Facing divorce can be overwhelming, especially when considering complex matters like Court Ordered Life Insurance. What exactly does this entail, and how does it impact your financial future? Join us as we explore the basics of Divorce and Court Ordered Life Insurance. What does it mean for you, and how can you navigate this aspect of the legal process with confidence? Let’s unravel the mystery together.

Why may courts require life insurance after divorce?

Courts may also require existence insurance after divorce for several reasons, primarily geared toward shielding the financial pastimes of the events worried, specifically kids and ex-spouses who rely on assistance bills. Here are some key motives why courts can also impose this requirement:

Ensuring Financial Support: In many divorce cases, one partner may be ordered to pay spousal assistance or baby help to the other. If the paying spouse were to pass away prematurely, it may jeopardize the economic balance of the recipient, mainly in the event that they rely upon the one’s bills for living prices. Life insurance provides a monetary safety internet by ensuring that guide payments are maintained on the occasion of the paying partner’s death.

Protecting Child Support: Children are frequently the most inclined events in divorce proceedings. Courts may additionally order life insurance to secure infant assistance bills until the youngsters attain maturity or turn out to be self-enough. This guarantees that the children’s economic desires are met even though the paying parent passes away suddenly.

Covering Debts and Obligations: Divorce settlements frequently contain the division of debts and assets among spouses. Life insurance may be used to cover superb debts or economic obligations, consisting of mortgage bills or other liabilities, ensuring that these financial obligations are met no matter the death of one of the events.

Maintaining Lifestyle and Standard of Living: Life coverage can help keep the lifestyle and standard of living that the family enjoyed prior to the divorce. This is specifically important for ex-spouses who can also grow to be acquainted with a sure degree of monetary guidance during the marriage.

Ensuring Compliance with Court Orders: Requiring life insurance as part of a divorce decree guarantees compliance with court orders. If the paying partner fails to preserve the required existence insurance, they’ll be held in contempt of court, potentially going through legal effects.

Life insurance considerations during a divorce:

Navigating existence insurance during a divorce requires careful attention and making plans to ensure economic stability for all events concerned. Here are a few key concerns to keep in mind:

Review Your Life Insurance Needs: As you go through a divorce, it’s crucial to consider your life insurance wishes. You may also need to adjust your insurance amount or beneficiaries to reflect your new circumstances. Consider factors such as child support obligations, outstanding debts, and future financial desires when determining an appropriate insurance level.

Determine if Your Policy is Considered a Marital Asset:

In many jurisdictions, life insurance regulations received at some point of the wedding are considered marital belongings to the department at some stage in divorce complaints. It’s essential to understand the fee of your policy and how it may be divided between you and your spouse. Consult with legal and financial experts to ensure an honest and equitable distribution of property.

Account for Cash Value in a Permanent Policy:

If you have a permanent life insurance policy with amassed coins cost, it is important to consider how this asset could be dealt with inside the divorce agreement. The cash value can be difficult to divide between you and your spouse, or you could want to barter for possession of the policy or its coin value as part of the settlement agreement.

Protect Alimony:

If you are the recipient of alimony (spousal help), life coverage can provide a safeguard in the occasion of your ex-partner’s loss of life. You might also negotiate with your ex-partner to preserve an existing coverage policy with you as the beneficiary to make sure that alimony bills continue even in the event of their passing.

Protect Child Support for Minor Dependents:

Life coverage can also be used to guard toddler support payments for minor dependents. If you’re the custodial discern receiving infant support, you can negotiate with your ex-spouse to hold a lifestyle coverage with the youngsters named as beneficiaries. This guarantees that financial support for the children keeps uninterrupted in the occasion of the paying figure’s demise.

Consider Term vs. Permanent Insurance:

Depending on your occasion, you may need to decide between time period lifestyle coverage and permanent existence coverage. Term life coverage gives coverage for a specific length, generally till kids attain adulthood or financial obligations are met. Permanent existence insurance, which includes complete life or ordinary life, presents insurance for existence and can have coin price accumulation. Consider which kind of coverage first-class suits your wishes and monetary scenario put up-divorce.

Navigating life insurance for the duration of a divorce calls for careful consideration of your very own desires, the value of your coverage as a marital asset, and the way to shield alimony and infant help payments. Consulting with prison and economic experts can assist in making sure that you make knowledgeable choices that safeguard your monetary future at some point during this hard time.

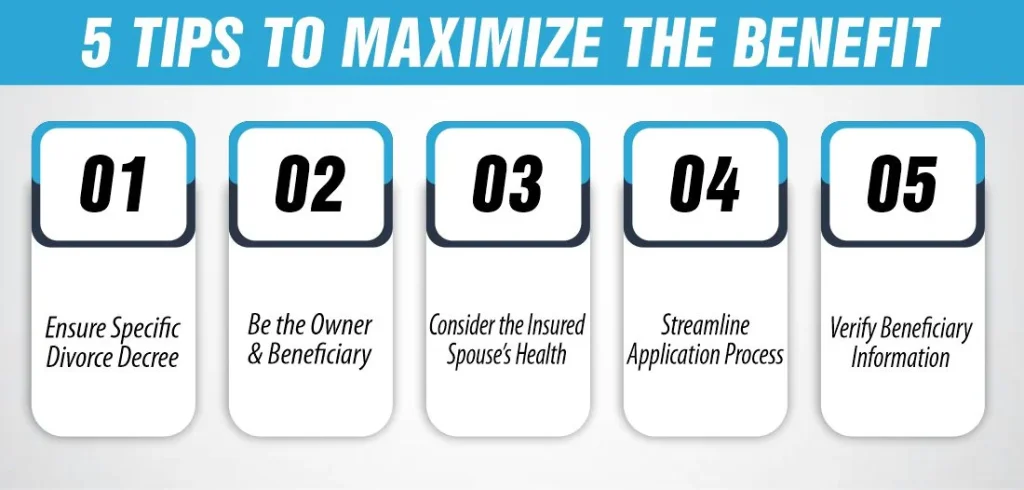

5 Tips to maximize the benefit:

Maximizing the advantages of Divorce and Court Ordered Life Insurance is vital for monetary safety. Here are 5 recommendations to help you make the maximum of your insurance:

Ensure Specific Divorce Decree:

When drafting the divorce decree, it’s vital to be as unique as feasible concerning the existence of insurance requirements. Collaborate carefully together with your legal professional to ensure that each one aspects associated with existence coverage are sincerely outlined. Specify the duration for which the coverage must be maintained, making sure it aligns with the length of any economic duties together with toddler support or alimony. Additionally, detail the amount of coverage required to defend the hobbies of all events concerned effectively. Consider including provisions for periodic reviews to evaluate the sufficiency of coverage over the years, in particular as financial instances might also trade submit-divorce.

Be the Owner and Beneficiary:

To exert the most control over the existence of an insurance policy, it’s high quality to be both the owner and beneficiary. As the proprietor, you hold authority over critical aspects along with premium bills and coverage control. This possession ensures that you have a right away say in any adjustments or updates to the policy. Simultaneously, being the beneficiary ensures that you acquire the demise benefit immediately without relying on the cooperation or economic balance of your ex-spouse. If there are minor youngsters worried, bear in mind organizing an agreement to manipulate the proceeds, imparting lengthy-term economic security for them.

Consider the Insured Spouse’s Health:

The health of the insured partner plays a significant role in determining the supply and value of existing coverage insurance. Encourage your ex-spouse to undergo a clinical exam promptly to assess their insurability. Early evaluation allows for the identification of any capability fitness issues that would effect the ability to steady favorable premium fees. If pre-present conditions are a gift, explore alternative options together with assured trouble or simplified trouble guidelines that require minimal or no clinical underwriting. Discussing those options with a coverage agent or monetary marketing consultant can provide readability at the pleasant path of motion.

Streamline Application Process:

Simplifying the application system for existing coverage can expedite the issuance of coverage and ensure compliance with court docket orders. Gather all necessary documentation, such as the divorce decree and any other applicable criminal office work, to streamline the utility technique. Providing comprehensive facts upfront reduces the probability of delays or complications in the course of underwriting. Additionally, hold open verbal exchanges together with your coverage agent or broker to address any questions or worries right away. By proactively addressing requirements and supplying complete facts, you may reduce the effort and time required to steady the necessary lifestyle coverage.

Verify Beneficiary Information:

Double-checking beneficiary records is crucial to make sure that the supposed recipients acquire the policy proceeds as meant. Review the beneficiary designations carefully to affirm that they, as they should be, reflect your desires and any duties outlined within the divorce decree. Consider naming contingent beneficiaries to account for unforeseen situations or changes in the circle of relatives dynamics.

If minor kids are concerned, make sure that suitable preparations are made for the control of the proceeds on their behalf. Regularly evaluate and replace beneficiary designations as wished, especially within the event of foremost life adjustments, including remarriage or the start of additional kids. By preserving accurate beneficiary facts, you may make sure that the lifestyle coverage blessings provide the meant financial security for your loved ones.

What is court-ordered life insurance, and how does it work?

Court-ordered life insurance is a directive issued by a court as part of a divorce settlement or legal proceeding. It requires one party to obtain and maintain a life insurance policy for the benefit of another party or parties, typically children or an ex-spouse. This policy serves as a financial safety net, ensuring that support payments, such as child support or alimony, continue in the event of the insured party’s death. The court may specify the coverage amount, duration, and beneficiaries, and failure to comply with the court order can result in legal consequences. Essentially, court-ordered life insurance provides a means of securing financial obligations and protecting the interests of dependents in the event of unforeseen circumstances.

How to Buy Life Insurance After a Divorce

Divorce often brings massive changes to at least one’s monetary scenario, necessitating a reassessment of coverage desires. Follow these steps to buy lifestyle insurance after a divorce:

Assess Your Financial Situation:

Start by evaluating your post-divorce monetary responsibilities. Consider any outstanding debt, including mortgages or loans, and ongoing financial obligations like child support or alimony payments. Take inventory of your property and liabilities to determine the quantity of insurance needed to guard your family in the event of your demise.

Review Existing Coverage:

If you had life insurance throughout your marriage, evaluate your existing policy to decide if it still meets your needs, such as publish-divorce. Consider whether any adjustments are vital, such as adjusting the insurance quantity or updating beneficiaries.

Evaluate Dependents’ Needs:

Consider the monetary wishes of your dependents, including children or growing-old parents. Calculate the amount of income replacement needed to cover their living fees, training expenses, and other economic duties. This will help you determine the ideal stage of coverage to ensure their financial protection.

Consider Your Budget:

Determine how much you can afford to spend on life insurance rates each month. Balancing your coverage needs and your budget is vital to finding a policy that provides adequate protection without straining your budget.

Compare Insurance Quotes:

Shop around and reap rates from multiple coverage companies to evaluate coverage alternatives and premium rates. Consider running with an impartial insurance agent who can provide independent recommendations and help you find the coverage that fits your needs and price range.

Understand Policy Options:

Familiarize yourself with specific types of lifestyle insurance guidelines, inclusive of term life insurance and permanent lifestyle coverage (whole life or generic life). Understand the features and benefits of each kind of policy, in addition to any limitations or exclusions that may be practiced.

| Features | Term life insurance | Permanent life insurance |

| Duration | 10 to 40 years | Life |

| Cost | $25 to $30/month | 5 to 15 times more than term |

| Guaranteed death benefit? | Yes, within the term | Yes |

| Guaranteed cash value? | No | Yes |

| How cash value grows | N/A | Earns interest at a predetermined rate |

| Premiums | Level | Level or changes based on cash value |

Review Policy Terms:

Carefully assess the terms and conditions of any policy you’re considering. Pay attention to factors such as coverage quantity, premium bills, policy length, and any additional riders or advantages presented.

Complete the Application Process:

Once you’ve decided on a coverage that meets your wishes, entire the utility technique with the coverage company. Be prepared to offer personal information, undergo a scientific examination if required, and solution questions on your fitness and lifestyle.

Make Your Initial Premium Payment:

After your application is accredited, make your preliminary premium payment to activate the coverage. Keep track of Destiny premium payments to ensure your coverage stays under pressure and offers nonstop safety for you and your loved ones.

By following these steps, you may navigate the process of buying lifestyle insurance after a divorce and secure the financial protection to defend your loved ones’ destinies.

Conclusion:

In conclusion, Divorce and Court Ordered Life Insurance serves as a crucial safeguard in divorce proceedings, ensuring financial security for both parties and any dependents involved. Through clear and specific decrees, courts address the complexities of post-divorce financial arrangements, such as spousal support and child maintenance, by mandating life insurance coverage.

This requirement not only protects the recipient of support payments but also provides peace of mind for all parties, assuring continuity of financial support in the face of unforeseen circumstances. By adhering to court orders and maintaining appropriate life insurance coverage, individuals can navigate the challenges of divorce with greater confidence and assurance for their future financial well-being and that of their loved ones.

FAQs

Should you change your life insurance beneficiary after a divorce?

Yes, it is usually endorsed to trade your life coverage beneficiary after a divorce to make sure it aligns with your cutting-edge desires. Updating your beneficiary designation can save you your ex-partner from receiving the coverage proceeds in case you skip away.

Can you remove your ex-spouse as the beneficiary of your policy?

Yes, you’ve got the right to remove your ex-partner as the beneficiary of your lifestyle coverage. Updating your beneficiary designation ensures that the coverage proceeds reach the supposed recipients, aligning with your modern-day wishes. Ensure that you complete the vital office work to officially eliminate your ex-partner and designate new beneficiaries.

Can you name your child as a beneficiary?

Yes, you can name your child as a beneficiary of your life insurance policy. Designating your child ensures they receive the policy proceeds if you pass away, providing financial security for their future. Consider setting up a trust or appointing a guardian to manage the funds on behalf of a minor child until they reach adulthood.

References:

https://www.policygenius.com/life-insurance/life-insurance-and-divorce/

https://www.devteam.space/blog/ai-software-development-life-cycle-explained/

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.