the contestation process. Failing to meet deadlines or provide requested information could affect the outcome of the case.

7- Stay Updated and Persistent

Keep track of the progress of your contest and stay persistent in pursuing a resolution. Be prepared for potential delays and be patient throughout the process, as legal proceedings can sometimes take time.

8- Consider Alternative Dispute Resolution

In some cases, mediation or negotiation might offer a quicker and less adversarial way to resolve the contestation without going through lengthy court proceedings.

Remember, each contestation case is unique, and the specific steps involved may vary depending on various factors such as the policy terms, jurisdiction, and complexity of the situation. Seeking professional guidance and maintaining thorough documentation are key elements in successfully contesting a life insurance beneficiary.

Preventing a Contesting of Life Insurance Beneficiary

Preventing a contest of a life insurance beneficiary involves proactive steps aimed at minimizing the likelihood of disputes or challenges regarding the designated recipients listed on the policy. Here’s a guide on how to prevent contestation of a life insurance beneficiary:

Regular Policy Reviews

Routinely review your life insurance policy to ensure that beneficiary designations align with your current wishes and life circumstances. Update beneficiary information if significant changes occur, such as marriage, divorce, or the birth of children.

Clear and Explicit Communication

Clearly communicate your intentions regarding beneficiaries to your family members and loved ones. Discuss your decisions openly to avoid misunderstandings or surprises after your passing.

Consult Legal Experts

Seek advice from legal professionals, especially in complex family situations or when designating beneficiaries in blended families. They can offer guidance on the most appropriate ways to structure beneficiary designations.

Documentation and Records

Keep detailed records of communications, including any changes made to beneficiary designations. Maintain proper documentation to support your decisions and intentions.

Consider a Trust

In certain cases, setting up a trust can be a viable option to designate beneficiaries while providing specific instructions on how the proceeds should be managed and distributed. Trusts can add an extra layer of protection against potential contestation.

Regular Updates after Major Life Events

Any significant life events, such as the death of a beneficiary, remarriage, or the birth of additional children or grandchildren, should prompt a review and potential update of beneficiary designations.

Be Mindful of Potential Challenges

Anticipate possible challenges or disputes that could arise among potential beneficiaries. Take proactive measures to address and mitigate these potential issues before they become contentious.

Seek Mediation or Family Discussions

In some cases, open discussions or mediation sessions among family members regarding beneficiary designations can help prevent future disputes and foster understanding among involved parties.

The Bottom Line

In conclusion, contesting life insurance beneficiary involves legal complexities and emotional sensitivities. Understanding the process, knowing when to contest, and taking preventive measures are crucial steps to ensure the intended distribution of benefits according to your wishes.

Remember, seeking professional legal advice and maintaining transparent communication can significantly contribute to a smoother resolution in contested beneficiary situations. Always prioritize reviewing and updating your life insurance policy to align with your current circumstances, safeguarding your loved ones’ financial security in the future.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.