Life’s uncertainties don’t come with a passport check. They transcend borders, affecting us all—whether you’re sipping espresso in Rome, strolling through Tokyo’s bustling streets, or building dreams in the heart of New York City. As a non-US citizen, you’re crafting a life story that spans continents, but one thing remains constant: the importance of safeguarding your loved ones’ future.

For non-US citizens navigating life’s journey in the United States or abroad, securing a safety net through life insurance is a pivotal step toward ensuring financial stability and peace of mind. Imagine a world where your loved ones are shielded from financial hardship in the event of the unexpected. Whether you’re a green card holder, a student studying abroad, or someone on a work visa, understanding the nuances of life insurance for non-US citizens is paramount.

In this comprehensive guide, we unpack the complexities, demystify the jargon, and simplify the process of acquiring life insurance. From exploring eligibility factors to unraveling policy intricacies, we’re here to shed light on this critical aspect of financial planning. Let’s get started!

Is Life Insurance available to a non-US citizen?

Yes, life insurance is available to non-US citizens, although eligibility and the specific options can vary based on factors such as residency status, visa type, and the insurance company’s policies. Non-US citizens can typically apply for life insurance in the United States, considering they meet certain criteria set by insurance providers.

Insurance companies may require non-US citizens to provide documentation related to their visa status, residency, and sometimes medical history. Permanent residents (green card holders) might find it easier to qualify for life insurance compared to non-residents or individuals on temporary visas.

It’s essential to explore different insurance companies, understand their specific requirements and policies for non-US citizens, and possibly seek guidance from insurance agents or financial advisors specializing in international clients.

How non-US citizens can buy life insurance?

Non-US citizens can buy life insurance in the United States by following these general steps:

1- Research Insurance Options

Begin by researching insurance companies that offer coverage to non-US citizens. Look for providers that specialize in international clients or have policies catering to non-citizens.

2- Understand Eligibility Criteria

Different insurers have varying eligibility requirements based on factors such as residency status, visa type, and country of origin. Check the specific criteria each insurance company has for non-US citizens.

3- Gather Required Documentation

Prepare necessary documents such as identification (passport, visa), proof of residency or visa status, and any additional documentation the insurer might request, such as financial records or medical history.

4- Compare Policies

Evaluate different types of life insurance policies available, such as term life, whole life, or universal life insurance. Compare coverage amounts, premiums, policy terms, and any limitations or exclusions.

5- Consult with an Insurance Agent or Broker

Seek guidance from an experienced insurance agent or broker who specializes in serving non-US citizens. They can help navigate the complexities of insurance policies, assist in understanding the terms, and find the best-suited coverage options.

How Much Does Life Isurance Cost?

6- Complete the Application Process

Fill out the insurance application accurately and truthfully. Ensure all required documents are submitted along with the application. Be transparent about your personal information, health history, and any relevant details required by the insurer.

7- Undergo Underwriting

The insurance company will assess the application, possibly requiring a medical examination depending on the policy and coverage amount. The underwriting process determines the risk and premium rates.

8- Review and Purchase

Once approved, carefully review the policy terms and conditions before purchasing the life insurance policy. Make sure you understand the coverage, premiums, beneficiaries, and any limitations.

9- Pay Premiums

Pay the premiums on time to keep the policy in force and ensure coverage for your beneficiaries.

Remember, the process might vary among insurance companies, and specific requirements can differ based on individual circumstances. Consulting with insurance professionals and carefully reviewing the policies can help non-US citizens navigate the process more effectively and find the most suitable life insurance coverage for their needs.

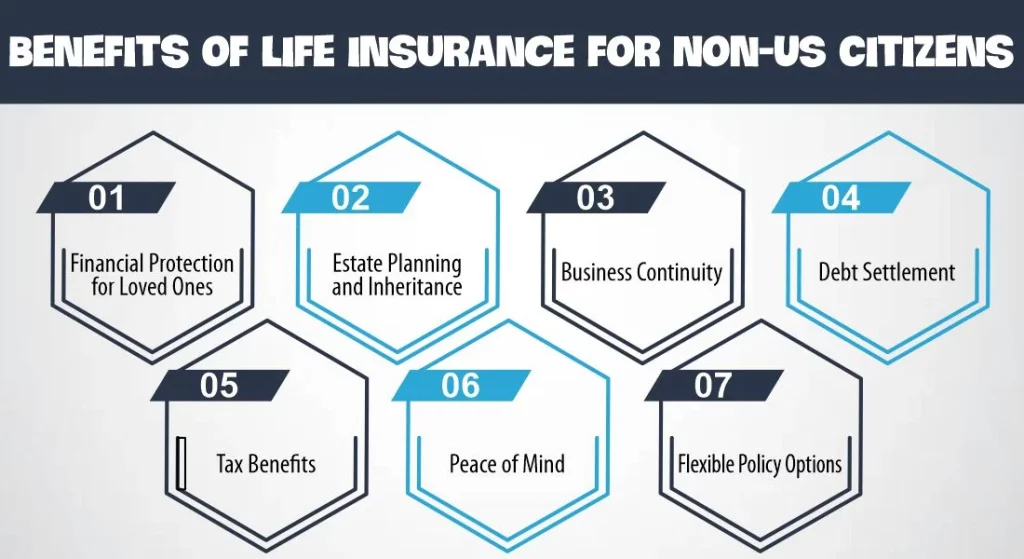

Benefits of Life Insurance for Non-US Citizens

Life insurance offers several important benefits for non-US citizens, providing financial security and peace of mind in various ways:

Financial Protection for Loved Ones

Life insurance ensures that in the event of the policyholder’s death, beneficiaries receive a lump sum or regular payments. This financial cushion can help cover living expenses, mortgage payments, debts, education costs, and other financial obligations, providing crucial support to surviving family members.

Estate Planning and Inheritance

For non-US citizens with assets or investments in the United States, life insurance can facilitate estate planning. It helps ensure a smooth transfer of assets to beneficiaries and can be a valuable component of inheritance planning.

Business Continuity

Life insurance can be pivotal for non-US citizens involved in business partnerships or as key employees in companies. It can provide funds for buy-sell agreements, protect business interests, and ensure continuity in the event of a partner or key person’s untimely demise.

Debt Settlement

Life insurance proceeds can be used to settle outstanding debts, such as loans, mortgages, or other financial liabilities, preventing the burden from falling on surviving family members.

Tax Benefits

Depending on the policy type and circumstances, life insurance may offer tax advantages or exemptions for non-US citizens, potentially reducing tax liabilities for beneficiaries.

Peace of Mind

Knowing that loved ones are financially protected can provide immense peace of mind. Life insurance allows policyholders to feel secure in the knowledge that their family’s financial future is safeguarded, even in their absence.

Flexible Policy Options

Insurance companies often offer a range of policy types, such as term life, whole life, or universal life insurance, allowing non-US citizens to choose a coverage plan that best aligns with their financial goals and needs.

Best Life Insurance Companies for non-US citizens

The best life insurance companies for non-US citizens can vary based on individual circumstances, visa types, residency status, and specific insurance needs. Here are some reputable insurance companies known for catering to non-US citizens:

1- New York Life Insurance Company

Known for its financial strength and variety of policy options, New York Life offers coverage to non-US citizens, including term life, whole life, and universal life insurance.

2- AXA Equitable Life Insurance Company

AXA provides life insurance options for non-US citizens, offering policies tailored to different visa types and residency statuses.

3- John Hancock Life Insurance Company

John Hancock offers life insurance solutions for non-US citizens, including term life and permanent life insurance policies, accommodating various visa types.

4- Prudential Financial

Prudential is another well-known insurer that offers life insurance options for non-US citizens, providing coverage tailored to specific visa categories and residency statuses.

5- AIG (American International Group)

AIG offers life insurance coverage to non-US citizens, with policies designed for individuals with diverse visa statuses and residency situations.

When selecting an insurer for life insurance for non-US citizens, it’s crucial to consider factors like the company’s financial stability, policy options, customer service, eligibility criteria, coverage limitations, and how well they cater to individuals with specific visa types or residency statuses.

Factors to Consider While Getting Life Insurance for Non-US Citizens

When seeking life insurance for non-US citizens, several key factors should be considered to ensure you obtain suitable coverage that aligns with your needs and circumstances:

- Residency Status and Visa Type: Your residency status and type of visa (temporary or permanent) can impact your eligibility for life insurance and the available policy options. Some insurers may have specific criteria or limitations based on residency status.

- Insurance Company’s Policy for Non-US Citizens: Research and understand the policies of different insurance companies regarding coverage for non-US citizens. Some insurers specialize in serving international clients and might offer more tailored options.

- Coverage Options: Consider the types of life insurance available (term life, whole life, universal life) and evaluate which aligns best with your financial goals and needs. Assess the coverage amount, duration, and any limitations or exclusions.

- Eligibility Requirements: Insurance companies may have specific documentation or requirements for non-US citizens, such as visa details, proof of residency, identification, and sometimes medical records. Ensure you understand and can fulfill these requirements.

- Premium Costs: Compare premium rates among different insurers for the same coverage to ensure you get competitive pricing. Factors like age, health status, and lifestyle can influence premium amounts.

- Underwriting Process: Understand the underwriting process involved, including whether a medical examination is required. Be prepared for potential differences in underwriting standards for non-US citizens compared to US citizens.

- Policy Limitations and Exclusions: Carefully review policy terms, limitations, and exclusions that might apply specifically to non-US citizens. Pay attention to any restrictions based on travel, residence in certain countries, or other factors.

Conclusion

Navigating the realm of life insurance as a non-US citizen involves careful consideration of various factors to secure the right coverage for your needs and circumstances. Understanding your residency status, visa type, and the policies offered by insurance companies are crucial initial steps.

From exploring coverage options to assessing eligibility requirements and premiums, being well-informed is key to making sound decisions. Remember, each insurer may have specific criteria and limitations for non-US citizens, making it essential to conduct thorough research and seek expert guidance.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.