In the realm of financial strategies, there’s a rising buzz about a game-changer: Infinite Banking. Imagine a financial approach that puts you in the driver’s seat, empowering you to create wealth, secure your future, and become your own banker. At the heart of this strategy lies the power of whole life insurance, not just any policy, but the right one tailored for Infinite Banking.

You can take this policy that grows your money steadily, lets you borrow from yourself without disrupting your financial plans, and offers flexibility like never before. Choosing the best whole life insurance for Infinite Banking isn’t just about securing a policy; it’s about unlocking a financial superhighway towards financial freedom.

Join us on a journey through the intricacies of Infinite Banking and discover how selecting the perfect whole life insurance policy can be your gateway to a future filled with financial stability, flexibility, and unbounded potential.

What is the Infinite Banking Concept?

The Infinite Banking Concept (IBC) is a financial strategy that revolves around utilizing a whole life insurance policy as a cornerstone for creating personal banking systems. This concept was popularized by Nelson Nash through his book “Becoming Your Own Banker.”

At its core, IBC empowers individuals to take control of their finances by leveraging a specially designed whole life insurance policy. The key principles include:

Get A Quote

+1(800)695-6528

- Whole Life Insurance: IBC uses a whole life insurance policy due to its dual nature; providing a death benefit for beneficiaries and accumulating cash value over time.

- Cash Value Growth: The policy’s cash value grows tax-deferred, often at a guaranteed or projected rate, creating a pool of funds that policyholders can access.

- Policy Loans: Individuals can borrow against the cash value of the policy through policy loans. These loans offer flexibility, allowing policyholders to use the funds for various purposes without the stringent approval processes of traditional banking.

- Continuous Growth and Control: As policy loans are repaid, the cash value continues to grow, creating a cycle of financing opportunities and financial growth that remains within the policyholder’s control.

IBC aims to provide individuals with a system that enables financial independence, control, and the potential for wealth creation while maintaining liquidity and stability through a carefully selected whole life insurance policy.

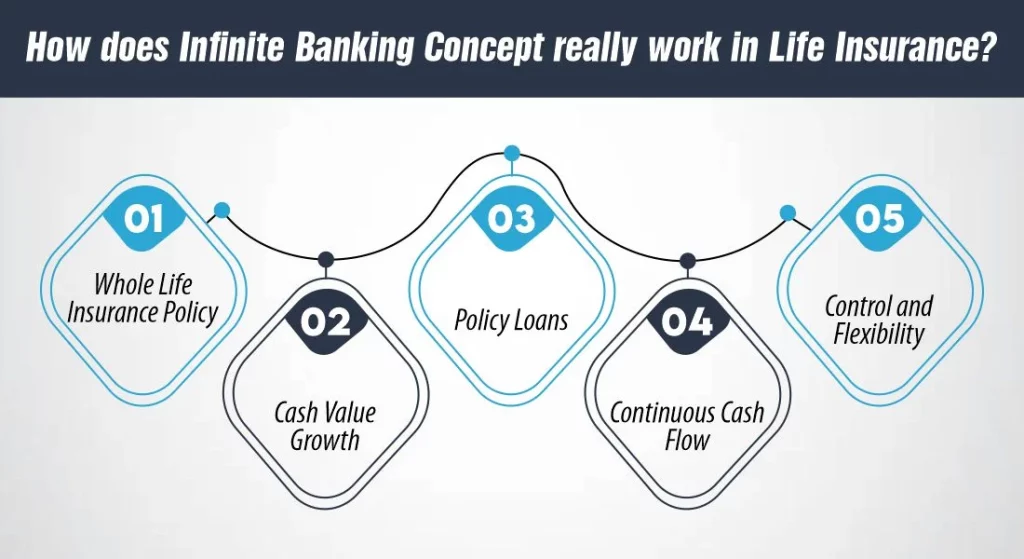

How does Infinite Banking Concept really work in Life Insurance?

The Infinite Banking Concept (IBC) operates by utilizing a whole life insurance policy as a financial tool to create a personal banking system. Here’s a breakdown of how IBC works within a life insurance policy:

1- Whole Life Insurance Policy

IBC relies on a specific type of whole life insurance policy, known for its cash value accumulation alongside the death benefit. The policyholder pays premiums, part of which goes toward the cost of insurance, while the remainder contributes to the cash value component.

2- Cash Value Growth

The policy’s cash value grows over time, either through guaranteed or projected rates set by the insurance company. This cash value accumulation occurs tax-deferred, providing a savings vehicle within the policy.

3- Policy Loans

Policyholders can borrow against the accumulated cash value by taking out policy loans from the insurance company. These loans allow access to funds without the need for credit checks or external approval processes, providing immediate liquidity.

4- Continuous Cash Flow

When a policy loan is taken, the cash value continues to accrue interest as if the loan amount were never withdrawn. As policy loans are repaid, the cash value replenishes and grows, allowing for further loans or investment opportunities.

5- Control and Flexibility

IBC grants the policyholder control over their finances, offering flexibility in using policy loans for investments, major purchases, education expenses, or any financial needs. By maintaining control over the policy and its cash value, individuals create a cycle of borrowing, repaying, and reusing funds while continuing the growth of their policy’s cash value.

Overall, the Infinite Banking Concept functions by leveraging the cash value growth within a whole life insurance policy, providing a personalized banking system that offers liquidity, control, and the potential for financial growth through borrowing and repaying against the policy’s accumulated cash value. This strategy aims to create a self-sustaining cycle of wealth accumulation and financial independence.

Choosing the Best Whole Life Insurance for Infinite Banking

Selecting the best whole life insurance policy for Infinite Banking involves considering specific criteria that align with your financial goals and the principles of Infinite Banking. Here’s a comprehensive guide to choosing the most suitable policy:

Financial Stability of the Insurer

Choose a reputable and financially stable insurance company. Look for high ratings from independent agencies like A.M. Best, Standard & Poor’s, or Moody’s to ensure the company’s reliability and ability to meet its obligations over the long term.

Cash Value Growth Potential

Evaluate policies that offer consistent and competitive cash value growth rates. Consider policies with guaranteed cash value growth or those with a history of providing attractive dividends or interest credited to the cash value.

Flexibility in Premiums and Coverage

Opt for policies that offer flexibility in premium payments, allowing you to adjust payments or coverage levels based on your financial circumstances. Look for features like paid-up additions or flexible premium options to enhance cash value accumulation.

Low Fees and Expenses

Carefully examine the policy’s fee structure and expenses. Choose policies with minimal charges as excessive fees can impact the cash value growth. Look for transparency in fee disclosures and understand how these charges affect the policy’s overall growth potential.

Favorable Policy Loan Features

Select policies with favorable loan provisions. Look for low-interest rates on policy loans, ease of accessing funds, and minimal impact on the policy’s growth or death benefit when borrowing against the cash value.

Customization Options

Consider policies with riders or additional features that complement Infinite Banking strategies. Riders such as guaranteed insurability, waiver of premium, or enhanced cash value growth options can tailor the policy to your specific needs.

Professional Advice

Seek guidance from financial professionals or advisors experienced in Infinite Banking strategies. They can provide insights into policies that align with your goals and help you navigate the complexities of various insurance products.

Top Whole Life Insurance Options for Infinite Banking

When considering the top whole life insurance options for implementing the Infinite Banking Concept, several insurance companies stand out for their policy features, cash value growth potential, and overall suitability for this strategy. Here are some of the top choices:

1- MassMutual

MassMutual offers whole life insurance policies renowned for their robust dividend-paying capabilities. These policies often provide attractive cash value growth potential and come with various riders that enhance policy flexibility, aligning well with Infinite Banking strategies.

2- Guardian Life

Guardian Life’s whole life insurance policies typically offer strong cash value accumulation, dividend options, and flexibility in terms of policy adjustments. They provide riders and features that cater to the requirements of Infinite Banking, enabling policyholders to optimize cash value growth.

3- Mutual of Omaha

Mutual of Omaha is known for offering whole life insurance policies that emphasize stability, strong dividends, and customization options. Their policies often provide competitive cash value growth rates and flexible payment structures, making them suitable for implementing Infinite Banking strategies.

4- New York Life

New York Life’s whole life insurance policies are recognized for their stability and steady cash value growth. With a history of consistently paying dividends, these policies offer policyholders the potential for substantial cash value accumulation, aligning well with Infinite Banking principles.

5- Northwestern Mutual

Northwestern Mutual offers whole life insurance policies with a strong focus on cash value growth and stability. Their policies typically feature robust dividend-paying capabilities and various riders that provide policyholders with flexibility and customization options for Infinite Banking strategies.

When considering the best whole life insurance options for implementing Infinite Banking, it’s crucial to evaluate the specific policy features, cash value growth potential, financial stability of the insurer, flexibility in premiums and coverage, as well as the suitability of riders for your individual financial goals.

Why People Use Infinite Banking for Life Insurance?

People opt for Infinite Banking as a strategy for life insurance for several compelling reasons:

Control Over Finances

Infinite Banking empowers individuals to take control of their finances. By utilizing a whole life insurance policy, individuals can create their own banking system, enabling them to borrow against the policy’s cash value and repay it at their convenience. This level of control is appealing to those seeking autonomy in managing their wealth.

Liquidity and Flexibility

It offers liquidity and flexibility that traditional banking systems may not provide. Policyholders can access funds through policy loans without the need for credit checks or stringent approval processes. This flexibility allows them to use the funds for investments, emergencies, or various financial opportunities without restrictions.

Legacy Planning

Life insurance policies inherently offer a death benefit that serves as a form of financial protection for beneficiaries. Infinite Banking allows policyholders to simultaneously build a legacy while utilizing the policy’s cash value during their lifetime.

Long-Term Wealth Building

By continuously borrowing and repaying against the policy’s cash value, individuals can create a cycle of financial growth within the policy, potentially leading to long-term wealth accumulation.

Financial Privacy and Security

The transactions and borrowing against the policy typically remain private between the policyholder and the insurance company, providing a level of financial privacy and security that may be appealing to some individuals.

Conclusion

Infinite Banking, backed by the right whole life insurance policy, empowers individuals to take control of their finances, create a stable cash flow, and build long-term wealth. When selecting the best whole life insurance for Infinite Banking, consider factors such as financial stability, cash value growth, flexibility, fees, and policy loan features.

Conduct thorough research and consult with financial experts to tailor a policy that aligns with your financial objectives and maximizes the potential of your Infinite Banking strategy. With the right whole life insurance policy, you can pave the way towards financial security and wealth accumulation.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.